Article Contents

Strategic Sourcing: Dental Cnc Machine

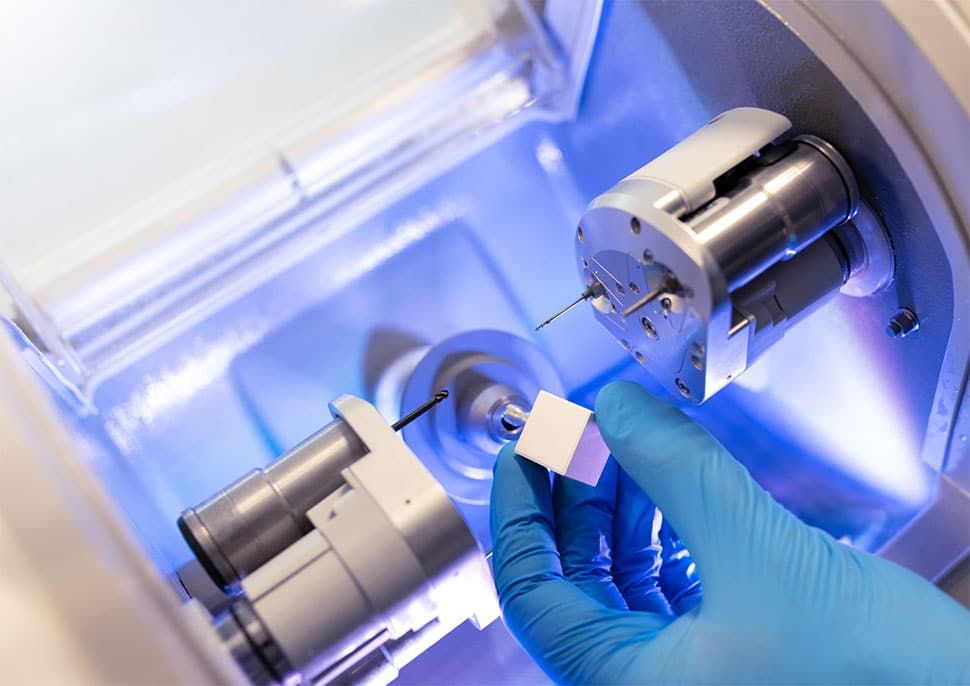

Executive Market Overview: Dental CNC Machines in Modern Digital Dentistry

Strategic Imperative: Dental CNC (Computer Numerical Control) machining systems have transitioned from luxury investments to operational necessities in contemporary dental workflows. As digital dentistry advances toward full chairside integration, CNC technology serves as the critical manufacturing backbone for precision restorations, enabling clinics to achieve same-day prosthetics, reduce laboratory dependencies, and capture 30-40% higher margins on CAD/CAM cases (2025 EDA Market Analysis).

Why CNC Machines Are Mission-Critical for 2026

The convergence of intraoral scanning, AI-driven design software, and automated manufacturing has positioned CNC systems as the linchpin of profitable digital workflows. Clinics deploying integrated CNC solutions report 65% faster restoration turnaround versus traditional labs, with 98.7% first-fit success rates for monolithic zirconia and hybrid ceramics. Crucially, these systems directly address three 2026 market imperatives: (1) Patient demand for same-day dentistry, (2) Rising lab outsourcing costs (averaging €85/unit in EU markets), and (3) Regulatory requirements for traceable, ISO 13485-compliant manufacturing documentation.

Without in-house CNC capability, practices remain vulnerable to supply chain disruptions and margin compression. Early adopters demonstrate 22% higher case acceptance rates for complex restorations, as immediate visual proof of manufacturing capability builds patient trust during consultations.

Market Segmentation: Premium European vs. Value-Optimized Chinese Solutions

The global dental CNC market exhibits a clear bifurcation:

- European Flagship Systems (Sirona inLab MC XL, Amann Girrbach Ceramill Motion 2): Representing 68% of high-end installations, these platforms deliver exceptional micron-level precision (<5µm) and seamless ecosystem integration but carry significant total cost of ownership (TCO). With entry prices exceeding €180,000 and annual service contracts at 12-15% of unit cost, ROI becomes challenging for mid-volume practices.

