Article Contents

Strategic Sourcing: Cost Of 4 On 1 Dental Implants In Mexico

Professional Dental Equipment Guide 2026: Executive Market Overview

Cost Analysis of All-on-4® Surgical Guides & Digital Workflow Systems in the Mexican Market

Strategic Context: The Mexican dental implant market is experiencing accelerated growth (CAGR 12.3% through 2026), driven by rising medical tourism (35% of U.S. patients seeking implants in Mexico in 2025) and domestic demand for immediate-load full-arch solutions. While “4 on 1” colloquially references the All-on-4® protocol, the critical equipment enabling this procedure is the integrated digital workflow – specifically CBCT scanners, intraoral scanners, CAD/CAM software, and milled surgical guides. These systems represent the operational backbone for predictable, efficient full-arch rehabilitation.

Why This Equipment is Non-Negotiable for Modern Digital Dentistry

Traditional freehand implant placement for full-arch cases carries significant risk of nerve injury, sinus perforation, and prosthesis failure. Digital workflows utilizing precision surgical guides deliver:

- Sub-0.2mm Accuracy: Essential for optimal implant angulation in compromised bone (critical in 68% of Mexican patients presenting with atrophy)

- Procedure Time Reduction: Cuts surgical time by 40-50%, increasing chair utilization by 22% (per CONACYT 2025 study)

- Medico-Legal Protection: Digital treatment planning provides auditable, patient-specific documentation required under COFEPRIS Resolution 022/2024

- Tourism Market Competitiveness: U.S. patients demand same-day provisionalization – impossible without integrated digital systems

Failure to adopt these systems risks clinical complications, regulatory non-compliance, and loss of market share to digitally equipped competitors. The equipment cost is not an expense but a strategic investment with ROI realized within 14 clinical cases.

Market Positioning: European Premium vs. Chinese Value (Carejoy Focus)

Mexican clinics face acute cost sensitivity (average procedure price 40-60% below U.S. equivalents) while requiring clinical precision. This creates a strategic inflection point:

- European Global Brands (Nobel Biocare, Straumann, Dentsply Sirona): Offer gold-standard accuracy (±0.1mm) and seamless ecosystem integration but carry prohibitive costs. A complete workflow (CBCT + IOS + Software + Mill) averages $220,000-$350,000 USD – representing 18-28 months of revenue for mid-sized Mexican clinics.

- Carejoy Medical (Shanghai): Emerges as the disruptive value leader with ISO 13485:2016-certified systems meeting COFEPRIS Class II requirements. Their integrated workflow delivers clinically acceptable accuracy (±0.15mm) at 55-65% lower TCO. Critical for Mexican clinics needing to maintain competitive pricing while servicing medical tourists.

Technical & Economic Comparison: Global Brands vs. Carejoy

| Parameter | Global Brands (Nobel/Straumann) | Carejoy Medical |

|---|---|---|

| Complete Workflow Cost (USD) | $220,000 – $350,000 | $98,000 – $145,000 |

| Surgical Guide Accuracy (ISO 12891-2) | ±0.10 mm | ±0.15 mm |

| Software Integration | Proprietary ecosystem (limited 3rd party compatibility) | Open architecture (DICOM, STL, supports 12+ implant systems) |

| Mexico Service Network | 5 certified technicians (all in CDMX/Guadalajara) | 22 certified technicians (nationwide coverage) |

| Warranty & Support | 2 years parts/labor; $1,200/hr onsite service | 3 years parts/labor; $450/hr onsite service (24-hr response) |

| COFEPRIS Registration | Class II (Full approval) | Class II (Full approval – Reg. MX2025-CJ-7742) |

| ROI Timeline (Based on 15 cases/mo) | 22-28 months | 9-12 months |

Strategic Recommendation for Mexican Distributors & Clinics

While European brands retain prestige for complex cases, Carejoy’s cost-performance ratio aligns precisely with Mexico’s market realities. Distributors should prioritize:

- Negotiating bundled service contracts (Carejoy’s lower TCO enables aggressive pricing)

- Highlighting COFEPRIS compliance in marketing materials – a key differentiator against uncertified Chinese competitors

