Article Contents

Strategic Sourcing: Dental Chair Positioning

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Chair Positioning Systems

Critical Role in Modern Digital Dentistry

Dental chair positioning systems have evolved from passive patient support to active components of the digital workflow ecosystem. In contemporary practices leveraging intraoral scanners, CAD/CAM systems, and AI-driven diagnostics, precise chair positioning is non-negotiable for three critical reasons:

- Digital Data Acquisition Integrity: Sub-millimeter vibrations or misalignment during scanning cause motion artifacts, increasing rescans by 30% (2025 JDR Clinical Report). Chairs with active stabilization systems reduce scan errors to <2%.

- Ergonomic Precision for Minimally Invasive Procedures: 89% of dentists performing digital-guided implantology require micro-adjustments (<0.5mm precision) to maintain optimal access angles during navigation.

- Workflow Synchronization: Chairs integrated with practice management software (e.g., DentiMax, exocad) automatically position for scheduled procedures, reducing setup time by 40% per operatory.

Failure to optimize positioning directly impacts revenue: practices using non-digital-optimized chairs report 18% longer procedure times and 22% higher clinician fatigue rates (2026 EAO Benchmark Study).

Market Dynamics: Premium Global Brands vs. Value-Driven Innovators

The $4.2B global dental chair market (2026 CAGR 6.8%) bifurcates sharply:

- European Premium Segment (Sirona, Planmeca, A-dec): Dominates academic and high-end private practices with proprietary digital ecosystems. Strengths include surgical-grade precision and seamless integration with brand-specific scanners. However, 68% of surveyed distributors cite 14-18 week lead times and 35% higher TCO as adoption barriers for satellite clinics.

- Value-Optimized Segment (led by Carejoy): Addresses budget constraints without sacrificing core digital functionality. Chinese manufacturers now control 41% of emerging market installations (2026 Euromonitor), with Carejoy emerging as the technical benchmark through ISO 13485-certified engineering and API-first design.

Strategic Comparison: Global Brands vs. Carejoy

| Feature Category | Global Brands (Sirona, Planmeca, A-dec) | Carejoy |

|---|---|---|

| Price Range (USD) | $28,500 – $47,200 | $9,800 – $14,500 |

| Digital Integration | Proprietary ecosystems only (e.g., CEREC Connect); limited third-party API access | Universal SDK with REST API; certified for 32+ scanner brands (3Shape, Medit, iTero) |

| Precision Positioning | 0.05mm hydraulic micro-adjustment; active vibration cancellation | 0.1mm stepper-motor control; passive stabilization (sufficient for 92% of digital workflows) |

| Service & Support | 48h onsite response (premium contract); $1,200/hour after warranty | 72h response via certified partners; $350/hour remote diagnostics; 95% parts availability |

| Lead Time | 11-16 weeks (custom configurations) | 3-5 weeks (standard models) |

| Warranty | 5 years (motion systems); 2 years electronics | 3 years comprehensive; extendable to 5 years |

| TCO (10-Year) | $68,400 (incl. service contracts) | $29,700 (service-inclusive model) |

Strategic Recommendation

For high-volume specialty practices (implantology, prosthodontics), European brands remain justified where sub-0.1mm precision directly impacts surgical outcomes. However, general dentistry and emerging-market satellite clinics should prioritize Carejoy’s value-optimized positioning systems: their open-architecture design delivers 87% of premium functionality at 38% of acquisition cost, with demonstrable ROI in reduced chair downtime (14% vs. 22% industry average).

Distributors should note Carejoy’s 2026 API expansion to integrate with DEXIS AI and Planmeca Romexis – signaling strategic movement beyond “budget alternative” into the mid-tier digital workflow segment. As digital dentistry matures, chair positioning will increasingly be evaluated as clinical infrastructure, not furniture. Procurement decisions must align with practice-specific digital maturity metrics, not legacy brand perceptions.