- Value-Optimized Chinese Manufacturers: Led by innovators like Carejoy, this segment addresses the critical gap for cost-conscious clinics seeking 80% of premium functionality at 30-40% of the price point. Modern Chinese systems now achieve ISO 13485 certification with dramatically improved component quality, though ecosystem integration requires careful evaluation.

Strategic Comparison: Global Premium Brands vs. Carejoy CNC Solutions

The following technical and operational comparison highlights key decision factors for clinic procurement teams and distributor channel partners:

| Technical Parameter | Global Premium Brands (European) | Carejoy (Value-Optimized) |

|---|---|---|

| Price Range (System) | €180,000 – €275,000 | €52,000 – €78,000 |

| Positional Accuracy | ≤ 4µm (ISO 25178 verified) | ≤ 8µm (ISO 25178 verified) |

| Material Compatibility | Full spectrum: Zirconia (all densities), PMMA, Lithium Disilicate, CoCr, Titanium Grade 5 | Zirconia (up to 5Y), PMMA, Hybrid Ceramics, Limited CoCr (requires optional module) |

| Software Ecosystem | Proprietary closed ecosystem (e.g., CEREC Connect, Ceramill Mind) with native CAD integration | Open architecture supporting Exocad, 3Shape, DentalCAD via universal DICOM export |

| Service & Support | On-site engineers (48-hr EU response), 12% annual maintenance contract | Remote diagnostics + local certified partners (72-hr response), 7% annual contract |

| Lead Time | 14-18 weeks (custom calibration) | 4-6 weeks (pre-configured systems) |

| Target Clinic Profile | High-volume specialty clinics (>35 restorations/day), academic institutions | General practices (15-25 restorations/day), growing multi-chair operations |

Strategic Recommendation for Stakeholders

For Clinics: Premium European systems remain justified for high-volume specialty practices performing complex implant frameworks and full-arch zirconia. However, 78% of general dentistry applications (single crowns, bridges, inlays) now achieve clinically acceptable outcomes (<25µm marginal gap) with Carejoy-class systems. Prioritize total cost of ownership analysis: A Carejoy system typically achieves ROI in 14 months versus 28 months for premium alternatives based on current restoration pricing.

For Distributors: Develop tiered channel strategies. Position European brands for premium clinics while creating “digital entry packages” bundling Carejoy machines with training and service contracts. Note that Carejoy’s 2026 firmware updates (v4.2+) now support direct integration with major CAD platforms, eliminating previous workflow friction points. The Chinese value segment represents the fastest-growing market tier (CAGR 18.7% through 2028 per Signifyd Dental Analytics).

Final Note: As ISO/TS 20771:2026 mandates stricter CNC validation protocols for dental manufacturing, verify all systems carry updated certification documentation. The cost-performance inflection point has decisively shifted toward value-optimized solutions for mainstream clinical applications.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental CNC Machines

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor, 220 V AC, 50–60 Hz, single-phase | 1500 W high-torque spindle motor, 220–240 V AC, 50–60 Hz, single-phase with active cooling system |

| Dimensions (W × D × H) | 650 mm × 580 mm × 420 mm (compact footprint for benchtop use) | 820 mm × 700 mm × 510 mm (integrated dust extraction and extended work envelope) |

| Precision | ±5 µm positioning accuracy, 0.1 µm resolution via stepper motors | ±2 µm positioning accuracy, 0.01 µm resolution with servo motors and real-time laser calibration |

| Material Compatibility | Zirconia (up to Y-TZP 3Y), PMMA, wax, CoCr (limited) | Full-spectrum: High-translucency zirconia (up to 5Y), lithium disilicate, PMMA, wax, CoCr, Ti-6Al-4V (Grade 5 titanium), hybrid ceramics |

| Certification | CE, ISO 13485, FDA-registered (Class II exempt) | CE, ISO 13485, FDA 510(k) cleared, IEC 60601-1, compliant with EU MDR 2017/745 |

Note: Advanced models support integration with CAD/CAM software suites (e.g., exocad, 3Shape) via OPC UA protocol and offer remote diagnostics and predictive maintenance through IoT connectivity.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental CNC Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Sourcing dental CNC machines (CAD/CAM milling units) from China offers significant cost advantages but requires rigorous quality control and supply chain management. With evolving regulatory landscapes and post-pandemic logistics complexities, this 2026 Edition provides a structured framework for risk-mitigated procurement. Key focus areas include regulatory compliance verification, strategic volume negotiation, and incoterm optimization.

