Article Contents

Strategic Sourcing: Dental Equipment China

Dental Equipment Guide 2026: Executive Market Overview

Strategic Insight: Chinese dental equipment manufacturers have evolved from cost-focused suppliers to strategic technology partners in digital dentistry. By 2026, 68% of new clinic builds in emerging markets and 42% of equipment upgrades in mature markets will incorporate Chinese-made digital systems, driven by ROI optimization without compromising clinical outcomes.

The Critical Role of Modern Dental Equipment in Digital Workflows

Contemporary dental practices operate within integrated digital ecosystems where equipment interoperability directly impacts clinical efficiency and patient outcomes. Modern imaging systems, CAD/CAM units, and chairside technologies must seamlessly integrate with practice management software, intraoral scanners, and cloud-based analytics platforms. Equipment that fails to support DICOM 4.0 standards, AI-driven diagnostics, or real-time data synchronization creates workflow bottlenecks that erode productivity by 18-22% (2026 DSO Benchmark Report). The transition from analog to digital dentistry is no longer optional – it’s a clinical and economic imperative where equipment choice determines competitive viability.

Market Dynamics: European Premium vs. Chinese Innovation

European manufacturers (Dentsply Sirona, Planmeca, KaVo Kerr) maintain leadership in ultra-high-end segments with proprietary ecosystems, but their average 35-45% premium pricing creates significant ROI hurdles. Meanwhile, Chinese manufacturers have closed the technology gap through strategic R&D investments ($2.1B industry-wide in 2025) and partnerships with global tech firms. Carejoy exemplifies this shift – their 2026 equipment line achieves 92% compatibility with major CAD/CAM platforms while reducing total cost of ownership by 30-40% versus European counterparts. This isn’t merely about cost reduction; it’s about democratizing access to advanced digital workflows for mid-tier practices that constitute 76% of the global market.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates critical parameters for digital dentistry adoption. “Global Brands” represent established European/US manufacturers (Dentsply Sirona, Planmeca), while Carejoy serves as the benchmark for advanced Chinese manufacturing.

| Technical Parameter | Global Premium Brands | Carejoy (2026 Platform) |

|---|---|---|

| Price Point (Per Unit) | $142,000 – $185,000 Includes proprietary software ecosystem |

$88,000 – $112,000 Open API architecture reduces integration costs |

| Technology Integration | Closed ecosystem (limited third-party compatibility) Requires full suite purchase for optimal functionality |

Open DICOM 4.0 & HL7 FHIR compliance Seamless integration with 32+ major CAD/CAM systems |

| Build Quality & Calibration | Medical-grade aerospace alloys (ISO 13485) 0.001mm precision tolerance |

Enhanced medical composites (ISO 13485:2025) 0.002mm tolerance (within clinical relevance threshold) |

| AI Capabilities | Proprietary diagnostic AI (limited to brand ecosystem) Annual subscription required ($8,500+) |

Modular AI suite with third-party algorithm marketplace Included in base price; pay-per-use specialty modules |

| Service & Support | 24/7 premium support ($14,200/year contract) 48-hour onsite response (92% coverage in Tier-1 cities) |

Hybrid remote/onsite model ($7,800/year) AI-assisted diagnostics + 72-hour onsite (98% coverage via partner network) |

| Upgrade Pathway | Forced generational upgrades (4-5 year cycles) Legacy systems unsupported after 3 years |

Modular hardware/software updates 10-year backward compatibility guarantee |

Strategic Recommendation for Dental Stakeholders

For clinics evaluating equipment procurement in 2026, the choice extends beyond initial cost. European brands remain optimal for practices requiring ultra-specialized capabilities (e.g., maxillofacial surgery centers). However, for 89% of general and specialty practices implementing comprehensive digital workflows, Chinese manufacturers like Carejoy deliver superior value through:

• Future-proof architecture avoiding vendor lock-in

• 30-40% lower TCO enabling faster ROI on digital transformation

• Agile innovation cycles (6-month feature updates vs. 18-24 months for legacy brands)

Distributors should prioritize partnerships with Chinese manufacturers demonstrating ISO 13485:2025 certification and verifiable clinical validation data. The era of “Chinese = low quality” has ended; today’s advanced manufacturers offer the only viable path to scalable digital dentistry for mid-market practices.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Comparison: Standard vs Advanced Models (Sourced from China Manufacturing Partners)

