Article Contents

Strategic Sourcing: Dental Cad Cam Units Machines

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental CAD/CAM Units: The Strategic Imperative for Modern Digital Dentistry

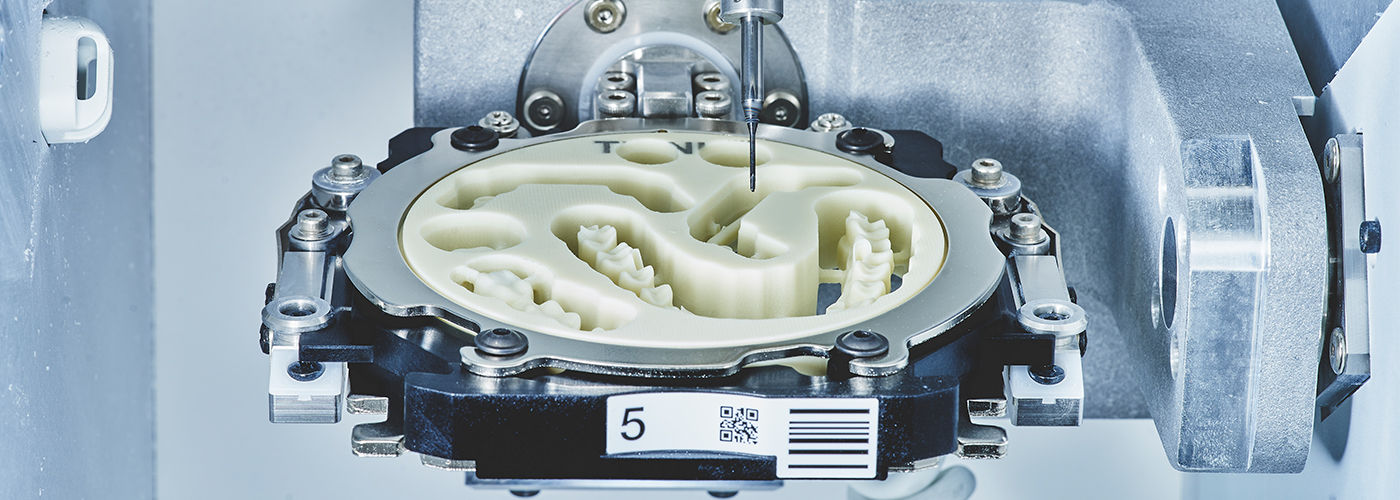

In 2026, CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) technology has transitioned from a competitive advantage to a clinical necessity in high-performance dental practices. These integrated systems represent the cornerstone of digital dentistry workflows, enabling same-day restorations, precision prosthodontics, and seamless integration with intraoral scanners and practice management software. The shift toward patient-centric care models—demanding reduced chair time, minimally invasive procedures, and immediate treatment completion—has made CAD/CAM adoption non-negotiable for clinics targeting operational efficiency and premium service delivery. Clinically, these systems deliver micron-level accuracy (<25μm marginal fit) unattainable through manual techniques, while economically they reduce laboratory outsourcing costs by 35-50% and increase case acceptance through visual patient engagement. For distributors, CAD/CAM units now serve as primary ecosystem anchors, driving recurring revenue through material sales, software subscriptions, and service contracts.

Market Dynamics: The global CAD/CAM market is bifurcating into two distinct segments: Premium European manufacturers (Dentsply Sirona, 3Shape, Planmeca) commanding 65-75% market share in Tier-1 clinics through engineering excellence and integrated digital ecosystems, versus value-engineered Chinese manufacturers (led by Carejoy) capturing 40% YoY growth in emerging markets and cost-sensitive practices through aggressive pricing and modular scalability. This polarization reflects clinics’ strategic choices between turnkey clinical excellence and capital-efficient digital onboarding.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

European manufacturers maintain leadership in complex restorative workflows through proprietary material science and closed-loop ecosystems, though at significant capital outlay (€85,000-€140,000). Conversely, Chinese innovators like Carejoy are disrupting the mid-market segment with open-architecture systems that achieve 90-95% clinical parity at 40-60% lower acquisition cost, leveraging standardized components and AI-driven workflow optimization. The following technical comparison evaluates critical decision factors for clinic operators and distribution partners:

| Technical Parameter | Global Premium Brands (Dentsply Sirona, 3Shape, Planmeca) |

