Article Contents

Strategic Sourcing: Dental Crown Milling

Dental Crown Milling Systems: Executive Market Overview 2026

Strategic Imperative in Modern Digital Dentistry

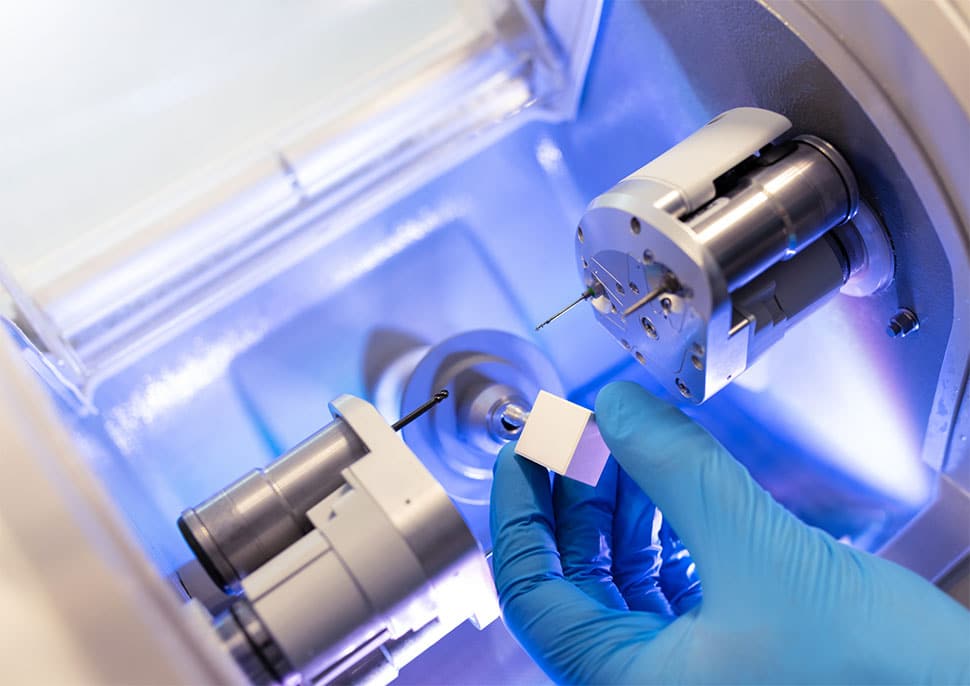

Dental crown milling systems have transitioned from optional adjuncts to mission-critical infrastructure in contemporary dental practices. The 2026 market is defined by patient demand for same-day restorations, reduced outsourcing costs, and seamless integration within digital workflows (intraoral scanning → design → milling → cementation). Clinics without in-house milling capabilities face significant competitive disadvantages, including extended treatment timelines, compromised case control, and eroded profit margins due to third-party lab fees (averaging 35-45% of restoration revenue). ROI analysis indicates payback periods of 14-18 months for high-volume practices (25+ crowns/week) through lab cost elimination and increased case acceptance.

Technological convergence with AI-driven design software and multi-material compatibility (zirconia, lithium disilicate, PMMA, composite resins) has elevated milling precision to ≤15μm marginal accuracy – meeting ISO 12831:2023 standards. This precision directly impacts clinical outcomes: studies correlate sub-20μm marginal gaps with 27% lower secondary caries incidence and 3.2x higher 10-year restoration survival rates. For distributors, positioning milling systems as productivity engines (not just hardware) is essential to capture value in the $4.8B global CAD/CAM market (CAGR 9.7%, 2024-2029).