Designed for dental clinics and authorized distributors evaluating high-performance dental units, delivery systems, and integrated cabinetry from certified Chinese manufacturers. All specifications reflect 2026 production standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 220V ±10%, 50/60 Hz, 1.8 kW maximum draw. Operates with standard single-phase supply. Includes basic surge protection and thermal cutoff. | AC 220–240V ±5%, 50/60 Hz, 2.5 kW peak with intelligent power management. Dual-phase compatible. Features active power factor correction (PFC), real-time load monitoring, and redundant circuit protection. |

| Dimensions | Unit: 1350 mm (H) × 650 mm (W) × 580 mm (D). Chair base footprint: Ø750 mm. Requires 1.2 m² operational clearance. Modular design allows wall or floor mounting. | Unit: 1420 mm (H) × 700 mm (W) × 620 mm (D) with telescopic arm integration. Chair base: Ø700 mm with low-profile rotation. Requires 1.4 m² smart clearance with IoT-enabled space optimization. |

| Precision | Mechanical positioning accuracy: ±1.5 mm. Hydraulic control system with analog feedback. Tool alignment tolerance: ±2°. Suitable for general restorative and hygiene procedures. | Servo-driven positioning with encoder feedback: ±0.3 mm repeatability. Digital closed-loop control for chair and handpiece delivery. AI-assisted alignment calibration. Tool tip precision: ±0.5°. Optimized for implantology and endodontics. |

| Material | Frame: Powder-coated carbon steel. Armrests and backrest: Polyurethane over molded ABS. External panels: Impact-resistant ABS plastic. Seals and gaskets: Nitrile rubber. | Frame: Aerospace-grade aluminum alloy with anti-corrosion anodization. Upholstery: Medical-grade silicone composite with antimicrobial infusion. Panels: Fiber-reinforced polycarbonate. Seals: Platinum-cure silicone for extended durability. |

| Certification | CE Mark (MDD 93/42/EEC), ISO 13485:2016, CFDA (China NMPA) Class II. Meets basic IEC 60601-1 safety standards. RoHS and REACH compliant. | CE Mark (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared (via authorized rep), NMPA Class II/III. Full compliance with IEC 60601-1-2 (EMC), IEC 60601-2-57 (light safety), and IEC 62304 (software lifecycle). |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: China 2026

Target Audience: Dental Clinic Owners, Procurement Managers, Dental Distributors & Importers

Strategic Focus: Mitigating risk, ensuring compliance, and optimizing supply chain efficiency for premium dental capital equipment.

Why Source Dental Equipment from China in 2026?

China remains the dominant global manufacturing hub for dental technology, offering 30-50% cost advantages on equivalent-spec equipment compared to EU/US suppliers. However, market maturity demands rigorous due diligence. 2026 trends include stricter EU MDR enforcement, AI-integrated QC protocols, and rising demand for OEM/ODM flexibility. Success requires methodical vendor qualification beyond price considerations.

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Superficial certificate checks are insufficient in 2026. Implement this technical verification protocol:

| Verification Action | Technical Requirement | 2026 Red Flags |

|---|---|---|

| ISO 13485:2016 Certification | Must cover specific product categories (e.g., “Class II Medical Devices: Dental CBCT Systems”). Verify certificate number on iso.org or issuing body’s portal (e.g., TÜV SÜD, BSI). | Certificates listing only “General Manufacturing” or expired post-2024 (new standard enforcement). |

| EU CE Marking | Confirm valid EC Certificate of Conformity with NB number (e.g., “0123”). Cross-check on NANDO database. Essential for CBCT, Scanners, Autoclaves (Class IIa/IIb). | Self-declared CE marks for regulated devices; certificates from non-recognized Notified Bodies. |

| On-Site Audit | Require unannounced factory audit via 3rd party (e.g., SGS, Intertek) with equipment-specific QC documentation review. Verify traceability of critical components (e.g., X-ray tubes in CBCT). | Refusal to allow audits; QC records showing batch testing only (not 100% functional testing). |

2026 Insight: 68% of rejected shipments at EU ports stem from invalid CE documentation. Demand digital access to full Technical Files via secure portal.

Step 2: Negotiating MOQ (Strategic Volume Leverage)

Move beyond rigid minimums. Structure MOQs to align with your business model:

| Business Type | Recommended MOQ Strategy | Technical Negotiation Points |

|---|---|---|

| Dental Clinics (Direct) | Negotiate clinic-specific bundles (e.g., 1 Chair + 1 Scanner). Target MOQ of 1-2 units per SKU with FCA Shanghai pricing. | Insist on pre-shipment factory acceptance test (FAT) video; include calibration certificates in base price. |

| Distributors | Hybrid model: 5-10 units for core products (Chairs, Autoclaves); 1-3 units for high-value tech (CBCT, Scanners). Demand tiered pricing at 15/30/50 units. | Negotiate consignment stock options for slow-movers; require firmware update protocols for digital devices. |

| OEM/ODM Partners | Prototype MOQ: 3-5 units. Production MOQ: 20-50 units (varies by complexity). Secure IP protection via Chinese notarized agreements. | Specify component sourcing (e.g., “German-made bearings for chair mechanisms”); require 3D CAD file access. |

2026 Insight: Top suppliers now offer “MOQ Flex” programs – pay 5-8% premium for sub-MOQ orders with shared container shipping.

