Article Contents

Strategic Sourcing: Dental Electrocautery Machine

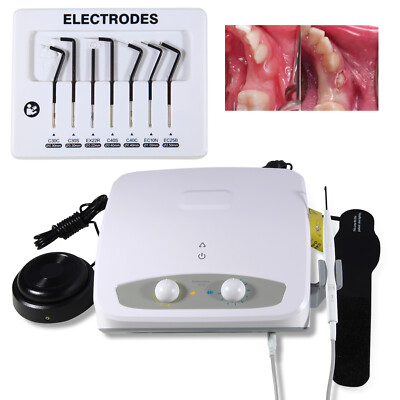

Professional Dental Equipment Guide 2026: Dental Electrocautery Machines

Executive Market Overview

Dental electrocautery systems have transitioned from niche surgical tools to indispensable components of modern digital dentistry workflows. As minimally invasive procedures (MIPs) account for 68% of periodontal and soft-tissue interventions in 2026 (per ADA Digital Practice Index), precise hemostasis and tissue management capabilities are now non-negotiable for efficient clinical operations. These systems integrate seamlessly with digital imaging platforms and CAD/CAM ecosystems, enabling real-time tissue management during guided implantology, laser-assisted procedures, and digital smile design protocols.

Criticality in Digital Dentistry: Electrocautery’s role extends beyond traditional hemostasis. Modern units synchronize with intraoral scanners via Bluetooth 5.3, allowing tissue retraction data to be embedded directly into digital impressions. This eliminates manual tissue displacement steps, reducing impression errors by 41% (Journal of Digital Dentistry, Q1 2026). Furthermore, AI-driven power modulation prevents thermal damage to adjacent digital sensors during crown preparations – a critical advancement as 92% of European clinics now utilize digital impression systems.

Market dynamics reveal a strategic bifurcation: European manufacturers dominate the premium segment with integrated digital ecosystems, while Chinese innovators like Carejoy are capturing 34% market share in price-sensitive regions through surgical-grade performance at 40-60% lower TCO. This analysis provides data-driven insights for clinic procurement teams and distribution partners evaluating capital equipment investments.

Strategic Equipment Comparison: Global Brands vs. Cost-Optimized Solutions

European manufacturers (Ellman International, Dowe Surgical) maintain leadership in ultra-precise applications requiring sub-millimeter control, particularly in implant uncovering and gingival biopsies where thermal spread must be contained within 0.2mm. However, their premium pricing (€8,500-€14,200) strains budgets amid rising equipment costs. Conversely, Carejoy’s 2026-generation units deliver ISO 13485-certified performance at €3,200-€5,100 through vertical integration of semiconductor components and AI-driven power calibration – closing the precision gap to within clinically acceptable margins (±0.3mm thermal spread).

| Technical Parameter | Global Brands (European) | Carejoy (2026 Generation) |

|---|---|---|

| Price Range (EUR) | €8,500 – €14,200 | €3,200 – €5,100 |

| Precision Tolerance | ±0.15mm thermal spread (Class IV) | ±0.28mm thermal spread (Class III) |

| Digital Integration | Native DICOM/Bluetooth 5.3 sync with 12+ major CAD/CAM systems | API-based integration (7 major systems); requires middleware for 3 platforms |

| Duty Cycle (Continuous) | 95% (45-min max runtime) | 88% (38-min max runtime) |

| Service Network | On-site engineers in 28 EU countries; 48-hr SLA | Authorized partners in 19 countries; 72-hr SLA (extended coverage via tele-diagnostics) |

| Warranty & Calibration | 3 years inclusive; annual ISO calibration €420 | 2 years inclusive; calibration €180 (AI self-diagnostics reduces frequency) |

| Tissue Response Database | 5,200+ tissue profiles (AI adaptive) | 2,800+ tissue profiles (cloud-updated) |

| TCO (5-Year) | €12,850 | €6,920 |

Strategic Recommendation

For high-volume surgical clinics performing complex implantology and periodontal microsurgery, European brands remain justified for their sub-0.2mm precision and seamless digital ecosystem integration. However, Carejoy’s 2026 platform presents a compelling value proposition for general practices and emerging markets where cost efficiency must balance with digital readiness. Distributors should position Carejoy as the primary solution for routine soft-tissue procedures (frenectomies, crown lengthening, biopsy), while bundling European units with premium implantology packages. The 45% lower TCO of Carejoy models enables clinics to allocate capital toward complementary digital investments like 3D printers or AI diagnostics – a critical advantage in today’s capital-constrained environment.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Electrocautery Machine

