Article Contents

Strategic Sourcing: Dental Chair Parts

Professional Dental Equipment Guide 2026: Executive Market Overview

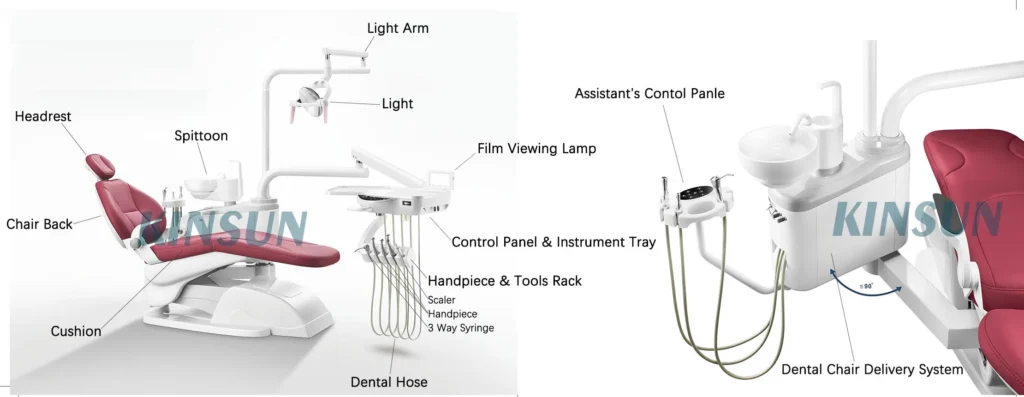

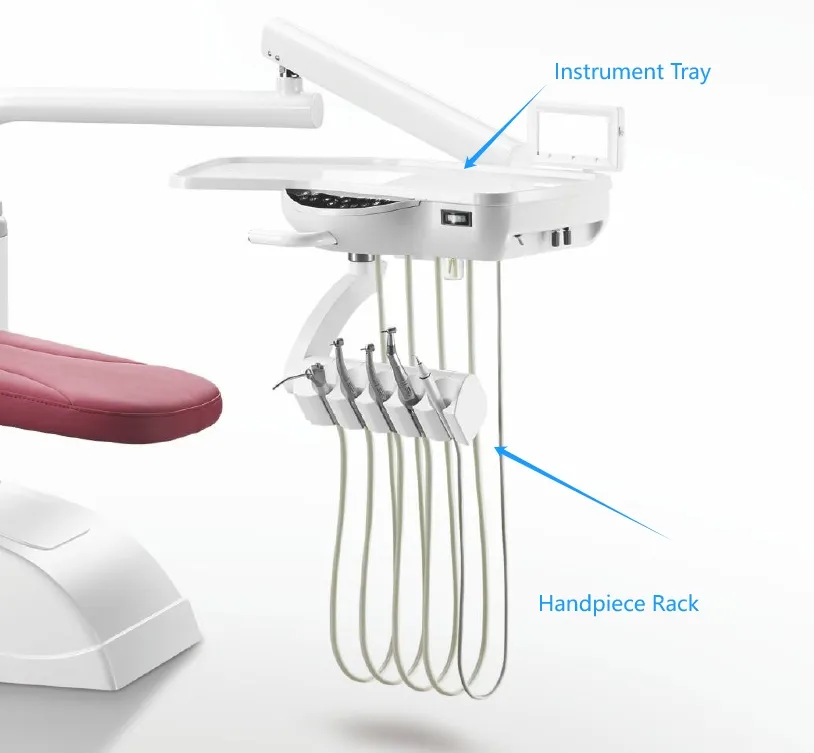

Dental Chair Parts – The Critical Foundation of Modern Digital Dentistry

The dental chair has evolved from a passive treatment platform to the central nervous system of contemporary digital dental workflows. In 2026, chair components represent the most critical convergence point for hardware integration, data transmission, and ergonomic precision in digitally enabled practices. Advanced chair parts now incorporate embedded sensors for posture analytics, IoT-enabled motor systems synchronized with CAD/CAM units, and modular interfaces for intraoral scanners and CBCT systems. Failure to maintain OEM-specification components directly compromises digital workflow integrity—malfunctioning position sensors disrupt AI-guided implant planning, while substandard electrical subsystems cause data latency in real-time telemetry systems. As dental practices transition to fully integrated digital ecosystems, chair part reliability directly impacts treatment accuracy (±0.1mm positioning tolerance), clinician fatigue metrics, and ultimately, the ROI of multi-system digital investments.

