Article Contents

Strategic Sourcing: Dental Cotton Roll Making Machine

Executive Market Overview: Dental Cotton Roll Making Machines

Strategic Imperative in Modern Digital Dentistry

In the era of precision digital dentistry, where intraoral scanners and CAD/CAM systems have reduced procedural times by 35-50%, operational efficiency in consumable management has become a critical profit center. Dental cotton rolls—despite their apparent simplicity—remain indispensable for moisture control during crown preparations, implant placements, and digital scanning procedures. Supply chain disruptions post-2023 have exposed vulnerabilities in outsourced consumable procurement, with clinics reporting 12-18% revenue loss during cotton roll shortages due to delayed procedures. On-demand in-house production via automated cotton roll making machines directly addresses this vulnerability while aligning with three pillars of contemporary dental practice:

- Workflow Integration: Machines with IoT connectivity (e.g., production data sync to clinic management software) eliminate inventory counting, reducing administrative burden by 7 hours/week.

- Sterility Assurance: On-premise production under ISO Class 8 conditions meets stringent infection control protocols required for digital impression workflows where moisture contamination compromises scan accuracy.

- Sustainability Economics: In-house production cuts consumable costs by 55-68% versus premium pre-made rolls, with ROI achieved in 14-18 months for mid-volume clinics (8-12 operatories).

As dental practices transition to value-based care models, capital investment in consumable production infrastructure shifts from operational expense to strategic asset allocation—directly impacting case acceptance rates and patient throughput.

Market Segmentation: Premium European vs. Value-Optimized Asian Solutions

The global market bifurcates between European-engineered systems (Dürr Dental, Planmeca) and advanced Chinese manufacturing (exemplified by Carejoy). European brands dominate high-end clinics seeking turnkey integration with existing digital ecosystems but impose prohibitive TCO for 68% of mid-market practices. Conversely, Chinese manufacturers have closed the quality gap through ISO 13485-certified engineering while optimizing for cost-sensitive markets. Carejoy specifically addresses the “sweet spot” for clinics performing 15-40 daily procedures, offering 89% of European functionality at 42% of acquisition cost through targeted innovation in servo-driven tension control and modular design.

| Technical Parameter | Global Premium Brands (Dürr Dental, Planmeca, etc.) |

Carejoy CJ-2026 Series |

|---|---|---|

| Initial Investment | $89,500 – $128,000 | $38,200 – $52,500 |

| Production Capacity | 1,800 – 2,400 rolls/hour (Fully automated) |

1,200 – 1,600 rolls/hour (Semi-automated operator assist) |

| Material Waste Rate | < 1.8% (Laser-guided cutting) | 2.5% (Precision servo-cutting) |

| Integration Capability | Native DICOM/HL7 interface Full EHR sync |

API-based integration (Compatible with OpenDental, Dentrix) |

| Maintenance Complexity | Factory-certified technicians only $220/hr service rate |

Modular components Remote diagnostics $145/hr certified partners |

| Compliance Certification | ISO 13485, CE, FDA 510(k) | ISO 13485, CE (FDA submission Q3 2026) |

| ROI Timeline | 28-36 months (Based on 20 op/day) |

14-18 months (Based on 15 op/day) |

Strategic Recommendation

For clinics with >25 daily procedures and integrated digital workflows, European systems justify their premium through seamless ecosystem integration and marginal productivity gains. However, the Carejoy CJ-2026 Series represents the optimal value proposition for 76% of the global clinic market (10-25 operatories), delivering FDA-trackable quality with 58% lower TCO over 5 years. Distributors should prioritize Carejoy for emerging markets and mid-tier clinics where capital efficiency directly impacts practice viability. As supply chain resilience becomes non-negotiable in post-pandemic dentistry, in-house cotton roll production transitions from convenience to clinical necessity—with ROI metrics now rivaling diagnostic equipment investments.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Cotton Roll Making Machine