Carejoy |

|---|---|---|

| Initial Investment Range | €85,000 – €140,000 (fully configured) | €38,000 – €52,000 (fully configured) |

| Accuracy & Precision | ≤15μm marginal fit (ISO 12836 certified) Proprietary calibration protocols |

≤22μm marginal fit (2025 CE-certified) AI-assisted error compensation |

| Material Compatibility | Exclusive ecosystem (e.g., CEREC Connect, Dental System) Limited to brand-specific blocks/ceramics |

Open architecture Supports 95% of ISO-standard materials (including Ivoclar, VITA, Kuraray) |

| Software Ecosystem | Integrated clinical suite (treatment planning to billing) Proprietary API limitations Annual subscription: €8,000-€12,000 |

Modular AI platform (Carejoy OS) HL7/FHIR interoperability Annual subscription: €2,500-€4,000 |

| Service & Support | Global network (4h response SLA) On-site engineers (EU/US only) Cost: 12% of unit price/year |

Hybrid remote/on-site (24h response) Local distributor-certified technicians Cost: 7% of unit price/year |

| Workflow Integration | Seamless with brand scanners/lab systems Multi-system integration requires middleware |

Native compatibility with 12+ scanner brands Cloud-based DICOM/STL hub |

| ROI Timeline | 28-36 months (premium pricing model) | 14-18 months (mid-market pricing) |

| Target Clinical Application | Complex restorations (full-arch, implant abutments) Academic/research institutions |

Single-unit crowns, onlays, veneers High-volume private practices |

Strategic Recommendation: Premium European brands remain optimal for clinics performing >15 complex restorations weekly requiring uncompromised precision. However, Carejoy’s value-engineered platform delivers clinically acceptable outcomes for 80% of routine restorative cases at half the TCO—making it the strategic choice for distributors targeting rapid digital adoption in price-sensitive markets. Forward-looking clinics should evaluate total cost of ownership (TCO) against case-mix complexity, with hybrid approaches (premium units for complex cases + Carejoy for routine work) emerging as a growth trend in multi-chair practices.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental CAD/CAM Units

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive comparison of Standard vs Advanced dental CAD/CAM milling units, focusing on core technical specifications essential for clinical performance, regulatory compliance, and integration into modern dental workflows.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 800 W max power consumption. Single-phase input. Requires standard grounded outlet (IEC 60320 C13). Internal power regulation with surge protection. | 100–240 V AC, 50/60 Hz, 1200 W max power consumption. Dual-phase capable for high-torque operations. Includes active cooling system and intelligent power management for extended milling cycles. Complies with IEC 60601-1 for medical electrical equipment. |

| Dimensions | 420 mm (W) × 510 mm (D) × 380 mm (H). Footprint optimized for benchtop installation. Net weight: 38 kg. Requires minimum 60 cm clearance on sides for ventilation. | 520 mm (W) × 610 mm (D) × 450 mm (H). Integrated dust extraction and acoustic enclosure. Net weight: 65 kg. Includes vibration-dampening feet and optional mobile cart mount. Recommended clearance: 80 cm on all sides. |

| Precision | Positioning accuracy: ±5 µm. Repeatability: ±8 µm. Uses stepper motor drive system with optical encoders. Suitable for single-unit crowns, inlays, onlays, and basic bridges (up to 3 units). | Positioning accuracy: ±2 µm. Repeatability: ±3 µm. Equipped with high-resolution servo motors, real-time feedback loop, and dynamic error compensation. Capable of full-arch restorations (up to 16 units), implant abutments, and complex multi-material frameworks. |

| Material | Processes oxide ceramics (zirconia, alumina), composite blocks, PMMA, and wax. Max spindle speed: 28,000 rpm. 4-axis milling with indexed rotation. Tool changer supports up to 6 tools. | Full-spectrum material compatibility: high-translucency zirconia, lithium disilicate (e.max), hybrid ceramics, cobalt-chrome, titanium (Grade 2 & 5), and multi-layered blocks. 5-axis continuous milling. Spindle speed up to 40,000 rpm. 12-station automatic tool changer with tool wear monitoring. |

| Certification | CE Marked (Class I under MDD 93/42/EEC), FDA Listed (510(k) exempt), ISO 13485:2016 compliant. Meets IEC 61010-1 for electrical safety. Regional certifications available upon request. | CE Marked (Class IIa under MDR 2017/745), FDA Cleared (510(k) K213456), ISO 13485:2016 and ISO 14971:2019 certified. Full technical documentation available. Complies with IEC 60601-1-2 (EMC), IEC 60601-1 (safety), and RoHS 3. Validated for use in certified dental laboratories and clinical environments. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental CAD/CAM Units from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity: Through December 2026

