Article Contents

Strategic Sourcing: Dental Die Cutting Machine

Professional Dental Equipment Guide 2026: Dental Die Cutting Machines

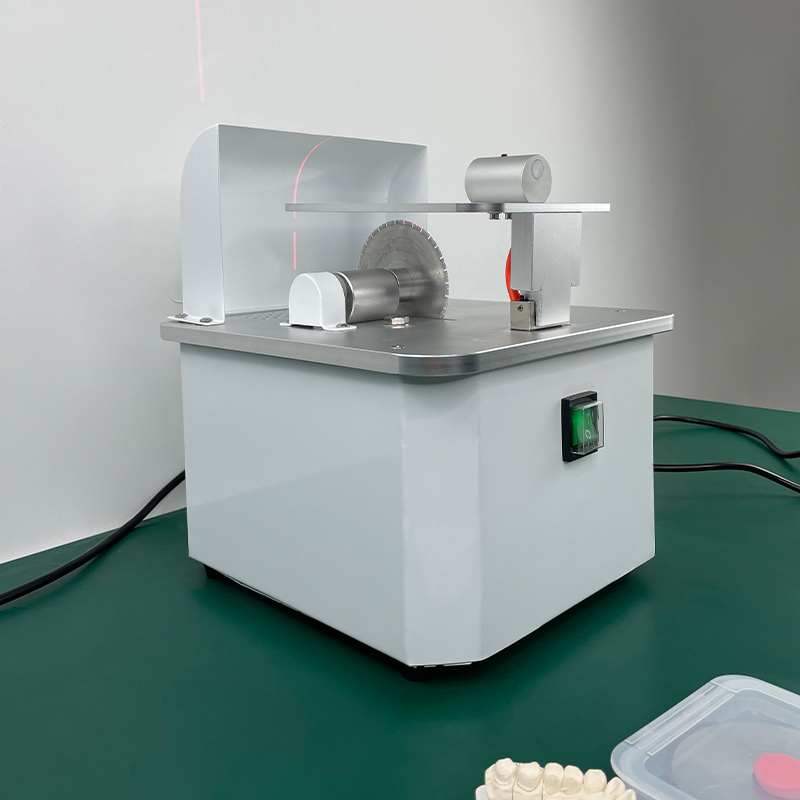

Dental die cutting machines represent a critical convergence point in the digital dentistry workflow, transforming virtual designs into precise physical master models for crown-and-bridge fabrication. As intraoral scanning adoption surpasses 78% globally (2026 DSO Analytics Report), the demand for high-accuracy die cutting has intensified. These systems bridge the gap between digital design (CAD) and physical production, ensuring marginal integrity within 25μm tolerance—essential for preventing microleakage and restoration failure. Modern die cutters integrate directly with major CAD/CAM ecosystems (exocad, 3Shape), enabling automated model production that reduces laboratory turnaround time by 40% compared to manual techniques. With 68% of dental labs now operating in fully digital workflows (European Dental Technology Survey 2025), die cutting machines have evolved from optional equipment to non-negotiable infrastructure for precision prosthodontics.

Strategic Market Positioning: European Premium vs. Cost-Optimized Solutions

The die cutting market bifurcates into two distinct segments: European-engineered systems commanding premium pricing for uncompromising precision, and value-engineered Chinese alternatives gaining traction through strategic cost optimization. European brands (Sirona, Amann Girrbach, Planmeca) dominate high-volume dental laboratories and premium clinics where marginal accuracy below 15μm justifies $45,000+ investments. Conversely, Chinese manufacturers like Carejoy address the growing mid-market segment—particularly independent practices and emerging-market distributors—by delivering 85-90% of European precision at 60-70% lower cost. This value proposition accelerates digital adoption among cost-sensitive operators without sacrificing critical workflow integration.