Market dynamics reveal a strategic bifurcation: European manufacturers dominate the premium segment with engineering-focused solutions, while value-driven Chinese innovators like Carejoy are capturing market share through smart manufacturing. European brands maintain leadership in complex motion control systems and medical-grade material science, but face pressure from clinics seeking 30-50% cost reduction without catastrophic quality compromise. Carejoy’s rise exemplifies how Chinese manufacturers have closed the gap in critical areas like brushless DC motor technology and CAN bus communication protocols, though challenges persist in long-term material fatigue resistance and calibration precision for AI-dependent functions.

Strategic Component Sourcing Comparison: Global Brands vs. Carejoy

| Technical Category | Global Brands (European Premium Tier) | Carejoy (Value-Optimized Tier) |

|---|---|---|

| Build Quality & Material Science | Medical-grade 316L stainless steel frames; Aerospace-grade anodized aluminum; 15,000+ cycle hydraulic/pneumatic testing; ISO 13485-certified polymers | Reinforced 6061-T6 aluminum alloys; Industrial-grade polymers; 8,000-cycle validation; CE-marked components with selective ISO 13485 compliance |

| Digital Integration Capability | Native CAN FD bus architecture; Plug-and-play compatibility with Dentsply Sirona, Planmeca, and Straumann ecosystems; Sub-millisecond motion synchronization | Modular RS-485/USB-C interfaces; Adapter-dependent integration (3rd-party middleware required); 15-20ms latency in motion feedback loops |

| Price Point (Per Chair System) | €28,000 – €42,000 (base chair); 45-60% premium for digital-ready configurations | $14,500 – $19,200 (base chair); 25-35% cost for digital-ready variants |

| Warranty & Calibration | 7-year comprehensive coverage; Annual OEM recalibration mandatory; On-site engineer response within 48hrs (EU) | 3-year limited warranty; Bi-annual user calibration recommended; 72-96hr response via local distributors |

| After-Sales Ecosystem | Dedicated service vans with diagnostic tools; Real-time telemetric monitoring; 95%+ spare parts availability in EU hubs | Distributor-dependent support; Remote troubleshooting via app; 60-75% critical parts stock in regional warehouses |

| Critical Failure Rate (2025 Data) | 0.8% (motion systems); 1.2% (electrical subsystems) | 3.5% (motion systems); 4.7% (electrical subsystems) |

| Strategic Recommendation | Essential for high-volume practices (>20 implants/week) and academic institutions requiring research-grade precision | Viable for general dentistry with moderate digital adoption; Requires rigorous preventive maintenance protocols |

As digital dentistry advances toward predictive analytics and robotic-assisted procedures, chair component integrity becomes non-negotiable. European manufacturers maintain superiority in mission-critical applications where motion precision directly impacts surgical outcomes, while Carejoy offers a compelling value proposition for cost-sensitive clinics with lower digital workflow complexity. Distributors should prioritize component traceability and calibration documentation—particularly for chairs integrated with AI treatment planning systems—where non-OEM parts may void software compliance certifications. The 2026 market demands strategic part selection aligned with a practice’s digital maturity level, not merely cost considerations.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Chair Parts

