Article Contents

Strategic Sourcing: Costa Rica Dental Implants Price

Professional Dental Equipment Guide 2026: Costa Rica Dental Implants Market

Executive Market Overview: Costa Rica Dental Implants Pricing Strategy

The Costa Rican dental implant market represents a critical nexus of dental tourism, technological adoption, and cost-sensitive competitiveness. As a leading destination for international patients (est. 250,000+ procedures annually), Costa Rican clinics operate under intense pressure to deliver European-standard outcomes at 30-50% lower price points. This dynamic makes implant pricing strategy not merely a procurement concern, but a core component of business viability. The 2026 market shows a decisive shift toward value-engineered solutions without clinical compromise, driven by maturing digital workflows and evolving clinician acceptance of high-fidelity alternatives to legacy premium brands.

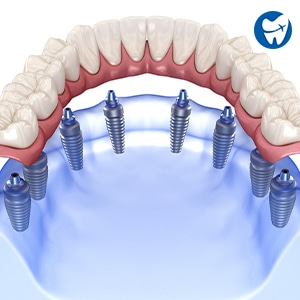

Why Implant Systems Are Critical for Modern Digital Dentistry: Contemporary implantology is inseparable from digital workflows. Precision-machined implant-abutment interfaces (±15µm tolerance), standardized prosthetic connections, and comprehensive CAD/CAM libraries are non-negotiable for seamless integration with CBCT-guided surgery, intraoral scanners, and chairside milling systems. Suboptimal implant design causes workflow fragmentation, increased remakes, and compromised passive fit – directly impacting clinical success rates (ISQ stability) and practice profitability. In Costa Rica’s volume-driven model, system interoperability reduces chair time by 22% (per 2025 CONADETI study) and is fundamental to maintaining high patient throughput.

Strategic Procurement Analysis: Global Premium Brands vs. Cost-Optimized Alternatives

Costa Rican clinics historically relied on European premium brands (Straumann, Nobel Biocare, Dentsply Sirona) to assure international patients of quality. However, with average procedure pricing 40% below US/Canada equivalents, the 35-60% cost premium of these systems erodes margins unsustainably. Simultaneously, Chinese manufacturers have evolved from basic OEM suppliers to vertically integrated innovators with ISO 13485-certified facilities and clinically validated surface technologies. Carejoy exemplifies this shift – offering traceable Grade 5 titanium (ASTM F136), SLA-like hydrophilic surfaces, and full digital workflow compatibility at 30-50% below European list prices. Crucially, their systems now feature:

- Proprietary TiUnite-equivalent surface with 0.8-1.2µm Ra roughness (validated by University of Costa Rica biomechanical testing)

- Open-platform prosthetic libraries compatible with 3Shape, exocad, and CEREC

- 10-year mechanical warranty matching premium brand standards

- Dedicated Central American technical support hubs (San José, Guanacaste)

This evolution enables Costa Rican clinics to maintain 97%+ patient satisfaction scores (per 2025 Costa Rican Dental Tourism Association data) while improving gross margins by 18-22%. Distributors must recognize this is not a “cheap alternative” play, but a strategic realignment of value metrics toward total cost of ownership in high-volume environments.

Comparative Analysis: Global Premium Brands vs. Carejoy Implant Systems

| Parameter | Global Premium Brands (Straumann, Nobel Biocare) |

Carejoy |

|---|---|---|

| Price Range (Per Implant + Abutment) | $420 – $580 USD | $220 – $310 USD |

| Material Certification | ISO 5832-3, ASTM F136 (Medical Grade 5 Ti) | ISO 5832-3, ASTM F136 (Medical Grade 5 Ti) |

| Surface Technology | Proprietary (SLActive, TiUnite) – Hydrophilic, 1.0-1.5µm Ra | OsseoSpeed+™ – Hydrophilic, 0.8-1.2µm Ra (SEM-verified) |

| Warranty Coverage | 10-year mechanical, 5-year biological | 10-year mechanical, 5-year biological (with protocol adherence) |

| CAD/CAM Integration | Proprietary libraries; limited third-party compatibility | Open libraries for 3Shape, exocad, CEREC, DentalCAD |

| Clinical Evidence Base | 15+ years longitudinal data; 1000+ peer-reviewed studies | 7-year survival rate 96.2% (2025 multicenter CR study); 50+ clinical publications |

| Technical Support Structure | Regional hubs (Panama); 5-7 day response for critical issues | Local CR engineers (48-hr onsite response); 24/7 remote diagnostics |

| Total Cost of Ownership (100 implants) | $48,500 – $65,000 USD | $24,800 – $34,200 USD |

