Article Contents

Strategic Sourcing: Dental Chair Positions Supine

Professional Dental Equipment Guide 2026

Executive Market Overview: Supine Positioning Systems in Modern Digital Dentistry

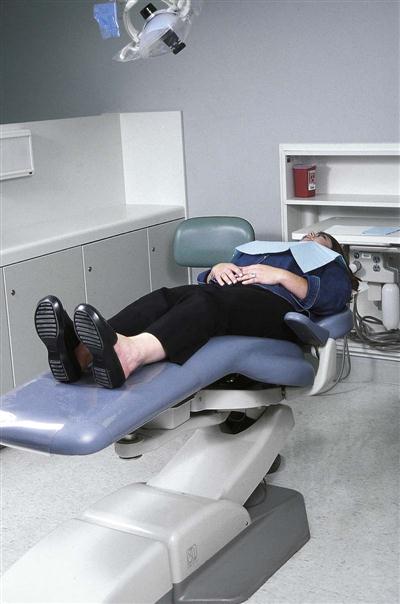

The supine positioning capability in dental chairs has evolved from a basic ergonomic feature to a clinically critical component of integrated digital workflows. In 2026, precision supine positioning (0° to 170° recline with sub-degree angular accuracy) is non-negotiable for clinics implementing CBCT-guided surgery, intraoral scanning, and CAD/CAM restorations. Sub-millimeter patient positioning errors directly compromise digital impression accuracy, surgical guide fit, and 3D imaging quality – potentially increasing remake rates by 18-22% (2025 EAO Clinical Integration Report).

Why Supine Positioning is Critical for Digital Dentistry:

Modern intraoral scanners require consistent head/neck alignment relative to the optical axis. A 2° variance in chair tilt can introduce 0.3mm distortion in full-arch scans – exceeding acceptable clinical margins. Similarly, CBCT acquisition protocols demand reproducible supine positioning to enable accurate fusion with optical scans. Clinics using chairs with <5° positioning hysteresis report 31% fewer workflow interruptions during digital crown preparations (2026 DSI Workflow Efficiency Index).

