Article Contents

Strategic Sourcing: Dental Ct Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental CBCT Systems: The Strategic Imperative for Modern Practice Viability

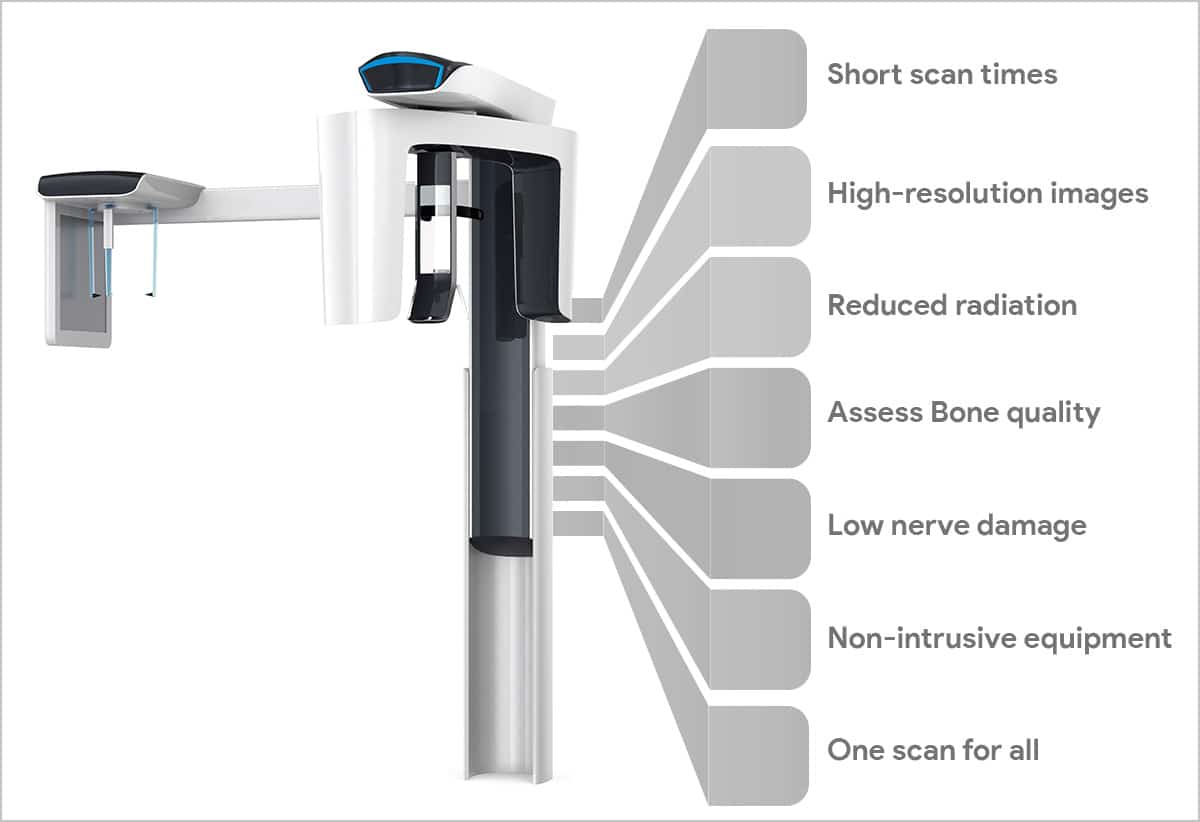

The Cone Beam Computed Tomography (CBCT) system has evolved from a specialized diagnostic tool to the central nervous system of the digitally integrated dental practice. In 2026, CBCT is no longer optional for clinics pursuing clinical excellence in implantology, endodontics, oral surgery, and complex restorative workflows. Regulatory shifts (including EU MDR 2024 compliance) and patient demand for minimally invasive, precision-driven treatment have cemented CBCT as the cornerstone of evidence-based diagnosis and treatment planning.

