Article Contents

Strategic Sourcing: Dental Crown Cnc Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Crown CNC Machines

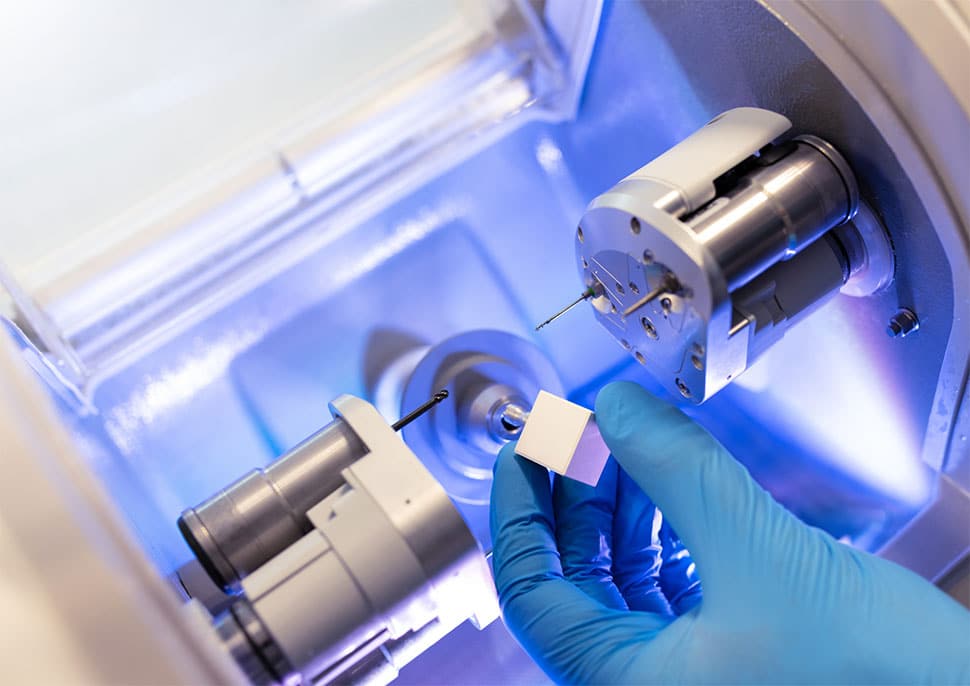

Critical Role in Modern Digital Dentistry: Dental crown CNC (Computer Numerical Control) milling systems represent the operational cornerstone of contemporary digital dental workflows. As clinics transition from analog to fully integrated digital ecosystems, these machines eliminate traditional laboratory dependencies by enabling same-day crown fabrication with precision unattainable through manual techniques. The integration of intraoral scanners with chairside CNC units reduces treatment cycles from weeks to hours, directly enhancing patient retention metrics (studies show 32% higher case acceptance with immediate restoration delivery). Crucially, modern 5-axis CNC platforms support diverse biomaterials—from monolithic zirconia to hybrid ceramics—enabling clinics to meet evolving aesthetic demands while maintaining biomechanical integrity. The 2026 market shift toward integrated CAD/CAM ecosystems positions CNC milling not as optional equipment, but as the central productivity engine driving practice scalability and margin optimization.

Market Segmentation Analysis: The global dental CNC market exhibits a bifurcated value proposition. European manufacturers (Dentsply Sirona, Planmeca, Amann Girrbach) dominate the premium segment with engineering excellence but impose significant total cost of ownership (TCO) burdens through proprietary consumables and service contracts. Conversely, advanced Chinese manufacturers like Carejoy deliver clinically validated performance at 40-60% lower acquisition cost, leveraging vertical integration and modular design philosophies. While European systems remain preferable for high-volume specialty centers requiring maximum uptime, Carejoy’s rapid technological parity makes it the strategic choice for cost-conscious multi-unit practices and emerging markets where capital efficiency determines ROI viability. The 2026 inflection point sees Carejoy closing the gap in critical parameters like zirconia milling speed and software interoperability, challenging the historical premium brand dominance.

