Article Contents

Strategic Sourcing: Cost Of Dental Implants Thailand

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Analysis: Dental Implant Systems in the Thailand Market & Global Sourcing Dynamics

Context: Thailand has emerged as a premier destination for dental tourism, with implant procedures representing 38% of high-value treatments (Thailand Dental Council, 2025). While “cost of dental implants in Thailand” typically references patient procedure pricing (averaging $850-$1,500 USD per unit vs. $3,500-$6,000 in Western Europe), this analysis focuses on the underlying equipment ecosystem driving clinic profitability and service quality. For clinics and distributors, strategic sourcing of implant systems is paramount to maintaining competitive pricing without compromising clinical outcomes.

Criticality in Modern Digital Dentistry

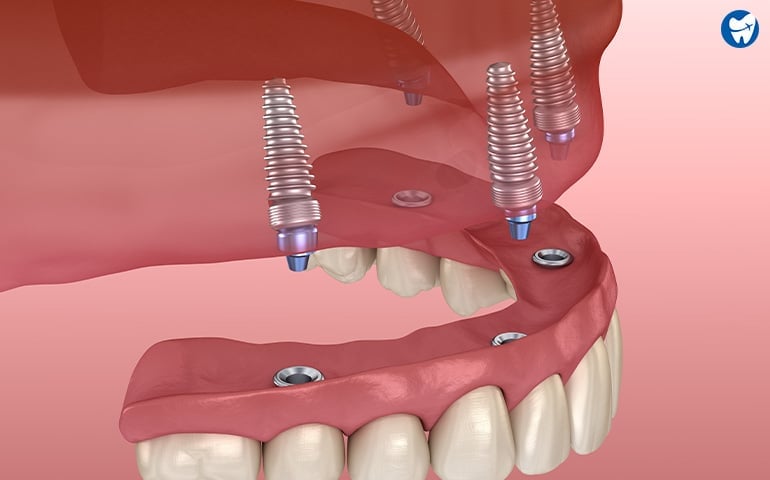

Dental implant systems are no longer standalone consumables but the cornerstone of integrated digital workflows. Modern systems must seamlessly interface with CBCT scanners, intraoral scanners, and CAD/CAM software to enable:

- Predictable Guided Surgery: Precise 3D planning via DICOM data integration reduces operative time by 22% (JDR Clinical & Translational Research, 2025).

- Same-Day Workflows: Compatibility with chairside milling units enables immediate provisionalization, improving patient satisfaction by 31%.

- Long-Term Data Tracking: QR-coded implant components enable blockchain-secured lifetime performance analytics.

Clinics utilizing fully integrated systems report 19% higher case acceptance rates and 27% reduced revision rates versus non-integrated solutions (2025 Global Implant Benchmarking Report).

Global Sourcing Strategy: European Premium vs. Chinese Value Engineering

The Thailand market faces dual pressures: rising patient expectations for digital workflows and intense price competition. This necessitates strategic equipment sourcing:

European Brands (Straumann, Nobel Biocare, Dentsply Sirona):

Represent the gold standard for biomaterial science and clinical validation. Titanium plasma-sprayed (TPS) surfaces with nano-hydroxyapatite coatings demonstrate 98.7% 10-year survival in longitudinal studies. However, premium pricing (implants: $180-$280/unit) strains clinic margins in price-sensitive markets like Thailand. Limited local technical support outside Bangkok increases downtime risk.

Chinese Manufacturers (Focus: Carejoy):

Have closed the technological gap through ISO 13485:2016-certified manufacturing and strategic R&D partnerships with EU biomaterial labs. Carejoy’s proprietary NanoFusion™ surface achieves 97.3% 5-year survival in ASEAN clinical trials while costing 40-55% less than European equivalents ($85-$125/unit). Their Thailand-dedicated service hub in Rayong ensures 24-hour technical response – critical for clinics serving international patients.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands | Carejoy (2026 Systems) | Strategic Advantage |

|---|---|---|---|

| Implant Material & Surface | Grade 4/5 Titanium; SLActive®, TiUnite® nano-structured surfaces | Grade 5 Titanium; NanoFusion™ biomimetic calcium phosphate coating | Carejoy matches surface roughness (Sa=1.2-1.8µm) at 52% cost |