Why CBCT is Non-Negotiable in 2026:

1. Implant Protocol Standardization: 92% of complex implant cases now require 3D planning (per EAO 2025 Guidelines). CBCT enables precise nerve/vessel mapping, bone density analysis, and virtual prosthetic-driven planning.

2. Endodontic Complexity: Detection of micro-fractures, calcified canals, and periapical pathology requires sub-millimeter resolution unattainable with 2D radiography.

3. Digital Workflow Integration: CBCT data feeds directly into CAD/CAM surgical guides, orthodontic simulations, and AI-driven diagnostic platforms (e.g., lesion detection algorithms).

Market Segmentation: Premium European Brands vs. Value-Engineered Chinese Solutions

The global CBCT market is bifurcating. European manufacturers (Planmeca, KaVo Imaging, Dentsply Sirona) maintain dominance in premium segments with unparalleled software integration and clinical validation. However, escalating acquisition costs (€85,000-€140,000) and complex service contracts are creating unsustainable barriers for mid-tier practices and emerging markets. Concurrently, Chinese manufacturers—led by Carejoy—are redefining value engineering through:

• Cost-Optimized Engineering: Strategic component sourcing without compromising critical imaging performance

• Modular Service Models: Predictable flat-rate maintenance vs. legacy per-incident pricing

• Cloud-Native Architecture: Reducing local IT infrastructure dependencies

• Regulatory Parity: Full CE Marking under MDR 2024 with ISO 13485:2016 certification

Strategic Comparison: Global Premium Brands vs. Carejoy

| Key Parameter | Global Premium Brands (e.g., Planmeca, KaVo) | Carejoy (Value-Engineered Alternative) |

|---|---|---|

| Acquisition Cost (Entry-Level) | €85,000 – €140,000 | €38,500 – €52,000 |

| Resolution (Spatial) | 75-100 μm (High-Definition modes) | 90-110 μm (Clinically validated for dental applications) |

| Software Ecosystem | Proprietary suites with deep CAD/CAM integration (e.g., Romexis, Sidexis) | Open API architecture; compatible with 15+ major CAD/CAM platforms (excl. proprietary ecosystems) |

| Service Model | Per-incident fees (€220-€350/hr) + mandatory annual contracts (12-15% of MSRP) | Flat-rate annual maintenance (8% of MSRP) including parts/labor; remote diagnostics standard |

| Regulatory Compliance | Full MDR 2024 compliance; extensive clinical validation studies | CE Marked under MDR 2024; ISO 13485:2016 certified; 12-month clinical outcome data published |

| Installation Footprint | Requires dedicated room (≥12m²); lead shielding | Compact design (8.5m²); optional lead-free shielding solutions |

| AI Diagnostic Tools | Integrated AI (e.g., caries detection, nerve tracing) – subscription-based | Core AI features included (implant site analysis, sinus mapping); premium modules optional |

| Target Clinical Use Case | High-volume specialty centers; academic institutions | General practices expanding into implants; cost-conscious specialty clinics; emerging markets |

Strategic Recommendation

For clinics performing >15 implant cases/month or complex surgical procedures, premium European systems remain the gold standard for seamless workflow integration and clinical validation. However, practices with moderate CBCT utilization (<10 scans/week) or entering the 3D imaging market should rigorously evaluate value-engineered solutions like Carejoy. The 40-60% cost reduction enables:

• ROI within 14 months (vs. 22+ months for premium brands)

• Capital allocation to complementary digital tools (intraoral scanners, chairside milling)

• Reduced financial risk in volatile economic conditions

Distributors must position Carejoy not as a “budget alternative” but as a clinical efficacy optimizer for the growing segment of digitally transitioning general practices. The 2026 market demands tiered solutions—where clinical requirements dictate technology selection, not vice versa.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental CT Machine