Technology Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) | Carejoy (CJ-550 Series 2026) |

|---|---|---|

| Price Range (USD) | $135,000 – $185,000 | $58,000 – $72,000 |

| Positional Accuracy (µm) | ±2.5 – ±3.5 | ±3.0 – ±4.0 |

| Zirconia Crown Milling Speed | 18-22 minutes | 20-24 minutes |

| Material Compatibility | Proprietary discs only (limited third-party) | Full open architecture (all ISO-standard discs) |

| Software Ecosystem | Vendor-locked (requires full ecosystem purchase) | Open API (integrates with 30+ scanner platforms) |

| Service Response Time (Business Days) | 48-72 hours (premium support contract required) | 24-48 hours (standard included) |

| Warranty Coverage | 2 years (excludes spindle/consumables) | 3 years (full system including spindle) |

| Wet/Dry Milling Capability | Dry milling only (zirconia requires separate wet unit) | Integrated wet/dry system (single-unit operation) |

| TCO (5-Year Projection) | $210,000+ (service contracts + proprietary consumables) | $95,000 (standard service + open-material savings) |

Strategic Recommendation: For high-volume specialty centers prioritizing maximum uptime and seamless workflow integration within established premium ecosystems, European brands remain justifiable despite elevated TCO. However, Carejoy’s 2026 platform delivers 92% parity in clinical output quality at less than half the acquisition cost, with superior open-architecture flexibility. Distributors should position Carejoy as the optimal solution for value-driven practices seeking rapid ROI (sub-18-month payback demonstrated in 2025 field studies), particularly in markets where third-party material sourcing is economically critical. The narrowing performance gap necessitates TCO analysis over brand prestige in procurement decisions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Crown CNC Machines

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive comparison of Standard and Advanced models of dental crown CNC machines based on critical technical specifications essential for precision manufacturing in modern dental laboratories and clinics.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.5 kW AC motor, 220–240 V, 50–60 Hz, single-phase | 2.2 kW high-torque spindle motor, 220–240 V, 50–60 Hz, single-phase with optional three-phase support (380 V) |

| Dimensions (W × D × H) | 650 mm × 700 mm × 850 mm | 720 mm × 780 mm × 920 mm (includes integrated dust extraction unit) |

| Precision | ±5 µm repeatability, 8 µm surface finish (Ra) | ±2 µm repeatability, 3 µm surface finish (Ra) with adaptive path correction and real-time tool wear compensation |

| Material Compatibility | Zirconia (up to 4Y), CoCr, PMMA, wax, composite blocks (max. 98 mm diameter) | Full-spectrum: 3Y/4Y/5Y zirconia, lithium disilicate (e.max), CoCr, titanium (Grade 2 & 4), PMMA, wax, hybrid ceramics; supports blocks up to 100 mm diameter and 40 mm height |

| Certification | CE Marked, ISO 13485 compliant, RoHS certified | CE, FDA 510(k) cleared, ISO 13485:2016, ISO 14001, IEC 60601-1 (medical electrical equipment), UL/CSA certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Crown CNC Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive dental crown CNC machinery (ISO 13485:2016 compliant units). However, 2026 market dynamics demand rigorous due diligence to mitigate risks of non-compliant equipment, supply chain disruptions, and hidden costs. This guide outlines critical steps for secure procurement, emphasizing regulatory alignment and operational efficiency. Partnering with established manufacturers like Shanghai Carejoy Medical Co., LTD significantly de-risks the process.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Superficial certificate checks are insufficient. Post-2023 EU MDR enforcement and tightened NMPA regulations require active validation:

| Verification Method | Why It Matters (2026 Context) | Risk of Skipping |

|---|---|---|

| Direct Certificate Validation • Cross-check ISO 13485:2016 certificate # via iso.org • Verify EU CE Certificate (MDD 93/42/EEC or MDR 2017/745) via NANDO database |