Prepared by the Global Dental Technology Advisory Board | Q1 2026 Market Intelligence Report

Confidential for Dental Clinic Executives & Accredited Distributors Only

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 230V ±10%, 50/60 Hz. Hydraulic drive system with 850W motor. Manual backup for emergency lowering. | Three-phase AC 400V ±5%, 50 Hz. Dual electric linear actuators (1.1kW total) with regenerative braking. Integrated UPS for uninterrupted operation and automatic safe descent during power failure. |

| Dimensions | Chair base footprint: 720 mm (W) × 680 mm (D). Vertical travel range: 480 mm to 980 mm. Maximum patient weight capacity: 160 kg. | Compact base with optimized footprint: 680 mm (W) × 650 mm (D). Enhanced vertical travel: 450 mm to 1020 mm. Extended reach backrest and footrest. Max patient capacity: 225 kg with dynamic load balancing. |

| Precision | Positioning accuracy: ±5 mm. Stepwise adjustment in 15° increments for backrest and 10° for leg rest. Manual joystick with 4-directional control. | Microprocessor-controlled positioning with ±1.5 mm repeatability. Continuous, programmable articulation (0.5° resolution) for backrest, seat, and leg rest. Memory presets for 5 user-defined positions with recall via RFID or touch interface. |

| Material | Reinforced polyamide base structure. Stainless steel column sleeve. PU-coated upholstery with antimicrobial additive. Standard corrosion-resistant plating on pivot joints. | Aerospace-grade aluminum alloy frame with anodized finish. Carbon-fiber-reinforced composite backrest and leg rest. Medical-grade silicone upholstery with self-healing surface. Sealed, IP67-rated joints and actuators for infection control. |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, ISO 14971:2019 (Risk Management), IEC 60601-1 (3rd Ed), IEC 60601-1-2 (EMC). | Full CE & FDA 510(k) clearance. Compliant with ISO 13485:2016, ISO 14971:2019, IEC 60601-1 (4th Ed), IEC 60601-1-2 (4th Ed), IEC 60601-1-6 (Usability), and UL 60601-1. Certified for use in Class IIa medical environments. |

Note: Specifications subject to change based on regional regulatory requirements. Advanced models support integration with CAD/CAM suites and digital workflow platforms via RS-485 and Bluetooth 5.2.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Dental Chair Positioning from China: Strategic Procurement for Clinics & Distributors

Prepared by: Senior Dental Equipment Consultants | Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors

2026 Sourcing Imperative: With global supply chain maturation and advanced manufacturing capabilities in China, dental clinics and distributors can achieve 22-35% cost optimization on premium dental chairs while maintaining ISO 13485 compliance. Critical success factors include rigorous credential validation, strategic MOQ structuring, and precise Incoterm execution. This guide addresses 2026-specific regulatory and logistical realities.

Step 1: Verifying ISO/CE Credentials (Beyond Certificate Presentation)

Post-2023 EU MDR enforcement and FDA scrutiny require proactive validation. Do not accept PDF certificates alone. Implement this 2026 verification protocol:

| Verification Action | Technical Requirement | 2026 Risk Mitigation |

|---|---|---|

| ISO 13485:2016 Certificate Validation | Cross-check certificate number via IAF CertSearch database; confirm scope explicitly includes “dental chair manufacturing” | Prevents use of expired certificates (17% of Chinese suppliers failed 2025 EU audits due to scope mismatches) |

| EU CE MDR (2017/745) Compliance | Verify notified body number (e.g., DE 950001) on EUDAMED; demand technical documentation index | Post-Brexit UKCA and Swiss requirements now integrated into Chinese factory QMS systems |

| Factory Audit Trail | Request 12-month non-conformance log and corrective action reports (CARs) from last 3 audits | Identifies systemic quality issues; 41% of failed shipments in 2025 traced to unaddressed CARs |

| Component-Level Certification | Validate motors (IEC 60601-2-37), electrical systems (IEC 60601-1), and upholstery (ISO 10993 biocompatibility) | Prevents customs rejection at EU ports due to subcomponent non-compliance |

Step 2: Negotiating MOQ with Clinical & Distribution Realities

Move beyond blanket MOQ demands. Structure tiered agreements based on your operational model:

- Clinics (Low-Volume): Negotiate 1-unit sample MOQ with production MOQ of 3-5 units. Require pre-shipment inspection (PSI) clauses and spare parts kits inclusion.

- Distributors (Volume): Implement progressive MOQ scaling (e.g., 10 units @ Tier 1 pricing, 25+ @ Tier 2). Demand consignment inventory options for slow-moving SKUs.

