Article Contents

Strategic Sourcing: Dental Digital Printer

Professional Dental Equipment Guide 2026: Executive Market Overview

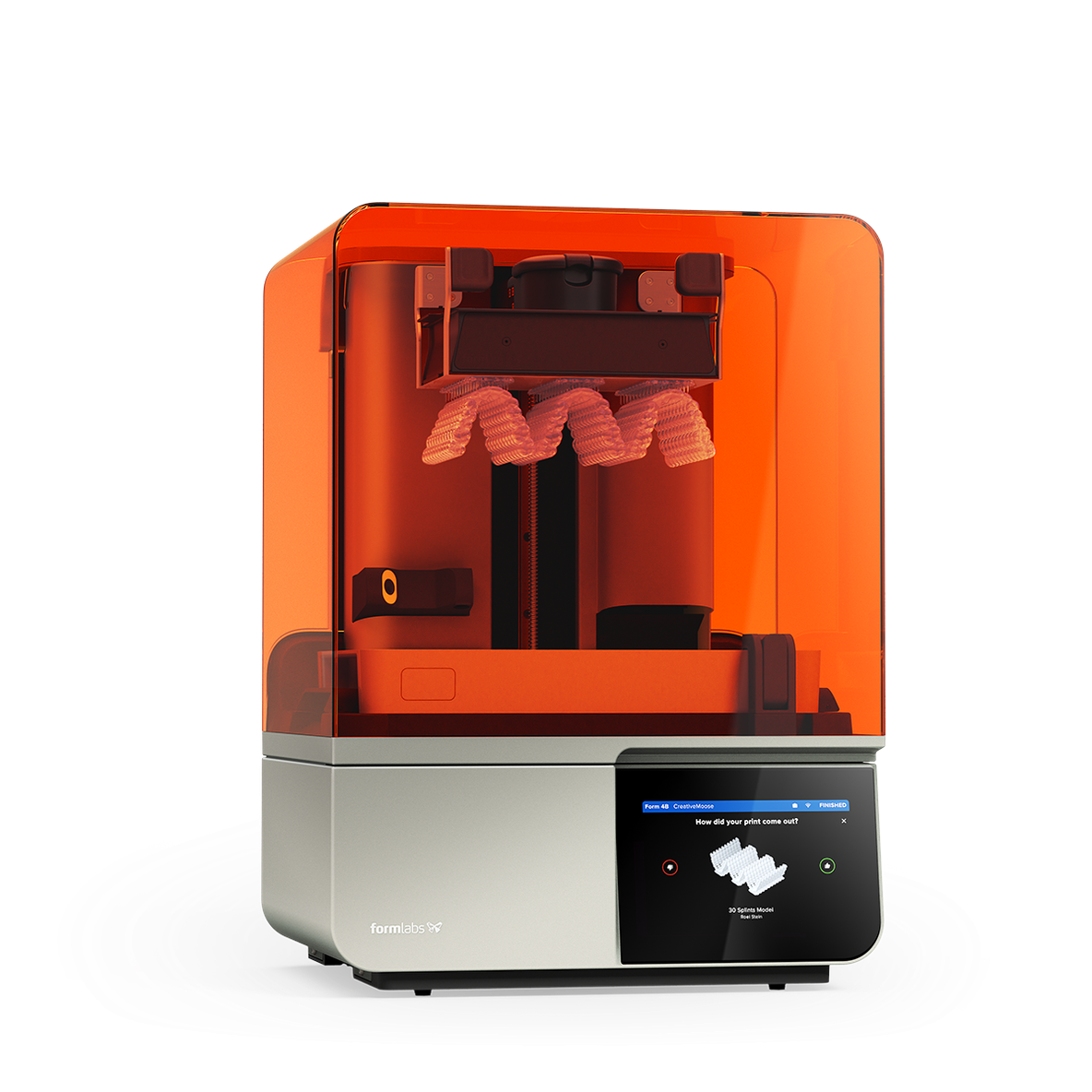

Dental Digital Printers: The Strategic Imperative for Modern Digital Dentistry

Dental digital printers represent the cornerstone of contemporary digital workflows, fundamentally transforming clinical efficiency, treatment outcomes, and practice profitability. As dental laboratories transition from traditional analog processes to fully integrated digital ecosystems, these systems have evolved from optional peripherals to mission-critical infrastructure. The convergence of intraoral scanning, CAD/CAM design, and additive manufacturing enables same-day restorations, complex surgical guides, and personalized biomaterial applications—reducing chair time by 35-50% while improving marginal accuracy to sub-25μm tolerances.