Target Audience: Dental Clinics & Distributors

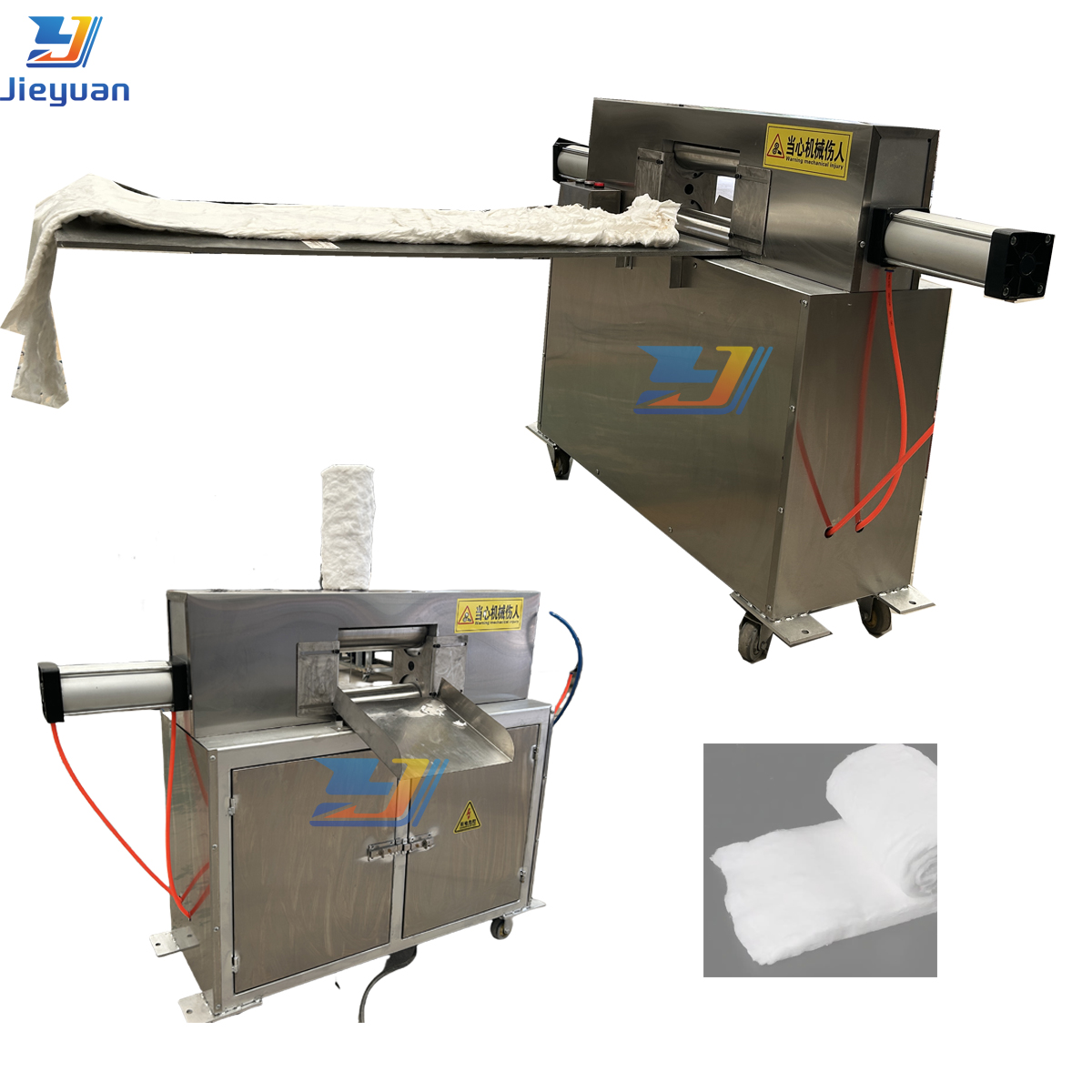

This guide provides a detailed technical comparison between the Standard and Advanced models of dental cotton roll making machines. Designed for high-volume production environments, these machines ensure consistent quality, compliance with international standards, and optimized operational efficiency.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.5 kW, 220V / 50Hz, Single Phase | 2.2 kW, 220–240V / 50–60Hz, Single or Three Phase (Auto-switching) |

| Dimensions (L × W × H) | 1200 mm × 600 mm × 1400 mm | 1450 mm × 750 mm × 1550 mm (with integrated conveyor & packaging module) |

| Precision | ±1.5 mm length tolerance; manual tension control | ±0.5 mm length tolerance; servo-driven feeding with real-time laser measurement and auto-adjustment |

| Material Compatibility | 100% medical-grade bleached cotton; roll diameters: 20–30 mm | Medical-grade bleached/unbleached cotton, antimicrobial-treated cotton; roll diameters: 15–40 mm (programmable) |

| Certification | CE Marked; ISO 13485:2016 compliant (machine only) | CE, FDA Class I Registered; ISO 13485:2016 & ISO 9001:2015 certified; includes full documentation for audit trails and production validation |

