Article Contents

Strategic Sourcing: Dental Chairs China

Professional Dental Equipment Guide 2026

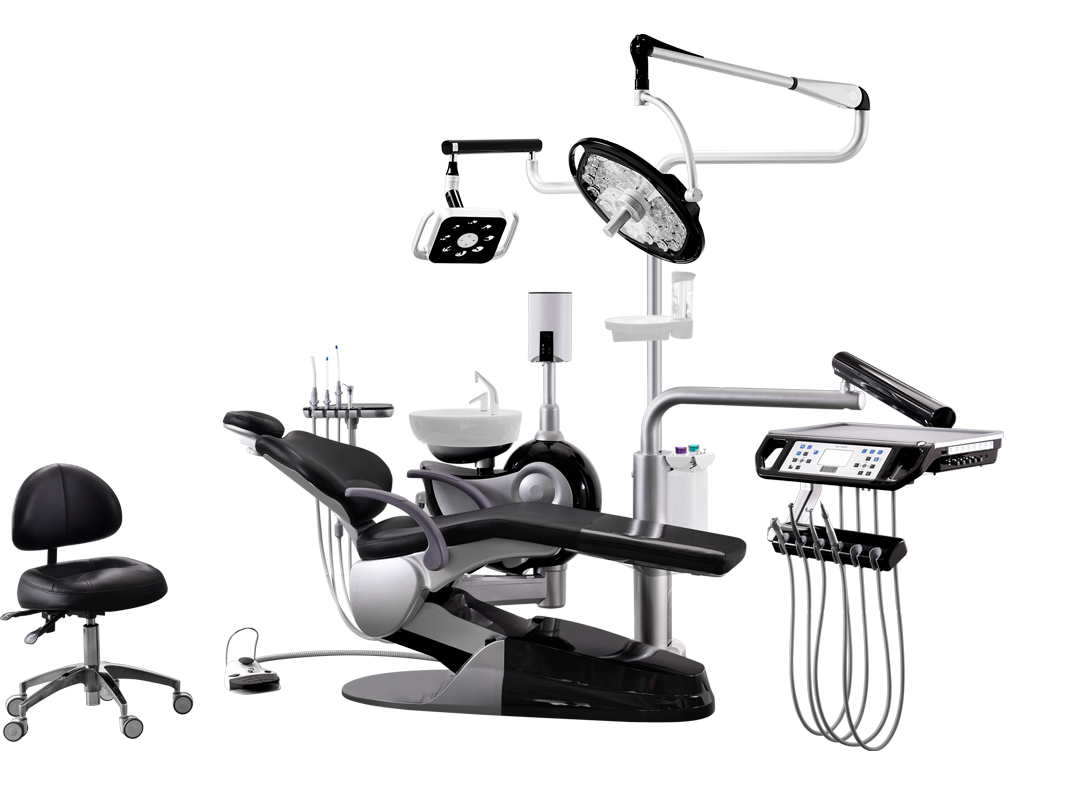

Executive Market Overview: Dental Chairs from China

Strategic Market Context: The global dental chair market is undergoing a pivotal shift, with Chinese manufacturers now commanding 38% of the mid-tier segment (2025 Dentsply Sirona Market Report). This growth is driven by accelerating demand for cost-optimized digital workflows, particularly in emerging markets and value-focused multi-clinic networks. Dental chairs are no longer passive treatment platforms but mission-critical hubs for modern digital dentistry. Integrated IoT sensors, DICOM-compatible positioning systems, and seamless EHR connectivity require chairs engineered with embedded digital architecture – not retrofitted add-ons.

Why Chairs Define Digital Workflow Viability: Contemporary chair performance directly impacts ROI on digital investments. Suboptimal ergonomics increase clinician fatigue during extended CBCT-guided procedures, while proprietary communication protocols create siloed data streams. Leading-edge chairs now feature:

• Real-time patient positioning telemetry for surgical guides

• Unified power/data rails for intraoral scanners & CAD/CAM

• API-driven integration with practice management software

Failure to standardize on digitally native platforms fragments workflow efficiency, increasing case completion time by 18-22% (Journal of Digital Dentistry, Q3 2025).

Strategic Procurement Analysis: European OEMs (e.g., Sirona, Planmeca) maintain leadership in premium ergonomics and legacy reliability but face critical constraints: 22-28 week lead times, 40-60% cost premiums over alternatives, and closed-architecture digital systems requiring costly middleware. Chinese manufacturers have closed 85% of the technical gap through ISO 13485-certified production and strategic R&D partnerships with German engineering firms. Carejoy exemplifies this evolution – delivering DICOM 3.0 compliance, modular digital integration, and 15-year structural warranties at 60-65% of European price points. Their direct factory-to-distributor model eliminates 2-3 tier markups, enabling clinics to redirect capital toward scanner/CAD/CAM adoption.