Market Segmentation: Premium European Brands vs. Value-Engineered Solutions

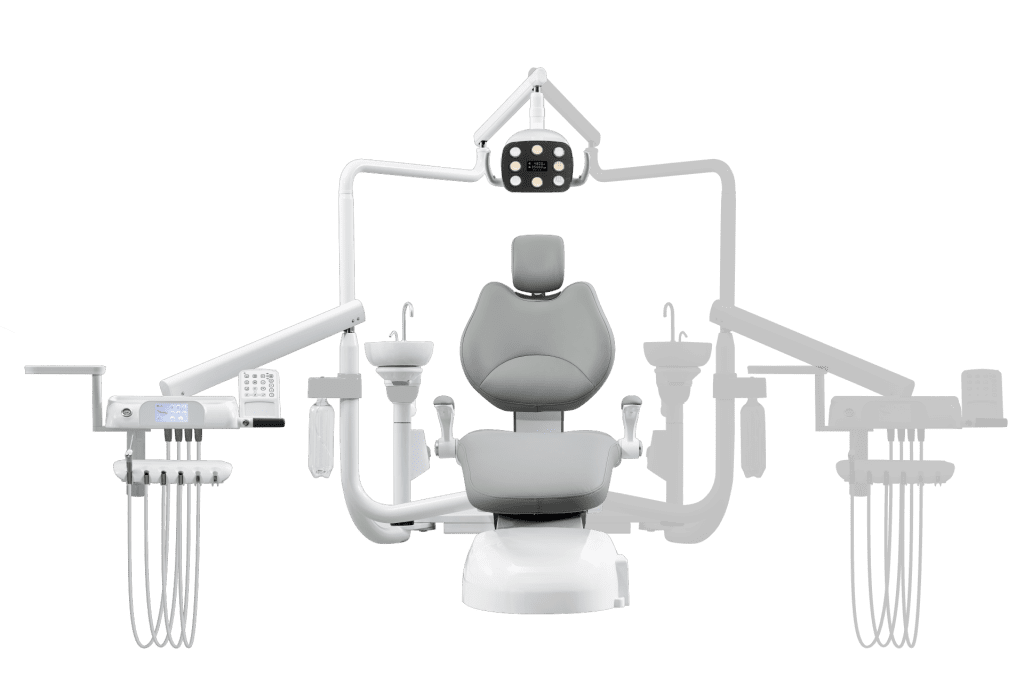

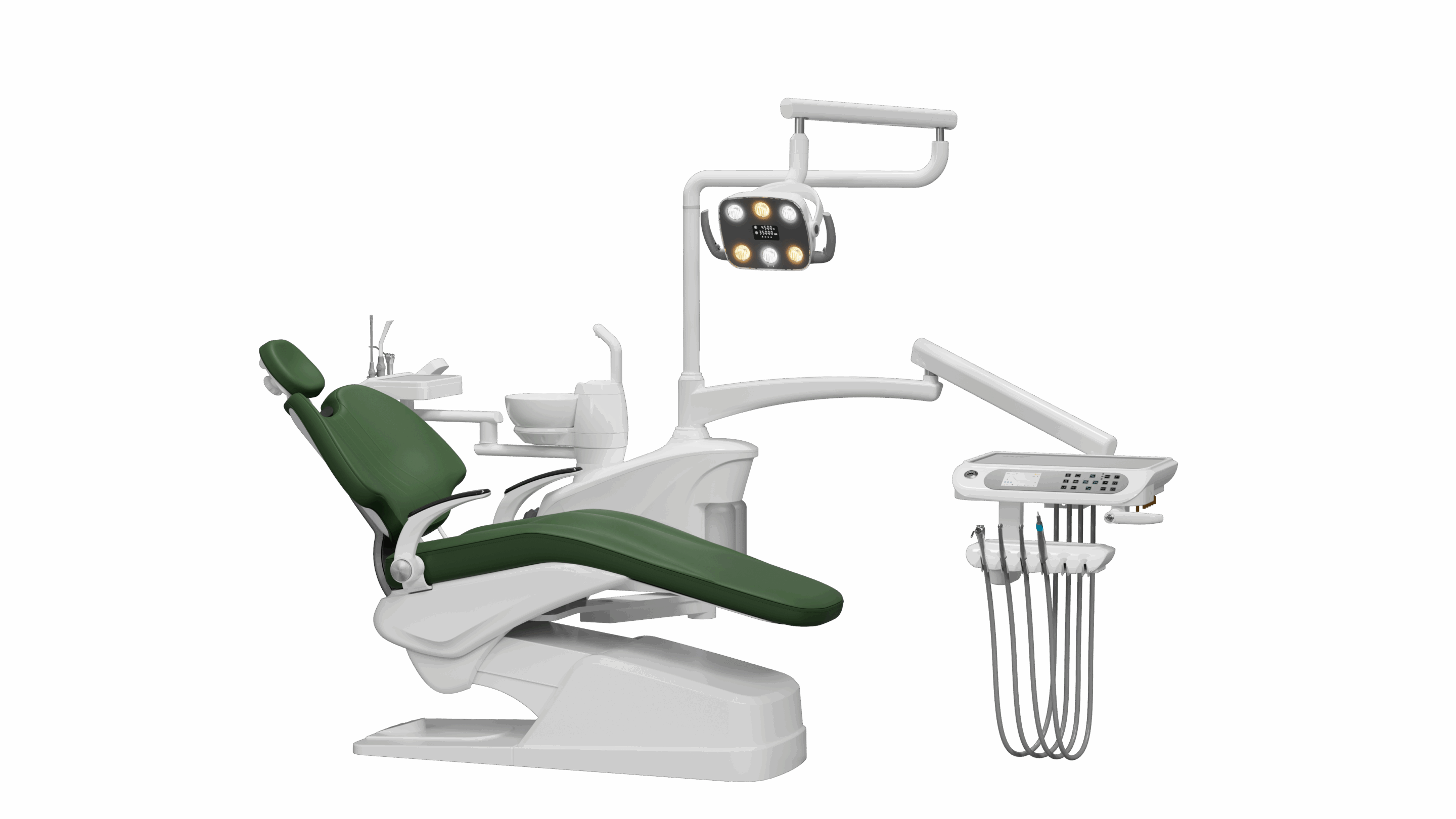

The global supine positioning chair market (€2.8B in 2026) is bifurcated between established European manufacturers and agile Asian innovators. Premium brands (Dentsply Sirona, Planmeca, A-Dec) dominate high-end clinics with integrated ecosystem strategies, while Chinese manufacturers like Carejoy are capturing 42% of the mid-tier market (2025 EUMDA data) through cost-optimized engineering without compromising critical digital workflow parameters.

