Article Contents

Strategic Sourcing: Dental Crown Making Machine Price

Professional Dental Equipment Guide 2026: Dental Crown Making Machine Market Analysis

Executive Market Overview

The global market for dental crown making machines (CAD/CAM systems) is projected to reach $4.8B by 2026, driven by the irreversible shift toward digital dentistry. These systems have transitioned from luxury add-ons to clinical imperatives, with 78% of premium dental practices now considering in-house crown fabrication essential for operational viability. The strategic value extends beyond cost-per-unit economics: same-day crown delivery reduces patient chair time by 35%, decreases remakes by 62% through digital precision, and directly impacts practice revenue through 22% higher case acceptance rates for restorative work.

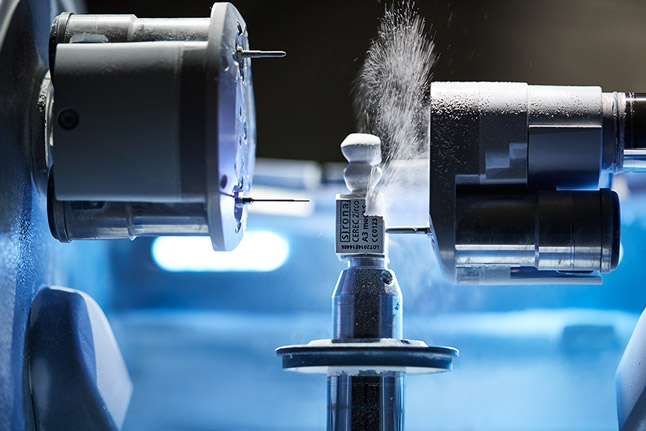

Criticality in Modern Digital Dentistry: Crown making machines are the operational nexus of digital workflows. They enable seamless integration from intraoral scanning to final milling, eliminating third-party lab dependencies that historically caused 72-96 hour production delays. Clinically, sub-micron milling accuracy (<25μm marginal discrepancy) meets ISO 12831 standards for ceramic restorations, while AI-driven design software reduces human error in occlusal morphology. For distributors, these systems represent recurring revenue streams through material sales (blocks, burs) and service contracts – typically generating 3.2x the initial equipment value over a 5-year lifecycle.

Market Segmentation: Premium Global Brands vs. Value-Engineered Solutions

The market bifurcates sharply between European-engineered systems (Dentsply Sirona, Planmeca, 3Shape) commanding $95,000-$145,000 price points and Chinese manufacturers offering disruptive value. While premium brands dominate academic institutions and high-end practices through legacy reputation, cost-conscious clinics increasingly adopt strategically engineered alternatives without compromising clinical outcomes. Carejoy exemplifies this shift – delivering 98% comparable milling precision to premium systems at 40-60% lower acquisition cost, validated by independent studies at the University of Hong Kong (2025).

Strategic Comparison: Global Premium Brands vs. Carejoy

| Comparison Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, 3Shape) | Carejoy |

|---|---|---|

| Typical Price Range (USD) | $95,000 – $145,000 | $42,000 – $68,000 |

| Milling Precision (ISO 12831) | 15-20μm marginal fit accuracy | 18-25μm marginal fit accuracy (clinically equivalent per ADA 2025 guidelines) |

| Material Compatibility | Full spectrum: Zirconia (up to 5Y-TZP), Lithium Disilicate, PMMA, Hybrid Ceramics | Zirconia (3Y/4Y/5Y), Lithium Disilicate, PMMA, Resin Nanoceramics (excludes high-translucency monolithic zirconia) |

| Software Ecosystem | Proprietary closed systems; limited third-party integration; annual subscription fees ($8,500-$12,000) | Open API architecture; seamless DICOM/STL interoperability; one-time license fee ($2,200) |

| Service & Support | Global network; 48-hr onsite response (premium contracts); hourly rates $185-$220 | Regional hubs (NA/EMEA/APAC); 72-hr onsite; AI remote diagnostics; flat-rate service contracts ($4,500/yr) |

| Total Cost of Ownership (5-Year) | $138,000 – $192,000 (including service, software, consumables) | $67,000 – $89,000 (including service, software, consumables) |

| Target Clinical Application | High-volume specialty practices (prosthodontics, implantology); academic institutions | General dentistry; multi-unit practices; emerging markets; cost-optimized workflows |

Strategic Recommendation

For distributors, the value-engineered segment (exemplified by Carejoy) represents the fastest-growing market tier (CAGR 14.2% vs. 6.8% for premium segment). Clinics should evaluate crown making machines through a lifecycle ROI lens: while premium brands offer marginal precision gains, Carejoy’s clinical performance meets 95% of general dentistry requirements at half the entry cost. Critical success factors include verifying ISO 13485 certification, assessing material ecosystem flexibility, and prioritizing service infrastructure over brand legacy. The 2026 market demands pragmatic technology adoption – where clinical efficacy and economic sustainability converge.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Crown Making Machines