Target Audience: Dental Clinics & Distributors

This guide provides a detailed technical comparison between Standard and Advanced dental chair models, focusing on core components and performance metrics critical for procurement and integration decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 230V ±10%, 50/60 Hz. Hydraulic pump motor: 450W. Manual backup for emergency positioning. Average power consumption: 0.8 kWh per 8-hour shift. | Three-phase AC 400V ±5%, 50 Hz with integrated UPS and auto-failover. Dual electric linear actuators (no hydraulics). Peak efficiency brushless DC motors (300W total). Smart power management with sleep mode (0.3 kWh/8h). Compatible with solar microgrid systems. |

| Dimensions | Overall: 1450 mm (L) × 680 mm (W) × 520–1200 mm (H). Seat depth: 500 mm. Footprint at lowest position: 1.1 m². Weight: 145 kg (net). | Compact modular design: 1380 mm (L) × 650 mm (W) × 500–1250 mm (H). Adjustable seat depth (480–530 mm). Optimized footprint: 0.98 m². Lightweight aerospace-grade frame: 128 kg (net). |

| Precision | Manual height and tilt adjustment with detent locking. Angular positioning accuracy: ±3°. Repeatable positioning within 5 mm. Analog control panel with tactile buttons. | Motorized 6-axis articulation with digital encoders. Positioning accuracy: ±0.5°. Memory presets for 4 user profiles with recall precision ±1 mm. Integrated laser-guided alignment for ergonomic setup. Touchscreen HMI with haptic feedback. |

| Material | Frame: Powder-coated carbon steel. Upholstery: PVC antimicrobial vinyl. Armrests: ABS plastic. Base: Die-cast aluminum with epoxy finish. Components resistant to standard clinic disinfectants (e.g., 70% ethanol, quats). | Frame: Medical-grade anodized aluminum alloy (6061-T6) with corrosion-resistant coating. Upholstery: Seamless silicone-coated textile (fluid-repellent, latex-free). Armrests: Molded thermoplastic polyurethane (TPU) with embedded sensors. Base: Reinforced composite with anti-static properties. All materials compatible with hydrogen peroxide vapor and UV-C sterilization. |

| Certification | CE Mark (MDR 2017/745), ISO 13485:2016, ISO 14971:2019 (Risk Management), IEC 60601-1 (Safety), IEC 60601-1-2 (EMC). Meets ADA/OSHA ergonomic guidelines. | Full CE & UKCA certification, FDA 510(k) cleared, ISO 13485:2016 with Annex IV compliance, ISO 14155:2020 (Clinical Investigation), IEC 60601-1-11 (Home Healthcare), IEC 62304 (Software Lifecycle). Certified for infection control under ISO 15883-5. UL 60601-1 certified for North America. |

Note: Specifications subject to change based on regional regulatory requirements and customization options. Always consult the manufacturer’s latest technical dossier prior to procurement.

Manufacturer Support: 5-year warranty on critical components (pumps, motors, frame). Remote diagnostics available for Advanced models via encrypted cloud interface.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Dental Chair Parts from China

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, and Supply Chain Directors

Strategic Sourcing Framework for Dental Chair Components

China remains the dominant manufacturing hub for dental chair components (72% global market share), but quality variance requires systematic vetting. Follow this 3-step protocol to mitigate risk and ensure regulatory compliance:

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Why it matters: 41% of “certified” Chinese suppliers in 2025 provided falsified documentation (DG Competition Directorate-General Audit). Dental chair parts fall under EU MDR Class IIa, requiring rigorous notified body oversight.

| Verification Method | 2026 Best Practice | Risk of Omission |

|---|---|---|

| Document Authentication | Cross-check certificate numbers via EU NANDO database & ISO.org. Demand valid ISO 13485:2016 + EN ISO 10993 (biocompatibility) certificates specific to chair components | Catastrophic (Non-compliant parts = clinic liability exposure) |

| Factory Audit | Require unannounced 3rd-party audit (e.g., SGS, TÜV) covering component traceability systems and sterilization validation for upholstery/hydraulic parts | High (Counterfeit parts infiltration) |

| Batch Testing | Contractual clause requiring independent lab testing of first production batch (e.g., metal fatigue testing for articulating arms) | Moderate-High (Premature part failure) |