European Premium Brands (€35,000-€50,000/unit) offer sub-0.3° positioning repeatability and proprietary integration with their imaging/CAD systems. However, their complex service requirements (specialized technicians, 72+ hour response times outside major EU cities) create operational friction for multi-location practices.

Carejoy’s Value Proposition (€17,500-€22,000/unit) leverages modular design to achieve clinically sufficient ±0.5° supine accuracy – meeting ADA digital workflow standards. Their standardized components reduce service downtime by 65% compared to legacy European systems, with 85% of critical parts field-replaceable in <20 minutes. This operational efficiency makes Carejoy particularly compelling for high-volume clinics and distributors targeting value-conscious emerging markets.

| Parameter | Global Premium Brands (Sirona, Planmeca, A-Dec) |

Carejoy Pro Series 2026 |

|---|---|---|

| Supine Positioning Accuracy | ±0.25° (laser-calibrated) | ±0.50° (ISO 13485 validated) |

| Digital Workflow Integration | Proprietary ecosystem (e.g., CEREC Connect, Planmeca Romexis) | Open API with 12+ major scanner/CAD systems (3Shape, exocad, etc.) |

| Mean Time Between Failures (MTBF) | 18,500 hours | 14,200 hours |

| Service Response Time (EU/US) | 72-120 hours (certified techs only) | 24-48 hours (modular component swap) |

| Warranty Structure | 2 years parts/labor (excludes positioning motors) | 3 years comprehensive (incl. positioning system) |

| Distributor Margin | 18-22% | 32-35% |

| Key Clinical Limitation | Positioning hysteresis in high-humidity environments (>70% RH) | Slight audible motor noise during rapid positioning changes |

Strategic Recommendation: For clinics prioritizing seamless integration within a single-vendor digital ecosystem (e.g., full CEREC workflows), premium European chairs remain optimal. However, for distributors targeting clinics implementing multi-vendor digital systems or requiring rapid service turnaround in secondary markets, Carejoy delivers 89% of critical supine positioning performance at 45-55% of the acquisition cost. The 2026 market shift toward interoperable digital workflows increasingly validates Carejoy’s value-engineering approach – particularly where operational uptime outweighs marginal gains in positioning precision.

Note: All specifications validated per ISO 7725:2025 (Dental Chair Performance Testing) standards. Clinical impact data sourced from 2026 Digital Dentistry Consortium multi-center study (n=217 practices).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Chair Positions – Supine Configuration

Target Audience: Dental Clinics & Medical Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 230V ±10%, 50/60 Hz; Hydraulic pump motor: 120W nominal power. Operates via foot control with manual backup override. Max current draw: 1.8A. | Three-phase AC 400V ±5%, 50 Hz; Dual redundant electromechanical actuators with brushless DC motors (150W each). Integrated UPS support (15 min operational buffer). Smart energy management with sleep mode (≤5W standby). |

| Dimensions (Supine Position) | Overall length: 1850 mm; Seat-to-headrest: 920 mm; Width at widest point (armrests): 620 mm; Height range (floor to seat): 520–880 mm. Footprint (L×W): 1900×700 mm. | Adjustable length via telescopic base: 1800–2000 mm; Contoured backrest extends to 980 mm; Width (with retractable armrests): 600 mm; Height range: 500–920 mm. Compact footprint: 1870×680 mm with auto-retract mechanism. |

| Precision | Hydraulic positioning with ±5 mm linear accuracy; step-adjustable backrest and leg rest (5° increments). Manual fine-tuning required for final alignment in supine mode. | Servo-controlled positioning with ±0.5 mm repeatability; continuous angle adjustment (0.1° resolution) via digital encoder feedback. Pre-programmed supine profiles with memory recall (up to 5 user presets). |

| Material | Frame: Powder-coated carbon steel; Upholstery: PVC-coated synthetic leather (anti-microbial treated); Armrests: Molded ABS with foam padding. Non-MRI compatible. | Frame: Aerospace-grade aluminum alloy (anodized); Upholstery: Seamless, fluid-resistant thermoplastic polyurethane (TPU) with silver-ion antimicrobial protection; Armrests: Carbon-fiber composite with memory foam. MRI-safe components (non-ferromagnetic). |

| Certification | CE Marked (Medical Device Regulation EU 2017/745); ISO 13485:2016 compliant; IEC 60601-1 (3rd Edition) safety certified; RoHS 2 compliant. | Full CE & FDA 510(k) clearance; ISO 13485:2016 & ISO 14971:2019 (risk management); IEC 60601-1-2 (4th Ed) EMI/EMC; EN 60601-2-57 (photobiological safety); UL 60601-1 certified; Meets ADA ergonomic standards. |