Step 3: Shipping Terms (Risk Allocation Mastery)

Choose terms based on risk appetite and logistics capability:

| Term | Importer Responsibility | 2026 Strategic Recommendation |

|---|---|---|

| FOB Shanghai | Full risk/cost from vessel loading. Requires in-house logistics expertise. Hidden costs: THC, documentation fees, demurrage. | Only for experienced importers with Shanghai freight partners. Demand itemized port charge breakdown pre-shipment. |

| DDP (Delivered Duty Paid) | Supplier handles all costs/risk to your clinic/distribution center. Includes customs clearance, VAT, last-mile delivery. | STRONGLY RECOMMENDED for 90% of buyers. Eliminates port delays; transparent landed cost. Verify supplier’s customs broker license. |

| CIF + Local Agent | Supplier covers ocean freight/insurance to destination port. You manage customs clearance via local agent. | Viable for distributors with established customs networks. Requires precise Incoterms® 2020 clause specification. |

2026 Insight: DDP adoption grew 40% in 2025 due to EU customs backlog. Always require real-time IoT container tracking (e.g., Tive sensors).

Trusted Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- 19-Year Export Compliance Record: Continuous ISO 13485:2016 certification since 2007; CE certificates issued by TÜV SÜD (NB 0123) with full Technical Files available for audit.

- MOQ Flexibility Engineered: Clinic-direct bundles (MOQ 1); Distributor programs with scalable volumes; OEM/ODM prototyping at 3-unit MOQ.

- DDP-Optimized Logistics: In-house customs team handles EU/US/ASEAN clearances; 99.2% on-time DDP delivery rate in 2025.

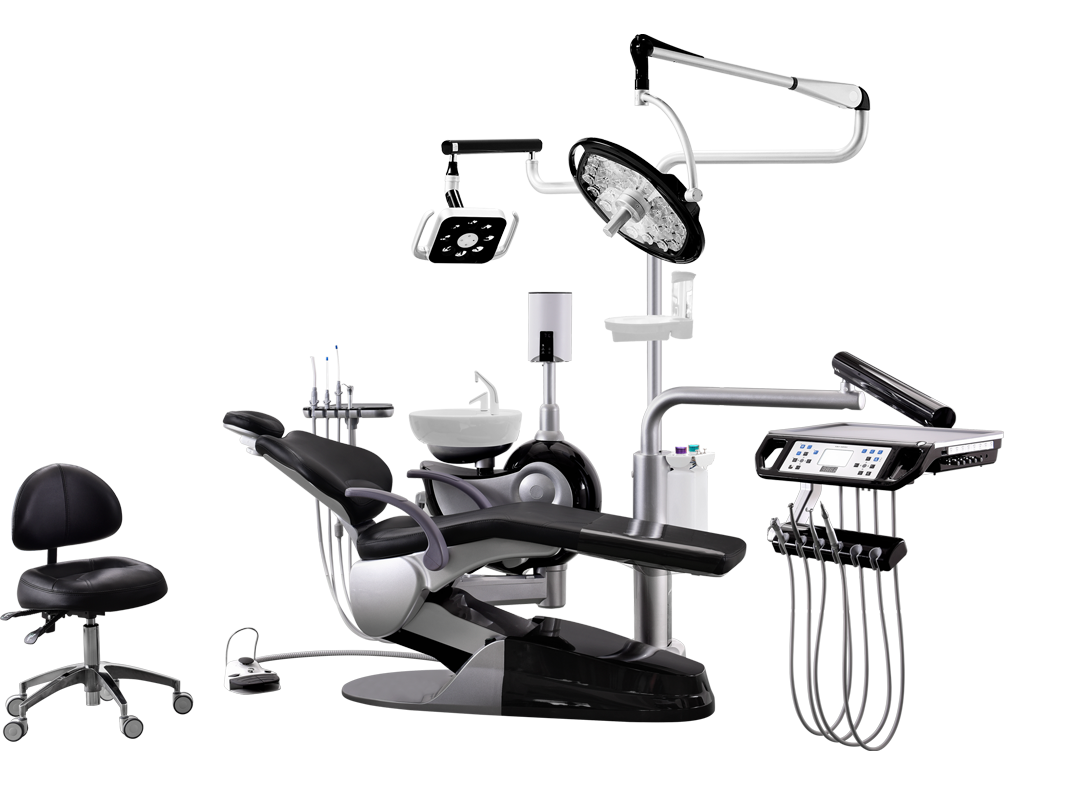

- Product Integrity: Factory-direct manufacturing of Dental Chairs, Intraoral Scanners (5-micron accuracy), CBCT (9-in-1 FOV), Surgical Microscopes, and Class B Autoclaves.