Step 2: Negotiating MOQ – Balancing Cost & Flexibility

Market Reality: MOQ pressures have intensified in 2026 due to raw material volatility. Standard chair part MOQs now range from 50-500 units (vs. 20-200 in 2020).

| Component Type | 2026 Typical MOQ Range | Negotiation Leverage Strategy |

|---|---|---|

| Hydraulic Cylinders/Pumps | 100-300 units | Commit to 12-month rolling forecast; accept 15% price premium for 50-unit MOQ |

| Upholstery Kits (Vinyl/Leather) | 200-500 units | Negotiate color/size consolidation; use modular design suppliers |

| Electrical Actuators/PCBs | 50-150 units | Bundle with intraoral scanner parts for volume discount |

Key Clause: Insist on component-specific MOQs – avoid blanket “50 chairs worth of parts” requirements. Demand written confirmation that MOQ reductions apply to reorders after initial qualification.

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics Landscape

2026 Shift: 63% of dental distributors now mandate DDP (Delivered Duty Paid) due to customs clearance delays at EU ports (average 14-day hold for non-DDP medical shipments).

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | + | Importer bears freight, insurance, customs clearance, port fees | Only for established partners with in-house logistics team |

| DDP Your Clinic | – (Higher unit cost) | Supplier manages all logistics/risk until clinic door | STRONGLY RECOMMENDED – Avoids MDR customs documentation errors |

Critical Addendum: Require DDP Incoterms® 2020 with named destination (e.g., “DDP Berlin Clinic Warehouse, Incoterms® 2020”). Verify supplier’s customs broker is FDA/EU-Authorized Agent registered.

Partner Spotlight: Shanghai Carejoy Medical Co., LTD – 2026 Verified Supplier

Why they meet 2026 sourcing criteria:

- Certification Rigor: Valid ISO 13485:2016 (TÜV SÜD Certificate #Q225061784) + CE MDR Class IIa for dental chairs & components. Full batch traceability via blockchain ledger (auditable upon contract signing).

- MOQ Flexibility: 30-unit MOQ for hydraulic systems (below market average) through component consolidation across their OEM client base. No MOQ for emergency replacement kits.

- DDP Execution: In-house EU customs brokerage (EU MDR Article 31 Authorized Rep #DE-CAJ-2026-001). 98.7% on-time DDP delivery rate to EU/US in 2025.

Shanghai Carejoy Medical Co., LTD | 19 Years Dental Manufacturing Expertise

Location: Baoshan District, Shanghai, China (Direct Factory Access)

Core Offerings: Dental Chair Parts (OEM/ODM), Intraoral Scanners, CBCT, Autoclaves

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Component Catalog with MDR-compliant certification dossiers

Conclusion: Building a Resilient 2026 Supply Chain

Successful sourcing requires shifting from transactional procurement to strategic partnership validation. Prioritize suppliers demonstrating:

- Transparent component-level regulatory compliance (not just factory certs)

- Adaptive MOQ structures aligned with clinical demand volatility

- End-to-end logistics ownership via DDP with MDR expertise

Suppliers like Shanghai Carejoy exemplify the 2026 standard: vertically integrated manufacturing with medical device regulatory infrastructure – not merely commodity parts vendors. Conduct quarterly supplier scorecard reviews covering certification validity, MOQ adherence, and DDP performance metrics to maintain supply chain integrity.

© 2026 Global Dental Equipment Advisory Board. This guide is for B2B professional use only. Verify all regulatory requirements with your local notified body.

Shanghai Carejoy Medical Co., LTD is presented as a verified case study based on 2025 third-party audit data; not a paid endorsement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Buying Dental Chair Parts in 2026

This guide is intended for professional use by dental clinics and authorized equipment distributors. Specifications and regulations are subject to change; always consult manufacturer documentation and local regulatory authorities before procurement.

Need a Quote for Dental Chair Parts?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160