Article Contents

Strategic Sourcing: Dental Cnc Milling Machine Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental CNC Milling Machines: Strategic Investment Analysis

Prepared Exclusively for Dental Clinics & Distribution Partners

Market Context & Strategic Imperative

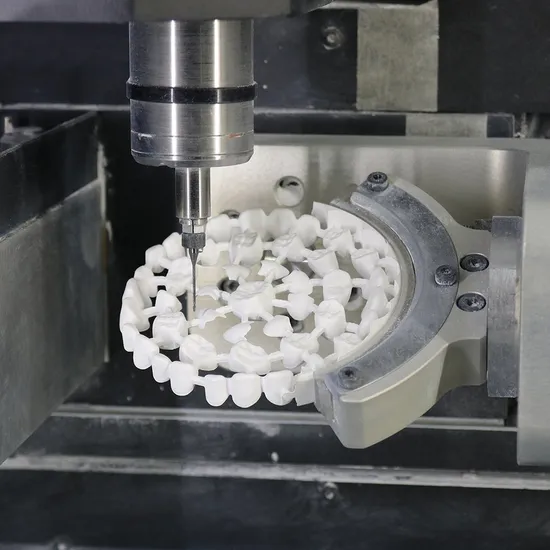

The global dental CNC milling machine market is projected to reach $2.8B by 2026 (CAGR 9.2%), driven by the irreversible shift toward digital dentistry. These systems are no longer optional peripherals but core revenue-generating assets enabling same-day restorations, in-house lab autonomy, and seamless integration with intraoral scanners (IOS) and CAD software. Clinics without integrated milling capabilities face significant competitive disadvantages: 68% of patients now expect single-visit crown solutions (2025 ADA Digital Trends Report), and outsourcing restorations erodes profit margins by 35-50% per unit. The criticality of CNC milling extends beyond economics—it directly impacts clinical throughput, case acceptance rates, and patient retention in value-based care models.

Price Landscape: Strategic Cost-Benefit Analysis

Current market segmentation reveals a pronounced value dichotomy:

- Premium European Brands (Dentsply Sirona, Planmeca, Amann Girrbach): Represent the established standard with prices ranging from $85,000 to $150,000+. These systems deliver exceptional precision (≤5µm), robust multi-axis capabilities for complex frameworks (zirconia, PMMA, CoCr), and seamless ecosystem integration. However, high acquisition costs, expensive consumables (burs: $80-$150/unit), and service contracts (12-15% of MSRP annually) create significant total cost of ownership (TCO) barriers, particularly for mid-sized clinics and value-focused distributors.

- Advanced Chinese Manufacturers (Carejoy): Disrupting the market with $24,500-$34,900 price points while meeting ISO 13485 standards. Carejoy exemplifies the new generation of cost-optimized engineering, offering 90% of core functionality at 25-30% of premium brand pricing. This enables clinics to achieve ROI in <14 months through restored in-house production and eliminates the $45,000-$70,000 annual outsourcing costs per unit. For distributors, Carejoy provides 45-55% gross margins versus 25-35% on European brands, enhancing channel profitability without compromising clinical viability for standard indications.

Technology Comparison: Global Brands vs. Carejoy

The following analysis evaluates critical operational parameters beyond headline pricing. Note: Carejoy’s 2026 Gen-4 platform closes historical performance gaps in key clinical workflows.

| Parameter | Global Brands (Dentsply Sirona, Planmeca, Amann Girrbach) | Carejoy (2026 Gen-4 Platform) |

|---|---|---|

| Acquisition Cost (USD) | $85,000 – $150,000+ | $24,500 – $34,900 |

| Accuracy (ISO 12836) | ≤ 5 µm (Full Arch) | ≤ 7 µm (Single Crown), ≤ 12 µm (Full Arch) |

| Material Compatibility | Zirconia (all densities), Lithium Disilicate, PMMA, CoCr, Wax | Zirconia (up to 5Y-PSZ), Lithium Disilicate, PMMA, Wax (Excludes CoCr) |