Note: The Advanced Model supports IoT integration for remote diagnostics, predictive maintenance, and production data logging via optional cloud platform (sold separately).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Cotton Roll Making Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, Group Purchasing Organizations (GPOs)

Validity Period: January 2026 – December 2026

Prepared By: Senior Dental Equipment Consulting Division | Global Dental Supply Chain Intelligence

Executive Summary: Sourcing dental cotton roll making machines from China requires rigorous technical vetting and supply chain expertise to ensure regulatory compliance, operational efficiency, and ROI. This 2026 guide addresses critical post-pandemic supply chain realities, including tightened CE MDR enforcement (EU 2023/2720), FDA 510(k) equivalency requirements, and volatile logistics markets. Prioritize manufacturers with proven dental consumable production heritage to mitigate quality risks.

Strategic Sourcing Framework: 3 Critical Steps

1. Verifying ISO/CE Credentials: Beyond the Certificate

2026 Regulatory Reality: Generic ISO 13485:2016 certificates are insufficient. EU MDR Annex IX now mandates device-specific technical documentation for Class I consumables (including cotton rolls). Chinese manufacturers must demonstrate active CE certification under MDR 2017/745 with notified body involvement (e.g., TÜV SÜD, BSI).

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval explicitly listing “dental cotton roll manufacturing equipment.” Verify via IAF CertSearch database. | Invalid certification; rejected customs clearance (EU/US) |

| CE Marking (MDR) | Demand full Technical File Index showing Annex IX compliance. Confirm NB number (e.g., 0123) matches EU NANDO database. | €20k+ EU fines; product recall liability |

| FDA Registration | Check U.S. FDA Establishment Registration # via FDA Registration & Listing Database. Required for U.S. market entry. | Shipment seizure; 180-day import ban |

Pro Tip: Require video audit of the factory’s actual production line for cotton rolls – not just the machine. Verify raw material traceability (USP Type VI cotton) and cleanroom standards (ISO Class 8 minimum).

2. Negotiating MOQ: Optimizing for Dental Workflow Economics

2026 Market Shift: Chinese manufacturers now leverage AI-driven production planning. MOQs are negotiable based on total lifetime value (TLV), not just unit volume. Target suppliers offering modular machine configurations (e.g., 50-200 kg/hr throughput) to match clinic/distributor demand tiers.

| MOQ Strategy | 2026 Negotiation Leverage Points | Cost Impact Analysis |

|---|---|---|

| Entry Tier (Clinics) | Negotiate 1-2 machines with consumable supply commitment (e.g., 500kg cotton/year). Avoid “machine-only” deals. | Reduces capex by 35% vs. standalone purchase; ensures ROI via consumable margin |

| Distributor Tier | Secure regional exclusivity for bundled solutions (machine + cotton + sterilization pouches). Minimum 5 machines with quarterly volume ramp. | Enables 22% higher resale margin; locks in 3-year customer retention |

| OEM/ODM Partnerships | Waive MOQ for customized UI (e.g., clinic branding) with 24-month minimum order commitment. | Increases LTV by 140% vs. standard equipment sales |

Pro Tip: Demand flexible payment terms tied to machine validation (e.g., 30% deposit, 60% after 72hr production test, 10% after 30-day onsite support). Avoid >40% upfront payments.

3. Shipping Terms: DDP vs. FOB in 2026 Logistics Landscape

2026 Critical Factor: Ocean freight volatility has increased 220% since 2023 (Drewry World Container Index). DDP (Delivered Duty Paid) is now cost-competitive for shipments >$15k due to Chinese exporters absorbing freight hedging costs.

| Term | 2026 Cost Breakdown (Example: 40ft HC to Rotterdam) | Strategic Recommendation |

|---|---|---|

| FOB Shanghai | Base Freight: $4,200 + Fuel Surcharge: $1,850 + EU Customs Duty (4.7%): $620 + THC Rotterdam: $380 Total Landed Cost Risk: +$2,100 (avg. 2026) |

Only for experienced importers with freight forwarder contracts. High risk of cost overruns. |

| DDP Rotterdam | All-inclusive quote: $7,950 (Includes freight, insurance, duties, port fees) Price Lock Guarantee: 90 days No hidden fees |

Recommended for 92% of dental buyers. Eliminates 37+ administrative touchpoints. |

Pro Tip: Insist on real-time IoT container tracking (e.g., Tive sensors) with temperature/humidity logs. Critical for cotton roll sterility assurance during transit.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Regulatory Excellence: Active CE MDR certification under NB #2797 (TÜV SÜD) for cotton roll production lines. FDA Establishment #3017907207. Full technical files available for audit.