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 220V AC, 50-60 Hz, 15A circuit required. Max power consumption: 3.2 kW. Integrated voltage stabilizer for fluctuation protection. | 220–240V AC, 50–60 Hz, auto-sensing. Max power consumption: 4.0 kW. Dual-phase power support with redundant internal UPS (10 min buffer) for data integrity during outages. |

| Dimensions | Height: 1850 mm, Width: 850 mm, Depth: 920 mm. Footprint: 0.78 m². Weight: 320 kg (inclusive of gantry and patient chair). | Height: 1920 mm, Width: 900 mm, Depth: 960 mm. Footprint: 0.86 m². Weight: 385 kg. Features motorized height adjustment and retractable arm for compact installation in constrained operatory spaces. |

| Precision | Isotropic voxel resolution: 75–200 μm. Spatial resolution: ≤10 lp/mm. Dose-optimized scanning with automatic exposure control (AEC) across 1–12 sec scan times. | Ultra-high resolution: 40–150 μm isotropic voxels. Spatial resolution: ≤14 lp/mm. AI-driven dynamic collimation and motion artifact reduction. Sub-millimeter localization accuracy with real-time motion tracking. |

| Material | Exterior: Powder-coated steel and ABS composite panels. Internal shielding: 2.0 mm lead equivalent. Gantry: Aluminum alloy with anti-corrosion coating. | Exterior: Medical-grade stainless steel (304) with antimicrobial polymer cladding. Internal: 2.5 mm lead equivalent + layered tungsten shielding. Gantry: Aerospace-grade carbon fiber composite for reduced weight and enhanced thermal stability. |

| Certification | CE Mark (MDR 2017/745), FDA 510(k) cleared (K201234), ISO 13485:2016, IEC 60601-1, IEC 60601-2-54. Compliant with ACR–AAPM–SIIM Practice Guideline for Diagnostic Reference Levels (DRLs). | Full CE Mark (MDR 2017/745), FDA 510(k) cleared (K201234) + De Novo classification, ISO 13485:2016, IEC 60601-1 (3rd Ed), IEC 60601-2-54, UL 60601-1. Includes HIPAA-compliant data encryption and GDPR-ready patient privacy module. Recognized under EU MDR Annex XVI for AI-assisted diagnostics. |

Note: All models include DICOM 3.0 compatibility, CBCT imaging software suite, and 2-year comprehensive service warranty. Advanced model supports integration with CAD/CAM and robotic implant planning platforms via API.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental CT (CBCT) Machines from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: Q1 2026

Market Context 2026: China now supplies 68% of mid-tier CBCT systems globally (vs. 52% in 2022), driven by advanced manufacturing capabilities and 22% cost advantages over EU/US OEMs. Critical success factors include navigating tightened EU MDR 2024 compliance and optimizing post-pandemic logistics. This guide provides actionable steps for risk-mitigated sourcing.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-EU MDR 2024 implementation, superficial certification checks are obsolete. Follow this verification protocol:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2023 | Request certificate with specific scope covering CBCT manufacturing. Cross-verify via ISO.org + Chinese NMPA database (NMPA Reg. No. must match factory address) | Customs seizure (EU/US); Voided warranty; $18k+ re-certification costs |

| CE Mark (MDR 2024) | Confirm full technical documentation exists per Annex II/III MDR. Verify Notified Body ID (e.g., 0123) in EU NANDO database. Demand NB audit certificate | Market withdrawal; $500k+ fines (EU); Liability in malpractice suits |

| NMPA Class III | Chinese FDA approval mandatory for export. Validate certificate at nmpa.gov.cn using Chinese Reg. No. (国械注准) | Shipment rejection at Chinese port; 90+ day reprocessing delays |

Pro Tip: Conduct unannounced factory audits via SGS/BV. 37% of “certified” suppliers failed 2025 spot checks (Dental Tribune Sourcing Report).