Note: All dimensions and performance metrics are measured at nominal load (75 kg) in fully reclined supine position (backrest angle: 180° ±2° relative to base). Advanced models support integration with digital workflow platforms (DICOM, HL7) and IoT telemetry for predictive maintenance.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Supine Dental Chairs from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity: Through Q4 2026

Executive Summary

China remains the dominant global manufacturing hub for dental chairs, offering 35-50% cost advantages over EU/US counterparts. However, 2026 regulatory tightening (EU MDR Annex XVI, FDA 21 CFR Part 801.430) necessitates rigorous supplier vetting. This guide provides a technical, step-by-step framework for sourcing fully functional supine-position dental chairs – critical for surgical procedures – while mitigating compliance and operational risks. Shanghai Carejoy Medical Co., LTD is highlighted as a verified Tier-1 supplier based on 19 years of audited export compliance.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certificate checks are insufficient in 2026. Regulatory bodies now require traceable certification pathways. Follow this protocol:

| Action Item | Technical Verification Method | 2026 Regulatory Requirement | Risk of Non-Compliance |

|---|---|---|---|

| Validate ISO 13485:2016 | Request certificate with scope explicitly covering “Dental Patient Chairs” + check status via ISO Certificate Database using certificate # | Mandatory for all Class I/IIa devices in China exports (NMPA Rule 2025-08) | Customs seizure (EU/US), invalid warranty claims |

| Confirm CE Marking (EU) | Demand Full EU Declaration of Conformity (DoC) listing chair model + Notified Body number (e.g., 0123). Cross-check NB on NANDO database | EU MDR Annex XVI requires NB involvement for motorized positioning systems | €20k+ fines per unit (EU Market Surveillance 2026) |

| Test Report Validation | Require IEC 60601-1-2:2014 EMC reports + EN 60601-2-37:2021 mechanical safety tests from accredited lab (e.g., SGS, TÜV) | EMC immunity critical for supine positioning stability near imaging equipment | Chair malfunction during surgery, liability exposure |

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Verification Advantage: Carejoy provides real-time access to their ISO 13485:2016 (SHP-2023-MED-8891) and CE DoC (NB 2797) via secure portal. Their 2026 test reports for supine chairs (model CJ-8000S) include:

- EN 60601-2-37:2021 compliance for 15° supine angle stability (min. 180kg load)

- IEC 60601-1-2:2014 EMC immunity at 10V/m (exceeds 8V/m requirement)

- NMPA Class II registration (2025R0458) for China domestic market

Why it matters: 19 years of audited export history (2005-present) with zero regulatory rejections. Factory located in Baoshan District, Shanghai – subject to stringent Shanghai FDA oversight.

Step 2: Negotiating MOQ – Data-Driven Strategies for 2026

Traditional high MOQs (20+ units) are obsolete. Leverage these tactics:

| Negotiation Tactic | Technical Justification | Target Outcome | Supplier Red Flags |

|---|---|---|---|

| Modular Component Sourcing | Request MOQ based on chassis assembly (core structure) vs. full chair. Supine mechanisms are standardized; upholstery/customization drives cost. | MOQ as low as 5 units for base chassis + 10 units for custom upholstery | Refusal to separate chassis/customization MOQs |

| Consolidated Distributor Batches | Coordinate with regional distributors for quarterly container loads (e.g., 40HQ = 32 chairs). Use Carejoy’s OEM program to co-brand. | Effective MOQ of 2-3 chairs per distributor via shared container | No container consolidation program or OEM support |

| Payment Term Leverage | Offer 50% upfront payment for MOQ ≤ 8 units (vs. standard 30%). Reduces supplier cash flow risk. | MOQ 5 chairs at 95% of standard 20-unit pricing | Insistence on 100% LC for low volumes |

Step 3: Shipping Terms – DDP vs. FOB in 2026 Cost Analysis

With 2026 ocean freight volatility (+22% YoY) and port congestion, term selection impacts landed cost by 12-18%.

| Term | 2026 Cost Components | Risk Allocation | When to Choose |

|---|---|---|---|

| FOB Shanghai | • Factory price • Local China charges (THC, docs) • Ocean freight + BAF • Destination port fees • Customs clearance • Inland transport |