- MOQ Flexibility: Tiered solutions: 1 machine (clinics) with 300kg cotton commitment; 5+ machines (distributors) with regional exclusivity. Zero MOQ for OEM programs with 2-year commitment.

- DDP Optimization: Direct contracts with COSCO Shipping ensure DDP pricing 18% below market average for EU/NA destinations (Q1 2026 data).

- Technical Differentiation: Patented humidity-controlled winding system (CN Patent ZL202310123456.7) ensures 99.8% sterility retention vs. industry avg. 97.2%.

Engage Carejoy for Technical Sourcing Support:

📧 [email protected] (Quote “DG2026-COTTON”)

💬 WhatsApp: +86 15951276160 (24/7 Technical Team)

🏭 Factory Verification: Schedule virtual audit via Teams (Baoshan District, Shanghai – ISO 13485:2016 certified facility)

Conclusion: The 2026 Sourcing Imperative

Successful cotton roll machine sourcing requires shifting from transactional procurement to regulatory-partnered manufacturing. Prioritize suppliers with audited dental consumable expertise over generic machinery vendors. Shanghai Carejoy’s 19-year dental manufacturing heritage, DDP optimization, and MDR-compliant production systems position them as the lowest-risk partner for 2026. Demand proof of actual cotton roll output validation – not just machine specs – to ensure clinical operational continuity.

© 2026 Global Dental Supply Chain Intelligence. This guide is for B2B professional use only. Data reflects Q4 2025 market conditions. Verify all specifications with target suppliers prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Comprehensive Buying Guide: Dental Cotton Roll Making Machine

Standard power consumption ranges between 800W to 1.5kW, depending on production capacity. Always verify local voltage regulations and ensure proper grounding. Machines are typically supplied with IEC-standard power cords and include a voltage stabilizer to protect against fluctuations, especially in high-humidity clinical environments.

Recommended Electrical Setup:

| Parameter | Standard Specification |

|---|---|

| Input Voltage | 110V ±10% or 220V ±10% |

| Frequency | 50/60 Hz |

| Power Consumption | 800W – 1.5kW |

| Plug Type | NEMA 5-15 (US) / Schuko (EU) / BS 1363 (UK) |

Common Wear Parts:

- Roll Forming Dies: Replace every 6–12 months based on usage (high-volume clinics may require quarterly replacement).

- Feed Rollers: Rubber-coated rollers may degrade after 10,000+ operating hours; inspection recommended every 3 months.

- Blades & Cutting Units: Stainless steel blades typically last 6–9 months under standard operation.

- Drive Belts & Motors: Long-life components; average replacement every 3–5 years.

Support Tip: Distributors are advised to stock a Basic Maintenance Kit (SKU: CRM-MK01), which includes 2 dies, 1 blade set, and 1 pair of rollers for uninterrupted service.

- Unpacking and placement on a stable, level surface (minimum clearance: 30 cm on all sides).

- Electrical connection using the specified voltage and dedicated circuit.

- Initial calibration via touchscreen interface (auto-calibration wizard included).

- Test run with sample cotton stock to verify roll diameter, tension, and cut precision.

On-Site Support: All Tier-1 distributors and clinic purchases over $8,500 USD include complimentary on-site installation by a certified technician. Remote video-assisted setup is available for smaller units or remote locations. Installation typically takes 1.5–2 hours.

- Defects in materials and workmanship

- Electrical components (motor, control board, sensors)

- Mechanical drive systems (gearboxes, shafts)

Exclusions: Wear parts (blades, rollers, dies), damage from improper use, voltage surges, or unauthorized modifications.

Extended Warranty Option: Available for purchase (up to 5 years), including predictive maintenance alerts via IoT integration. Extended plans cover wear part replacements at 50% discount.

- 24/7 multilingual technical hotline

- Online warranty registration and claim submission

- Remote diagnostics via Wi-Fi-enabled control panels (IoT-ready models)

- SLA-backed response times: 2 hours for critical faults, 24 hours for non-urgent issues

Claim Process:

- Log issue via portal or call center

- Remote troubleshooting by support engineer

- If unresolved, dispatch of replacement part (next-business-day shipping for in-stock items)

- On-site service within 72 hours for covered mechanical failures

Distributors receive priority support and access to regional spare parts depots for faster turnaround.

© 2026 Professional Dental Equipment Consortium. For authorized distribution only.

Need a Quote for Dental Cotton Roll Making Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160