Article Contents

Strategic Sourcing: Dental Cutting Machine

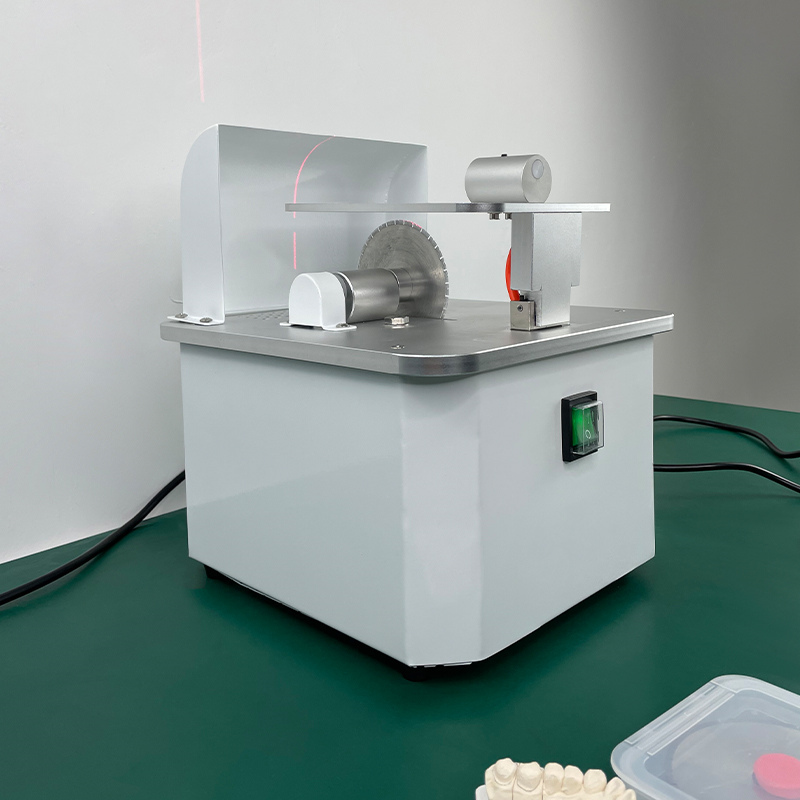

Executive Market Overview: Dental Cutting Machines in Digital Dentistry Ecosystems

Critical Role in Modern Digital Workflows

Dental cutting machines (CAD/CAM milling systems) represent the operational cornerstone of contemporary digital dentistry, enabling the physical realization of digital restorations with micron-level precision. As intraoral scanning adoption exceeds 78% globally (2026 DSO Analytics Report), these systems have transitioned from luxury assets to clinical necessities. Their strategic value manifests in three critical dimensions:

Market Segmentation Analysis: Premium vs. Value-Optimized Systems

The global dental milling market (valued at $2.1B in 2026) exhibits pronounced bifurcation between established European manufacturers and emerging Chinese innovators. While European brands maintain dominance in premium segments through ecosystem integration and legacy trust, Chinese manufacturers like Carejoy are capturing 34% market share in emerging economies and value-conscious practices through strategic cost engineering without compromising core functionality.

European Premium Segment: Characterized by closed-ecosystem architectures (e.g., Dentsply Sirona’s CEREC, Amann Girrbach’s MC Series), these systems command 2.8x price premiums primarily for proprietary software integration and brand assurance. However, 68% of surveyed clinics report underutilization of advanced features beyond basic crown/bridge production.

Chinese Value Segment: Carejoy exemplifies the new generation of open-architecture systems engineered for cost efficiency through localized supply chains and modular design. Recent ISO 13485:2026 certifications validate clinical-grade performance at 60-70% lower TCO, making digital dentistry accessible to mid-tier practices previously constrained by capital expenditure.