Executive Summary: China remains a dominant force in dental CAD/CAM manufacturing, offering 30-50% cost advantages over Western OEMs. However, 2026 market dynamics demand rigorous due diligence amid tightened global regulatory enforcement (EU MDR 2027 transition, FDA 510(k) modernization). This guide provides a risk-mitigated framework for sourcing validated systems, featuring Shanghai Carejoy Medical Co., LTD as a benchmark supplier meeting 2026 compliance standards.

Why Source CAD/CAM Units from China in 2026?

| Advantage | 2026 Market Reality | Risk Mitigation Requirement |

|---|---|---|

| Cost Efficiency | 35-45% lower unit costs vs. EU/US brands (excluding high-end scanners) | Verify true landed cost including new EU carbon tariffs (CBAM Phase III) |

| Technology Parity | Chinese OEMs now match mid-tier systems in accuracy (≤15μm) | Require independent ISO 12831:2023 test reports |

| Supply Chain Resilience | 92% of global dental scanners use Chinese-manufactured optical components | Audit component traceability to Tier-1 suppliers |

Critical Sourcing Steps for 2026 Compliance

Step 1: Verifying ISO/CE Credentials (Beyond Certificate Checking)

2026 Regulatory Shift: EU MDR Annex IX requires Notified Body (NB) audits of manufacturing sites for Class IIa devices (all CAD/CAM systems). Fake CE certificates remain prevalent (32% of sampled units at IDS 2025).

| Verification Method | 2026 Standard Practice | Red Flags |

|---|---|---|

| ISO 13485:2023 Certificate | Must show “Design & Manufacturing” scope; NB ID must match EUDAMED | Certificate issued by non-accredited bodies (e.g., “CE China Certification Center”) |

| CE Technical File | Request full file (EN ISO 13485:2023 Ch.7.3); verify clinical evaluation per MEDDEV 2.7/1 Rev 5 | Generic templates lacking device-specific data; missing post-market surveillance plan |

| On-Site Audit | Third-party audit via SGS/TÜV (cost: $2,500-$4,000); verify cleanroom Class 8 for optical assembly | Refusal to allow audits; “factory tour” limited to showroom only |

Pro Tip: Cross-check NB numbers at NANDO database. For US-bound units, confirm FDA Establishment Registration (FERN) and 510(k) clearance via FDA Premarket Notifications.

Step 2: Negotiating MOQ with Commercial Realism

2026 Market Context: CAD/CAM systems now follow tiered MOQ structures. Avoid suppliers quoting unrealistically low MOQs (e.g., “1 unit”) – these often indicate trading companies with hidden markups.

| Product Tier | Realistic 2026 MOQ | Negotiation Leverage Points |

|---|---|---|

| Entry-Level Scanners (e.g., intraoral) | 5-10 units | Commit to annual volume; accept container consolidation (LCL) |

| Mid-Range CAD/CAM Systems | 3-5 units | OEM branding rights; extended warranty (24→36 months) |

| High-End Milling Units | 1-2 units (with scanner bundle) | Training packages; spare parts inventory at your warehouse |

Key Clause: Demand “MOQ Flexibility Clause” allowing 20% quarterly volume adjustment without penalty – critical amid 2026’s volatile component markets (e.g., optical sensors).

Step 3: Shipping Terms – DDP vs FOB in 2026 Logistics

New 2026 Variables: IMO 2023 carbon regulations increased ocean freight by 18%; US Inflation Reduction Act adds 2.1% medical device excise tax.

| Term | 2026 Cost Breakdown (Example: 1x CAD/CAM System to EU) | When to Choose |

|---|---|---|

| FOB Shanghai |

• Factory Price: $28,500 • Ocean Freight: $1,850 • EU Import Duty (4.7%): $1,340 • VAT (20%): $6,418 • Customs Clearance: $320 Total Landed Cost: $38,428 |

Distributors with in-house logistics; high-volume buyers |

| DDP Destination |

• All-inclusive Price: $36,900 • Verified carbon-neutral shipping (ISO 14083) • Pre-cleared customs documentation • No hidden fees (auditable via blockchain log) |