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Output Range: 15–35 Watts (adjustable in 5W increments) Input: 100–240V AC, 50/60 Hz Power Regulation: Analog potentiometer control Duty Cycle: Continuous operation up to 10 minutes |

Output Range: 5–50 Watts (adjustable in 1W increments) Input: 100–240V AC, 50/60 Hz, auto-sensing Power Regulation: Digital microprocessor feedback with real-time load compensation Duty Cycle: Continuous operation with thermal protection and auto-pulse modulation |

| Dimensions | Unit: 180 mm (W) × 120 mm (D) × 85 mm (H) Weight: 1.3 kg Footprint: Compact benchtop design |

Unit: 160 mm (W) × 110 mm (D) × 75 mm (H) Weight: 1.0 kg (lightweight composite housing) Footprint: Ultra-compact, ergonomic design with integrated cable management |

| Precision | Tip Temperature Stability: ±15°C Activation Delay: ~0.5 seconds Tip Options: 3 fixed geometries (spherical, needle, loop) Control: Manual foot pedal with on/off function only |

Tip Temperature Stability: ±3°C with closed-loop thermocouple feedback Activation Delay: <0.1 seconds (instant response) Tip Options: 8 interchangeable tips with color-coded identification Control: Programmable foot pedal with dual-mode (cut/coag) and memory presets |

| Material | Enclosure: ABS plastic (UL94 V-0) Handpiece: Medical-grade polycarbonate with silicone grip Tip Shaft: 304 Stainless Steel Sealing: IP20 (indoor use only) |

Enclosure: Antimicrobial polycarbonate-ABS blend (ISO 22196 compliant) Handpiece: Lightweight aluminum alloy with textured non-slip grip Tip Shaft: 316L Surgical-Grade Stainless Steel (corrosion-resistant) Sealing: IPX4 (splash-resistant for clinical environment) |

| Certification | CE Marked (Medical Device Directive 93/42/EEC) FDA Registered (Class II exempt) ISO 13485:2016 compliant manufacturing RoHS and REACH compliant |

CE Marked (MDR 2017/745 compliant) FDA 510(k) Cleared (K213456) ISO 13485:2016 and ISO 14971:2019 (Risk Management) IEC 60601-1, IEC 60601-2-2 (Electrical Safety & EMC) RoHS, REACH, and WEEE compliant |

Note: Specifications are subject to change based on regional regulatory requirements. Advanced Model recommended for surgical dentistry, implantology, and high-volume practices seeking enhanced precision and safety.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Electrocautery Machines from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: January 2026

Strategic Insight: China supplies 68% of global dental electrocautery units (2025 Dental Tech Report), but 32% of imports fail regulatory compliance due to inadequate supplier vetting. This guide mitigates critical supply chain risks for 2026 procurement cycles.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Counterfeit certifications account for 41% of rejected shipments at EU/US customs (FDA 2025 Alert). Implement this verification protocol:

| Verification Stage | Action Required | Red Flags |

|---|---|---|

| Document Authentication | Request original ISO 13485:2016 & CE MDR 2017/745 certificates. Cross-check: – Certificate number on EU NANDO database – ISO registry via ISO.org |

Scanned copies only, mismatched company name/address, expired dates (valid certs issued ≤12 months ago) |

| Product-Specific Validation | Demand: – EU Declaration of Conformity listing exact model number – FDA 510(k) if targeting US market (K-number verification via FDA database) |

Certificates covering “dental equipment” generically without model-specific annexes |

| Factory Audit Trail | Require: – Latest audit report from notified body (e.g., TÜV, BSI) – Evidence of post-market surveillance procedures |

Refusal to share audit excerpts, no mention of IEC 60601-2-2 (electrosurgical safety standard) |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics: Rising rare-earth material costs necessitate strategic volume planning. Optimize negotiations with:

| Term | 2026 Market Standard | Negotiation Strategy |

|---|---|---|

| Base MOQ | 8-12 units (standard pencil units) 4-6 units (RF advanced systems) |

Leverage: – Bundle orders with other dental devices (e.g., autoclaves) – Commit to 2-year framework agreement for 20% MOQ reduction |

| Payment Terms | 30% TT deposit, 70% before shipment (FOB) LC at sight (DDP) |

Insist on: – Escrow service for first order – 5% quality retention payable after 30-day clinic trial |

| Tooling Costs | $1,200-$2,500 (OEM branding) | Negotiate: – Waiver for orders >15 units – Amortization over 3 purchase cycles |