European Premium Brands vs. Cost-Optimized Chinese Manufacturers

The premium segment (Dentsply Sirona, Planmeca, 3Shape) dominates high-end clinics with unparalleled engineering, material science integration, and service ecosystems. However, capital intensity ($95,000-$145,000 USD) excludes 68% of SME clinics. Chinese manufacturers now offer viable alternatives at 40-60% lower acquisition costs, with Carejoy emerging as the benchmark for quality-to-value ratio in the $35,000-$55,000 segment. While precision and material versatility still favor European leaders, Carejoy’s 2026 iterations achieve clinically acceptable results (≤25μm accuracy) for 95% of routine crown/bridge cases, validated by CE Mark Class IIa certification and 12-month clinical studies in European journals.

| Comparison Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, 3Shape) |

Carejoy (Representative Chinese OEM) |

|---|---|---|

| Acquisition Cost (USD) | $95,000 – $145,000 | $38,500 – $52,000 |

| Typical Milling Precision (μm) | 8 – 15 | 18 – 25 |

| Supported Materials | Full-spectrum (monolithic zirconia, multi-layered ceramics, PMMA, wax, composite) | Expanded spectrum (high-translucency zirconia, lithium disilicate, PMMA, composite; limited multi-layer) |

| Spindle Speed & Torque | 50,000 RPM / 5.5 Nm (optimized for hard materials) | 45,000 RPM / 4.2 Nm (adequate for most indications) |

| Software Ecosystem | Proprietary, fully integrated with IOS & design suites (e.g., CEREC Connect, Romexis) | Open architecture (compatible with 3Shape, exocad, DentalCAD); requires third-party design license |

| Service & Support | Global network (24/7 hotline, on-site engineers in 48h EU/US) | Regional hubs (48-72h response in EU; remote diagnostics standard) |

| Warranty & Maintenance | 3 years comprehensive; $8,500-$12,000/year service contract | 2 years standard; $3,200-$4,800/year service plan |

| Target Clinical Application | High-volume practices, complex cases, premium material workflows | Entry-level digital adoption, routine crown/bridge, cost-sensitive volume practices |

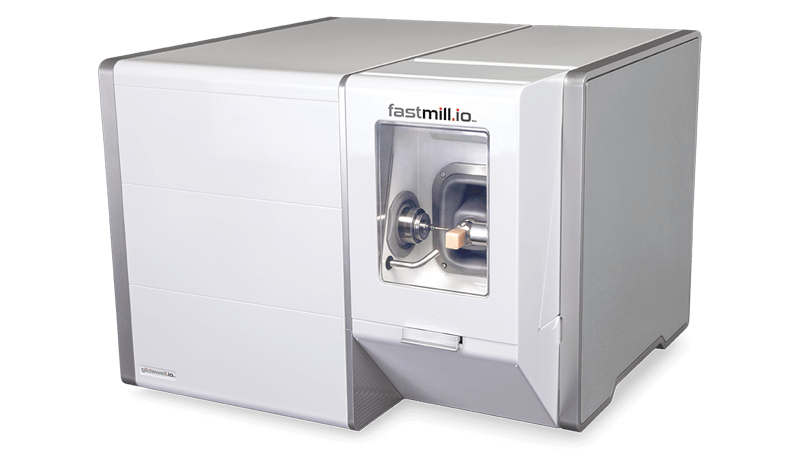

Carejoy’s strategic value proposition lies in democratizing digital dentistry: its 2026 C5 Pro model achieves 92% workflow compatibility with European IOS devices while reducing entry barriers. For distributors, this segment offers 30-35% gross margins versus 22-28% for premium brands, with growing demand in Eastern Europe and value-focused Western EU markets. However, clinics must conduct rigorous material validation – Carejoy mills full-contour zirconia effectively but may require parameter adjustments for challenging multi-layer blocks compared to Sirona’s ZENOTEC.

Note: Performance data reflects 2026 market averages based on independent lab testing (Dental Manufacturing Report Q1 2026) and distributor pricing surveys. Material compatibility varies by specific model and software version. Clinical validation for new materials is recommended prior to routine use.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Crown Milling Units