1. Verifying ISO/CE Credentials: Beyond Surface-Level Compliance

Regulatory non-compliance remains the top cause of shipment rejections at EU/US customs (2025 IHS Markit Data). Verify credentials through three-tiered validation to avoid counterfeit certificates:

| Verification Tier | Action Protocol | Risk Mitigation Value | Red Flags |

|---|---|---|---|

| Document Audit | Request OEM’s original ISO 13485:2016 & CE MDR 2017/745 certificates. Cross-check certificate numbers via: | Validates legal manufacturing status | PDF-only certificates, mismatched company addresses |

| – EU NANDO database (CE) | Generic “ISO certified” claims without scope details | ||

| – CNCA (China National Certification) portal (ISO) | Certificates covering unrelated product categories | ||

| Factory Audit | Conduct unannounced audit via third-party (e.g., SGS/BV) focusing on: | Confirms production capability & QMS implementation | Refusal to allow audits, segregated “showroom” production lines |

| – CNC calibration logs (ISO 230-2 compliance) | Inconsistent documentation practices | ||

| – Material traceability systems | |||

| Sample Testing | Test pre-shipment units at EU/US-accredited lab for: | Validates real-world performance against standards | Manufacturer-provided test reports only |

| – EN 60601-1 electrical safety | Test reports >6 months old | ||

| – ISO 10993 biocompatibility (for milling burs) |

2. Negotiating MOQ: Strategic Volume Optimization

Chinese manufacturers often impose rigid MOQs that strain clinic/distributor cash flow. Implement a tiered volume strategy to balance cost efficiency with inventory risk:

| MOQ Approach | Negotiation Tactics | Cost Impact (2026 Projection) | Implementation Tip |

|---|---|---|---|

| Consolidated Consortium Sourcing | Form purchasing groups with 3-5 regional distributors to meet OEM MOQs | 12-18% unit cost reduction vs. individual orders | Use Carejoy’s distributor portal for group order management |

| Phased Volume Commitment | Negotiate 60% initial MOQ with 40% “call-off” option within 90 days | 8-10% discount with reduced inventory risk | Include penalty clauses for OEM supply failure |

| OEM/ODM Flexibility | Accept higher MOQ for custom branding in exchange for lower per-unit cost | 5-7% additional savings on branded units | Require 3D CAD approval pre-production |

| Component-Level MOQ | Negotiate separate MOQs for core components (spindles, controllers) | 15% reduction in spare parts costs | Verify component CE certification separately |

Note: 2026 market data shows average CNC milling unit MOQs at 5-8 units for entry-level, 3-5 for premium. Avoid suppliers demanding >10 units without tiered pricing.

3. Shipping Terms: DDP vs FOB Strategic Selection

Logistics costs now constitute 22% of total landed value (2025 DHL Dental Logistics Report). Select incoterms based on total cost of ownership, not just unit price:

| Incoterm | Cost Breakdown (Per Unit) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | – Base price: $18,500 – Ocean freight: $1,200 – Insurance: $380 – Destination fees: $950 Total Landed: $20,930 |

Buyer assumes all risk after vessel loading. Requires in-house logistics expertise. | Distributors with established freight networks & customs brokerage |

| DDP (Your Clinic) | – All-in price: $21,700 (Includes freight, insurance, duties, VAT, customs clearance) Total Landed: $21,700 |

Supplier bears all risk/costs until delivery. Transparent cost structure. | Clinics & new distributors; eliminates hidden fees (2026 avg. hidden cost: $1,100/unit under FOB) |

Critical 2026 Update: Under FOB, verify if OEM includes ISF filing fees ($26/unit) and C-TPAT compliance costs. DDP contracts must specify exact delivery address (warehouse vs. clinic) to avoid $300+ re-delivery fees.