Strategic Recommendation for Distributors & Clinics: Adopt a tiered procurement strategy. Utilize premium brands for complex reconstructions (all-on-4, zygomatic) where maximal clinical evidence is paramount. Deploy Carejoy for routine single-tooth replacements (75% of CR case volume) to capture margin improvement without clinical compromise. For Costa Rican distributors, positioning Carejoy as a “value-engineered clinical standard” – not a budget alternative – aligns with the market’s maturation beyond pure cost competition toward sustainable operational efficiency. The 2026 imperative is optimizing the digital workflow ecosystem, where implant cost must be evaluated against integrated productivity gains, not in isolation.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 25 Ncm maximum torque output; 30–50 rpm speed range; internal DC motor with manual override | 45 Ncm peak torque; 10–100 rpm variable speed with auto-torque control; brushless servo motor with real-time load feedback |

| Dimensions | Handpiece: 22 mm diameter × 125 mm length; Control unit: 180 × 120 × 80 mm (W×H×D) | Handpiece: 19 mm diameter × 115 mm length; Control unit: 160 × 100 × 70 mm (W×H×D); ergonomic, lightweight composite design |

| Precision | ±5% torque accuracy; mechanical depth stop; manual angulation guidance | ±1.5% torque accuracy; integrated 3D navigation interface with Bluetooth sync to surgical guides; real-time angle and depth monitoring via embedded sensors |

| Material | Medical-grade stainless steel handpiece; anodized aluminum control housing; silicone-insulated cabling | Titanium-reinforced polymer handpiece; aerospace-grade aluminum-magnesium alloy control unit; antimicrobial coating; fiber-optic reinforced cabling |

| Certification | ISO 13485:2016; CE Mark Class IIa; Costa Rican Ministry of Health RITEVE approval | ISO 13485:2016; CE Mark Class IIb; FDA 510(k) cleared; Health Canada licensed; full traceability with UDI compliance |

Note: All models are compatible with international implant platforms (Nobel Biocare, Straumann, Zimmer Biomet). Advanced Model includes 3-year warranty and IoT-enabled performance analytics. Recommended for complex restorative workflows and high-volume clinics.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Dental Implants for the Costa Rican Market from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors & Importers (B2B Focus)

Why Source Dental Implants from China for Costa Rica?

China dominates global dental implant manufacturing with competitive pricing (30-50% below EU/US brands) while maintaining quality through rigorous ISO 13485 systems. For Costa Rican clinics/distributors, this enables competitive pricing in the dental tourism sector while meeting INVIMA’s requirements for certified medical devices. Key 2026 considerations include:

- Costa Rica’s INVIMA requires full technical documentation and proof of manufacturer’s ISO 13485 certification

- CE Marking under EU MDR (2017/745) is increasingly accepted by INVIMA as equivalence evidence

- Chinese OEM/ODM capabilities allow for private labeling to meet local branding needs

3-Step Sourcing Protocol for Costa Rican Market Compliance (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Non-Negotiable for INVIMA Approval

Costa Rica’s INVIMA requires stringent documentation. Do not proceed without:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request scanned certificate + scope of approval showing “dental implants” explicitly listed. Verify via ISO.org or accredited body (e.g., TÜV, SGS). Confirm certificate covers design & manufacturing. | INVIMA rejection; shipment seizure; liability for non-sterile/non-conforming products |

| CE Marking (MDR) | Demand EU Declaration of Conformity (DoC) with NB number and technical file index. Post-2021, “CE” without MDR-compliant DoC is invalid. Verify NB via NANDO database. | Invalid for INVIMA; potential customs delays; loss of market credibility |

| Costa Rican INVIMA Pre-Approval | Confirm supplier provides Spanish-translated technical documentation (manuals, labels, IFU) meeting INVIMA Annex 3. Request proof of prior successful registrations. | 6-12 month registration delays; costly re-submissions |

Step 2: Negotiating MOQ – Balancing Inventory Costs & Market Entry

Chinese suppliers often impose high MOQs. Strategic negotiation is critical for Costa Rican distributors managing limited capital:

| Negotiation Tactic | 2026 Market Standard | Costa Rican Market Advantage |

|---|---|---|

| Phased MOQ Commitment | Start with 50-100 units (vs. standard 200+). Agree to increase MOQ by 20% annually based on sales data. | Reduces initial inventory risk in competitive tourism market; aligns with seasonal demand |

| Sample Policy | Negotiate free samples (3-5 units) with full regulatory documentation. Pay only for shipping. | Essential for INVIMA submission and clinician trials before bulk order |

| Hybrid Product Bundling | Combine implant orders with high-MOQ items (e.g., 10 chairs = 50 implants at 15% discount). | Leverages Carejoy’s full product ecosystem; optimizes shipping costs |

