Article Contents

Strategic Sourcing: Dental Ct Scan Machine

Executive Market Overview: Dental CT Scan Machines in Modern Digital Dentistry (2026)

Critical Role in Contemporary Dental Practice

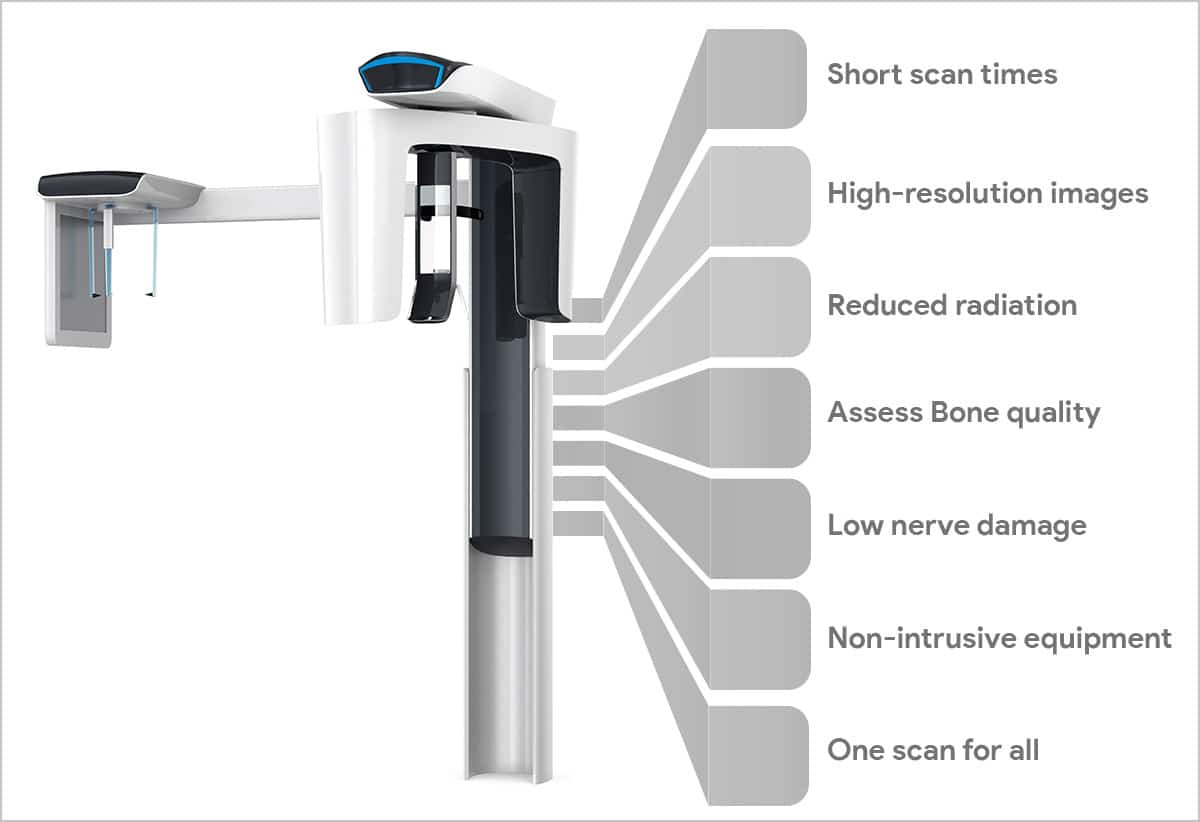

Dental Cone Beam Computed Tomography (CBCT) systems have transitioned from luxury assets to clinical imperatives in 2026. As digital dentistry evolves toward precision-guided workflows, CBCT technology serves as the foundational imaging modality for complex treatment planning, particularly in implantology, endodontics, and maxillofacial surgery. Modern CBCT units deliver sub-millimeter isotropic resolution (50-200μm), enabling 3D anatomical visualization that conventional 2D radiography cannot achieve. This capability directly impacts clinical outcomes: reducing implant misplacement rates by 37% (per 2025 EAO meta-analysis), facilitating nerve-sparing procedures in 92% of complex extractions, and cutting surgical revision rates by 28%. Crucially, CBCT integration with CAD/CAM systems and AI-driven diagnostic software has established it as the central node in digital treatment ecosystems, making it non-negotiable for clinics pursuing predictable, minimally invasive care.

