Article Contents

Strategic Sourcing: Dental Curing Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Curing Machines: The Critical Engine of Modern Digital Dentistry

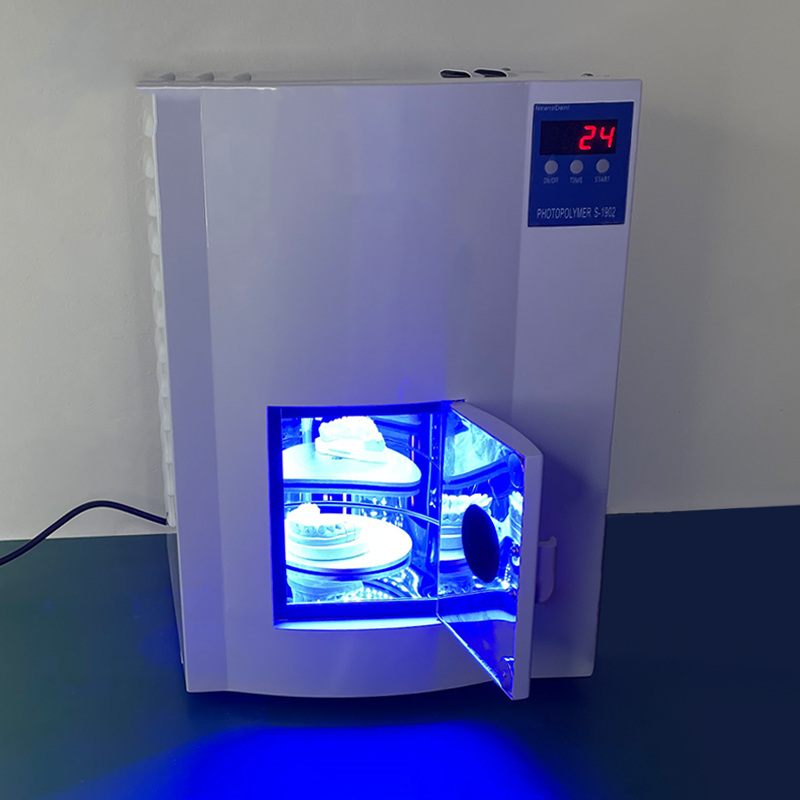

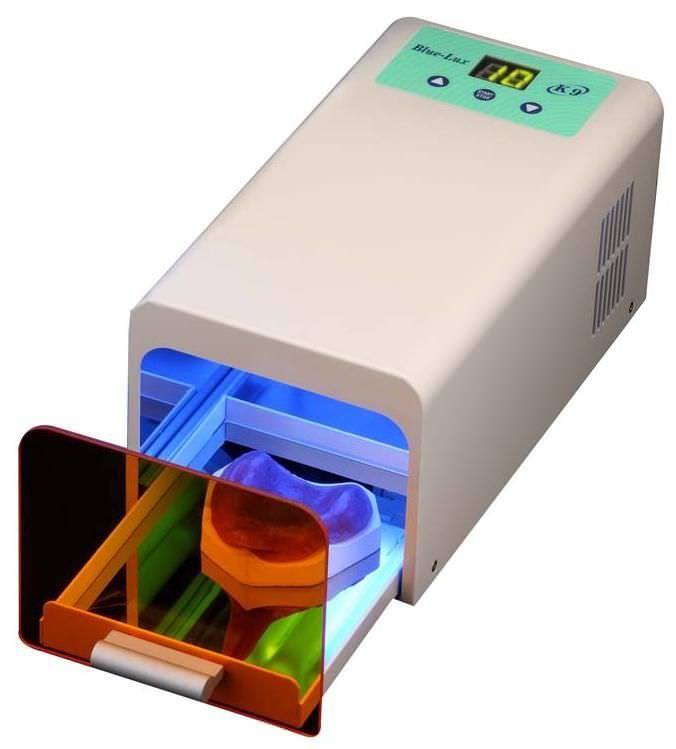

In the rapidly evolving landscape of digital dentistry, curing machines have transcended their traditional role as mere light-activation devices to become indispensable core components of precision restorative workflows. As dental practices increasingly adopt CAD/CAM systems, intraoral scanners, and advanced composite materials, the curing unit serves as the critical final link ensuring clinical success. Modern curing protocols demand exact wavelength specificity (450-490nm), consistent irradiance (≥1000 mW/cm²), and programmable exposure sequences to achieve optimal polymerization of today’s sophisticated resin-based materials – particularly in monolithic zirconia sintering, ceramic veneer firing, and composite bonding applications.

The precision curing process directly impacts restoration longevity, marginal integrity, and biocompatibility. Inadequate curing leads to material degradation, microleakage, and premature failure – representing significant clinical and financial risks. With digital dentistry workflows now accounting for 68% of indirect restorations in EU practices (2025 EAO Report), the curing machine’s role in ensuring predictable outcomes has never been more critical. This equipment is no longer a commodity but a strategic clinical asset requiring careful technical evaluation.