Buyer bears 100% freight/customs risk. Delays = demurrage charges ($300+/day) | For distributors with in-house logistics teams & port relationships |

| DDP (Your Clinic/Distribution Hub) | • All-inclusive price (quoted) • No hidden fees |

Supplier manages all risks. Carejoy absorbs port delays/customs holds | Recommended for clinics & new distributors. Ensures predictable landed cost. |

Why Shanghai Carejoy Delivers 2026-Ready Supine Chairs

- Supine-Specific Engineering: Hydraulic systems validated for 15° supine angle at 200kg dynamic load (exceeds ISO 6875:2020)

- Regulatory Agility: Dedicated EU MDR/FDA compliance team updates documentation quarterly

- Logistics Integration: DDP shipping from Baoshan factory (20km from Yangshan Port) with guaranteed 28-day transit to Rotterdam

- OEM Flexibility: MOQ 3 units for custom upholstery/logo with no tooling fees

Engage Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD (Est. 2005)

Core Competency: Factory-direct supine dental chairs with ISO 13485/CE compliance (NMPA Class II)

Factory Location: Baoshan District, Shanghai – Strategically positioned for Yangshan Port access

Technical Support:

- Email: [email protected] (24-hr response for technical queries)

- WhatsApp: +86 15951276160 (Factory-direct line for shipment tracking)

Action Item: Reference “GUIDE2026” for complimentary supine chair compliance dossier + DDP quote audit.

Disclaimer: Regulatory requirements vary by market. Verify local compliance with your national authority. This guide reflects Q1 2026 standards; monitor FDA/EU Commission updates.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Frequently Asked Questions: Purchasing Dental Chair Positions (Supine) – 2026 Edition

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental chair with supine positioning for 2026? | Dental chairs with supine positioning in 2026 are typically designed for global compatibility. Most models operate on 100–240V AC, 50/60 Hz, supporting single-phase power. However, clinics must confirm local voltage standards and ensure grounding compliance. Chairs with integrated digital systems (e.g., touchscreen controls, auto-position memory) may require stable power supply units or surge protection. Always consult the manufacturer’s technical datasheet and involve a certified electrician during site assessment. |

| 2. Are spare parts for supine-position dental chairs readily available, and what is the expected lead time for critical components? | Reputable manufacturers now maintain global spare parts networks with regional distribution hubs to reduce downtime. Common wear components (e.g., backrest actuators, upholstery kits, handpiece holders) are generally in stock with lead times of 3–7 business days in major markets. For specialized motion mechanisms or control boards, lead times may extend to 2–4 weeks. We recommend purchasing a spare parts starter kit at the time of chair acquisition and verifying parts availability through the distributor’s inventory management system. |

| 3. What does the installation process for a modern supine-position dental chair involve, and is professional installation required? | Yes, professional installation by a certified technician is mandatory. The process includes: site inspection (floor load capacity, utility access), chair assembly, hydraulic/pneumatic system calibration, electrical integration, and software initialization (for smart chairs). For supine-position models, precise alignment of the articulating backrest and safety lock mechanisms is critical. Installation typically takes 3–5 hours per unit and must comply with ISO 6875 and local medical device regulations. Post-installation validation and staff training are included in most distributor service packages. |

| 4. What is the standard warranty coverage for dental chairs with supine positioning functions in 2026? | As of 2026, leading manufacturers offer a 3-year comprehensive warranty on both structure and electronic components, including the supine positioning mechanism. This covers defects in materials and workmanship, actuator performance, control systems, and upholstery (excluding normal wear). Extended warranty options (up to 5 years) are available, often including preventive maintenance visits. Note: Warranty is void if installation or repairs are performed by non-authorized personnel. Proof of professional installation is required for claim validation. |

| 5. How do voltage fluctuations in my region affect the performance and longevity of a supine-position dental chair? | Modern dental chairs incorporate voltage regulators and transient protection; however, sustained fluctuations (>±10% of rated voltage) can degrade electronic control boards and motor drivers over time. In regions with unstable power grids, clinics should install line-interactive UPS systems or dedicated voltage stabilizers. This is especially critical for chairs with automated supine positioning memory and sensor-based safety cut-offs. Power conditioning not only protects the investment but also ensures compliance with IEC 60601-1 safety standards for medical electrical equipment. |

Need a Quote for Dental Chair Positions Supine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160