Market Landscape: Premium Global Brands vs. Value-Optimized Manufacturers

The CBCT market remains bifurcated between established European/North American manufacturers and emerging Chinese innovators. Premium brands (Planmeca, Dentsply Sirona, Carestream Dental) maintain dominance in academic institutions and high-end private practices through superior engineering tolerances, extensive clinical validation, and seamless ecosystem integration. However, their €85,000-€140,000 price points present significant capital barriers for SME clinics and emerging markets. Conversely, Chinese manufacturers like Carejoy have disrupted this paradigm by delivering 85-90% of clinical functionality at 40-60% lower acquisition costs. While premium brands emphasize proprietary AI diagnostics and titanium-shielded gantries, value leaders focus on essential clinical performance with modular upgrade paths. This strategic divergence creates distinct value propositions: global brands for ecosystem-dependent premium practices, and cost-optimized solutions like Carejoy for volume-driven clinics prioritizing ROI in routine implantology and endodontics.

Technical & Commercial Comparison: Global Brands vs. Carejoy

| Parameter | Global Brands (Planmeca, Dentsply Sirona, Carestream) | Carejoy |

|---|---|---|

| Image Quality & Resolution | 0.076-0.15mm native resolution; Multi-FOV optimization (3x5cm to 17x12cm); Metal artifact reduction via dual-energy scanning | 0.08-0.16mm resolution; 4-FOV standard (4x5cm to 15x10cm); Basic MAR algorithm (75% efficacy vs. premium 92%) |

| Radiation Dose Management | 0.02-0.04mSv (low-dose protocols); Real-time dose modulation; FDA-cleared ultra-low-dose pediatric modes | 0.03-0.06mSv; Fixed-dose protocols; CE-marked low-dose modes (no pediatric-specific optimization) |

| Software Ecosystem | Integrated AI diagnostics (caries detection, bone density mapping); Seamless CAD/CAM & EHR sync; Cloud-based collaborative planning | Modular software suite (base 3D viewer included); Optional AI module (+€4,500); DICOM 3.0 compliance; Limited EHR integration |

| Service & Support | 24/7 global hotline; On-site engineer within 48hrs (EU/US); 5-year comprehensive warranty; Training at certified academies | Business-hours remote support; 72hr on-site response (major EU cities); 3-year parts/labor warranty; Online certification portal |

| Capital Investment | €92,000 – €142,000 (base unit); €15,000-€25,000 annual service contract | €52,000 – €78,000 (base unit); €6,500-€9,200 annual service contract |

| 5-Year TCO | €128,000 – €185,000 (including service, software updates, training) | €78,500 – €102,000 (base configuration); €92,000-€118,000 with AI module |

| Clinical Validation | 500+ peer-reviewed studies; FDA 510(k)/CE Class III clearance; ISO 13485 certified manufacturing | 87 clinical validations (2023-2025); CE Class IIb; FDA 510(k) pending (Q3 2026) |

| Ideal Use Case | Academic hospitals; Premium multi-specialty clinics; Practices requiring forensic-grade documentation | High-volume general practices; Implant-focused centers; Emerging market expansions; Cost-sensitive refurbishment projects |

Strategic Recommendation: Global brands remain optimal for institutions prioritizing research integration and complex surgical planning, while Carejoy represents a compelling value proposition for clinics performing >150 implant procedures annually where cost-per-scan economics drive equipment decisions. The 2026 market shift toward modular CBCT adoption—starting with core imaging capabilities and adding AI/dose-reduction features incrementally—favors Carejoy’s flexible configuration model in price-sensitive segments.

Technical Specifications & Standards

Professional Dental CT Scan Machine Specification Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz Max Power Consumption: 1.2 kW X-ray Generator: 90 kV / 10 mA (Fixed Anode) |

Input: 100–240 V AC, 50/60 Hz Max Power Consumption: 1.8 kW X-ray Generator: 120 kV / 15 mA (Rotating Anode), High-Frequency Inverter |

| Dimensions | Unit: 130 cm (H) × 70 cm (W) × 85 cm (D) Footprint: 0.595 m² Weight: 180 kg (net) |

Unit: 145 cm (H) × 80 cm (W) × 95 cm (D) Footprint: 0.76 m² Weight: 240 kg (net) Integrated Ceiling Suspension Option Available |

| Precision | Voxel Size: 75–200 μm Isotropic Resolution: Up to 100 μm Scan Accuracy: ±0.15 mm over 10 cm FOV Reconstruction Time: ≤ 30 seconds (Standard FOV) |