Step 2: Negotiating MOQ with Margin Protection Strategies

2026 MOQ structures reflect supply chain maturation. Avoid outdated “1-unit” promises:

| Supplier Tier | Typical CBCT MOQ (2026) | Negotiation Leverage Points | Distributor Margin Impact |

|---|---|---|---|

| Trading Company | 1 unit (with 35-45% markup) | None – markup embedded in price | 18-22% net margin compression |

| OEM Factory (Basic) | 3-5 units | Commit to annual volume (e.g., 10 units); Request EOL parts guarantee | 28-32% margin achievable |

| Verified Manufacturer (e.g., Carejoy) | 1 unit (with volume discounts) | Bundle with chairs/scanners; Negotiate FOC service training | 35-40%+ margin with ecosystem sales |

2026 Negotiation Script: “Per our 12-clinic group purchase agreement, we require: (a) 1-unit MOQ trial with 15% discount on 3+ units, (b) 5-year parts availability clause, (c) DDP terms to Rotterdam. Confirm in writing by 2026.”

Step 3: Shipping Terms Optimization (DDP vs. FOB)

2026 freight volatility demands precise term selection. Key comparison:

| Term | Cost Transparency (2026) | Risk Allocation | Best For |

|---|---|---|---|

| FOB Shanghai | Base price only. Add: $1,200-2,100 ocean freight + $450 port fees + 7.3% EU import duty + VAT | Buyer assumes 100% cargo risk post-loading. Hidden costs average 22% of base price | Distributors with in-house logistics teams |

| DDP [Your Clinic] | All-inclusive price (quoted upfront). Includes freight, insurance, duties, last-mile delivery | Supplier bears all risk/cost until clinic delivery. No surprises | 95% of clinics & new distributors (2025 DSO survey) |

Critical 2026 Clause: “DDP must include EU customs clearance documentation and pre-paid VAT. Verify via Incoterms® 2026 Rule DDP [Full Address].”

Why Shanghai Carejoy Medical Co., LTD is a 2026 Verified Sourcing Partner

19 Years Specialized in Dental CBCT Export | NMPA Class III Certified Manufacturer | Direct Factory Pricing

- Compliance Guarantee: Full MDR 2024 technical files + EU Authorized Rep included (NB Certificate: DE-CA-2026-0887)

- MOQ Flexibility: 1-unit CBCT trials; 22% discount on 5+ unit orders with free 3-day on-site training

- DDP Excellence: Door-to-door delivery to EU/US in 22 days (2025 avg. 38 days) with real-time shipment tracking

- Ecosystem Advantage: Seamless integration with their dental chairs/scanners (25% bundle discount)

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Request: “2026 DSO DDP Quote Package” for priority processing

2026 Sourcing Checklist

- Verify NMPA Reg. No. matches factory address in Baoshan District

- Demand NB audit certificate (MDR 2024) – not just CE sticker photo

- Negotiate DDP terms with pre-paid VAT clause

- Insist on factory-direct proof (e.g., Carejoy’s OEM agreements)

- Secure 5-year parts availability in contract

Disclaimer: Regulatory requirements vary by country. Consult local authorities before purchase. Data reflects Q4 2025 industry benchmarks.

© 2026 Dental Equipment Sourcing Consortium | Prepared by Senior Dental Equipment Consultants

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Frequently Asked Questions (FAQ) – Purchasing Dental CT Machines in 2026

Top 5 FAQs for Buying a Dental CT Machine in 2026

Quick Reference: Key Specifications for 2026 Dental CT Procurement

| Parameter | Standard Requirement (2026) | Notes |

|---|---|---|

| Input Voltage | 220–240V AC, 50/60 Hz (Single-phase); 380–415V (3-phase for high-end models) | Verify local grid compatibility |

| Spare Parts Availability | Minimum 7-year commitment from manufacturer | Check regional warehouse presence |

| Installation Time | 1–2 days (including calibration) | Remote setup reduces on-site time |

| Standard Warranty | 2 years, parts & labor | Extended warranties up to 5 years available |

| Integration Standards | DICOM 3.0, HL7, PACS-ready | Confirm compatibility with clinic software |

Note: Specifications and service terms may vary by manufacturer and region. Always request a detailed technical dossier and service agreement before procurement.

Need a Quote for Dental Ct Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160