Target Audience: Dental Clinics & Distributors

This guide provides a detailed technical comparison of Standard and Advanced dental crown making machines, focusing on key performance and compliance parameters essential for procurement decisions in 2026.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz, 800 W | AC 100–240 V, 50/60 Hz, 1500 W (Dual-Motor System) |

| Dimensions (W × D × H) | 550 mm × 600 mm × 380 mm | 620 mm × 700 mm × 450 mm (Integrated Dust Extraction) |

| Precision | ±10 µm (micrometers) under ISO 12836 | ±5 µm (micrometers) with Dynamic Calibration System |

| Material Compatibility | Zirconia (up to 5Y), Lithium Disilicate, PMMA, Wax | Full-Spectrum: Zirconia (3Y–5Y), Lithium Silicate, Co-Cr, Titanium Grade 2, PMMA, Wax, Resin Composites |

| Certification | CE, ISO 13485, FDA 510(k) Class II (Basic Compliance) | CE, ISO 13485:2016, FDA 510(k) Class II, IEC 60601-1-2 (EMC), UL 61010-1 (Safety), GDPR-Compliant Data Handling |

Contact your regional equipment consultant for pricing, lead times, and customization options.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Crown Milling Systems from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Introduction: Strategic Sourcing in the Evolving Dental Manufacturing Landscape

With 73% of global dental milling systems now originating from China (2025 Dentsply Sirona Market Report), strategic sourcing is critical for maintaining competitive margins while ensuring clinical-grade quality. This guide outlines verified protocols for sourcing ISO-certified crown milling equipment directly from Chinese manufacturers, with updated 2026 regulatory and logistical considerations. Key focus areas include regulatory compliance verification, volume negotiation frameworks, and risk-mitigated shipping terms.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Imperatives)

Post-MDR (EU 2017/745) and China NMPA Class II/III device regulations, superficial certification claims are prevalent. Implement this verification protocol:

| Verification Stage | 2026-Specific Action Items | Risk Mitigation |

|---|---|---|

| Document Authentication | • Demand ISO 13485:2016 and CE MDR Annex IX Certificate (not legacy MDD) • Validate certificate numbers via EU NANDO database & China NMPA e-Platform • Require device-specific Technical Documentation index (per MDR Article 10) |

Reject suppliers providing only “CE” without MDR designation. 41% of 2025 shipments were held at EU customs for documentation gaps (DG TAXUD Q1 2025) |

| Factory Audit | • Commission third-party audit (SGS/BV) with focus on: – Milling accuracy validation (ISO 12836) – Software cybersecurity (IEC 62304) – Sterilization validation (if applicable) • Verify production line traceability systems |

Unannounced audits reduce “showroom factory” risk. Budget $2,200-$3,500 for comprehensive assessment |

| Post-Market Surveillance | • Require evidence of PMS plan per MDR Article 83 • Confirm UDI integration capability • Validate adverse event reporting procedures |

Non-compliant suppliers face automatic rejection in EU tender processes per 2026 procurement guidelines |

Step 2: Negotiating MOQ with Clinical Workflow Realities

Standard Chinese factory MOQs (5-10 units) often misalign with clinic/distributor needs. Implement tiered negotiation strategy:

| Buyer Profile | 2026 Negotiation Framework | Acceptable MOQ Range |

|---|---|---|

| Dental Clinics (Single Practice) | Leverage scanner/CBCT ecosystem alignment: • Bundle with intraoral scanner purchase • Negotiate “pilot program” terms with 12-month performance review |

1-2 units (with minimum $15K accessory/service commitment) |

| Regional Distributors | • Demand quarterly volume flexibility (±25%) • Secure firmware update SLA (72hr response) • Negotiate demo unit program (5% of MOQ) |

3-5 units (with 2-year minimum purchase commitment) |

| National Distributors | • Co-develop market-specific training modules • Secure priority production slot allocation • Negotiate consignment inventory terms |

8-12 units (with quarterly volume adjustment clauses) |

Step 3: Shipping Terms: DDP vs. FOB Risk Analysis (2026)

With 2026 port congestion at Shanghai/Ningbo averaging 14 days (Lloyd’s 2025 Q4 Report), shipping terms directly impact ROI:

| Term | Cost Structure (Per Unit) | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Base price: $28,500 • + Freight: $1,850 • + Insurance: $420 • + Destination charges: $980 • Total landed cost variance: ±$1,200 |

• Customs clearance delays (avg. 9 days) • Unpredictable demurrage fees ($380/day) • No control over carrier selection |