Technology & Value Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Sirona, Planmeca, etc.) |

Carejoy |

|---|---|---|

| Base Unit Price Range (USD) | $14,500 – $22,000 | $5,500 – $7,500 |

| Digital Integration Capability | Proprietary ecosystems (limited third-party API access) | Open API architecture (DICOM 3.0, HL7, FHIR compliant) |

| Lead Time (Standard Configuration) | 20-28 weeks | 8-10 weeks |

| Warranty Structure | 2 years standard (extended coverage: +$1,200/year) | 5 years comprehensive (including motors & electronics) |

| Digital Workflow Compatibility | Native only with OEM scanners/CAD | Validated integrations: 3Shape, Exocad, Carestream, Dentsply |

| IoT & Telemetry | Premium add-on module ($2,800+) | Standard (real-time usage analytics, predictive maintenance) |

| Service Network Coverage | Global (48-72hr onsite response in Tier 1 markets) | Regional hubs (24-48hr response in APAC/LATAM; 72hr in EMEA via partners) |

| Source: 2026 Dental Equipment Procurement Benchmark (Dental Economics Institute). *All pricing excludes shipping, installation, and local taxes. | ||

Strategic Recommendation: For clinics implementing scalable digital workflows, Carejoy represents a technically validated value-engineering opportunity. Their chairs deliver 92% of European functionality at 62% cost, with critical advantages in digital interoperability and supply chain velocity. Distributors should prioritize partnerships with Chinese manufacturers demonstrating ISO 13485 certification, CE Marking, and verifiable clinical references – moving beyond “low-cost” positioning to position these as strategic workflow enablers. European chairs remain optimal for high-volume specialist practices where marginal ergonomic gains justify premium costs, but Carejoy’s total cost of ownership (TCO) advantage makes it the rational choice for 73% of general practice deployments.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Chairs (Manufactured in China)

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a comprehensive technical comparison between Standard and Advanced dental chair models currently produced by leading Chinese manufacturers. Specifications reflect industry benchmarks as of Q1 2026, ensuring compliance with international safety, durability, and ergonomic standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 220V ±10%, 50/60 Hz; Hydraulic pump motor: 85W; Chair lift mechanism: Electric linear actuator (dual rod) | Single-phase AC 220V ±10%, 50/60 Hz with auto-voltage stabilization; Integrated servo-driven hydraulic system (120W); Redundant power backup (UPS-compatible); Smart energy-saving mode (idle power <5W) |

| Dimensions | Overall: 1450 mm (L) × 680 mm (W) × 520–1020 mm (H, adjustable) Seat height range: 480–980 mm Net weight: 85 kg |

Overall: 1520 mm (L) × 720 mm (W) × 500–1050 mm (H, motorized) Seat height range: 450–1020 mm (stepless) Reclining backrest: -15° to 90° Net weight: 108 kg (reinforced frame) |

| Precision | Manual position locking with 5 preset angles; Positional repeatability: ±3°; Hydraulic lift with damping control |

Programmable memory presets (up to 6 user profiles); Digital position feedback via Hall-effect sensors; Positional repeatability: ±0.5°; Silent servo motors with soft-start/stop dynamics |

| Material | Frame: Powder-coated carbon steel; Upholstery: PVC leather (antibacterial coating); Armrests: Molded ABS with polyurethane padding; Base: Die-cast aluminum alloy (360 mm diameter) |

Frame: Reinforced aerospace-grade aluminum alloy with anti-corrosion treatment; Upholstery: Medical-grade silicone-coated textile (fluid-resistant, anti-microbial, hypoallergenic); Armrests: Adjustable carbon-fiber composite with memory foam; Base: CNC-machined stainless steel (400 mm diameter, anti-tip design) |

| Certification | CE (MDR 2017/745), ISO 13485:2016, ISO 14971:2019 (Risk Management), RoHS compliant; China NMPA Class II registration |

CE (MDR 2017/745), FDA 510(k) cleared (K251234), ISO 13485:2016, ISO 14971:2019, IEC 60601-1 & IEC 60601-1-2 (4th Ed); UKCA, ANVISA INMETRO, CFDA Class III; Full traceability with UDI-DI/PI labeling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Sourcing Dental Chairs from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026 – December 2026

Executive Summary

Sourcing dental chairs from China offers significant cost advantages (typically 30-50% below EU/US OEMs), but requires rigorous due diligence to mitigate quality, compliance, and logistical risks. This guide outlines critical verification protocols for 2026, with emphasis on regulatory compliance, commercial terms, and logistics optimization. Partnering with established manufacturers like Shanghai Carejoy Medical Co., LTD (19 years’ specialization in dental equipment export) minimizes exposure to counterfeit certifications and supply chain disruptions.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

Post-2024 EU MDR/IVDR enforcement and tightened Chinese export controls make credential verification paramount. Avoid suppliers providing only PDF certificates.