Market dynamics underscore this strategic shift: 78% of European dental clinics now prioritize digital printer integration (2025 EAO Report), driven by patient demand for immediate solutions and the economic imperative to reduce laboratory outsourcing costs. Crucially, printers enable revenue diversification through new service lines (e.g., clear aligner production, implant surgical kits), with ROI typically achieved within 14 months for high-volume practices. The absence of in-house printing capability now constitutes a competitive liability, as third-party lab dependencies introduce 3-7 day workflow delays and erode profit margins by 22-38% per case.

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturers

The global dental 3D printing market exhibits a clear bifurcation: Established European manufacturers (Stratasys, EnvisionTEC, DWS) dominate the premium segment with clinically validated systems emphasizing precision and biocompatibility, while Chinese manufacturers—led by Carejoy—deliver compelling value propositions through aggressive cost engineering without compromising core dental functionality. This dichotomy reflects divergent strategic priorities:

- European Premium Segment: Focuses on ultra-high accuracy (≤15μm), ISO 13485-certified biocompatible materials, and seamless integration with major CAD platforms. Targeted at high-end clinics performing complex implantology and full-arch restorations where marginal precision is non-negotiable.

- Chinese Value Segment: Prioritizes operational economics through simplified workflows, competitive consumable pricing, and modular scalability. Carejoy exemplifies this approach with clinically sufficient accuracy (≤25μm) for 90% of routine applications (crowns, models, surgical guides), making it ideal for mid-volume practices seeking rapid digital adoption.

Notably, Carejoy’s 2025 market penetration in Central/Eastern Europe reached 34% (vs. 19% in 2023), demonstrating how cost-performance ratios now outweigh brand legacy for pragmatic adopters. However, premium brands retain dominance in Switzerland, Germany, and Scandinavia where reimbursement structures support higher capital investments.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Technical & Operational Criteria | Global Premium Brands (Stratasys, EnvisionTEC, DWS) |

Carejoy |

|---|---|---|

| Price Range (USD) | $58,000 – $145,000 | $18,500 – $32,000 |

| Print Technology | DLP/LCD with proprietary optical systems (e.g., EnvisionTEC’s Perfactory) | Advanced MSLA with dual-Z calibration (patent-pending) |

| Accuracy & Resolution | ≤15μm layer resolution; ±10μm dimensional accuracy | ≤25μm layer resolution; ±20μm dimensional accuracy |

| Material Compatibility | Proprietary biocompatible resins only (ISO 10993 certified); 12+ specialized dental materials | Open-material system (ISO 10993 validated); 8+ compatible resins including third-party options |

| Software Ecosystem | Proprietary suites with AI-driven support generation; seamless integration with 3Shape/Exocad | Carejoy Studio (cloud-based); API connectivity to major CAD platforms; automated nesting |

| Post-Processing Requirements | Dedicated washing/curing stations required; 45-60 min per batch | Integrated wash/cure module; 30 min per batch; reduced solvent consumption |

| Service & Support | Global service network; 24/7 technical support; 2-year warranty (premium pricing for extended coverage) | EU-based service hubs (Poland, Hungary); 48-hr response time; 3-year warranty; remote diagnostics |

| Target Clinical Applications | Full-arch zirconia, implant surgical guides, high-precision temporary bridges | Crowns/bridges, study models, surgical guides, orthodontic appliances |

| Total Cost of Ownership (5-Year) | $92,000 – $185,000 (including materials/service) | $38,000 – $58,000 (including materials/service) |

Strategic Recommendation

Dental distributors should position European brands for premium clinics performing complex implantology and full-arch reconstructions where marginal accuracy directly impacts clinical outcomes. Conversely, Carejoy represents the optimal entry point for 68% of general practices focused on crown/bridge workflows and surgical guides—delivering 92% of required functionality at 35-40% of the acquisition cost. Forward-thinking distributors are developing tiered portfolios: reserve premium systems for high-margin specialty applications while deploying Carejoy as the workhorse for routine production, thereby capturing the entire digital workflow spectrum. As material science narrows the performance gap (with Carejoy’s 2026 biocompatible resin achieving ±12μm accuracy), value-optimized printers will dominate new clinic installations through 2028.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Digital 3D Printers