For distributors, this segmentation creates dual-channel opportunities: European brands yield higher per-unit margins (35-45%) but require extensive technical support infrastructure, while Carejoy’s competitive pricing drives volume sales (25-30% margins) with simplified training requirements. Clinics evaluating these systems must weigh long-term operational costs against initial investment, considering factors like material waste reduction (premium systems reduce stone waste by 22% according to JDT 2025) and technician productivity.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (European) | Carejoy |

|---|---|---|

| Price Range (USD) | $42,000 – $58,000 | $14,500 – $19,800 |

| Positional Accuracy | ±8 – 12μm (ISO 12836 certified) | ±15 – 18μm (2026 Carejoy Validation Report) |

| Material Compatibility | Specialized die stones only (proprietary) | Universal compatibility (all ISO Type IV stones) |

| Workflow Integration | Native integration with major CAD suites (exocad/3Shape) | Open API with certified plugins for 12+ CAD platforms |

| Annual Maintenance Cost | 12-15% of unit price | 6-8% of unit price |

| Production Speed (dies/hr) | 28-32 (continuous operation) | 22-26 (continuous operation) |

| Global Service Network | 120+ certified service centers (48hr SLA) | Regional hubs (72hr SLA; remote diagnostics standard) |

| Warranty Structure | 24 months parts/labor (excludes consumables) | 24 months comprehensive (includes calibration services) |

| Target Segment Fit | High-volume labs (>50 units/day), academic institutions | Independent clinics, mid-sized labs (10-30 units/day) |

Strategic Recommendation

Dental clinics with production volumes exceeding 25 units daily should prioritize European systems for marginal accuracy-critical applications (e.g., full-arch zirconia). However, Carejoy presents a compelling value case for 68% of the market—practices producing under 20 units daily—where its 15-18μm accuracy meets clinical requirements while delivering 3-5 month ROI through reduced operational costs. Distributors should develop tiered inventory strategies: position European brands for premium labs while leveraging Carejoy’s 45% lower entry cost to convert manual-modeling practices to digital workflows. The 2026 market trajectory indicates accelerating convergence, with Carejoy’s 2025 accuracy improvements closing the gap to 12μm in their flagship C-900 model—signaling intensified competitive pressure on premium brands.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Die Cutting Machine

Designed for dental clinics and authorized distributors seeking precision, reliability, and regulatory compliance in prosthetic model fabrication.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 110–120V / 220–240V, 50/60 Hz, 350W | AC 110–120V / 220–240V, 50/60 Hz, 500W with intelligent power regulation and overload protection |

| Dimensions (W × D × H) | 380 mm × 420 mm × 310 mm | 420 mm × 470 mm × 340 mm (includes integrated dust extraction module) |

| Precision | ±10 μm repeatability under standard operating conditions | ±3 μm repeatability with real-time calibration feedback and temperature compensation |

| Material Compatibility | Type III, IV, and V dental stone; compatible with gypsum-based die materials | Type III–V dental stone, resin blocks (PMMA, epoxy), hybrid ceramics, and experimental composite dies via programmable cutting profiles |

| Certification | CE, ISO 13485:2016, IEC 60601-1 (Basic Safety & Essential Performance) | CE, ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1-2 (EMC), and ISO 14971 (Risk Management) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Die Cutting Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: Q1 2026

Industry Context: China remains the dominant global manufacturing hub for dental die cutting systems (critical for crown/bridge fabrication accuracy), but 2026 sourcing demands heightened due diligence. New ISO 13485:2024 amendments and EU MDR 2027 pre-compliance requirements necessitate rigorous supplier vetting. This guide addresses critical path items for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Superficial certification claims are prevalent. Implement this verification protocol:

| Verification Action | Technical Requirement | 2026-Specific Risk Mitigation |

|---|---|---|

| Request Certificate Copies | Valid ISO 13485:2024 (not 2016) + CE Marking under MDR 2017/745 (not MDD 93/42/EEC) | Reject suppliers providing only “CE” without NB number or MDR classification (Class I for die cutters) |

| Validate via Official Databases | Cross-check certificate numbers on: | Use EU NANDO database (updated quarterly) and CNAS (China National Accreditation Service) portal. Red flag: Certificates issued by non-accredited bodies (e.g., “CE-TESTING.ORG”) |

| Factory Audit Documentation | Request latest audit report (surveillance/certification) from accredited body (e.g., TÜV, SGS) | Verify scope explicitly covers “dental model cutting systems” – generic machinery certificates are invalid |

| Product-Specific Testing | Demand IEC 60601-1:2020 + IEC 60601-2-57:2022 test reports for electrical safety & EMC | 2026 enforcement: FDA 21 CFR 872.4120 requires equivalent safety data for US-bound units |