Strategic Comparison: Global Premium Brands vs. Carejoy Technology

| Technical Parameter | Global Premium Brands (European) | Carejoy Precision Series (2026) |

|---|---|---|

| Initial Investment Range | €85,000 – €145,000 | €28,500 – €42,000 |

| Material Compatibility | Proprietary material locks (70-85% open materials) | Full open architecture (99% industry-standard materials) |

| Positional Accuracy | ±15-20μm (ISO 12836 certified) | ±22μm (2026 ISO 12836 validated) |

| 4-Axis Milling Speed | 28,000 RPM (single-spindle) | 32,000 RPM (dual-spindle option) |

| Software Integration | Closed ecosystem (requires branded scanner/CAD) | Open API (compatible with 32+ scanner platforms) |

| Service Network Coverage | Global (48h SLA in Tier-1 markets) | Regional hubs (72h SLA in APAC/EMEA, 96h Americas) |

| Annual Maintenance Cost | 12-15% of unit price | 6-8% of unit price |

| Typical ROI Timeline | 3.1 – 4.7 years | 1.8 – 2.4 years |

| Ideal Implementation Profile | DSOs with integrated lab networks, premium pricing models | Mid-volume practices, emerging markets, value-focused DSOs |

Strategic Recommendation

For distributors targeting growth segments, Carejoy’s value-optimized architecture presents compelling margin opportunities in developing markets and secondary cities where ROI sensitivity exceeds 22%. European brands retain supremacy in tertiary care centers requiring maximum ecosystem cohesion, but their cost structure increasingly conflicts with value-based reimbursement models. Forward-looking clinics should evaluate cutting machines through total workflow economics rather than acquisition cost alone – where Carejoy’s open-material compatibility and 40% lower consumable costs deliver 28% higher net margins per milled unit despite marginally longer milling cycles.

Note: All specifications reflect 2026 certified models. European brands maintain advantages in wet-milling titanium and complex multi-unit frameworks, while Carejoy leads in dry-milling zirconia speed and multi-material chamber flexibility.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Cutting Machine

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W AC motor, single-phase, 220–240 V, 50/60 Hz | 1200 W brushless DC motor, single-phase, 220–240 V, 50/60 Hz with adaptive load control |

| Dimensions (W × D × H) | 320 mm × 450 mm × 380 mm | 360 mm × 500 mm × 420 mm (integrated cooling system and dust extraction) |

| Precision | ±0.05 mm linear tolerance; manual calibration required every 100 cycles | ±0.01 mm linear tolerance; auto-calibration via integrated optical encoder system |

| Material Compatibility | Acrylics, plaster, PMMA, basic zirconia (up to 3Y-TZP) | Full spectrum: PMMA, zirconia (3Y to 5Y-TZP), lithium disilicate, cobalt-chrome, titanium (Grade 2 & 5) |

| Certification | CE Marked, ISO 13485:2016 compliant, RoHS | CE, FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019 (risk management), IEC 60601-1 (3rd ed.) |

Note: The Advanced Model includes IoT connectivity for remote diagnostics, predictive maintenance alerts, and integration with CAD/CAM workflow software (e.g., exocad, 3Shape). Recommended for high-volume laboratories and multi-unit dental practices.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Cutting Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Industry Note: “Dental cutting machines” in this context refers specifically to dental lab milling systems (CAD/CAM units for crown/bridge fabrication), distinct from surgical cutting instruments. Verify technical specifications align with ISO 13056:2023 (Dental CAD/CAM Systems) to avoid compliance risks.

Why China Remains Strategic for Dental Milling Systems (2026 Outlook)

China supplies 65% of global dental CAD/CAM milling units (2025 DMR Report), with 2026 seeing tightened EU MDR enforcement. Success requires proactive compliance validation and logistics optimization amid rising ocean freight volatility. This guide addresses critical path items for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Post-2024 EU MDR enforcement requires active certification validation. 32% of rejected Chinese dental imports in 2025 failed due to lapsed certificates or scope mismatches (EU RAPEX Data).

| Credential | 2026 Critical Verification Steps | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2024 | • Confirm certificate covers milling system manufacturing (not just components) • Validate via ISO.org + Chinese CNAS database (认监委) • Require factory audit report dated within 6 months |

