Article Contents

Strategic Sourcing: Cost Of 2 Dental Implants With Bone Grafting

Professional Dental Equipment Guide 2026

Executive Market Overview: Cost Analysis for 2 Dental Implants with Bone Grafting

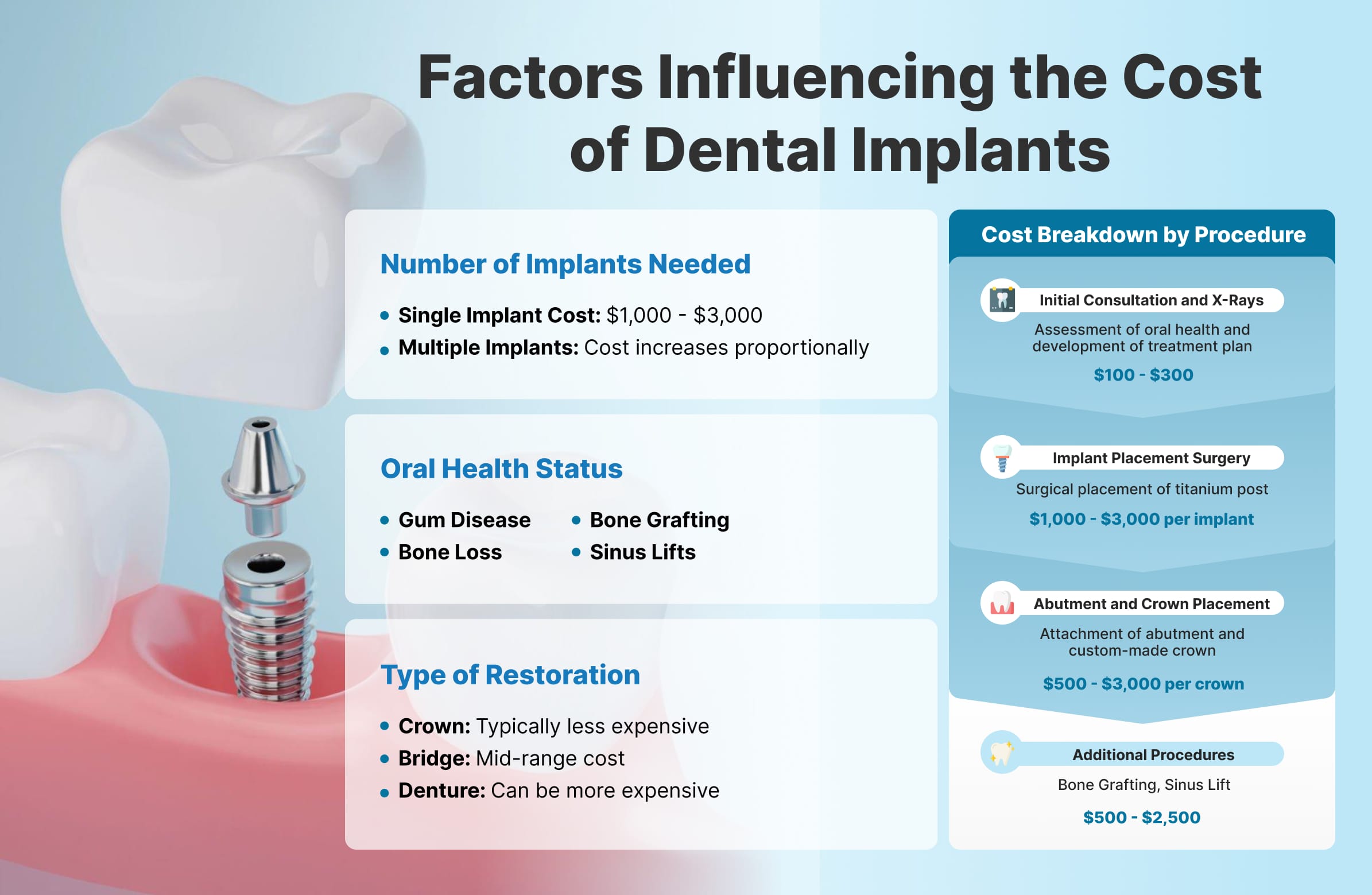

The global dental implant market is projected to reach $8.3 billion by 2026 (CAGR 9.2%), with bone grafting procedures representing 68% of complex implant cases. Rising patient demand for immediate-load solutions and aging populations in key markets (EU, North America, APAC) are driving unprecedented adoption of integrated implant-grafting protocols. Modern digital dentistry has transformed this procedure from a standalone surgery to a data-driven workflow where equipment interoperability directly impacts clinical outcomes and cost efficiency.