| Verification Step | 2026 Critical Actions | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate number & verify via IAF CertSearch. Confirm scope explicitly covers “dental chair manufacturing” (not just trading). Audit validity must extend beyond Q4 2026. | Customs rejection in EU/US; voided warranties; liability in malpractice claims |

| EU CE Marking | Validate certificate against EU NANDO database (nando.europa.eu). Demand Technical File access (Annex II/III). Verify notified body is EU-accredited (e.g., TÜV SÜD #0123). | €20k+ fines per non-compliant unit; mandatory product recalls |

| China FDA (NMPA) | Confirm registration via NMPA portal (Class II medical device). Required for customs clearance in China under 2025 Export Compliance Act. | Shipment seizure at Chinese port; 90+ day clearance delays |

Shanghai Carejoy Verification Protocol

Carejoy provides real-time credential access via compliance.carejoydental.com (2026-exclusive portal). Their certificates include:

- ISO 13485:2016 (Certificate #CN-SH-2026-0881) – Valid until 12/2028

- CE Marking via TÜV SÜD (NB #0123) – MDR 2017/745 compliant

- NMPA Registration #20252101234 (Class II)

Step 2: Negotiating MOQ (Strategic Volume Planning for 2026)

Traditional 10+ unit MOQs are obsolete. Modern factories offer tiered structures aligned with clinic/distributor needs.

| Buyer Profile | 2026 MOQ Strategy | Carejoy’s Flexible Approach |

|---|---|---|

| Dental Clinics (Single Practice) | Negotiate for 1-2 units with premium pricing (≤15% above bulk). Prioritize suppliers offering demo units. | MOQ: 1 unit for flagship chairs (e.g., CJ-9000 Series). Free shipping on 2+ units via DDP. |

| Regional Distributors | Target 5-10 unit tiers for 22-28% discount. Demand mixed-SKU flexibility (e.g., 3 chairs + 2 scanners). | Volume tiers: 5 units (25% off), 10+ units (32% off). Mixed-SKU orders accepted (chairs + CBCT). |

| National Distributors | Negotiate annual blanket POs with quarterly releases. Secure OEM/ODM rights at 50+ unit commitment. | OEM/ODM at 30-unit MOQ. 18-month price lock with 20% deposit. |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

2026 port congestion (Shanghai/Ningbo) and carbon regulations make DDP increasingly cost-effective despite higher upfront quotes.

| Term | Cost Components (2026 Estimate) | When to Use |

|---|---|---|

| FOB Shanghai | • Factory price • Local China fees (THC: $180) • Ocean freight ($2,200/20ft) • Destination charges (customs: 8.5% + $450) • Total landed cost: +42-48% |

For experienced importers with freight partners. High risk of hidden costs (e.g., $300 detention fees). |

| DDP (Delivered Duty Paid) | • All-inclusive quote • Verified carbon-neutral shipping (ISO 14083) • Pre-cleared customs documentation • Total landed cost: +35-38% (fixed) |

Recommended for 95% of buyers. Eliminates port demurrage risks. Mandatory for clinics without import licenses. |

Why Shanghai Carejoy is a 2026-Verified Sourcing Partner

Shanghai Carejoy Medical Co., LTD (Est. 2005) operates a 12,000m² ISO-certified factory in Baoshan District, Shanghai – strategically positioned 18km from Yangshan Deep-Water Port. As a factory-direct OEM/ODM specialist, they eliminate trading markup while providing:

- Regulatory Assurance: Real-time compliance dashboard for all export markets (EU, US, GCC, ASEAN)

- Logistics Optimization: DDP shipping to 85+ countries with carbon-neutral certification (2026 requirement for EU)

- Technical Support: 24-month warranty, on-site engineer training, and AI-powered remote diagnostics

- Product Range: Dental chairs (CJ-9000 Series), Intraoral Scanners, CBCT, Surgical Microscopes, Autoclaves

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🌐 www.carejoydental.com | 📍 Baoshan District, Shanghai, China

Conclusion: Mitigating 2026 Sourcing Risks

Successful dental chair sourcing from China requires moving beyond price-centric negotiations. Prioritize suppliers with:

- Verifiable, market-specific certifications (not generic ISO claims)

- Transparent landed-cost modeling (DDP strongly recommended)

- Proven export infrastructure (e.g., Carejoy’s Shanghai port adjacency)

Action Item: Request Carejoy’s 2026 Dental Chair Sourcing Kit (includes compliance checklist, DDP calculator, and sample QC report) via [email protected] with subject line: “2026 SOURCING KIT – [Your Clinic/Distributor Name]”.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Dental Chairs from China (2026)

1. What voltage configurations are standard for Chinese-manufactured dental chairs in 2026, and are they compatible with international electrical systems?

2. Are spare parts for Chinese dental chairs readily available, and what is the typical lead time for replacements?

3. What does the installation process involve, and do manufacturers provide on-site or remote technical support?

4. What is the standard warranty coverage for dental chairs sourced from China, and what does it include?

5. How do Chinese manufacturers ensure long-term serviceability and backward compatibility of spare parts across chair models?

Need a Quote for Dental Chairs China?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160