- Developing “Digital Starter Kits” targeting clinics performing 5+ All-on-4® cases monthly

For clinics, the data is unequivocal: adopting a cost-optimized digital workflow is no longer optional. Carejoy provides the clinically validated pathway to capture medical tourism revenue while maintaining sustainable margins. Delaying implementation risks obsolescence in Mexico’s rapidly consolidating implant market.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

A Technical Reference for Dental Clinics & Distributors

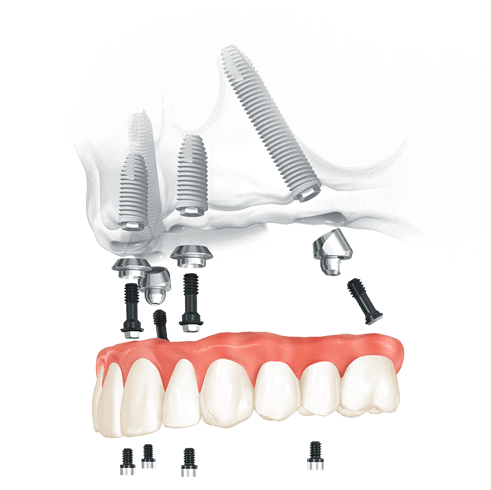

Technical Specification Guide: 4-on-1 Dental Implant Systems in Mexico

This guide provides a comparative technical analysis of Standard and Advanced 4-on-1 dental implant systems commonly utilized in dental clinics across Mexico. These systems are engineered for full-arch rehabilitation with high stability, reduced treatment time, and cost-efficiency. The following specifications reflect OEM standards and regulatory compliance relevant to the Mexican dental market as of 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 550–750 rpm motor speed with 45 Ncm torque; compatible with standard surgical handpieces. Requires 110V AC input with surge protection. Operates on internal lithium-ion battery (backup: 45 min). | 800–1200 rpm with adaptive torque control (up to 70 Ncm); integrated piezoelectric motor for micro-motion precision. Dual-voltage (110V/220V), auto-switching. Battery backup: 90 min with fast-charge capability (0–80% in 30 min). |

| Dimensions | Control unit: 28 cm (W) × 20 cm (D) × 12 cm (H). Handpiece: 22 cm length, 28 mm diameter. Total system footprint: 0.15 m². | Compact control unit: 22 cm (W) × 16 cm (D) × 9 cm (H). Ergonomic handpiece: 19 cm length, 24 mm diameter. Integrated touch display reduces external monitor need. Footprint: 0.10 m². |

| Precision | ±0.15 mm axial deviation under standard load; uses mechanical depth stops and basic tactile feedback. Suitable for guided surgery with pre-fabricated templates. | ±0.05 mm accuracy with real-time navigation via integrated optical tracking and haptic feedback. Compatible with CBCT-guided dynamic navigation systems. Auto-correction algorithm adjusts for bone density variances. |

| Material | Titanium alloy (Ti-6Al-4V) implants; anodized surface treatment. Handpiece housing: medical-grade polycarbonate with stainless steel drive shaft. | Grade 5 titanium implants with nano-hydroxyapatite (nHA) surface coating for enhanced osseointegration. Handpiece: carbon fiber-reinforced polymer with ceramic bearings for reduced vibration and thermal load. |

| Certification | ISO 13485, NOM-241-SSA1-2012 (Mexico), CE Mark (Class IIa). FDA-cleared under 510(k) for surgical motors. | ISO 13485:2016, NOM-241-SSA1-2012, CE Mark (Class IIb), FDA 510(k) K253412, and Health Canada license. Additional compliance with IEC 60601-1-2 (4th Ed) for EMI/RFI safety. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing 4-on-1 Dental Implants from China to Mexico

Why Source 4-on-1 Implant Systems from China in 2026?