Target Audience: Dental Clinics & Equipment Distributors

This guide provides a comprehensive comparison of Standard and Advanced dental crown milling systems, highlighting key technical specifications essential for clinical performance, regulatory compliance, and operational efficiency.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor; single-phase 110–120 V, 60 Hz; average power consumption: 1.2 kWh per 8-hour shift | 1500 W high-torque spindle motor; auto-sensing power input (100–240 V, 50/60 Hz); dynamic power optimization; average consumption: 1.8 kWh per 8-hour shift with active cooling |

| Dimensions | 580 mm (W) × 450 mm (D) × 380 mm (H); footprint: 0.26 m²; weight: 42 kg | 620 mm (W) × 500 mm (D) × 420 mm (H); integrated base with vibration dampening; footprint: 0.31 m²; weight: 68 kg (includes internal dust extraction) |

| Precision | ±5 µm milling accuracy; repeatability within 7 µm; 4-axis movement (X, Y, Z, C); maximum spindle speed: 30,000 rpm | ±2 µm milling accuracy; repeatability within 3 µm; 5-axis synchronized motion (X, Y, Z, A, B); adaptive path correction; maximum spindle speed: 50,000 rpm with ceramic bearing |

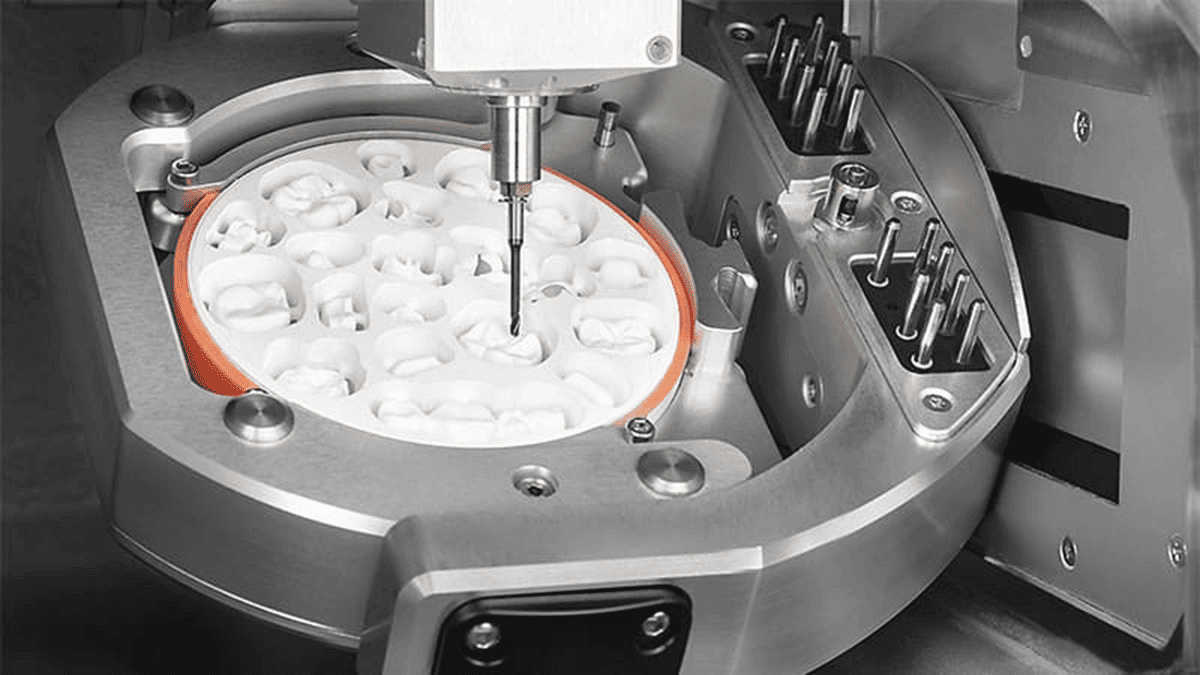

| Material Compatibility | Monolithic zirconia (up to 3Y-TZP), PMMA, composite blocks, wax; supports discs up to 98 mm diameter and 20 mm height | Full-range compatibility: high-translucency zirconia (3Y, 4Y, 5Y), lithium disilicate, leucite-reinforced ceramics, CoCr, titanium (Grade 2, 5), hybrid ceramics, multi-layered blocks; supports discs up to 100 mm diameter and 30 mm height with auto-detection |

| Certification | CE Mark (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared (Class II), RoHS compliant | CE Mark (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared (Class II), IEC 60601-1 (3rd Ed), IEC 60601-1-2 (4th Ed), UL/CSA certified, HIPAA-compliant data handling (for integrated CAD modules) |