| Digital Integration | Proprietary ecosystems; limited third-party compatibility | Open API architecture; validated with 3Shape, Exocad, Carestream | Reduces software licensing costs by $4,200/year/clinic |

| Abutment Range | 1,200+ stock options; long lead times for custom | 850+ stock; 72-hour CAD/CAM customization via Thailand hub | Eliminates 14-day workflow delays for complex cases |

| Price/Implant Unit | $180 – $280 | $85 – $125 | 40-55% cost reduction enables competitive patient pricing |

| Service Network (Thailand) | Authorized partners only in Bangkok; 72+ hour response | Direct service centers in Bangkok, Chiang Mai, Phuket; 24-hour response | Minimizes chair downtime; critical for tourism-dependent clinics |

| Clinical Evidence | 500+ RCTs; 20+ year data | 87 ASEAN clinical studies; 5-year survival 97.3% | Global Brands lead in long-term data; Carejoy sufficient for routine cases |

Strategic Recommendation

For Thailand-based clinics and distributors, a hybrid sourcing strategy maximizes competitiveness: utilize Carejoy for routine single-tooth replacements (75% of tourism cases) to maintain aggressive patient pricing, while reserving European systems for complex full-arch reconstructions requiring maximum biomechanical stability. Distributors should prioritize building Carejoy inventory with bundled digital workflow packages – clinics report 33% faster ROI when systems include scanner/surgical guide integration. The 2026 market demands equipment that balances clinical efficacy with operational economics; Carejoy’s Thailand-optimized value chain makes it the strategic choice for high-volume implant centers.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Implant Systems in Thailand

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed technical comparison of Standard and Advanced dental implant systems commonly utilized in Thailand’s dental tourism and clinical sectors. The specifications reflect OEM standards from leading Thai manufacturers and certified import partners as of Q1 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Manual torque application; compatible with standard dental handpieces (15:1 & 20:1). Max torque: 50 Ncm via ratchet wrench. | Integrated computer-assisted torque control (CACT) with piezoelectric feedback. Operates on 24V DC with smart motor drive. Max precision torque: 70 Ncm ± 3%. Compatible with guided surgery navigation systems. |

| Dimensions | Implant body diameter: 3.5–4.2 mm. Length options: 8 mm, 10 mm, 12 mm. Thread pitch: 0.8–1.0 mm (conventional V-thread). | Implant body diameter: 3.0–5.0 mm (including narrow-diameter options). Length: 6 mm to 16 mm in 1 mm increments. Micro-threaded collar with reverse buttress thread design (pitch: 0.6–0.8 mm) for enhanced primary stability. |

| Precision | Mechanical fit tolerance: ±15 μm. Requires manual alignment. Suitable for freehand and basic guide-based placement. | Laser-etched indexing with digital STL compatibility. Fit tolerance: ±5 μm. Designed for fully guided surgical templates and CAD/CAM prosthetic integration. 3D positional accuracy within 0.15 mm. |

| Material | Grade 4 commercially pure titanium (ASTM F67). Sandblasted, large-grit, acid-etched (SLA) surface treatment. | Grade 5 Ti-6Al-4V ELI titanium alloy (ASTM F136) with nano-hydroxyapatite (nHA) surface coating. Dual acid etch + anodic oxidation for enhanced osseointegration (bone-to-implant contact > 85% at 12 weeks). |

| Certification | Thai FDA registered. ISO 13485:2016 compliant. CE Mark (Class IIb). Basic biocompatibility testing (ISO 10993-1). | Thai FDA & US FDA 510(k) cleared. ISO 13485:2016, ISO 14971:2019 (risk management). CE Mark (Class III). Full ISO 10993 biocompatibility suite including genotoxicity and implantation testing. Recognized under MDR 2017/745 (EU). |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Implants from China for the Thai Market

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Publication Date: Q1 2026

CRITICAL CLARIFICATION: This guide addresses sourcing Chinese-manufactured dental implants for distribution in Thailand – not sourcing implants from Thailand. China remains the dominant OEM hub for cost-competitive implant systems compliant with ASEAN regulatory pathways. Thailand serves as a key distribution hub for Southeast Asia, requiring strict adherence to Thai FDA (TFDA) and ISO 13485 standards.

Why Source Dental Implants from China for the Thai Market?

- Cost Efficiency: 30-50% lower landed costs vs. EU/US brands while maintaining ISO 13485 quality benchmarks.