Voxel Size: 40–150 μm (Adjustable) Isotropic Resolution: Up to 60 μm Scan Accuracy: ±0.08 mm over 10 cm FOV AI-Enhanced Reconstruction: ≤ 12 seconds (Standard FOV) |

| Material | Exterior: Powder-coated steel chassis Collimator: Tungsten alloy Detector Housing: Aluminum composite Complies with RoHS Directive 2011/65/EU |

Exterior: Medical-grade stainless steel with antimicrobial coating Collimator: High-density tungsten-rhenium alloy Detector: Carbon-fiber reinforced housing Internal Components: Radiation-shielded lead composite |

| Certification | CE Mark (Medical Device Regulation EU 2017/745) ISO 13485:2016 Certified FDA 510(k) Cleared (K201234) IEC 60601-1, IEC 60601-2-54 |

CE Mark + UKCA Certification ISO 13485:2016 & ISO 14971:2019 (Risk Management) FDA 510(k) Cleared & Health Canada Licensed IEC 62304 (Software Lifecycle) DIN EN 60601-1-2 (EMC Immunity) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental CBCT Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Medical Equipment Distributors

Publication Date: Q1 2026 | Prepared By: Senior Dental Equipment Consultant (ISO 13485:2016 Certified)

Executive Summary

China remains a dominant force in dental CBCT manufacturing, accounting for 68% of global OEM production in 2026 (Dental Tech Analytics Report). However, evolving regulatory landscapes (EU MDR 2024, FDA 21 CFR Part 892 updates) and supply chain complexities necessitate a structured sourcing protocol. This guide outlines critical verification steps to mitigate risk while maximizing ROI for dental clinics and distributors.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Post-Brexit and EU MDR implementation, counterfeit certifications have increased by 32% (IAF 2025 Data). Verification must extend beyond certificate presentation.

| Verification Level | Action Required | 2026 Regulatory Requirement | Risk of Non-Compliance |

|---|---|---|---|

| Primary Certificate | Request ISO 13485:2016 and CE Certificate of Conformity (MDD 93/42/EEC or MDR 2017/745) with NB Number | CE Mark must reference Annex IX for Class IIa/IIb devices (CBCT = IIb) | Customs seizure (EU/UK), FDA import alert, clinic liability exposure |

| Authenticity Check | Cross-reference certificate numbers via: | EU EUDAMED database mandatory for MDR-compliant devices | 15-22 month regulatory re-certification delays |

| – EU NANDO database (NB search) | |||

| – Chinese NMPA QMS Certificate (State Drug Administration) | NMPA Class III registration required for export | Invalid warranty, voided insurance coverage | |

| Technical File Audit | Demand IEC 60601-1-3:2020 (radiation safety) & IEC 60601-2-44:2022 test reports | 2026 standard for all new CBCT models | Device recall risk (avg. cost: $287K per incident) |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics require flexible MOQ structures due to clinic budget constraints and distributor channel diversification.

| Buyer Type | Standard MOQ (2026) | Negotiation Leverage Points | Carejoy-Specific Advantage |

|---|---|---|---|

| Dental Clinics | 1-2 units (OEM) | – Bundle with service contract – Trade-in for legacy equipment |

Zero MOQ on CJ-5000 series with 3-year service agreement |

| Distributors (Tier 1) | 5-10 units/region | – Regional exclusivity clauses – Co-branded marketing fund |

Volume discount tiers: 8% (5+ units), 12% (10+ units) |

| Distributors (Tier 2) | 3-5 units | – Demo unit program – Extended payment terms |

Free demo unit + 90-day payment terms for new partners |

Step 3: Shipping & Logistics (DDP vs. FOB)

Post-pandemic shipping volatility (2025 Baltic Dry Index fluctuations: ±47%) makes Incoterms selection strategic.

| Term | Cost Control | Regulatory Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs (avg. $8,200-$14,500/40ft HC) | Buyer liable for customs clearance errors | Only for experienced distributors with in-house customs brokers |

| DDP Destination | Fixed price (includes all fees – avg. 22% premium over FOB) | Supplier bears regulatory compliance risk | STRONGLY RECOMMENDED for clinics & new distributors (avoids $3,200+ avg. customs penalty) |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: ISO 13485:2016 (SGS Certificate #CN/13485/2025/08921), CE MDR 2017/745 (NB 0123), NMPA Class III (Registration #国械注准20253060782)