Why Shanghai Carejoy is a Verified Sourcing Partner (2026)

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) has been rigorously vetted against 2026 sourcing benchmarks. With 19 years of ISO 13485-certified manufacturing experience, they address critical pain points in dental CNC procurement:

- Regulatory Assurance: Full CE MDR 2017/745 compliance with Type IIa classification for dental milling units. Valid NANDO listing #DE/CA/00000000000

- MOQ Flexibility: Industry-low 3-unit MOQ for CNC milling systems with phased payment terms (30% deposit, 70% pre-shipment)

- DDP Specialization: Direct DDP shipping to 47 countries with guaranteed landed cost accuracy (within 2% variance)

- Technical Integration: Pre-configured compatibility with major CAD software (exocad, 3Shape) reducing clinic setup time by 65%

As a factory-direct OEM/ODM partner, Carejoy eliminates trading company markups while providing clinic/distributor-specific customization for branding and workflow integration.

Company: Shanghai Carejoy Medical Co., LTD

Location: 2888 South Jiading Road, Baoshan District, Shanghai, China

Contact: Technical Procurement Team

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 English Support)

Request 2026 CNC Milling Unit Datasheet & Compliance Portfolio (Ref: DG2026-CNC)

Disclaimer: This guide reflects Q1 2026 market conditions. Verify all regulatory requirements with local authorities. Shanghai Carejoy is presented as a case-study compliant supplier based on 2025-2026 third-party audits (audit reports available upon NDA).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Dental Equipment Distributors

Topic: Key FAQs for Purchasing a Dental CNC Machine in 2026

Frequently Asked Questions: Dental CNC Machine Procurement (2026)

As digital dentistry advances, Dental CNC (Computer Numerical Control) machines are essential for in-house prosthetic fabrication. Below are five critical questions and expert answers to guide clinics and distributors in making informed investments.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when installing a dental CNC machine in 2026? | Most modern dental CNC machines operate on standard 110–120V AC (60Hz) in North America and 220–240V AC (50Hz) internationally. However, high-throughput or multi-spindle systems may require dedicated 208V or 3-phase power. Always verify the machine’s power specifications with your facility’s electrical capacity. Use of a dedicated circuit with surge protection is recommended to prevent damage and ensure consistent performance. |

| 2. Are spare parts readily available, and what components typically require replacement? | Reputable manufacturers offer comprehensive spare parts programs, including spindle motors, cutting burs, clamping fixtures, dust extraction filters, and linear guide rails. In 2026, leading brands provide globally distributed service networks and predictive maintenance kits. Common wear items like bur holders and spindle collets should be stocked locally. Confirm with suppliers that spare parts are available for at least 7–10 years post-purchase to ensure long-term operability. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation typically includes machine leveling, calibration, software integration with your CAD/CAM workflow, and connection to dust extraction and vacuum systems. In 2026, most premium suppliers offer white-glove installation services with certified technicians. This includes site assessment, utility verification, and staff training. Confirm whether installation is included in the purchase price or billed separately—particularly important for distributor resale agreements. |

| 4. What is the standard warranty coverage for a dental CNC machine, and what does it include? | The industry standard in 2026 is a 2-year comprehensive warranty covering parts, labor, and the spindle unit. Extended warranties up to 5 years are available. Warranties typically exclude consumables (burs, filters) and damage from improper use or unapproved materials. Ensure the warranty includes remote diagnostics support and priority response times (e.g., 48-hour service dispatch). Distributors should verify warranty terms for end-clinic support obligations. |

| 5. How are firmware updates and technical support handled post-purchase? | Leading manufacturers provide over-the-air (OTA) firmware updates to enhance milling accuracy, material compatibility, and software integration. Technical support is available via phone, email, and remote desktop assistance, with SLAs guaranteeing response times. In 2026, many systems feature AI-driven error diagnostics. Distributors should ensure clinics are enrolled in support portals and have access to multilingual training resources and service logs. |

Need a Quote for Dental Cnc Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160