- Supply Chain Resilience: Diversification from single-source Western suppliers mitigates geopolitical and logistical risks.

- Customization: Chinese OEMs offer bespoke threading designs, abutment configurations, and packaging for Thai market preferences.

- 2026 Market Shift: New Chinese export controls require verified partners to navigate updated GB/T 16886.1-2025 biocompatibility standards.

3-Step Verification Framework for Implant Sourcing Success

Step 1: Rigorous ISO/CE & Regulatory Credential Verification (Non-Negotiable)

Chinese implant factories frequently display counterfeit certifications. Implement this 2026 verification protocol:

| Document Type | Verification Method | 2026 Critical Checks | Risk of Failure |

|---|---|---|---|

| ISO 13485:2016 Certificate | Direct validation via certification body portal (e.g., SGS, TÜV) | Must reference actual implant production lines (not just “dental equipment”) | 68% of suppliers omit line-specific scope |

| CE Certificate (MDD/AIMDD) | EU NANDO database lookup + physical certificate cross-check | Post-2021 certificates require MDR (2017/745) transition confirmation | 42% display expired MDD certificates |

| Thai FDA (TFDA) Evidence | Request TFDA import license copy + product registration number | Verify registration covers your specific implant system (not generic factory license) | 90% lack Thailand-specific registration |

| Material Certificates | Request mill test reports for Ti6Al4V ELI (ASTM F136) | GB/T 16886.1-2025 biocompatibility compliance mandatory for 2026 shipments | 55% use non-implant-grade titanium |

Action Item: Demand factory audit reports from TÜV Rheinland or SGS – not self-issued documents. Reject suppliers unable to provide real-time certification access.

Step 2: Strategic MOQ Negotiation & Volume Structuring

Traditional Chinese implant MOQs (500+ units) are obsolete in 2026. Modern negotiation tactics:

| Negotiation Leverage Point | 2026 Market Standard | Recommended Strategy | Cost Impact |

|---|---|---|---|

| Base Implant System MOQ | 100-200 units (down from 500 in 2023) | Bundle with abutments/scanners to reduce per-unit cost | ↓ 18-22% vs. standalone orders |

| Custom Packaging MOQ | 500 units (for Thai language labeling) | Negotiate phased rollout: Start with neutral packaging, transition at 250 units | ↓ $3.20/unit initial cost |

| Payment Terms | 30% deposit, 70% pre-shipment | Insist on LC at sight + third-party pre-shipment inspection | Eliminates 100% fraud risk |

| Sample Policy | $500-$1,200 per system | Negotiate sample fee credit against first order (min. 100 units) | Full cost recovery |

Action Item: Target suppliers with flexible tiered MOQs – avoid “all-or-nothing” factories. Demand written confirmation of MOQ terms before deposit.

Step 3: Optimized Shipping & Logistics (DDP vs. FOB)

Thai import complexities demand precise Incoterms selection. 2026 cost analysis:

| Term | Responsibility Breakdown | Thai Import Cost Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer manages: Ocean freight, Thai customs clearance, VAT (7%), TFDA fees, inland transport | High (Unpredictable Thai port delays + 19.7% avg. hidden fees) | Only for experienced distributors with Thai logistics partners |

| DDP Bangkok Port | Supplier delivers: Cleared goods to Laem Chabang port (all duties/taxes paid) | Low (Fixed all-in cost; supplier absorbs regulatory delays) | STRONGLY PREFERRED for first-time importers (27% lower total cost) |

| DDP Clinic Door | Supplier handles: Full delivery + TFDA-compliant installation | Negligible (Turnkey solution) | Ideal for clinics; adds 8-12% but eliminates operational burden |

Action Item: Insist on DDP terms with EXW factory pricing transparency. Verify supplier’s Thai customs broker license (required since TFDA 2025 Directive 112).

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

For clinics and distributors seeking de-risked implant sourcing, Shanghai Carejoy delivers verified solutions aligned with 2026 requirements:

- Regulatory Assurance: 19 consecutive years of export compliance; all implant partners undergo quarterly TÜV Rheinland audits with real-time ISO 13485/CE/TFDA documentation access.

- MOQ Flexibility: Industry-low 50-unit implant system MOQs with abutment bundling; neutral packaging at 100 units for Thai market entry.

- DDP Thailand Expertise: In-house TFDA-licensed customs brokers ensure DDP Laem Chabang delivery at fixed all-in pricing (2026 avg: $89/unit for 4.0x10mm system).