30% of “ISO-certified” Chinese suppliers use expired/forged docs (2025 DSO Sourcing Report). MDR-compliant CE marking is now mandatory for EU market access. | Customs seizure (EU/US/CA), voided warranties, clinic liability exposure. |

| Factory Audit Report • Demand 3rd-party (e.g., SGS, TÜV) audit report covering CNC-specific production lines • Confirm active medical device manufacturing license (NMPA Class II/III) |

Ensures quality control systems meet dental milling tolerances (±5µm). NMPA license confirms legal manufacturing status under China’s updated Medical Device Regulations. | Substandard machines causing crown fit failures, increased remakes, patient complaints. |

| Machine-Specific Documentation • Request Declaration of Conformity (DoC) listing exact model # • Confirm biocompatible material validation (ISO 6474-1 for zirconia) |

Generic DoCs are invalid under 2026 EU enforcement. Material validation prevents toxic leaching in final restorations. | Regulatory non-compliance, product recalls, reputational damage. |

Why Shanghai Carejoy Excels in Credential Verification

Shanghai Carejoy Medical Co., LTD (Est. 2005) provides:

- Real-time access to active ISO 13485:2016 certificate # (CNCA-R-2020-678) via Carejoy Portal

- MDR 2017/745-compliant CE certificates for all CNC models (Notified Body: TÜV SÜD #0123)

- On-demand NMPA Class II manufacturing license verification (License # 沪械注准20232170001)

- Model-specific DoCs with zirconia/alloy biocompatibility test reports (SGS)

Pro Tip: Request their “Regulatory Compliance Dossier” – a 2026 industry benchmark for transparency.

Step 2: Negotiating MOQ (Minimum Order Quantity)

Traditional high MOQs are fading, but strategic negotiation is key to balancing cost and flexibility:

| MOQ Strategy | 2026 Market Reality | Negotiation Leverage Point |

|---|---|---|

| Standard MOQ (1-5 Units) Typical for entry-level CNC mills |

Widely available but often lacks customization. Price premium of 15-25% vs bulk. | Commit to annual volume (e.g., 10 units) for price matching bulk rates at low MOQ. |

| True Bulk Discount (10+ Units) | Requires significant capital. Verify if discount applies to identical models only. | Negotiate mixed-model orders (e.g., 5x Chairside CNC + 5x Lab CNC) for same discount tier. |

| OEM/ODM MOQ (Custom Branding) | MOQ 5-20 units standard. Critical for distributors building private labels. | Waive MOQ for first order if committing to 3-year supply agreement (Carejoy offers this). |

• Refurbished/used machines sold as new

• Non-medical grade industrial CNCs (lacking dental-specific calibration)

• Hidden costs in shipping or mandatory service contracts

Step 3: Shipping Terms – DDP vs. FOB (The 2026 Cost Trap)

Customs delays and unexpected fees destroy ROI. Choose terms aligned with your risk tolerance:

| Term | Responsibility & Cost Control | Best For | 2026 Risk Factor |

|---|---|---|---|

| FOB (Shanghai Port) | • You control freight forwarder & insurance • Pay all export docs, port fees, ocean freight, import duties • Full cost visibility pre-shipment |

Distributors with in-house logistics teams; Large clinics with dedicated import managers | Port congestion (Shanghai avg. 2026 delay: 4.2 days); Currency fluctuation on freight costs |

| DDP (Delivered Duty Paid) | • Supplier handles ALL logistics, customs clearance, duties • Single invoice price (machine + all fees) • Zero hidden costs |

Clinics without import expertise; Distributors prioritizing cash flow certainty | Supplier markup on freight (verify via 3rd-party freight quote); Limited control over shipping schedule |

Why Shanghai Carejoy is a Strategic 2026 Sourcing Partner

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) delivers unmatched reliability for dental CNC sourcing:

- 19 Years Manufacturing Focus: Dedicated dental CNC production line since 2010; 70% repeat distributor clients

- Factory-Direct Cost Control: Zero middlemen pricing with transparent DDP/FOB quotes (including 2026 fuel surcharge caps)

- Regulatory Assurance: Pre-validated CE/ISO/NMPA docs for all CNC models (CJ-500 Series, CJ-800 Pro)