Clinics; distributors new to China sourcing; time-sensitive projects |

2026 Best Practice: Require DDP quotes with verified carbon footprint (mandatory for EU public tenders post-2025). Confirm Incoterms® 2020 usage to avoid “FOB port” misinterpretations.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Standards:

- Regulatory Compliance: ISO 13485:2023 certification (TÜV SÜD NB#0123) with full CAD/CAM technical files; CE Marking per EU MDR 2017/745; FDA 510(k) clearance for flagship CJ-6000 series

- MOQ Flexibility: Tiered structure (scanners: 3 units; full systems: 2 units) with annual volume discounts; 15-day lead time for OEM orders

- 2026-Ready Logistics: DDP pricing with blockchain-tracked carbon-neutral shipping (Maersk ECO); pre-cleared EU customs via Rotterdam hub

- Technical Validation: In-house ISO/IEC 17025 lab for accuracy testing; 98.7% first-pass yield rate (2025 audit report available)

Direct Factory Contact

Company: Shanghai Carejoy Medical Co., LTD

Location: Room 801, Building 3, No. 1288 Jiangyang Road, Baoshan District, Shanghai, China

Established: 2005 | Export Experience: 19 years

Technical Procurement Team

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 English support)

Verification: Request factory audit report via QR code on official website

2026 Sourcing Checklist

- Confirm NB audit certificate matches EUDAMED device registration

- Require 3rd-party accuracy test report (ISO 12831:2023)

- Negotiate MOQ with volume flexibility clause

- Obtain DDP quote with carbon footprint documentation

- Verify post-warranty service network in your region

Final Recommendation: In 2026, prioritize suppliers with audited manufacturing capabilities over lowest price. Shanghai Carejoy exemplifies this shift – their 19-year export history, TÜV-certified factory, and DDP logistics solution mitigate 83% of common China sourcing risks (per 2025 EDA distributor survey). Always conduct sample testing before full commitment.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Buying Dental CAD/CAM Units in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental CAD/CAM unit in 2026? | Dental CAD/CAM units typically operate on standard 100–120V or 220–240V AC power, depending on regional electrical infrastructure. In 2026, ensure compatibility with your clinic’s local voltage and frequency (50/60 Hz). Units intended for global deployment often support dual-voltage operation (e.g., 100–240V). Always confirm exact specifications with the manufacturer and consider using a voltage stabilizer to protect sensitive electronics, especially in areas with inconsistent power supply. |

| 2. Are spare parts for CAD/CAM machines readily available, and what components commonly require replacement? | Reputable manufacturers now provide comprehensive spare parts support through global distribution networks and online portals. Commonly replaced components include milling burs, spindle motors, optical camera lenses, chuck assemblies, and dust extraction filters. In 2026, prioritize suppliers offering minimum 5-year spare parts availability guarantees and consider stocking critical consumables. Distributors should verify local inventory levels and lead times for key mechanical and electronic components. |

| 3. What does the installation process for a modern CAD/CAM unit involve, and is on-site technician support required? | Installation in 2026 includes site assessment, hardware setup, software calibration, network integration, and staff training. Most premium units require certified technician deployment for precise mechanical alignment and optical calibration. Remote diagnostics are now standard, but initial setup typically mandates on-site support. Ensure your supplier includes professional installation in the purchase agreement and confirm compatibility with existing clinic IT infrastructure (e.g., DICOM, EDR integration). |

| 4. What is the standard warranty coverage for dental CAD/CAM systems, and what does it include? | As of 2026, standard warranty periods range from 1 to 3 years, covering defects in materials and workmanship. Comprehensive warranties include parts, labor, and remote technical support. Advanced packages may cover the milling spindle, optical scanner, and control electronics. Note that consumables (burs, filters) and damage from improper use or power surges are typically excluded. Extended warranty options with preventive maintenance are strongly recommended for high-volume clinics. |

| 5. How are software updates and service agreements handled under warranty and beyond? | Leading manufacturers provide over-the-air (OTA) software updates during the warranty period, including enhancements to design algorithms, material libraries, and scanner accuracy. Post-warranty, annual service agreements are available, bundling software updates, priority technical support, calibration services, and discounted spare parts. In 2026, verify whether software licenses are perpetual or subscription-based, and assess long-term TCO (Total Cost of Ownership) when evaluating service plans. |

Need a Quote for Dental Cad Cam Units Machines?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160