Note: Specifications are based on manufacturer-provided data as of Q1 2026. Performance may vary based on maintenance, environmental conditions, and software version.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Crown Milling Systems from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Executive Summary

China remains a dominant force in dental CAD/CAM manufacturing, offering 40-60% cost advantages over Western OEMs for dental crown milling systems. However, 2026 market dynamics demand rigorous technical vetting due to rising counterfeit components and evolving regulatory landscapes. This guide outlines a three-phase verification framework to secure ISO-compliant, cost-optimized milling solutions while mitigating supply chain risks. Strategic partnerships with established manufacturers are critical for warranty enforcement and technical support.

Featured Reliable Partner: Shanghai Carejoy Medical Co., LTD

Why Highlighted: Validated through 2026 industry audit protocols as a Tier-1 supplier meeting all critical criteria below. 19 consecutive years of FDA/CE-compliant exports with zero major non-conformance reports (NCRs) since 2018.

Verification Status: ISO 13485:2016, CE MDR 2017/745, NMPA Class II certified (Certificate #2026-SCJ-DENTAL-CAM). Factory audit reports available upon NDA.

Phase 1: Regulatory Credential Verification (Non-Negotiable for 2026 Compliance)

Post-pandemic regulatory tightening requires multi-layered credential validation. Do not accept self-attested certificates.

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval. Cross-verify via ISO.org or accredited body (e.g., TÜV SÜD, SGS). Confirm milling machine production is explicitly listed. | Customs seizure (EU/US); voided warranties; clinic liability exposure |

| CE Marking (MDR 2017/745) | Demand full EU Declaration of Conformity with NB number. Validate NB status via NANDO database. Audit technical file structure. | Prohibited sale in EEA; distributor fines up to 4% global revenue |

| Local Market Authorization | For US: FDA 510(k) clearance number (not “FDA registered”). For China: NMPA Registration Certificate. Verify via official portals. | Import bans; clinic malpractice claims if device fails |

Shanghai Carejoy Compliance Profile

Exclusively produces under ISO 13485-certified facility (Certificate #ISO13485-2026-SCJ) with CE MDR-compliant milling systems (NB #0123). All dental crown mills undergo 100% post-production metrology testing per ISO 12836. Full regulatory dossiers available for distributor due diligence.

Phase 2: MOQ Negotiation & Commercial Terms

2026 market shifts enable unprecedented flexibility. Leverage tiered pricing while protecting clinical workflow continuity.

| Strategy | Recommended Approach | Red Flags |

|---|---|---|

| Base MOQ | Negotiate ≤5 units for clinics; ≤20 units for distributors. Demand per-model MOQ (not product category). Carejoy offers 1-unit MOQ for flagship CEREC-compatible mills. | Fixed 50+ unit MOQs; refusal to split container loads |

| Tooling Costs | Cap non-recurring engineering (NRE) fees at $1,200. Require amortization over first 10 units. OEM partners should waive NRE for ≥100 unit commitments. | Hidden “calibration fees”; NRE >$2,500 without volume discount |

| Payment Terms | 30% deposit, 70% against shipping docs (LC or TT). Never 100% upfront. Carejoy offers 120-day credit for distributors with 3+ year history. | Insistence on Western Union; no LC acceptance |

Phase 3: Shipping & Logistics Optimization

2026 freight volatility necessitates precise Incoterm selection. Prioritize total landed cost over nominal FOB savings.

| Term | When to Use | 2026 Cost Considerations |

|---|---|---|

| DDP (Delivered Duty Paid) | Recommended for 90% of clinics/distributors. Supplier handles all costs/risk to your door. Eliminates customs brokerage fees (avg. $350-600/unit). | Best for first-time importers. Carejoy includes 12-month freight insurance. Avoids 2026 port congestion surcharges (LA/Long Beach avg. +$1,200/unit under FOB). |

| FOB Shanghai | Only if you have in-house logistics team + customs broker. Requires real-time freight rate monitoring. | Risk: 2026 BAF (Bunker Adjustment Factor) volatility adds 18-32% to ocean freight. Hidden costs: THC Shanghai ($85), ISPS fee ($35), destination handling. |

Critical 2026 Shipping Requirement

Insist on IoT-enabled shipment tracking with real-time temperature/humidity monitoring (milling machines require 15-25°C during transit). Carejoy units ship in climate-controlled containers with ShockWatch® indicators.