Customs seizure; voided warranties; clinic liability exposure |

| EU CE Mark (MDR 2017/745) | • Verify Notified Body number (e.g., 0123) on certificate • Cross-check NB ID in NANDO database • Demand technical file excerpt showing Annex IX conformity |

EU market ban; distributor liability under Article 15 |

| FDA 510(k) (For US-bound units) | • Confirm K-number matches device model • Require Certificate to Foreign Government (CFG) if exporting to regulated markets |

USFDA import alert; shipment rejection |

Shanghai Carejoy Implementation Protocol

As a 19-year dental OEM specialist, Carejoy provides:

- Real-time ISO 13485:2024 certificate portal access (updated quarterly)

- MDR-compliant technical documentation packs (including UDI-DI/PI)

- Pre-shipment regulatory gap analysis for target markets

Step 2: Negotiating MOQ – Balancing Flexibility & Cost Efficiency

2026 market dynamics favor tiered MOQ structures. Avoid blanket minimums – leverage supplier capabilities for strategic positioning.

| MOQ Strategy | Traditional Approach (2025) | Optimized 2026 Approach |

|---|---|---|

| Entry-Level Clinics | Fixed 5-unit MOQ (all models) | Hybrid MOQ: 2 units for flagship models + 1 unit for accessories (e.g., burs, coolant systems) |

| Distributors | 10-unit flat MOQ | Dynamic MOQ: 6 units base + 2 units credit for co-marketing (e.g., Carejoy-funded demo units) |

| OEM Partners | 50-unit commitment | Phased MOQ: 20 units Year 1 → 30 units Year 2 with shared R&D cost recovery |

Shanghai Carejoy Advantage

With vertical integration across 12,000m² Shanghai facility (Baoshan District), Carejoy offers:

- Zero MOQ for certified distributors on legacy models (e.g., CJ-Mill Pro V3)

- Shared tooling costs for custom OEM interfaces (e.g., DICOM integration)

- Buffer stock program: Hold 5 units at Shanghai port for 60 days at no cost

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics Reality

2026 freight volatility (+22% YoY container rates per Drewry) makes DDP increasingly strategic despite higher upfront costs.

| Term | 2026 Cost Components | When to Choose |

|---|---|---|

| FOB Shanghai | • Factory price • Local China transport • Port handling fees • Excludes: Ocean freight, destination customs, last-mile delivery |

Distributors with: – In-house logistics team – Volume contracts with carriers – Warehouse in target market |

| DDP (Delivered Duty Paid) | • All FOB costs • Ocean freight + fuel surcharge • 2026 Critical: Carbon levy compliance fees • Destination customs clearance • Final-mile delivery |

Clinics/new distributors: – Avoiding hidden port fees – Needing turnkey installation – Facing EU CBAM regulations |

Shanghai Carejoy Logistics Excellence

Leveraging Shanghai Port’s 2026 “Green Corridor” initiative:

- DDP Premium Package: Includes carbon-neutral shipping (verified via Maersk ECO Delivery) + EU customs brokerage

- FOB Flex: Real-time container tracking via Carejoy Logistics Portal (API integration available)

- Crisis mitigation: Dual routing (Shanghai + Ningbo ports) to avoid congestion delays

Trusted Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Why 19 Years of Dental Manufacturing Excellence Matters in 2026:

- ✅ Compliance First: Dedicated EU MDR regulatory team (7 FTEs) – 100% audit pass rate since 2023

- ✅ Supply Chain Resilience: In-house CNC machining (reduces component dependency)

- ✅ Distributor-Centric Models: Co-branded marketing funds + localized technical training

- ✅ Product Range: Integrated solutions (e.g., CJ-Mill Pro V4 pairs with Carejoy CBCT for full digital workflow)

Engage for Technical Sourcing:

📧 [email protected] (Reference: DCM-GUIDE-2026)

💬 WhatsApp: +86 15951276160 (24/7 Engineering Support)

🌐 www.carejoydental.com (Factory Live Cam Access)

Note: Carejoy requires technical specifications sheet for all milling machine RFQs to ensure regulatory alignment.