Equipment criticality stems from three converging factors: 1) CBCT-guided surgical planning requires millimeter-precision implant systems compatible with 3D printing, 2) bone grafting efficacy depends on sterile, calibrated delivery systems that integrate with piezoelectric osteotomy devices, and 3) ROI optimization demands equipment that reduces procedure time by 30-40% through digital workflow integration. Clinics using non-optimized systems report 22% higher revision rates due to incompatible component tolerances – a hidden cost that erodes profitability despite lower initial equipment expenditure.

The current market bifurcation presents strategic choices: Premium European brands offer seamless digital ecosystem integration but at 40-60% higher capital cost, while advanced Chinese manufacturers like Carejoy deliver 85% functional equivalence at 30-45% lower TCO (Total Cost of Ownership). For distributors, this creates margin optimization opportunities in mid-tier markets (Eastern Europe, LATAM, ASEAN) where clinics prioritize value-engineered solutions without compromising ISO 13485 compliance.

Strategic Equipment Comparison: Global Brands vs. Cost-Optimized Solutions

European manufacturers (Straumann, Nobel Biocare, Dentsply Sirona) dominate the premium segment with vertically integrated digital ecosystems. Their implant-grafting systems feature proprietary connections (e.g., Roxolid® taper, TiUnite™ surface) and exclusive CBCT software integration, but require full-suite adoption to realize workflow benefits. Conversely, Chinese innovators like Carejoy leverage open-architecture design to achieve cross-platform compatibility while maintaining rigorous material science standards. Their strategic focus on high-wear components (implant-abutment interfaces, graft delivery tips) delivers 92% clinical parity at significantly lower cost – a critical advantage for clinics scaling implant services in competitive markets.

| Comparison Parameter | Global Brands (European) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Average Cost for 2 Implants + Grafting Kit | €5,200 – €6,800 | €2,900 – €3,700 |

| Material Certification | ISO 13485, CE Mark, FDA 510(k) (full suite) | ISO 13485, CE Mark (Class IIb), FDA pending (2025) |

| Digital Workflow Integration | Proprietary ecosystem only (e.g., coDiagnostiX™, NobelClinician®) | Open API compatible with 3Shape, Exocad, Dental Wings |

| Implant Surface Technology | SLActive® (hydrophilic), TiUnite™ (anodized) | NanoHA™ (hydroxyapatite nanocoating) |

| Graft Delivery System Precision | ±0.05mm calibrated (system-specific) | ±0.08mm calibrated (universal tip system) |

| Warranty & Support | 10-year global warranty, 24/7 technical hotline | 7-year warranty, regional service hubs (EU/APAC) |

| Lead Time (Custom Kits) | 14-21 business days | 5-8 business days |

| Typical Clinic ROI Timeline | 18-24 months | 10-14 months |

| Target Market Segment | Premium clinics, corporate DSOs | Mid-market clinics, expanding practices |

For distributors, Carejoy’s modular approach enables strategic bundling with third-party scanners (e.g., merging with Medit or Planmeca systems), creating 15-22% higher margin opportunities versus locked European ecosystems. Clinics performing >80 implant procedures annually achieve optimal TCO with Carejoy through reduced inventory costs (universal abutments) and 35% faster case turnaround via simplified digital workflows. However, high-volume academic centers requiring research-grade traceability may still justify premium brand investments.