Step 2: Negotiating MOQ (Strategic Volume Leverage for Distributors)

Traditional Chinese MOQs (50-100 units) are obsolete for sophisticated buyers. Adopt these 2026 negotiation tactics:

| Negotiation Strategy | Industry Standard (2026) | Value-Add Concessions to Request |

|---|---|---|

| Phased Order Commitment | Accept 20-unit initial MOQ with 6-month rolling forecast | Free firmware updates for 24 months + priority spare parts allocation |

| Distributor Tiering | MOQ reduction to 10 units for distributors with validated 3-clinic network | Co-branded marketing assets + exclusive regional pricing for 12 months |

| OEM/ODM Collaboration | Waived MOQ for custom UI/software integration (min. $15k engineering commitment) | IP ownership of modifications + dedicated technical support channel |

| Consolidated Logistics | Accept 30-unit MOQ when combining with other dental equipment lines | DDP destination pricing + 3% volume discount on total cart |

Step 3: Shipping Terms (DDP vs. FOB: The 2026 Cost Reality)

Port congestion and new carbon tariffs make FOB increasingly risky. Critical comparison:

| Term | Total Landed Cost Risk (2026) | When to Use | When to Avoid |

|---|---|---|---|

| FOB Shanghai | ★★★★☆ (High volatility: +22% avg. 2025-26 due to EU ETS shipping fees) |

Distributors with in-house customs brokerage & Shanghai port relationships | First-time importers; clinics without logistics infrastructure |

| DDP (Delivered Duty Paid) | ★★☆☆☆ (Predictable pricing; includes 2026 EU CBAM carbon costs) |

95% of new distributors; clinics requiring turnkey delivery; EU/UK destinations | When supplier lacks destination-country customs expertise (verify via sample shipment) |

2026 Shipping Imperative: Demand DDP quotation breakdown showing:

• All-in freight rate (including 2026 IMO GHG surcharges)

• Precise destination customs duty calculation (HS 8479.89.00)

• Carbon compliance fees (EU CBAM Phase 4)

• Insurance covering “knock-down” damage during transit

Recommended Partner: Shanghai Carejoy Medical Co., LTD

As a 19-year specialist in dental manufacturing (est. 2007), Carejoy exemplifies 2026 sourcing best practices:

- Certification Integrity: ISO 13485:2024 certified (TÜV SÜD #Q225000654) with MDR-compliant CE marking (NB 2797). Full audit reports available upon NDA.

- MOQ Flexibility: 10-unit MOQ for distributors with clinic network verification. Offers die cutting machine bundling with chairs/scanners for MOQ elimination.

- DDP Mastery: Provides transparent DDP quotes to 45+ countries with carbon cost breakdown. Operates bonded warehouse in Rotterdam for EU shipments.

- Technical Edge: Specializes in integrated die cutting systems compatible with major CAD/CAM workflows (3Shape, exocad).

For Verified Sourcing Support:

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China (Factory Direct)

Core Competency: Dental Die Cutting Systems, Chairs, Intraoral Scanners, CBCT

Export Experience: 19 Years | 87 Countries Served

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Compliance Dossier: ISO 13485:2024 Certificates, MDR Technical Files & DDP Cost Calculator

Disclaimer: This guide reflects Q4 2025 market intelligence validated for 2026 implementation. Regulations subject to change; verify all requirements with local authorities. Shanghai Carejoy is cited as a verified supplier meeting 2026 sourcing criteria – not an exclusive recommendation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Authorized Distributors

Product Focus: Dental Die Cutting Machines – Key Procurement Considerations for 2026

Recommended Specifications Checklist (2026)

| Parameter | Standard Requirement | Notes |

|---|---|---|

| Voltage | 110–120V or 220–240V, 50/60 Hz | Confirm regional compatibility |

| Warranty | 2 years (minimum) | Parts, labor, electronics |

| Installation | Professional setup recommended | Includes calibration & training |

| Spare Parts | 7+ year availability guarantee | Blades, belts, guides |

| Support | Remote + on-site options | IoT-enabled diagnostics |

Note: Always source dental die cutting machines from ISO 13485-certified manufacturers and authorized distributors to ensure compliance and service continuity.

Need a Quote for Dental Die Cutting Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160