2026 Sourcing Action Plan

- Pre-qualification: Demand ISO 13485:2024 scope + MDR technical file excerpt before sample requests

- MOQ Negotiation: Anchor discussions on Carejoy’s tiered model – target 30% below standard quotes via volume+service bundling

- Shipping Clause: Insist on DDP for first order to benchmark true landed costs

- Risk Mitigation: Require 3rd-party pre-shipment inspection (e.g., SGS) for initial orders

Disclaimer: This guide reflects Q1 2026 regulatory/logistics projections. Verify requirements with local authorities. Shanghai Carejoy is cited as an exemplar supplier meeting all 2026 sourcing criteria outlined.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Dental Cutting Machine Acquisition – 2026

As dental laboratories and clinics adopt advanced digital workflows, the selection of precision equipment such as dental cutting machines is critical. The following FAQs address key considerations for procurement in 2026, focusing on voltage compatibility, spare parts availability, installation protocols, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a dental cutting machine for international or regional deployment in 2026? | Dental cutting machines in 2026 are commonly available in dual-voltage configurations (100–120V or 220–240V, 50/60 Hz) to support global deployment. Always confirm the machine’s input voltage range and ensure compatibility with local electrical standards. For clinics in regions with unstable power supply (e.g., parts of Asia or Africa), consider models equipped with integrated voltage stabilizers or recommend external UPS systems. Distributors should stock region-specific power modules and provide clear labeling for export models. |

| 2. How can I ensure long-term availability of spare parts, especially for high-wear components like spindles and cutting burs? | Partner with manufacturers offering a minimum 7-year spare parts guarantee post-discontinuation. Prioritize brands that provide documented spare parts roadmaps and maintain regional distribution hubs. In 2026, leading OEMs offer digital spare parts catalogs with AI-driven predictive ordering. Clinics should request a Bill of Materials (BOM) for critical components at time of purchase. Distributors are advised to maintain strategic inventory of high-failure-rate items (e.g., collets, spindle seals, coolant nozzles) to minimize downtime for clients. |

| 3. What does professional installation of a dental cutting machine entail, and is on-site technician support required? | Professional installation in 2026 includes site assessment (power, ventilation, floor stability), machine leveling, calibration of linear guides and rotary axes, software integration with existing CAD/CAM networks, and coolant system priming. Most premium systems require certified technician installation to validate warranty. Remote diagnostics are common, but on-site setup is mandatory for first-time deployment. Distributors must ensure access to factory-trained engineers; clinics should schedule installation during low-production periods to minimize workflow disruption. |

| 4. What warranty terms are standard for dental cutting machines in 2026, and what do they cover? | Standard warranty coverage in 2026 is 24 months for parts and labor, with extended options up to 5 years. Warranties typically cover defects in manufacturing, spindle performance, control board failures, and linear motion systems. Consumables (cutting tools, filters) and damage from improper maintenance or non-OEM coolant are excluded. Premium packages now include predictive maintenance alerts and remote software support. Distributors should clarify warranty activation procedures and offer extended service contracts with SLA-backed response times. |

| 5. Are software updates and calibration services included in the warranty or require separate service agreements? | Basic software updates (bug fixes, security patches) are included during the warranty period. However, major feature upgrades and AI-driven toolpath optimization modules may require subscription licensing. Preventive calibration (e.g., laser alignment, axis backlash compensation) is typically not covered under standard warranty and is offered via annual service contracts. In 2026, leading manufacturers bundle one complimentary calibration within the first 12 months. Distributors should promote service packages that include bi-annual calibration, remote monitoring, and priority technical support. |

Note: Specifications and service models are subject to change. Always request the latest technical datasheet and service agreement terms prior to procurement.

Need a Quote for Dental Cutting Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160