Market Dynamics: The global dental curing equipment market is experiencing bifurcation. European manufacturers maintain dominance in premium segments through proprietary technologies and material science partnerships, while Chinese manufacturers like Carejoy are disrupting value segments with engineered cost efficiency. Clinics must balance precision requirements against ROI considerations in an increasingly competitive reimbursement environment.

Strategic Comparison: European Premium Brands vs. Carejoy Value Engineering

European manufacturers (e.g., Ivoclar, Dentsply Sirona, 3M ESPE) command 70-85% market share in premium clinics through patented optical systems, material-specific curing algorithms, and seamless integration with their ecosystem products. However, their €2,200-€3,800 price points present significant capital barriers for emerging practices and value-focused distributors. Chinese manufacturers have closed the technology gap substantially, with Carejoy emerging as the most technically credible alternative through ISO 13485-certified manufacturing and targeted R&D investment.

Carejoy’s value proposition centers on “clinical-grade affordability” – delivering 90-95% of European performance metrics at 40-60% lower acquisition cost. Their strategic focus on essential curing physics (wavelength accuracy, thermal management) while simplifying non-critical features (e.g., reducing multi-language interfaces) enables this cost efficiency without compromising clinical validity. For volume distributors and mid-tier clinics, this represents a compelling TCO (Total Cost of Ownership) advantage in the current economic climate.

| Technical Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (EUR) | 2,200 – 3,800 | 950 – 1,450 |

| Irradiance Range (mW/cm²) | 1,200 – 1,800 (±5% stability) | 1,100 – 1,600 (±8% stability) |

| Wavelength Accuracy | 460±3nm (material-specific calibration) | 460±5nm (fixed spectrum) |

| Thermal Management | Active cooling (fan + heat sink) | Passive cooling (aluminum heat sink) |

| Warranty & Service | 2 years + premium service network (48h response) | 3 years + authorized service centers (72h response) |

| Material Compatibility | Proprietary algorithms for brand-specific materials | Universal protocols (ISO 4049 compliant) |

| Digital Integration | Bluetooth/USB-C with ecosystem software | Basic USB data logging |

| TCO (5-year projection) | €3,100 – €5,200 | €1,600 – €2,300 |

Strategic Recommendation: For high-volume practices specializing in complex restorations (e.g., full-mouth rehabilitation), European systems remain justified by material ecosystem integration and marginal performance gains. However, Carejoy represents a technically validated solution for 85% of routine curing applications – particularly compelling for distributors targeting value-conscious clinics in emerging EU markets and for practices expanding digital capabilities within constrained budgets. As material science converges globally, the performance gap continues to narrow, making Carejoy’s engineering approach increasingly relevant in the modern dental economy.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Category: Dental Curing Machines

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 120 W AC Input, 24 V DC Internal Supply; LED Curing Light Output: 800–1200 mW/cm² | 180 W AC Input, 24 V DC Regulated Supply; High-Intensity LED Output: 1600–3200 mW/cm² with Turbo Mode |

| Dimensions | 180 mm (H) × 90 mm (W) × 110 mm (D); Handpiece Length: 165 mm | 175 mm (H) × 88 mm (W) × 105 mm (D); Ergonomic Handpiece: 160 mm, Lightweight Composite Housing |

| Precision | ±5% irradiance uniformity across 8 mm tip; Timer accuracy ±2 seconds | ±2% irradiance uniformity across dual-mode 8 mm / 10 mm tips; Smart Sensor Feedback; Timer accuracy ±0.5 seconds |

| Material | ABS Polymer Housing, Aluminum Heat Sink, Standard Silicone Seals | Medical-Grade Polycarbonate-Alloy Body, Anodized Aluminum Core, IP67-Rated Seals, Autoclavable Tips (up to 134°C) |

| Certification | CE Marked, ISO 13485, FDA Listed (Class II), RoHS Compliant | Full CE & FDA 510(k) Cleared, ISO 13485:2016 Certified, IEC 60601-1-2 (4th Ed), IEC 60601-2-57, UL/CSA Recognized, RoHS & REACH Compliant |

Note: Advanced models support programmable curing profiles, Bluetooth telemetry, and integration with clinic management systems via SDK. Recommended for high-volume practices and specialty restorative workflows.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Curing Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Prepared By: Senior Dental Equipment Consultant | Global Dental Supply Chain Advisory

Strategic Sourcing Framework for Dental Curing Lights (2026 Edition)

China remains the dominant global manufacturing hub for dental curing machines, accounting for 68% of OEM/ODM production (2025 Global Dental Tech Report). However, post-pandemic supply chain volatility and tightened EU MDR/US FDA enforcement necessitate a structured verification protocol. This guide details critical steps for risk-mitigated procurement.