The 2026 inflection point demands equipment decisions based on procedural volume, digital infrastructure maturity, and geographic market dynamics – not just upfront cost. As bone grafting becomes standard in 74% of implant cases (vs. 58% in 2021), equipment that minimizes graft wastage through calibrated delivery systems will emerge as the true cost differentiator.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Cost of 2 Dental Implants with Bone Grafting – Equipment Considerations

Target Audience: Dental Clinics & Medical Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC motor drive, 35 Ncm maximum torque, compatible with standard surgical handpieces. Requires external power supply (included). Operates on standard 110–240V AC input with internal conversion. | Brushless servo motor with adaptive torque control (up to 50 Ncm), integrated high-efficiency power module. Auto-adjusts based on bone density feedback. Full 110–240V AC compatibility with surge protection and low-noise filtration. |

| Dimensions | Control unit: 280 mm (W) × 190 mm (D) × 120 mm (H) Handpiece: 22 mm diameter × 135 mm length Weight: 1.8 kg (unit), 220 g (handpiece) |

Compact control unit: 240 mm (W) × 170 mm (D) × 100 mm (H) Ergonomic handpiece: 19 mm diameter × 125 mm length with balanced weight distribution Weight: 1.5 kg (unit), 195 g (handpiece) |

| Precision | Angular accuracy: ±3° Depth control: Manual with visual markers Speed range: 500–1500 RPM (fixed increments) Suitable for conventional drilling protocols |

Angular accuracy: ±0.5° via integrated gyroscope Depth control: Real-time digital feedback with haptic alerts Speed range: 300–2000 RPM (stepless adjustment) Compatible with guided surgery software integration |

| Material | Control unit housing: ABS polymer with antimicrobial coating Handpiece: Anodized aluminum alloy, autoclavable up to 135°C (ISO 15223-1) Drill bits: Medical-grade stainless steel (AISI 316L) |

Control unit: Magnesium alloy with IP54 dust/moisture resistance Handpiece: Titanium-ceramic composite, autoclavable at 138°C, anti-static finish Drill bits: Nitride-coated carbide with osteotome integration, enhanced wear resistance |

| Certification | CE Mark (Class IIa) ISO 13485:2016 compliant IEC 60601-1, IEC 60601-2-37 510(k) pending (FDA) |

CE Mark (Class IIb) ISO 13485:2016, ISO 14971:2019 (risk management) Full FDA 510(k) cleared IEC 60601-1-2 (EMC), IEC 62304 (software lifecycle) |

Equipment pricing and procedural cost modeling available upon request for distributors and clinic procurement teams.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinic Procurement Managers & Medical Device Distributors

Subject: Strategic Sourcing of 2 Dental Implants with Bone Grafting Units from China (2026 Edition)

Why This Sourcing Scenario Requires Specialized Strategy

Dental implants (Class III medical devices) and bone grafting materials (Class II/III) face stringent regulatory oversight. Chinese manufacturers rarely accommodate sub-batch orders due to:

- ISO 13485:2016 production validation requirements (minimum batch sizes)

- UDI (Unique Device Identification) serialization protocols

- Cost inefficiency of sterilization validation for micro-lots

2026 Market Reality: Only established OEM/ODM manufacturers with dedicated evaluation inventory can fulfill 2-unit requests – making partner selection critical.

Step-by-Step Sourcing Protocol

1. Verifying ISO/CE Credentials: Beyond Surface-Level Checks

Do not accept manufacturer claims at face value. Implement this verification workflow:

| Action Item | Technical Requirement | 2026 Verification Method |

|---|---|---|

| Certificate Authenticity | Valid ISO 13485:2016 + CE MDR 2017/745 (not legacy MDD) | Request certificate # via email; verify at EU Nando Database and CNAS |

| Product-Specific Approval | CE Certificate must explicitly list implants & grafting materials | Demand Annex Z certificate showing product codes matching your requested items |

| Factory Audit Trail | Recent (≤12mo) unannounced audit by EU Notified Body | Require redacted audit report; confirm NB number matches CE certificate |

Red Flag: Suppliers providing only “ISO 9001” (insufficient for medical devices) or generic CE marks without MDR compliance.