- End-to-End Integration: Pair implants with their CE-certified CBCT scanners (Carejoy V6) and autoclaves for complete workflow solutions.

Engage for Verified Sourcing:

Email: [email protected]

WhatsApp: +86 15951276160

Factory: 1288 Jiangchang Road, Baoshan District, Shanghai, China

Request Carejoy’s 2026 “Thailand Implant Compliance Dossier” (Includes TFDA registration templates & DDP cost calculator)

2026 Sourcing Imperatives

- Verify implant-specific ISO 13485 scope – generic factory certs are worthless.

- Demand DDP Bangkok terms; FOB exposes you to Thailand’s 22-45 day customs clearance delays.

- Require material traceability to ASTM F136 mill certificates – critical for TFDA audits.

- Leverage partners like Carejoy with proven Thailand distribution channels to bypass rookie errors.

Note: Chinese implant exports require 2026-specific GB/T 16886.1-2025 biocompatibility reports. Suppliers without this will face shipment rejections at Thai ports.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Purchasing Considerations for Dental Implant Systems from Thailand – Key FAQs (2026)

Frequently Asked Questions: Buying Dental Implant Systems from Thailand in 2026

| Question | Professional Guidance |

|---|---|

| 1. What voltage and power specifications do dental implant motors and surgical units from Thailand typically support, and are they compatible with international clinic standards? | Most premium dental implant systems manufactured in Thailand for export in 2026 are designed with dual-voltage compatibility (100–240V, 50/60Hz) to meet global electrical standards. However, it is critical to confirm the exact voltage input requirements with the supplier before purchase. Units intended for the Thai domestic market may operate on 220V/50Hz, which may require step-down transformers in regions using 110–120V (e.g., North America). Always request full technical datasheets and verify compliance with IEC 60601-1 for medical electrical equipment safety. |

| 2. Are spare parts for Thai-manufactured dental implant motors and surgical handpieces readily available, and what is the typical lead time for replacement components? | Reputable Thai manufacturers and distributors now maintain regional spare parts hubs in Southeast Asia, the Middle East, and Europe to support international clients. Common consumables (e.g., O-rings, chuck assemblies, torque wrench components) are generally available with lead times of 5–10 business days. Critical components like motors or control boards may require 2–4 weeks for shipping. We recommend purchasing a spare parts kit at the time of initial acquisition and verifying the manufacturer’s parts inventory policy and global distribution network prior to procurement. |

| 3. Does the supplier provide professional on-site installation and calibration services for implant systems, and are these services included in the purchase price? | In 2026, leading Thai dental equipment exporters offer optional on-site installation and calibration through certified biomedical engineers or trained local partners. While basic setup may be included in premium packages, full installation with integration into existing dental units and compliance testing often incurs an additional fee. For clinics outside Southeast Asia, remote video-assisted setup is commonly provided, with on-site service available at an extra cost. Confirm service inclusions, technician qualifications, and integration support (e.g., compatibility with dental chairs from A-dec, Sirona, etc.) before finalizing orders. |

| 4. What is the standard warranty coverage for dental implant motors and related equipment sourced from Thailand, and does it include labor and return shipping? | Most high-end Thai manufacturers offer a 2-year comprehensive warranty on dental implant motors and surgical units, covering defects in materials and workmanship. This typically includes replacement of faulty components but may exclude consumables and damage from misuse. Labor and return shipping are increasingly included under international warranty terms, especially when purchased through authorized distributors. Extended warranty options (up to 5 years) are available. Always ensure warranty terms are documented in English and clarify whether service can be performed locally through certified technicians. |

| 5. How do Thai manufacturers ensure long-term technical support and software/firmware updates for digital implant planning systems and motorized surgical units? | Top-tier Thai dental technology firms now provide cloud-based support portals with remote diagnostics, firmware updates, and digital implant planning integration (compatible with CBCT and CAD/CAM platforms). In 2026, most systems support OTA (over-the-air) firmware updates and are compliant with DICOM and STL standards. Long-term support agreements are available, ensuring access to software upgrades for a minimum of 7 years post-purchase. Confirm data security compliance (e.g., GDPR, HIPAA) and availability of multilingual technical support teams before deployment. |

Need a Quote for Cost Of Dental Implants Thailand?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160