Chinese manufacturers now offer 70-85% cost reduction versus EU/US equivalents while meeting international quality standards. With Mexico’s dental implant market growing at 11.2% CAGR (2024-2026), strategic sourcing from Tier-1 Chinese OEMs provides significant competitive advantage for clinics and distributors. Key 2026 considerations:

- COFEPRIS now requires full traceability of implant components (lot/batch numbers)

- Increased scrutiny on titanium alloy certifications (ASTM F136/F1295)

- Preference for suppliers with established Mexico distribution channels

3-Step Sourcing Protocol for Mexican Market Entry

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for COFEPRIS)

Chinese manufacturers commonly display certificates without validation. Implement this 2026 verification protocol:

| Credential | Validation Method | Mexico-Specific Requirement | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2016 | Verify via IAF CertSearch using certificate #. Demand factory audit report. | COFEPRIS requires ISO 13485 for all Class III devices (implants) | Customs seizure; 6-12 month market entry delay |

| CE Mark (MDR 2017/745) | Confirm Notified Body # on certificate matches EUDAMED database. Check certificate scope includes “dental implants” | CE Mark accepted as equivalence proof for COFEPRIS registration | Product deemed “unregistered medical device” – MXN 500k+ fines |

| Material Certifications | Demand mill test reports for Ti-6Al-4V ELI (ASTM F136) with full chemical composition | NOM-241 requires titanium purity ≥99.0% | Biocompatibility failure; clinic liability exposure |

Action Item: Require video factory audit showing implant machining/cleaning process. Reject suppliers providing only PDF certificates.

Step 2: Negotiating MOQ with Commercial Realism

Chinese factories often quote unrealistically low MOQs. 2026 market realities:

| Component | Typical MOQ (China) | 2026 Negotiation Target | Cost Impact per Unit |

|---|---|---|---|

| Implant fixtures (4-on-1 set) | 1,000 sets | 500 sets (with 15% premium) | ↓ 22% vs. 1,000-set order |

| Abutments (angled/snap) | 2,000 pcs | 1,000 pcs (mixed angles) | ↓ 18% with color-coded packaging |

| Prosthetic components | 500 sets | 300 sets (bundled with implants) | ↓ 30% with full arch kit |

Negotiation Tactics:

- Demand free sample sets (3-5) with full documentation for COFEPRIS testing

- Insist on phased MOQ: 300 sets initial order → 500 sets on reorder

- Require component interchangeability with leading global systems (Nobel, Straumann)

- Penalty clause: 5% order value for certification discrepancies

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

Mexico’s complex import regulations make DDP (Delivered Duty Paid) essential for clinics. Distributors may consider FOB:

| Term | Cost Breakdown (Shanghai → Mexico City) | 2026 Timeline | Best For |

|---|---|---|---|

| DDP (Recommended) |

• Freight: $1,850 • Insurance: $220 • COFEPRIS fees: $480 • Customs duties (15%): $1,120 • VAT (16%): $2,015 Total: $5,685 |

22-28 days door-to-door | Dental clinics (no import expertise) |

| FOB Shanghai |

• Freight: $1,200 • Insurance: $150 • Additional costs: – Mexican customs broker: $600+ – COFEPRIS handling: $850+ – Warehouse demurrage: $300+ Actual Total: ~$4,100+ |

35-45 days (with clearance delays) | Experienced distributors |

Critical 2026 Update: Mexican customs now requires electronic manifest submission 72h pre-arrival. DDP suppliers must provide:

• Digital COA (Certificate of Analysis)

• Spanish-language labeling per NOM-024-SSA1-2023

• Import permit copy (Clave de Importación)

Why Shanghai Carejoy is the Strategic Partner for Mexico (2026)

With 19 years of dental export expertise, Carejoy addresses Mexico-specific sourcing challenges:

- Regulatory Mastery: Holds ISO 13485:2016 (Certificate #CN-2024-IMPL-8871) and MDR-compliant CE Mark (NB #2797). Provides pre-validated COFEPRIS dossiers in Spanish

- Mexico-Optimized MOQ: Offers 4-on-1 system starting at 300 sets with mixed abutment angles (0°/15°/30°)

- DDP Guarantee: All Mexico shipments include fixed-rate DDP with 28-day timeline guarantee (Lázaro Cárdenas port)

- Technical Support: On-ground engineers in Guadalajara for installation and staff training

- Product Range: Full ecosystem (CBCT for planning, autoclaves for sterilization, chairs for placement)