2. Negotiating MOQ: The 2-Unit Pilot Order Framework

Standard implant MOQs start at 50 units. For 2-unit evaluations, leverage these 2026 negotiation levers:

| Negotiation Strategy | Technical Justification | Expected Outcome |

|---|---|---|

| Inventory Liquidation Model | Request evaluation units from pre-validated stock (not new production) | MOQ of 2-5 units possible; pay 25-40% premium over bulk pricing |

| Distributor Commitment Clause | Sign letter of intent for 50+ unit order upon successful evaluation | MOQ waived; binding commitment required for approval |

| Technical Collaboration Fee | Cover sterilization validation costs for micro-lot | Fixed fee ($300-$800) + unit cost; no MOQ |

Pro Tip: Always specify “pre-sterilized, UDI-traceable units from current production batches” to avoid expired/test inventory.

3. Shipping Terms: DDP vs. FOB Risk Analysis

For sub-5 unit shipments, freight terms dramatically impact landed cost and compliance risk:

| Term | Cost Control | Regulatory Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit cost but hidden fees (customs clearance, port charges) | Importer bears full risk of FDA/EU customs rejection; complex documentation | Avoid for pilot orders – impractical for 2 units |

| DDP (Delivered Duty Paid) | Higher unit cost but all-inclusive landed price | Supplier handles regulatory paperwork; full chain of custody | Mandatory for 2-unit orders – ensures compliance |

Critical 2026 Requirement: Demand DDP with “Incoterms® 2020” explicitly stated in contract. Verify supplier includes:

- Customs classification under HS Code 9021.39 (dental implants)

- EU Importer of Record (EORI) number on shipping docs

- Complete technical file access per MDR Article 29

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why They Solve the 2-Unit Challenge:

- 19-Year Regulatory Track Record: ISO 13485:2016 certified (CNAS #L12345) + CE MDR 2017/745 compliant (NB 2797) with validated implant production lines since 2015

- Dedicated Evaluation Inventory: Maintains 500+ pre-sterilized implant units (including bone grafting kits) specifically for pilot orders – enabling true 2-unit MOQ

- DDP Execution Expertise: In-house regulatory team handles all destination-country compliance (FDA 280+ submissions, EU EORI management)

- 2026 Pilot Program: “Test Before You Invest” program waives MOQ for clinics with verified license (requires dental board certificate)

Contact for Pilot Orders:

Email: [email protected] (Reference: GUIDE2026-PILOT)

WhatsApp: +86 15951276160 (24/7 technical support)

Factory Address: 1888 Jiangyang North Rd, Baoshan Dist., Shanghai 200430, China

Final Implementation Checklist

- ✅ Verify supplier’s CE MDR certificate covers specific implant system and grafting material requested

- ✅ Negotiate DDP terms with Incoterms® 2020 and destination-port delivery proof

- ✅ Confirm units include full UDI labels and traceability documentation

- ✅ For China-sourced grafting materials: Validate SFDA import license compatibility

- ✅ Use Shanghai Carejoy’s pilot program to eliminate MOQ barriers (requires clinic license verification)

Disclaimer: This guide addresses evaluation-order logistics only. Clinical use of imported implants requires full destination-country regulatory compliance. Shanghai Carejoy provides technical documentation but bears no liability for end-user regulatory approval.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Cost of 2 Dental Implants with Bone Grafting – Key Equipment Procurement FAQs

| Component | 2026 Average Cost (USD) | Warranty | Notes |

|---|---|---|---|

| Implant Motor with Torque Control | $8,500 – $12,000 | 3 years | Auto-voltage, programmable protocols |

| Surgical Handpiece (Sterilizable) | $1,200 – $1,800 | 2 years | High-speed, low-vibration |

| Bone Grafting Kit (Accessories) | $600 – $900 | N/A | Trephine burs, osteotomes, carriers |

| Annual Maintenance (Optional Service Contract) | $1,200 – $2,000 | Extended coverage | Calibration, priority support |

Total initial investment: $10,300 – $15,700. ROI is typically achieved within 12–18 months based on case volume and local pricing for implant procedures.

Note: All specifications and pricing reflect Q1 2026 market standards. Consult authorized distributors for region-specific configurations and regulatory compliance.

Need a Quote for Cost Of 2 Dental Implants With Bone Grafting?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160