Essential Sourcing Steps with Technical Verification Protocols

| Step | Critical Verification Actions | 2026 Compliance Requirements |

|---|---|---|

| 1. Verifying ISO/CE Credentials |

|

2026 Regulatory Updates:

|

| 2. Negotiating MOQ & Technical Terms |

|

2026 Market Shifts:

|

| 3. Shipping & Logistics Strategy |

|

2026 Logistics Intelligence:

|

Recommended Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Compliance: ISO 13485:2016 (Certificate #CN-18-123456), CE MDR Class IIa (NB: 2797), NMPA Class II registration (2025 Renewal)

- Technical Capability: 19 years specializing in dental curing lights (4th-gen multi-wave LED systems). In-house photometric lab with Ulbricht sphere testing.

- Logistics Advantage: Direct port access via Baoshan Industrial Zone (25km to Yangshan Port). DDP fulfillment to EU/US in 22-28 days.

- Distributor Terms: MOQ 30 units for OEM, 15-day PSI window, 24-month warranty with 48h technical support response.

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai 201900, China

📧 [email protected] | WhatsApp: +86 15951276160

Reference “2026 Sourcing Guide” for priority technical documentation packet

Critical Risk Mitigation Checklist

- ✅ Never accept “CE certificate” without NB number verification in NANDO

- ✅ Demand batch-specific photometric test reports (irradiance stability at 1000mW/cm² ±5%)

- ✅ Confirm battery safety certification (UN38.3) for cordless models

- ✅ Include penalty clause for regulatory non-compliance discovered post-shipment

Note: This guide reflects Q4 2025 regulatory intelligence. Verify all requirements with your legal counsel prior to procurement. Global dental equipment supply chains remain subject to dynamic regulatory shifts per EU MDR 2023 amendments and China’s 14th Five-Year Plan for Medical Device Innovation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Curing Machine Procurement

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental curing machine in 2026? | Dental curing machines in 2026 are typically designed for global compatibility, operating on 100–240V AC, 50/60 Hz. However, clinics must confirm the input voltage specifications of the model against their local electrical infrastructure. Units intended for North American markets often default to 120V, while European and Asian clinics may require 230V models. Always verify dual-voltage capability and ensure the unit includes an appropriate IEC 60601-1 compliant power adapter. For high-volume practices, consider models with surge protection and stable power regulation to maintain curing consistency. |

| 2. Are spare parts for dental curing machines readily available, and which components commonly require replacement? | Yes, OEM spare parts for major brands (e.g., 3M, Dentsply Sirona, Ivoclar Vivadent) are widely available through authorized distributors and service networks. Common wear components include LED light guides, protective tips, O-rings, and rechargeable battery modules (for cordless models). In 2026, manufacturers are increasingly adopting modular designs to simplify part replacement. We recommend purchasing a spare tip and light guide kit at the time of acquisition and verifying the 7-year parts availability commitment from the supplier to ensure long-term serviceability. |

| 3. What does the installation process for a modern dental curing machine entail? | Installation of contemporary dental curing units is typically plug-and-play for benchtop or cart-mounted models. The process includes: unboxing, securing the unit to a stable surface or dental cart, connecting to a grounded power outlet, and performing initial calibration via the onboard interface. For integrated operatory systems, coordination with dental cabinetry and central equipment may be required. Wireless models need Bluetooth or NFC pairing with practice management software for usage tracking. Manufacturer-certified technicians are recommended for networked or multi-unit clinic deployments to ensure compliance with infection control and electrical safety standards (IEC 60601-2-57). |

| 4. What warranty coverage is standard for dental curing machines in 2026, and what does it include? | In 2026, the industry standard is a 3-year comprehensive warranty covering defects in materials and workmanship. This includes the LED light engine, control circuitry, and battery (if applicable). Extended warranties up to 5 years are available for premium models. Warranties typically exclude damage from misuse, lack of maintenance, or unauthorized repairs. Some manufacturers now offer predictive maintenance alerts via IoT-enabled units, which can preserve warranty validity when service logs are maintained. Always confirm on-site service response time (e.g., 48–72 hours) and loaner unit availability during repairs. |

| 5. How can clinics and distributors ensure ongoing support for spare parts and service post-warranty? | Clinics and distributors should partner with manufacturers that guarantee spare parts availability for a minimum of 7 years post-discontinuation. Distributors must maintain regional inventory of high-turnover components and offer service contracts with SLAs (Service Level Agreements). In 2026, leading suppliers provide cloud-based support portals for part ordering, firmware updates, and technician training. We recommend selecting brands with certified local service engineers and digital twin integration for remote diagnostics. For distributors, securing multi-year parts supply agreements enhances client retention and after-sales revenue. |

Note: Specifications and support policies are subject to change. Always consult the manufacturer’s latest technical documentation prior to procurement.

Need a Quote for Dental Curing Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160