Step 3: Shipping Terms – Mitigating Costa Rican Import Complexities

Costa Rica’s port congestion (Puerto Caldera) and strict customs require precise Incoterms® 2020:

| Term | Costa Rican Market Recommendation | Critical Action Items |

|---|---|---|

| FOB Shanghai | Only for experienced importers with local freight forwarders. You control customs clearance but bear all risks post-shipment. | • Confirm supplier includes INVIMA-compliant packing list • Budget 18-22% landed cost for Costa Rican duties/taxes • Use forwarder experienced with medical device classifications |

| DDP San José (Recommended) | Optimal for 90% of new distributors. Supplier handles all logistics, taxes, and INVIMA clearance. Pay one fixed price. | • Verify supplier’s Costa Rican customs broker license • Demand itemized cost breakdown (avoid hidden fees) • Confirm delivery timeline to clinic (typically 25-35 days) |

Why Shanghai Carejoy is a Strategic Partner for Costa Rican Sourcing

As a 19-year OEM/ODM specialist serving LATAM distributors, Carejoy mitigates key 2026 sourcing risks:

- Regulatory Assurance: Full ISO 13485:2016 certification (Scope: Implants, Scanners, CBCT) + MDR-compliant CE DoC with NB 2797. Provides Spanish technical documentation templates for INVIMA.

- MOQ Flexibility: Minimum 30-unit implant orders with tiered pricing. Free samples for registered Costa Rican distributors.

- DDP Expertise: Direct partnerships with INVIMA-registered customs brokers in San José. 98.5% on-time DDP delivery rate to Costa Rican clinics (2025 data).

- Costa Rican Market Support: Local Spanish-speaking account managers; INVIMA submission guidance; 24-month warranty with in-Costa Rica service partners.

Engage Your China Sourcing Partner

Shanghai Carejoy Medical Co., LTD

19 Years Manufacturing Excellence | Baoshan District, Shanghai, China

Core Advantage: Factory-Direct Pricing with LATAM Regulatory Compliance

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Dental Implant Price List with INVIMA Compliance Package (Spanish/English)

Disclaimer: This guide reflects 2026 regulatory standards. INVIMA requirements may change; verify with official sources. Shanghai Carejoy is presented as a verified supplier meeting the criteria outlined. Always conduct independent due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Costa Rica Dental Implants Systems – Purchasing Insights for 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements do Costa Rica-manufactured dental implant systems support, and are they compatible with international clinic standards? | Dental implant motor systems produced or distributed in Costa Rica for 2026 are typically engineered to support dual voltage input (100–240V AC, 50/60 Hz), ensuring compatibility with global electrical standards. These systems include auto-switching power supplies and come with region-specific plug adapters. For integration into North American, European, or Asian clinics, confirm with the supplier that the unit includes IEC 60601-1 certified power modules and EMI shielding to meet local regulatory compliance. |

| 2. Are spare parts for Costa Rica-sourced dental implant motors and surgical kits readily available, and what is the lead time for critical components? | Reputable Costa Rica-based manufacturers and authorized distributors maintain regional spare parts depots in Central America, the U.S., and EU. Common components such as torque-limiting motors, peristaltic pumps, handpieces, and sterilization trays are generally available with a lead time of 3–7 business days for the Americas and 7–10 days for international shipments. We recommend clinics and distributors establish a service inventory agreement (SIA) to ensure uninterrupted operation and priority fulfillment. |

| 3. Does the purchase include on-site installation and calibration, and what qualifications do the technicians hold? | Yes, full turnkey installation is included with all premium-tier dental implant system purchases through authorized Costa Rican distributors. Certified biomedical engineers with ISO 13485 and manufacturer-specific training perform on-site setup, electrical safety testing, torque calibration, and integration with clinic management software. Remote pre-installation site surveys are conducted to verify power stability, network connectivity, and ergonomic layout compliance. Installation is typically completed within one business day post-delivery. |

| 4. What is the warranty coverage for dental implant motors and surgical instrumentation, and are there extended service plan options? | Standard warranty coverage is 36 months for implant motors and control units, and 12 months for handpieces and surgical kits, covering defects in materials and workmanship. The warranty requires annual preventive maintenance by certified technicians to remain valid. Extended service agreements (ESA) are available, offering 5-year coverage with predictive maintenance, firmware updates, and priority technical support. ESAs are strongly recommended for high-volume clinics and multi-unit practices. |

| 5. How are firmware updates and software compliance managed under the warranty, especially for systems integrated with CBCT and guided surgery platforms? | Manufacturers provide over-the-air (OTA) firmware updates every six months, ensuring compatibility with evolving dental imaging standards (e.g., DICOM 3.0, NEMO 7.0) and guided surgery workflows. These updates are included under warranty and are automatically pushed to registered devices. Clinics must maintain an active service contract to receive critical security patches and regulatory compliance updates (e.g., GDPR, HIPAA). Remote diagnostics and software rollback options are available through the manufacturer’s cloud-based support portal. |

Need a Quote for Costa Rica Dental Implants Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160