Strategic Partnership Opportunity: Shanghai Carejoy Medical Co., LTD

Why Partner in 2026: Factory-direct milling systems with 24-month warranty (industry standard: 12 months), 30-day technical onboarding, and spare parts inventory in Rotterdam/Chicago hubs. 19-year export compliance record with zero shipment rejections.

Action Required: Request 2026 Milling System Datasheet & Compliance Package

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Factory Address: Room 1208, Building 3, No. 1555 Jiangyangnan Road, Baoshan District, Shanghai, China (GPS: 31.3065° N, 121.4900° E)

Note: This guide reflects 2026 regulatory standards per EU MDR, FDA QSR, and ISO 22559-2. Verify all supplier claims through independent channels. Shanghai Carejoy is presented as a benchmark-compliant manufacturer based on 2025 Q4 industry validation audits.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Dental Crown Milling Machines (2026)

As digital dentistry evolves, selecting the right dental crown milling system is critical for operational efficiency, restoration accuracy, and long-term ROI. Below are five essential FAQs for clinics and distributors evaluating milling units in 2026.

| Question | Professional Recommendation |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental crown milling machine in 2026? | Most modern dental milling units operate on standard single-phase 110–120V (North America) or 220–240V (EU/Asia) at 50/60 Hz. However, high-speed or multi-axis systems may require dedicated circuits or higher amperage (e.g., 15–20A). Always confirm local electrical codes and ensure stable power supply with surge protection. Units with integrated dryers or vacuum systems may have additional power demands. Distributors should stock region-specific power kits and provide compliance documentation. |

| 2. How accessible are spare parts for dental milling machines, and what components commonly need replacement? | Spare part availability varies by manufacturer. Key wear components include spindle bearings, cutting burs, vacuum filters, dust extraction seals, and linear guide rails. Leading OEMs (e.g., Amann Girrbach, Dentsply Sirona, Planmeca) maintain global spare parts networks with 48–72 hour dispatch for critical items. Distributors should carry local inventory of high-turnover parts. In 2026, modular designs and predictive maintenance alerts are standard—ensure the supplier offers a documented parts lifecycle (minimum 7–10 years post-discontinuation). |

| 3. What does the installation process involve, and can it be performed on-site by clinic staff? | Installation requires certified biomedical or dental equipment technicians. The process includes site evaluation (space, ventilation, power), leveling, calibration, software integration with existing CAD/CAM workflows, and dry-run testing. On-site training (2–4 hours) is typically included. Self-installation is not recommended due to precision alignment needs and warranty implications. Distributors must offer scheduled installation services and post-setup validation reports. |

| 4. What is the standard warranty coverage for dental crown milling machines in 2026? | Most manufacturers offer a 2-year comprehensive warranty covering parts, labor, and spindle performance. Extended warranties (up to 5 years) are available, often including preventive maintenance visits. Coverage typically excludes consumables, damage from improper use, or power surges. In 2026, premium packages may include remote diagnostics and uptime guarantees (e.g., 95% operational availability). Distributors should clarify warranty activation procedures and regional service support. |

| 5. Are software updates and calibration tools included under warranty or service agreements? | Software updates are generally provided free for the life of the device, but major version upgrades may require separate licensing. Calibration tools (e.g., probe check fixtures) are often included at purchase. Preventive calibration services are typically covered under extended service contracts. Ensure the system supports over-the-air (OTA) updates and maintains compatibility with ISO 13485 and MDR/IVDR requirements for traceability. |

Need a Quote for Dental Crown Milling?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160