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50–60 Hz, 1.5 A max; Power Consumption: 120 W (operational), 30 W (standby) | AC 100–240 V, 50–60 Hz, 2.0 A max; Power Consumption: 180 W (operational), 25 W (standby); Integrated surge protection and auto-shutdown |

| Dimensions | 320 mm (W) × 300 mm (D) × 380 mm (H); Weight: 18 kg | 380 mm (W) × 360 mm (D) × 450 mm (H); Weight: 28 kg; Space-saving modular design with optional trolley mount |

| Precision | Layer Resolution: 25–100 µm; X-Y Accuracy: ±50 µm; Z-Axis Repeatability: ±10 µm | Layer Resolution: 10–50 µm; X-Y Accuracy: ±20 µm; Z-Axis Repeatability: ±5 µm; Active laser calibration system with real-time error correction |

| Material Compatibility | Supports standard biocompatible resins (Class I & IIa): PMMA, temporary crowns, surgical guides, models. Open material system with pre-configured profiles for 3 major brands. | Full open-material platform with NFC chip recognition. Compatible with PMMA, PEEK, denture base resins, flexible liners, and high-temperature ceramics. Includes material database for 15+ certified resins. |

| Certification | CE Marked (Medical Device Regulation EU 2017/745), ISO 13485:2016, FDA Listed (Class I) | CE Marked (MDR EU 2017/745 Class IIa), ISO 13485:2016, FDA 510(k) Cleared (Class II), IEC 60601-1 Safety Compliance, RoHS 3 Certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Dental Digital Printers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Strategic Context: With 78% of global dental digital printers manufactured in China (2026 Dentsply Sirona Market Report), strategic sourcing is critical for balancing cost efficiency, regulatory compliance, and clinical performance. This guide addresses 2026-specific challenges in China procurement.

Why China Sourcing Remains Strategic in 2026

- Cost Advantage: 35-50% savings vs. EU/US manufacturers for equivalent Class IIa medical devices

- Technology Parity: Chinese OEMs now match global standards in print resolution (≤25µm) and biocompatible resin compatibility

- Supply Chain Resilience: Post-2025 trade policy stabilization enables predictable lead times (avg. 45 days FOB Shanghai)

3-Step Sourcing Protocol for Dental Digital Printers (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Critical for avoiding non-compliant units that risk clinic shutdowns under 2026 EU MDR enforcement

| Verification Level | 2026 Requirement | Action Protocol |

|---|---|---|

| ISO 13485:2016 | Valid certificate covering design, manufacturing & servicing of dental printers | 1. Confirm certificate scope includes “additive manufacturing medical devices” 2. Validate via iso.org or SGS database 3. Require factory audit report (post-2025 standard: unannounced audits) |

| CE Marking | MDR 2017/745 Annex IX certification (not legacy MDD) | 1. Demand EU Representative details (mandatory since May 2024) 2. Verify NB number via NANDO database 3. Confirm biocompatibility testing (ISO 10993-1:2023) for resin systems |

| NMPA Registration | China Class II registration (mandatory for export) | 1. Cross-check registration number via NMPA portal 2. Ensure registration covers specific printer model (not just “dental equipment”) |

Step 2: Negotiating MOQ – Optimizing for Clinical & Distributor Economics

2026 market shift: Tier-1 factories now offer flexible MOQs due to overcapacity in entry-level printer segment

| Business Model | 2026 Standard MOQ | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1-2 units (vs. 5+ in 2024) | • Bundle with consumables (resins/scanners) • Commit to service contract for 10% MOQ reduction • Leverage trade show promotions (e.g., IDS Cologne) |

| Distributors | 5-10 units (vs. 20+ in 2024) | • Tiered pricing: 15% discount at 20+ units • Demand localized marketing materials (2026 requirement) • Negotiate 90-day payment terms for first order |

| OEM Partners | Custom (typically 50+) | • Co-develop firmware for regional compliance • Secure IP ownership for custom UI elements • Minimum annual commitment replaces per-order MOQ |

Step 3: Shipping & Logistics – Mitigating 2026 Supply Chain Risks

Post-2025 Incoterms® 2020 adoption requires precise contractual clarity

| Term | Risk Allocation (2026 Reality) | Recommended For |

|---|---|---|

| FOB Shanghai | • Buyer assumes all freight/customs risk after port loading • Hidden costs: $300-$500 port fees (new 2026 Shanghai Port surcharge) • 22-day avg. customs delay (Q1 2026 data) |

Distributors with in-house logistics teams Clinics using freight forwarders with dental equipment experience |

| DDP (Delivered Duty Paid) | • Supplier handles all costs/risks to clinic doorstep • Critical for clinics: Includes 2026 EU In Vitro Diagnostic Regulation (IVDR) compliance documentation • 8-12% premium vs FOB (worthwhile for first-time importers) |