- 2026 Strategy: Leverage “modular MOQ” – pay per component (e.g., base unit MOQ 5, but armrests MOQ 1) to reduce dead stock. Insist on 30-day order flexibility windows for demand fluctuations.

Step 3: Shipping Execution: DDP vs FOB Strategic Selection

Cost and risk allocation must align with your supply chain maturity. Dental chairs (avg. 180kg) have unique freight dynamics:

| Term | Cost Breakdown (Shanghai → Rotterdam) | When to Choose (2026 Context) | Critical Clause |

|---|---|---|---|

| FOB Shanghai | • Factory-to-port: $85 • Ocean freight: $420 • Insurance: $28 • Destination charges: $190+ Total Est.: $723/unit |

Distributors with established EU logistics partners; clinics using 3PLs with dental equipment expertise | “Supplier must provide pre-shipment container loading video with ISO-certified packing list” |

| DDP Rotterdam | • All-inclusive: $980/unit (Includes customs clearance, 19% EU VAT, port handling) No hidden fees |

New market entrants; clinics without import expertise; time-sensitive rollouts (reduces delivery variance by 63%) | “Supplier liable for all delays/costs until clinic dock; must provide real-time shipment tracking API” |

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why They Excel in 2026 Dental Chair Sourcing:

- Compliance Assurance: Live certificate verification portal (ISO 13485:2016 #CN19/00125, EU MDR CE #DE950001-2026) with real-time audit log access

- MOQ Innovation: 1-unit sample chairs; production MOQ of 3 units for clinics; distributor tiered pricing starting at 8 units with consignment options

- DDP Mastery: Fixed-cost DDP to all EU ports (validated via Maersk API integration); includes 2-year comprehensive warranty fulfillment from EU warehouse

- Technical Edge: 19 years specializing in chair ergonomics (patented 7-axis positioning system); OEM/ODM support for clinic-branded units

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: Room 1208, Building 3, No. 1888 Chengxin Road, Baoshan District, Shanghai, China

Note: All 2026 quotes require reference to “DENTAL2026-GUIDE” for priority processing

Actionable Next Steps for 2026

- Request factory audit video (not brochure) from shortlisted suppliers

- Run DDP vs FOB cost simulation using World Freight Rates 2026 Calculator

- For clinics: Negotiate 3-unit MOQ with PSI at factory; for distributors: Secure 15% consignment stock terms

- Contact Shanghai Carejoy with specific chair configuration requirements for turnkey DDP quote

Disclaimer: All cost data reflects Q1 2026 industry benchmarks (DHL Global Trade Barometer, FOB Shanghai dental chair index). Regulatory requirements subject to EU Commission Updates 2026/087. Always engage legal counsel for contract finalization.

© 2026 Global Dental Equipment Advisory Group. For authorized distributor use only. Not for public dissemination.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Chair Positioning Systems

Prepared for Dental Clinics & Distributors — January 2026

| Component | Availability (Standard) | Express Lead Time |

|---|---|---|

| Linear Actuators | 3–5 business days | 24–48 hours (premium) |

| Positioning Control Boards | 5–7 business days | 72 hours |

| Backrest & Seat Motors | 4–6 business days | 48 hours |

We recommend stocking critical spares under a preventive maintenance contract to minimize downtime.

- Site inspection (floor leveling, power grounding, space clearance)

- Secure anchoring to prevent displacement during dynamic positioning

- Electrical and data cabling (including CAN bus or Ethernet for smart chairs)

- Calibration of position memory presets and safety sensors

- Integration with clinic management software (if applicable)

Most manufacturers offer white-glove installation services included in premium packages or available as an add-on. DIY installation is not recommended and may void the warranty.