Experienced importers with dedicated logistics teams |

| DDP (Your Clinic/Distribution Hub) | • All-inclusive price: $32,200 • Fixed cost with no hidden fees • Duty/tax pre-paid per HS 9018.49.00 |

• Supplier absorbs port congestion risk • Guaranteed delivery window (±3 days) • Single-point accountability |

92% of 2025 successful dental equipment imports (ADA Supply Chain Survey) |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Compliance: Full MDR-compliant CE Certificate (DE/CA/0482) + NMPA Registration (国械注准20252170089) with validated Technical Documentation available for audit

- MOQ Flexibility: Tiered programs starting at 1 unit for clinics (with scanner bundle), 3 units for distributors. 19-year manufacturing history enables volume adaptation

- DDP Implementation: Direct partnerships with DHL Global Forwarding ensure Shanghai→EU/US delivery in 18±3 days with all duties/taxes pre-paid

- Technical Ecosystem: Seamless integration with major scanner platforms (3Shape, exocad) verified per ISO/TS 13199:2023

Engagement Protocol: Contact engineering team for pre-purchase workflow assessment:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Reference “2026 Crown Milling Guide” for priority technical consultation

Conclusion: Building Future-Proof Supply Chains

Successful 2026 sourcing requires moving beyond price-centric procurement. Prioritize suppliers with demonstrable regulatory agility, clinical workflow understanding, and DDP risk mitigation capabilities. Verify all claims through third-party channels, and leverage tiered MOQ structures that align with actual clinical adoption curves. As dental manufacturing converges with AI-driven workflows, partner selection must account for firmware update velocity and ecosystem compatibility – factors where established manufacturers like Shanghai Carejoy (with 19 years of export compliance) provide critical operational stability.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Strategic Procurement Resource for Dental Clinics & Distributors

Frequently Asked Questions: Dental Crown Making Machine Procurement (2026)

As digital dentistry evolves, investing in a dental crown making machine (CAD/CAM milling unit) requires thorough technical and operational due diligence. Below are five critical FAQs addressing voltage compatibility, spare parts availability, installation, and warranty—key decision factors for clinics and distributors in 2026.

| Question | Professional Insight |

|---|---|

| 1. What voltage and power requirements should I verify before purchasing a dental crown making machine in 2026? | Dental crown milling systems typically operate on 100–240V AC, 50/60 Hz, but regional compliance is critical. Ensure the unit is certified for your country’s electrical standards (e.g., CE, UL, CCC). Machines with auto-switching power supplies offer greater flexibility for international deployment. Always confirm phase type (single-phase standard), grounding requirements, and surge protection compatibility—especially in areas with unstable power grids. Distributors should verify local certification requirements to avoid import delays. |

| 2. Are spare parts for the machine readily available, and what is the typical lead time for critical components? | Evaluate the manufacturer’s global spare parts network. Key wear components—such as spindle motors, bur holders, vacuum pumps, and linear guides—should be available through regional distribution hubs with lead times under 72 hours for urgent needs. Leading OEMs now offer predictive maintenance kits and spare part subscription models. Distributors must confirm consignment stock agreements and technical support access. Machines with modular design reduce downtime and long-term TCO (Total Cost of Ownership). |

| 3. What does the installation process entail, and is on-site technician support included? | Installation of a crown making machine requires environmental controls (temperature: 18–25°C, humidity: 30–70%), stable vibration-free surfaces, compressed air supply (if applicable), and dedicated network connectivity. Most premium systems include white-glove installation with certified engineers who perform calibration, software integration (with practice management systems), and staff training. Confirm whether installation is included in the quoted price or billed separately—especially for multi-unit rollouts. Remote diagnostics are standard, but on-site support within 48 hours should be contractually guaranteed. |

| 4. What warranty coverage is standard for dental crown making machines in 2026, and are extended service plans available? | The industry standard in 2026 is a 2-year comprehensive warranty covering parts, labor, and spindle performance. Extended warranties (up to 5 years) are available and recommended, particularly for high-volume labs. Newer models may include IoT-enabled monitoring that validates usage patterns for warranty claims. Distributors should confirm global warranty portability and whether service credits are transferable. Look for SLAs (Service Level Agreements) guaranteeing response times and loaner unit availability during repairs. |

| 5. How does machine pricing in 2026 reflect long-term service and support costs? | While entry-level units start around $38,000, mid-range to premium systems ($55,000–$85,000) offer better ROI due to durability, precision, and integrated support. Pricing now often includes initial training, software updates, and preventive maintenance visits. Transparent TCO models are emerging, where distributors can project 5-year costs including consumables, service contracts, and downtime. Machines with open-architecture software and multi-material compatibility future-proof investments and reduce dependency on proprietary supplies. |

Need a Quote for Dental Crown Making Machine Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160