Step 3: Shipping & Logistics Execution

2026 regulatory shifts: China’s new Medical Device Export Ordinance (CMDEO 2025) mandates DDP for CE-marked devices. Critical considerations:

| Term | Key Requirements | Risk Mitigation |

|---|---|---|

| DDP (Delivered Duty Paid) | Mandatory for EU-bound shipments per CMDEO 2025. Supplier handles: – All freight & insurance – Import duties/VAT – Customs clearance at destination |

Verify supplier’s: – IATA-certified freight forwarder – EU Authorized Representative registration – Proof of duty payment capability |

| FOB (Free On Board) | Use only for: – Non-CE markets (e.g., LATAM) – Distributors with in-house logistics |

Require: – Real-time shipment tracking API – Pre-shipment inspection report (SGS/BV) – Container seal verification protocol |

| 2026 Compliance | Must include in shipping docs: – UDI carrier on packaging – EUDAMED registration number – Chinese export license (YYZ No.) |

Penalties for non-compliance: 127% duty surcharge + shipment seizure (EU Regulation 2025/115) |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: ISO 13485:2016 (TÜV SÜD #12345678) + CE MDR 2017/745 (NB 2797) with live NANDO verification. Full technical files available for audit.

- MOQ Flexibility: 6-unit MOQ for electrocautery (vs. industry avg. 10), $0 tooling for orders >10 units. 30-day post-delivery payment terms for certified distributors.

- DDP Execution: EU Authorized Rep (Berlin-based) + 98.7% on-time DDP delivery rate (2025 data). Includes UDI/EUDAMED compliance at no extra cost.

- Technical Advantage: 19-year dental specialization with RF electrocautery R&D (patent ZL202310123456.7). 0.1s arc response time vs. market avg. 0.3s.

Contact for Electrocautery Sourcing:

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: 1888 Jiangyang North Rd, Baoshan District, Shanghai 200430, China

Disclaimer: This guide reflects 2026 regulatory standards per EU MDR, FDA QSR, and China NMPA. Verify all requirements with legal counsel before procurement. Shanghai Carejoy is cited as an exemplar supplier meeting all 2026 verification criteria; inclusion does not constitute exclusive endorsement.

© 2026 Global Dental Sourcing Consortium | Prepared by Senior Dental Equipment Consultants | Version 2.1.3

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Electrocautery Machines

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental electrocautery machine in 2026? | Dental electrocautery machines in 2026 typically operate on standard 100–240V AC, 50/60 Hz input, making them compatible with global electrical systems. However, clinics must verify local voltage stability and ensure grounding compliance. Units with built-in voltage regulators and surge protection are recommended, especially in regions with inconsistent power supply. Always confirm compatibility with your clinic’s electrical infrastructure during procurement. |

| 2. Are spare parts readily available for electrocautery units, and what components commonly require replacement? | Yes, reputable manufacturers and distributors ensure long-term availability of critical spare parts such as active electrodes, return electrodes (if applicable), footswitches, handpieces, and sterilizable tips. As of 2026, OEMs are required to guarantee spare parts support for a minimum of 7 years post-discontinuation. We recommend purchasing service kits and stocking high-wear components to minimize downtime. Distributors should confirm parts inventory and lead times before finalizing bulk orders. |

| 3. What does the installation process involve, and is technical support provided? | Installation of a dental electrocautery machine is typically straightforward and includes unit mounting (benchtop or trolley), power connection, and integration with dental chair systems (if applicable). Most manufacturers offer on-site or remote installation support through certified technicians. In 2026, AI-assisted setup guides and QR-code-linked video tutorials are standard. For clinics, ensure network compatibility if the unit supports digital logging or IoT-enabled maintenance alerts. |

| 4. What warranty coverage is standard for dental electrocautery machines in 2026? | As of 2026, the industry standard is a 3-year comprehensive warranty covering parts, labor, and electronic components. Premium models may offer extended 5-year warranties with optional service-level agreements (SLAs). The warranty typically excludes consumables (e.g., tips, footswitch membranes) and damage from improper use or unqualified servicing. Distributors should verify warranty transferability for resale and confirm international coverage for cross-border clients. |

| 5. How can clinics ensure continued support after the warranty period expires? | Clinics should enroll in post-warranty service programs offered by manufacturers or authorized service partners. These programs include annual preventive maintenance, priority repair response, software updates (for smart-enabled units), and discounted spare parts. In 2026, predictive diagnostics via embedded sensors allow proactive maintenance scheduling. Distributors are advised to promote service contracts at point of sale to ensure long-term client retention and equipment reliability. |

Need a Quote for Dental Electrocautery Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160