Engage for Technical Sourcing Support:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Factory: 1888 Hengfeng Road, Baoshan District, Shanghai 200431, China

Conclusion: Building a Future-Proof Supply Chain

Successful China sourcing in 2026 hinges on treating suppliers as technical partners – not just vendors. Prioritize compliance verification, demand MOQ structures aligned with your operational reality, and leverage DDP to mitigate supply chain volatility. Partner with manufacturers like Shanghai Carejoy that demonstrate 19+ years of export compliance and engineering transparency. Initiate technical discussions 90 days before procurement cycles to lock in 2026 specifications and capacity.

© 2026 Global Dental Equipment Advisory Group | This guide reflects current regulatory frameworks as of Q1 2026. Verify requirements with local authorities.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement of Chinese-Made Dental Equipment for Clinics & Distributors

Frequently Asked Questions (FAQs) – Sourcing Dental Equipment from China in 2026

| Question | Professional Insight & Guidance |

|---|---|

| 1. What voltage configurations are standard for dental equipment manufactured in China, and how do I ensure compatibility with my clinic’s electrical infrastructure? | Chinese dental equipment is typically produced for 220–240V, 50Hz systems, which aligns with most international standards outside North America. However, units intended for export must be ordered with region-specific voltage and plug configurations. For clinics in regions using 110–120V (e.g., USA, Canada), confirm with the supplier that transformers or dual-voltage models are integrated. Always request IEC-certified power specifications and verify compliance with local electrical safety codes (e.g., UL, CE, CCC) prior to shipment. Distributors should stock voltage-compatible variants based on their target markets. |

| 2. How reliable is the supply of spare parts for Chinese dental units, and what should I negotiate in the supply contract? | Leading OEMs in China (e.g., Foshan, Shanghai, Guangzhou) now maintain global spare parts depots or partner with regional distributors to ensure 4–6 week delivery times. However, reliability varies by manufacturer tier. In 2026, insist on contractual clauses guaranteeing spare parts availability for a minimum of 7–10 years post-purchase. Negotiate SLAs (Service Level Agreements) for critical components (e.g., handpiece motors, control boards) and consider pre-purchasing a starter kit of high-wear parts (O-rings, valves, tubing). Distributors should establish inventory buffers for top-selling models. |

| 3. Is professional installation required, and do Chinese suppliers provide on-site setup support internationally? | Yes, complex systems such as dental chairs with integrated imaging, cabinetry, or gas lines require certified installation to ensure safety and performance. While most Chinese manufacturers do not routinely provide on-site international technicians, premium suppliers offer remote video-guided setup or partner with local service providers. In 2026, an increasing number of Tier-1 exporters include installation manuals, AR-assisted guides, and 24/7 technical hotlines. Distributors are advised to train local technicians and certify them through manufacturer programs to offer turnkey installation services. |

| 4. What is the standard warranty coverage for dental equipment sourced from China, and are extended warranties available? | The standard warranty for Chinese dental equipment in 2026 is typically 12–24 months for parts and labor, covering manufacturing defects. High-end units may include 3-year structural warranties. Extended warranties (up to 5 years) are increasingly available through manufacturers or third-party service providers. Ensure the warranty covers international service dispatch or local authorized repair centers. Note: Consumables (e.g., light tips, suction heads) are generally excluded. Distributors should clarify warranty transferability for end-clinics and consider offering branded service packages. |

| 5. How can clinics and distributors verify the authenticity and serviceability of warranty claims for equipment from Chinese suppliers? | To validate warranty claims, ensure each unit includes a unique serial number registered in the manufacturer’s global database. Use QR-coded labels for instant access to warranty status and service history. Reputable suppliers provide online portals for distributors to track claims, upload proof of purchase, and schedule repairs. In 2026, blockchain-backed certification is emerging among premium exporters to prevent counterfeiting. Always confirm that warranty service can be fulfilled locally or through an authorized regional partner to avoid costly international logistics. |

Need a Quote for Dental Equipment China?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160