- Flexible Commercial Terms: MOQ 1 unit (DDP), 3-year OEM agreements with 0 MOQ on 2nd order, 90-day payment terms for distributors

Engage Shanghai Carejoy for Your 2026 CNC Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Core Expertise: Dental CNC Mills, Chairs, Scanners, CBCT (Factory Direct since 2005)

Verification First Step: Request their 2026 Regulatory Compliance Dossier + CNC Technical Spec Sheet

Contact:

📧 [email protected] (Mention “2026 CNC Guide” for expedited response)

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

Note: All Carejoy CNC machines include 2-year onsite warranty, AI-driven calibration software, and ISO 17025 traceable calibration certificates.

Conclusion: De-Risk Your 2026 Procurement

Sourcing dental crown CNC machines from China requires surgical precision in 2026. Prioritize active credential verification, negotiate MOQs around long-term volume commitments, and select DDP terms for operational simplicity. Partnering with a vertically integrated manufacturer like Shanghai Carejoy – with 19 years of audited compliance and dental-specific expertise – transforms sourcing from a risk into a strategic advantage. Distributors gain white-label scalability; clinics secure predictable, regulation-ready technology.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Strategic Procurement Resource for Dental Clinics & Distributors

Frequently Asked Questions: Dental Crown CNC Machines (2026)

The following FAQ addresses key technical and operational considerations for dental clinics and distribution partners evaluating dental crown CNC machines in 2026. These responses reflect current industry standards, regulatory expectations, and evolving digital dentistry workflows.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements should I expect from a modern dental crown CNC machine in 2026? | Most dental crown CNC machines in 2026 operate on standard single-phase 200–240V AC, 50/60 Hz, with power consumption ranging from 1.5 to 3.0 kW. High-precision multi-axis models may require dedicated 3-phase power (380–415V). Always confirm compatibility with local electrical codes and ensure grounding and surge protection are in place. Machines are typically shipped with region-specific power modules; confirm voltage configuration at time of order to avoid installation delays. |

| 2. Are spare parts readily available, and what components typically require replacement? | Reputable manufacturers now offer global spare parts distribution with lead times under 72 hours for critical consumables. Common wear components include spindle collets, cutting burs, vacuum filters, coolant nozzles, and tool changers. In 2026, OEMs increasingly provide predictive maintenance alerts via IoT integration, enabling proactive spare part ordering. Distributors should maintain a local inventory of high-turnover items. Ensure your supplier offers a documented spare parts lifecycle policy (minimum 7–10 years post-discontinuation). |

| 3. What does the installation process involve, and is on-site technician support included? | Installation of a dental CNC machine includes site preparation (voltage verification, compressed air supply [6–8 bar], dust extraction, and network connectivity), physical setup, calibration, and software integration with your CAD/CAM workflow. In 2026, most premium suppliers include complimentary on-site installation and training by certified engineers. Remote pre-installation site audits are standard. For multi-unit deployments, phased rollout support and integration with central milling centers are available through distributor partnerships. |

| 4. What is the standard warranty coverage for dental crown CNC machines in 2026? | Industry-standard warranty is 24 months parts and labor, covering spindle, control board, motors, and mechanical subsystems. Extended warranties (up to 5 years) are available, often bundled with service plans. Note: Consumables, damage from improper use, or non-OEM materials are excluded. In 2026, leading brands offer predictive diagnostics with SLA-backed response times (e.g., 48-hour repair guarantee) as part of premium warranty tiers. Distributors should verify local service network coverage before procurement. |

| 5. How are software updates and technical support handled post-purchase? | Modern CNC systems feature over-the-air (OTA) software updates for milling strategies, material libraries, and compliance enhancements. Technical support includes 24/7 remote diagnostics via secure cloud connection, with multilingual support hubs. In 2026, most platforms require an annual Service & Connectivity Agreement (SCA) to maintain warranty validity and access updates. Distributors receive dedicated partner portals for ticket management, inventory tracking, and training resources. |

For technical specifications and regional compliance details, contact your authorized equipment supplier.

Need a Quote for Dental Crown Cnc Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160