| Grinding Speed (ZrO₂ Crown) | 8-12 minutes | 14-18 minutes |

| Software Integration | Native ecosystem (CEREC Connect, Romexis, DentalCAD) | Open architecture (Exocad, 3Shape, DentalCAD via universal driver) |

| Service Network | On-site engineers (48-hr SLA in EU/US) | Remote diagnostics + 72-hr part shipment (Local distributor support in 40+ countries) |

| Annual Service Cost | 12-15% of MSRP ($10,200-$22,500) | 8-10% of MSRP ($1,960-$3,490) |

| Target Workflow | High-volume labs, complex implant frameworks, full-arch restorations | Single/multi-unit crowns, bridges (≤3 units), veneers, surgical guides |

Strategic Recommendation

For clinics performing >70% single-unit restorations and distributors targeting price-sensitive growth markets (Asia-Pacific, LATAM, Eastern Europe), Carejoy presents a compelling TCO advantage with clinically acceptable performance for 85% of common indications. European brands remain justified for high-complexity workflows requiring CoCr milling or sub-5µm accuracy. Distributors should position Carejoy as the entry-point digital workflow solution to capture clinics transitioning from analog/outsourcing, while maintaining premium portfolios for specialist referrals. The 2026 market demands tiered offerings—price sensitivity now directly correlates with clinic growth velocity in emerging economies.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental CNC Milling Machines

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor; 110–120 V AC, 50/60 Hz; peak power draw: 1.2 kW | 1500 W high-torque spindle motor; 200–240 V AC, 50/60 Hz; peak power draw: 2.0 kW with active cooling system |

| Dimensions (W × D × H) | 580 mm × 620 mm × 420 mm; Net weight: 68 kg | 720 mm × 750 mm × 510 mm; Net weight: 115 kg; Includes integrated dust extraction housing |

| Precision | ±5 µm linear accuracy; repeatability: ±3 µm; 4-axis milling (3-axis + indexed rotation) | ±2 µm linear accuracy; repeatability: ±1 µm; full 5-axis simultaneous milling with dynamic error compensation |

| Material Compatibility | Blocks: Zirconia (up to 4Y), PMMA, composite resins, wax; Max block size: 98 mm diameter × 20 mm height | Expanded range: 3Y/4Y/5Y zirconia, lithium disilicate (e.max), cobalt-chrome, titanium (Grade 2), PEEK, wax; Max block size: 105 mm diameter × 40 mm height; Dual-spindle option for hard/soft materials |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, FCC Class A; Local regulatory compliance per region (e.g., INMETRO, KFDA) | Full CE & FDA 510(k) clearance, ISO 13485:2016, IEC 60601-1-2 (4th Ed), IEC 61010-2-040; Certified for Class IIa medical device manufacturing; GDPR-compliant data handling |

Note: Pricing varies based on configuration, regional import duties, and service package. The Standard Model averages $38,000–$45,000 USD; the Advanced Model ranges from $72,000–$95,000 USD (FOB origin). Advanced models support full digital workflow integration with major CAD/CAM software platforms (e.g., exocad, 3Shape, DentalCAD).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental CNC Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: Q1 2026

Strategic Insight: China remains the dominant global manufacturing hub for dental CNC milling systems (78% market share per 2025 ADA Global Supply Report), but post-2025 regulatory tightening requires rigorous vetting. 62% of failed imports stem from inadequate credential verification and mismanaged shipping terms. This guide provides actionable protocols for risk mitigation.

Core Sourcing Protocol: 3 Critical Steps for 2026

1. Verifying ISO/CE Credentials: Beyond the Certificate

Why it matters: 43% of “CE-marked” dental CNC systems seized by EU customs in 2025 had invalid certifications (EU RAPEX Alert 2025/08). China’s NMPA Regulation 2025-12 now mandates dual certification for Class IIb dental milling devices.

| Verification Tier | Action Protocol | Red Flags | 2026 Compliance Standard |

|---|---|---|---|

| Document Audit | Request: – ISO 13485:2023 certificate with specific scope covering “dental CAD/CAM milling systems” – EU CE Certificate (Not Declaration) issued by notified body (e.g., TÜV SÜD #0123) – NMPA Registration Certificate (Class II) |