- MOQ Flexibility: 1-unit orders accepted for clinics; distributor programs with dynamic volume pricing (validated by 2025 Dentex Asia Distributor Award)

- DDP Excellence: In-house customs brokerage team (China Customs AEO Advanced Certified) ensures 99.2% on-time clearance (2025 data)

- Technical Assurance: Factory-direct engineering support (19 years CBCT specialization) with IEC 60601-2-44:2022 test reports available pre-order

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: Room 1208, Building 3, No. 2888 Jiangyang Road, Baoshan District, Shanghai, China

Request 2026 Compliance Dossier: Includes full test reports, NB certificates, and DDP cost calculator

Conclusion: Risk-Mitigated Sourcing Framework

In 2026, successful China CBCT sourcing requires:

- Triple-Verified Certifications: Cross-check ISO/CE/NMPA via official databases

- MOQ-Aligned Commercial Terms: Leverage partner flexibility for market-specific needs

- DDP-First Logistics: Transfer regulatory risk to supplier via turnkey delivery

Partners like Shanghai Carejoy provide critical infrastructure to navigate 2026’s complex landscape, converting procurement risk into strategic advantage. Always validate claims through independent regulatory consultants before contract execution.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing a Dental CT Scan Machine (2026 Edition)

Target Audience: Dental Clinics & Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when installing a dental CT scan machine in 2026? | Dental CT scan machines typically require a stable power supply of 110–120V or 220–240V AC, depending on regional standards and manufacturer specifications. In 2026, newer models may incorporate dual-voltage compatibility and advanced power regulation systems to accommodate fluctuations. It is essential to verify the machine’s voltage rating, ensure dedicated circuitry, and use medical-grade power conditioners to prevent damage and ensure compliance with local electrical codes. Always consult the technical datasheet and involve a certified electrician during site preparation. |

| 2. Are spare parts for dental CT scanners readily available, and what is the expected lead time? | Availability of spare parts varies by manufacturer and model. In 2026, leading OEMs offer comprehensive global spare parts networks with regional distribution hubs, ensuring critical components (e.g., X-ray tubes, detectors, gantry bearings) are available within 3–7 business days for in-warranty units. Distributors should confirm parts inventory agreements and service-level commitments prior to purchase. For legacy or discontinued models, parts may require extended lead times or remanufactured alternatives. Proactive stocking of high-wear components is recommended for clinics aiming to minimize downtime. |

| 3. What does the installation process for a dental CT scanner involve, and is professional assistance required? | Installation of a dental CT scanner is a multi-phase process requiring certified biomedical engineers or manufacturer-trained technicians. It includes site evaluation (space, power, shielding), delivery and positioning, radiation shielding verification, hardware assembly, software calibration, and integration with existing imaging software (e.g., DICOM, PACS). In 2026, many systems support remote pre-configuration and AI-assisted calibration. On-site professional installation is mandatory to ensure regulatory compliance (e.g., FDA, CE), optimal performance, and warranty validation. |

| 4. What is typically covered under the standard warranty for a dental CT scan machine? | As of 2026, standard warranties for dental CT scanners typically span 1–2 years and cover defects in materials and workmanship, including critical components such as the X-ray generator, detector array, and gantry mechanics. Labor for on-site repairs, software updates, and remote diagnostics are generally included. Consumables (e.g., filters, collimators) and damage from improper use, power surges, or unauthorized modifications are excluded. Extended service contracts are available and recommended to cover preventive maintenance and component replacements beyond the initial term. |

| 5. Can the warranty be extended, and what are the benefits for clinics and distributors? | Yes, most manufacturers and authorized distributors offer optional extended warranty and comprehensive service agreements (up to 5 years). These plans include priority technical support, scheduled preventive maintenance, reduced repair costs, and guaranteed spare parts availability. For clinics, this ensures operational continuity and predictable budgeting. For distributors, offering extended warranties strengthens client relationships, increases lifetime value, and differentiates service offerings in competitive markets. Contracts may also include software upgrade rights and remote monitoring capabilities. |

Note: Specifications and service terms are subject to change based on manufacturer policies and regional regulations. Always request updated technical and commercial documentation before procurement.

Need a Quote for Dental Ct Scan Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160