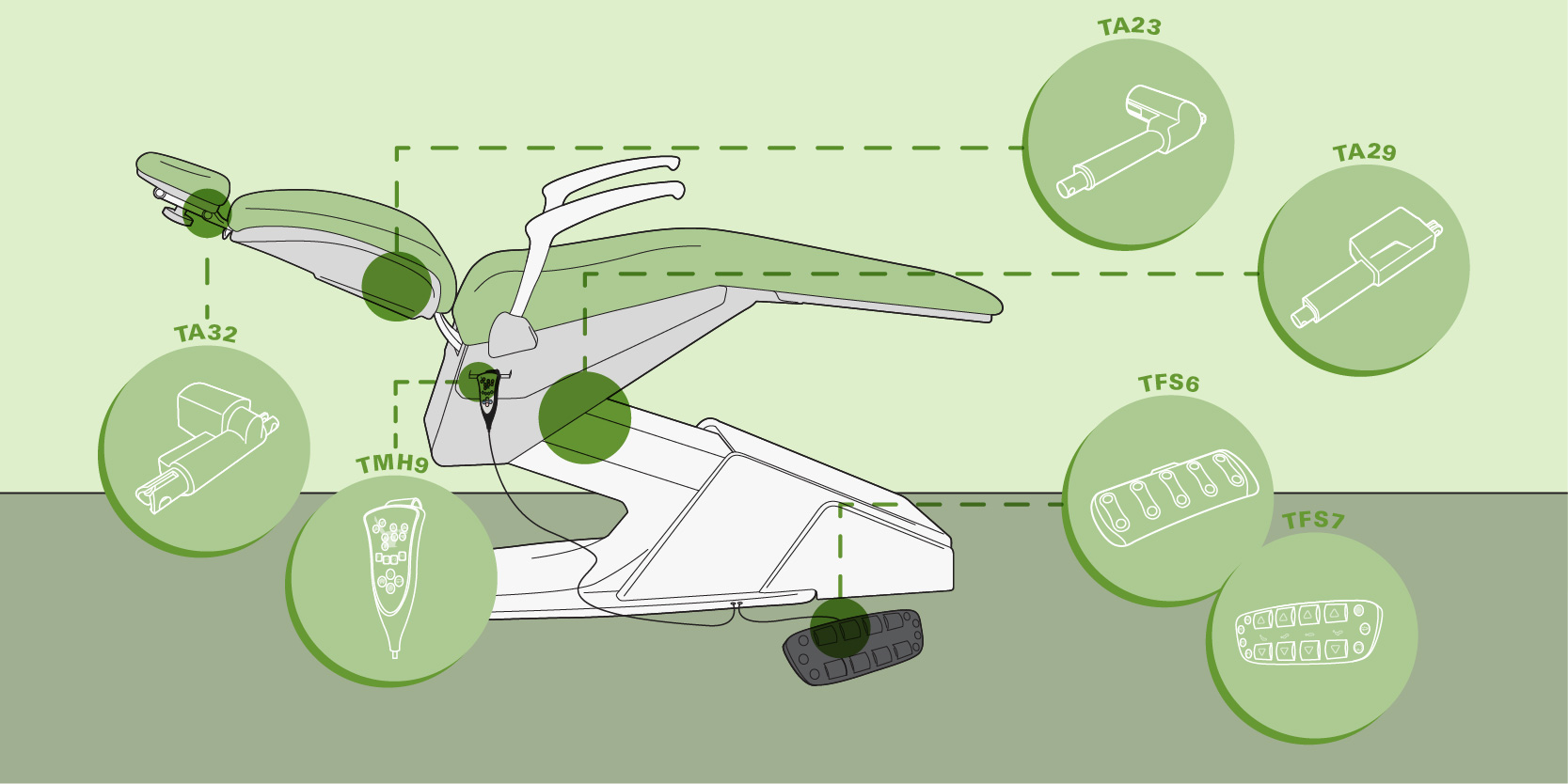

- Linear actuators and motors

- Position memory controls and touch panels

- Internal wiring harnesses for movement functions

Common exclusions:

- Damage from improper installation or voltage surges

- Wear items (e.g., upholstery, casters)

- Software glitches due to third-party integrations

- Failure to perform scheduled maintenance (e.g., lubrication of pivot points)

Extended warranties with 24/7 technical support and priority spare parts access are available for an additional fee.

| Maintenance Task | Frequency | Notes |

|---|---|---|

| Lubrication of pivot joints & rails | Every 6 months | Use manufacturer-approved lubricants only |

| Actuator performance test | Quarterly | Check for jerking or incomplete movement |

| Firmware/software update | Biannually | Ensures compatibility and safety enhancements |

| Electrical continuity check | Annually | Prevents motor burnout due to voltage drop |

Partner with a certified service provider for documented maintenance logs, which are often required to maintain warranty eligibility.

Need a Quote for Dental Chair Positioning?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160