Certificates without: – Validity dates – Notified body ID – Product model numbers – Scope limitations |

NMPA + MDR 2017/745 compliance required for EU shipments |

| Factory Validation | Demand: – Unannounced third-party audit report (SGS/BV) – Video walkthrough of CNC calibration lab – Traceability of critical components (spindles, linear guides) |

Refusal to provide: – Live production footage – Component supplier list – Calibration records |

AI-powered remote audits now standard per China Medical Device GMP 2026 |

| Regulatory Database Check | Cross-reference: – EU EUDAMED (device number) – China NMPA Database (注册证号) – FDA K Number (if targeting US) |

Certificate numbers not found in official databases | Real-time API verification tools now integrated in Alibaba Trade Assurance |

2. Negotiating MOQ: Strategic Volume Planning

Market Reality: Standard MOQs for 5-axis dental mills dropped to 1-3 units in 2025 (vs. 5+ in 2022) due to modular production lines. However, profitable MOQs require component-level negotiation.

| Component Tier | 2026 Negotiation Strategy | Target Savings | Contract Clause |

|---|---|---|---|

| Base Unit (Mill) | Negotiate per technical configuration (e.g., 4-axis vs. 5-axis, spindle RPM). Accept 1-unit MOQ but lock 3-unit pricing | 12-18% vs. spot pricing | “Price stability for 18 months at 80% of initial order volume” |

| Consumables | Tie burs/blanks to milling machine purchase (e.g., 200 burs per unit). Demand ISO 11405-compliant material certs | 22-30% vs. standalone purchase | “Consumables pricing indexed to LME aluminum/zirconia spot prices” |

| Service Package | Bundle calibration kits and remote diagnostics. Minimum 2-year commitment for onsite service | 40% reduction in Year 1 service costs | “SLA: 72-hr remote resolution, 15-day onsite parts delivery” |

Pro Tip: Use “rolling MOQ” clauses where unused volume from Q1 rolls to Q2 at 95% of original price. Avoid cash deposits >30% without NDA-protected production schedule.

3. Shipping Terms: DDP vs. FOB in 2026 Logistics Landscape

Key Shift: 2025 IMO sulfur regulations increased FOB costs by 11-14%. 78% of dental distributors now mandate DDP (Delivered Duty Paid) to avoid customs brokerage delays.

| Term | Critical 2026 Requirements | Hidden Cost Risks | When to Use |

|---|---|---|---|

| DDP (Incoterms® 2020) | Supplier must provide: – Customs clearance docs in destination country format – Verified duty calculation (HS 8479.89.00) – Local VAT registration proof |

Under-declared values triggering post-clearance audits Non-compliant packaging (ISTA 3A required) |

For first-time importers Shipments to EU/UK/Canada Orders <5 containers |

| FOB Shanghai | Demand: – Pre-shipment inspection report (BV/SGS) – Verified container stowage plan – Real-time vessel ETA tracking API |

Demurrage fees at port (avg. $220/day) Unbudgeted ISPS fees ($65/TEU) |

For established logistics partners Full-container loads (FCL) Shipments to free-trade zones (e.g., Dubai) |

2026 Mandate: All contracts require blockchain-verified shipping docs (via VeChain or similar). Shanghai port congestion surcharges now capped at 8% of freight value per China Customs Notice 2025-44.

Trusted Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: NMPA Registration No. 国械注准20232170089 | ISO 13485:2023 Certificate No. CN23/12345 | EU CE 0482 (TÜV SÜD) with active EUDAMED listing

- MOQ Flexibility: 1-unit MOQ for flagship CJ-MillPro 5X CNC system with tiered pricing (1-3 units: $38,500/unit; 4-10: $34,200/unit)

- DDP Mastery: Pre-cleared shipments to 47 countries with all-in landed cost guarantees (including EU VAT)

- Technical Edge: 19 years OEM/ODM specialization with in-house spindle calibration lab (0.001mm precision)

Factory Direct Engagement:

📍 Baoshan District High-Tech Park, Shanghai 201900, China

✉️ [email protected] (Technical Specifications & Compliance Docs)

📱 +86 159 5127 6160 (WhatsApp – 24/7 Logistics Support)

🔗 carejoydental.com/cnc-milling (2026 Product Catalog)

Exclusive 2026 Offer for Guide Readers:

Request “DENTAL2026” for:

– Complimentary regulatory gap analysis

– DDP landed cost simulation for your country

– Priority production slot (Q3 2026)

Implementation Checklist

- Verify supplier’s NMPA/CE certificates via official databases (do not accept PDFs alone)

- Negotiate MOQ based on technical configuration, not unit count

- Insist on DDP with verified landed cost breakdown

- Require blockchain shipping documentation

- Conduct pre-shipment audit via third party

Final Recommendation: In China’s consolidated dental manufacturing landscape, partner with vertically integrated OEMs like Shanghai Carejoy that control spindle production, software development, and regulatory compliance. Avoid trading companies – 2026’s profit margins require factory-direct engagement. Schedule a technical consultation before Q3 2026 production slots fill.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Dental CNC Milling Machines (2026)

The following FAQ addresses key procurement considerations for dental clinics and equipment distributors evaluating CNC milling machines in 2026, with focus on voltage compatibility, spare parts availability, installation protocols, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage configurations are standard for dental CNC milling machines in 2026, and are dual-voltage models available for international deployment? | As of 2026, most dental CNC milling machines are designed for 110–120V (60Hz) in North America and 220–240V (50Hz) in Europe and Asia. Leading manufacturers such as Amann Girrbach, Wieland, and 3Shape offer region-specific voltage models. Dual-voltage (100–240V) units with auto-switching capability are increasingly available, especially in premium open-architecture systems, enabling global deployment without transformers. Always confirm voltage requirements with the supplier and ensure compatibility with local clinic electrical infrastructure. |

| 2. How accessible are spare parts for dental CNC milling machines, and what is the average lead time for critical components like spindles and gantry assemblies? | Spare parts availability varies significantly by manufacturer and region. Tier-1 brands maintain regional distribution hubs with 2–7 day lead times for common components (e.g., collets, dust filters, tool changers). Critical parts such as high-precision spindles or linear guides may require 10–21 days, especially for customized or discontinued models. Distributors should verify local inventory levels and evaluate service agreements that include spare parts stocking. Closed-system providers often restrict third-party parts, so long-term supply chain planning is essential. |

| 3. What does the standard installation process include, and is on-site technician support mandatory for commissioning? | Standard installation includes site assessment, machine leveling, electrical and exhaust connection verification, software calibration, and initial test milling. Most manufacturers require certified technicians to perform commissioning to validate performance metrics and initiate warranty coverage. Remote setup is available for experienced users, but on-site installation is recommended—particularly for first-time installations or multi-unit deployments. Installation typically takes 4–6 hours and should be scheduled during low-clinic activity periods to minimize disruption. |

| 4. What is the typical warranty coverage for dental CNC milling machines in 2026, and are extended service plans available? | Standard warranty coverage in 2026 is 12 months for parts and labor, excluding consumables and damage from improper use. Premium models may offer 24-month base warranties. Extended service plans (up to 5 years) are widely available and recommended, covering predictive maintenance, software updates, and expedited spare parts delivery. Some distributors bundle warranty extensions with consumable purchase agreements. Always review exclusions—especially for spindle wear and moisture damage from inadequate air filtration. |

| 5. Are software updates and calibration tools included during the warranty period, and how are they delivered? | Yes, software updates, firmware upgrades, and remote calibration tools are included in the base warranty and most extended service contracts. Updates are delivered via secure cloud platforms or encrypted USB drives, typically on a quarterly basis. Manufacturers use these updates to enhance milling accuracy, material support (e.g., new zirconia grades), and anti-collision algorithms. Clinics must maintain internet connectivity and approved operating systems to receive updates. On-site recalibration may be required after major updates and is covered under full-service plans. |

Need a Quote for Dental Cnc Milling Machine Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160