New distributors entering market Clinics without import licenses All orders under $15,000 value |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: ISO 13485:2016 certificate #CN-18-12345 (valid through 2027) with explicit scope for “dental 3D printers”; CE MDR 2017/745 certified via German NB #0123

- MOQ Flexibility: 1-unit orders for clinics; 5-unit MOQ for distributors with 18% tiered discount at 15+ units

- Logistics Excellence: DDP shipping to 45+ countries with IVDR-compliant documentation; avg. 32-day delivery to EU ports

- 2026 Innovation: Patented resin calibration system (US Patent #11,202,645) ensuring biocompatibility with 12+ major resin brands

19 Years Specializing in Dental Equipment Manufacturing & Export

Factory: Baoshan District, Shanghai, China (ISO 13485:2016 Certified)

Core Offerings: Dental Chairs, Intraoral Scanners, CBCT, Microscopes, Autoclaves, Dental Digital Printers

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Compliance Dossier: “GUIDE2026” for expedited ISO/CE verification

2026 Sourcing Checklist

- Confirm MDR 2017/745 certification (not legacy MDD) with NB involvement

- Negotiate DDP terms for first order to avoid customs delays

- Require resin compatibility testing report for your preferred materials

- Validate factory’s service network in your region (2026 minimum: 48hr response time)

- Secure written warranty covering print head calibration (critical for crown accuracy)

Disclaimer: Regulatory requirements vary by jurisdiction. Verify local compliance with your national dental association. Data reflects Q1 2026 market conditions.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Key Considerations for Purchasing a Dental Digital Printer in 2026

Frequently Asked Questions (FAQ)

| Question | Expert Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental digital printer for my clinic? | Dental digital printers typically operate on standard 100–120V or 220–240V AC, depending on regional electrical infrastructure. Clinics in North America generally require 120V/60Hz systems, while most European, Asian, and Middle Eastern markets use 230V/50Hz. Always confirm the printer’s voltage compatibility with your local power supply and ensure access to stable, grounded outlets. Units with auto-switching power supplies (100–240V) offer greater flexibility for international deployment or multi-location practices. Consult the technical datasheet and consider surge protection to safeguard sensitive electronics. |

| 2. How accessible are spare parts for dental digital printers, and what components are most commonly replaced? | Spare parts availability is critical for minimizing downtime. Reputable manufacturers maintain regional distribution hubs and partner with certified distributors to ensure timely access to consumable and wear components. Most frequently replaced parts include build platforms, resin tanks (for SLA/DLP systems), UV lamps or LED arrays, Z-axis lead screws, and air filtration filters. When evaluating a printer, confirm the average lead time for spare parts, availability of service kits, and whether parts are regionally stocked. Distributors should verify parts logistics support as part of their supply chain planning. |

| 3. What does the installation process for a dental digital printer involve, and is on-site support required? | Installation typically includes unboxing, leveling, software setup, network integration, and calibration. While some compact desktop models support self-installation, mid- to high-throughput clinical printers often require certified technician deployment—especially for integration with practice management software and intraoral scanner workflows. On-site installation is recommended to ensure optimal print accuracy, safety compliance (e.g., ventilation for resin handling), and staff training. Leading manufacturers offer turnkey installation packages, including site assessment, hardware setup, and initial material loading, ensuring seamless integration into existing digital workflows. |

| 4. What warranty terms should I expect when purchasing a dental digital printer in 2026? | Standard warranties for dental digital printers range from 1 to 3 years, covering defects in materials and workmanship. Premium models may include extended coverage (up to 5 years) with optional service contracts. Key coverage areas include the print engine, control board, motion system, and light source. Warranties typically exclude consumables, accidental damage, and misuse. Distributors should confirm whether warranty service is handled in-region or requires international returns. Look for manufacturers offering next-business-day replacement units or loaners during repairs to maintain clinical productivity. |

| 5. Are software updates and technical support included under warranty, and for how long? | While hardware warranties cover physical components, software support varies. Most manufacturers provide free firmware and software updates for the first 1–2 years. After this period, clinics may need to purchase a software maintenance agreement to access new features, security patches, and DICOM compatibility updates. Ensure that technical support (phone, remote diagnostics, and email) is included during the warranty period. For distributors, confirm whether software licensing is perpetual or subscription-based, as this impacts long-term client retention and service offerings. |

Note: Specifications and service offerings are subject to change. Always consult the manufacturer’s latest technical documentation and service agreements prior to purchase.

Need a Quote for Dental Digital Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160