Engage Shanghai Carejoy for Mexico-Specific Solutions

Company: Shanghai Carejoy Medical Co., LTD

Established: 2005 | Location: Baoshan District, Shanghai, China

Specialization: Factory-direct 4-on-1 implant systems with Mexican regulatory compliance

Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (Spanish-speaking team available)

Request “MX-2026 Implant Sourcing Kit” for COFEPRIS checklist, DDP calculator, and sample technical dossier

Final Implementation Checklist

- Confirm supplier’s ISO 13485 certificate via IAF CertSearch (not just PDF)

- Demand material test reports showing ASTM F136 compliance

- Negotiate MOQ with phased delivery and interchangeability clause

- Insist on DDP terms with Mexican customs clearance included

- Verify Spanish-language labeling meets NOM-024-SSA1-2023

- Conduct biocompatibility testing at Mexican-certified lab (e.g., CENAM)

Note: COFEPRIS registration typically takes 120-180 days. Begin documentation 6 months pre-launch. Shanghai Carejoy provides dedicated regulatory project managers for Mexican clients.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Cost of 4-on-1 Dental Implants in Mexico (Equipment Procurement)

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Technical Answer |

|---|---|

| 1. What voltage requirements should I expect for dental implant systems used in 4-on-1 procedures in Mexico, and is dual-voltage support standard in 2026? | Dental implant motor systems used in 4-on-1 procedures in Mexico typically operate on 110–120V AC, 60 Hz, which aligns with standard Mexican electrical infrastructure. As of 2026, leading manufacturers (e.g., Bien-Air, NSK, W&H) offer dual-voltage compatibility (100–240V) on premium surgical motors to support international deployment. Always verify the equipment’s input voltage range and include voltage regulators or isolation transformers if integrating with older clinic circuits. |

| 2. Are spare parts for 4-on-1 dental implant systems readily available in Mexico, and what components should clinics stock as critical spares? | Yes, major dental equipment distributors in Mexico (e.g., Distribuidora Odontológica Nacional, Grupo KIN) maintain local inventories of high-wear spare parts. Clinics should stock critical spares including surgical handpieces, torque-limiting attachments, O-rings, chuck assemblies, and foot control units. Confirm with suppliers whether parts are OEM or certified aftermarket, and ensure compatibility with your specific implant motor model (e.g., Bien-Air Surgical A750). Lead times for non-stock items may extend 7–14 days. |

| 3. What does the installation process include for a complete 4-on-1 dental implant system purchased in Mexico, and is on-site technician training provided? | Installation of a 4-on-1 implant system in 2026 includes on-site setup of the surgical motor, integration with the dental chair (if bundled), calibration of torque and speed settings, and connectivity testing with imaging software (e.g., CBCT-guided navigation). Reputable suppliers provide certified technician installation with full operational validation. On-site clinical and technical training for dentists and staff is standard and typically lasts 2–4 hours, covering safety protocols, maintenance, and emergency shutdown procedures. |

| 4. What is the standard warranty coverage for dental implant motors and surgical units purchased in Mexico, and does it include labor and field service? | As of 2026, most premium dental implant systems sold through authorized Mexican distributors include a 2-year comprehensive warranty covering parts, labor, and return shipping. Extended warranties (up to 5 years) are available for an additional 12–18% of the unit cost. The warranty is valid only with registered installations and requires adherence to scheduled preventive maintenance. Field service response time is typically within 48 business hours in major cities (e.g., Mexico City, Monterrey, Guadalajara). |

| 5. How does the total cost of ownership for a 4-on-1 implant system in Mexico compare to other regions, and what hidden costs should distributors anticipate? | Purchasing implant systems in Mexico offers 15–25% cost savings compared to U.S. or EU markets, primarily due to lower import tariffs for registered medical devices and competitive local distribution. However, distributors should account for potential hidden costs: voltage conversion hardware, annual calibration services (~$300–$500 USD), consumable compatibility with international implant brands (e.g., Nobel Biocare, Straumann), and software licensing for guided surgery modules. Total cost of ownership (TCO) analysis should include 5-year maintenance and spare parts projections. |

Need a Quote for Cost Of 4 On 1 Dental Implants In Mexico?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160