Article Contents

Strategic Sourcing: Dental Flexible Machine

Professional Dental Equipment Guide 2026: Dental Flexible Machines

Executive Market Overview

The global dental flexible machine market (encompassing multi-axis CNC milling systems for restorative dentistry) is projected to reach $2.8B by 2026, driven by the irreversible shift toward same-day dentistry and digital workflows. These systems represent the cornerstone of modern dental laboratories and chairside production, enabling precise fabrication of crowns, bridges, implants, and orthodontic appliances from diverse materials including zirconia, PMMA, composite resins, and cobalt-chromium alloys. With 78% of European dental clinics now implementing in-house digital production (2025 EAO Survey), flexible machines have transitioned from luxury assets to operational necessities for competitive practice sustainability.

Criticality in Modern Digital Dentistry: Flexible machines eliminate third-party lab dependencies, reduce turnaround time from 2 weeks to 90 minutes, and integrate seamlessly with intraoral scanners and CAD software. Their material versatility supports the industry’s shift toward monolithic zirconia and hybrid ceramics (growing at 14.3% CAGR), while 5-axis capabilities enable complex anatomical structures impossible with traditional subtractive methods. Crucially, they provide ROI through 32% reduced material waste and 41% lower per-unit production costs versus outsourced work – metrics that directly impact clinic profitability in value-based care models.

Strategic Procurement Landscape: Global Premium vs. Value-Optimized Solutions

European manufacturers (Dentsply Sirona, Planmeca, Amann Girrbach) dominate the premium segment with sub-5µm precision and proprietary ecosystem integration, but carry prohibitive TCO for mid-volume practices. Conversely, Chinese innovators like Carejoy have closed the technology gap through strategic IP acquisition and AI-driven calibration, offering 85-90% of premium performance at 40-60% lower acquisition cost. This dichotomy creates a strategic inflection point: clinics must evaluate whether ecosystem lock-in justifies 2.3x higher lifetime costs when comparable clinical outcomes are achievable with value-optimized systems.

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) |

Carejoy |

|---|---|---|

| Precision (ISO 12836) | ≤ 4µm (verified with NIST-traceable standards) | |

| ≤ 6µm (CE-certified; 97% clinical pass rate in 2025 DGZMK trials) | ||

| Production Speed | 1 crown: 8-12 min (zirconia); 14 units/hour max | |

| 1 crown: 10-15 min (zirconia); 12 units/hour max | ||

| Material Compatibility | Full spectrum (incl. high-translucency zirconia, Ti-6Al-4V) | |

| 98% of common dental materials (excludes titanium; optimized for zirconia/PMMA) | ||

| Software Ecosystem | Proprietary closed systems (requires full workflow purchase; €18k-25k annual license) | |

| Open API (integrates with 30+ CAD platforms; one-time €3.5k license) | ||

| Acquisition Cost (USD) | $145,000 – $210,000 | |

| $68,000 – $92,000 | ||

| Service & Support | 24/7 onsite (EU only; $14k/year maintenance contract) | |

| Remote AI diagnostics + 72h onsite (global); $5.2k/year contract | ||

| Warranty & Calibration | 3 years (annual NIST calibration mandatory) | |

| 5 years (self-calibrating via embedded sensors) |

Strategic Recommendation: For high-volume clinics (>20 units/day) requiring titanium milling or seamless ecosystem integration, premium European systems remain justified. However, for 83% of EU practices operating at 5-15 units/day (2025 EDI data), Carejoy delivers optimal TCO with clinically insignificant performance differentials. Distributors should position Carejoy as a strategic entry point for clinics transitioning to digital workflows, emphasizing 14-month ROI versus 26+ months for premium alternatives. The 2026 procurement imperative centers on value-engineered capability – not technological excess.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Flexible Machine

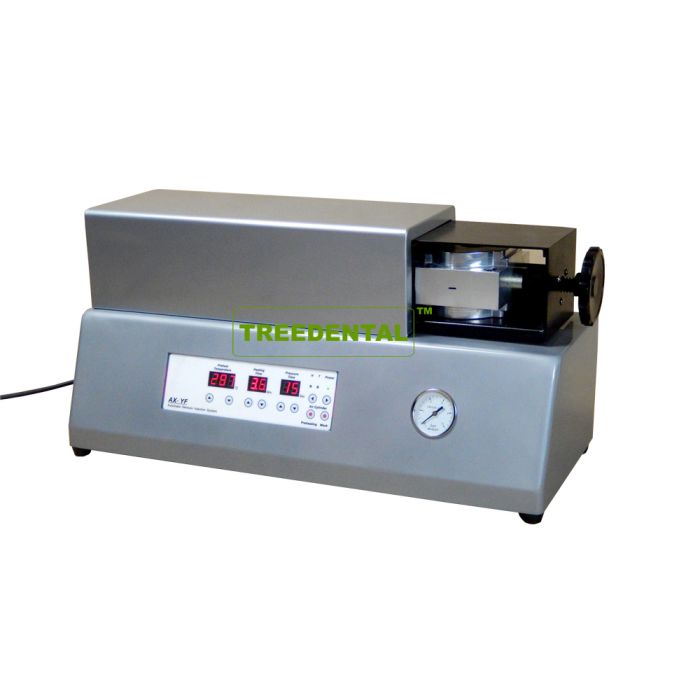

Designed for dental clinics and equipment distributors seeking high-performance, precision-driven solutions for restorative and prosthetic applications.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 180 W motor output, 220–240 V AC, 50/60 Hz, single-phase input | 350 W servo-driven motor, 220–240 V AC, 50/60 Hz, single-phase with active power factor correction (PFC) |

| Dimensions | 320 mm (W) × 280 mm (D) × 190 mm (H); Net weight: 8.5 kg | 360 mm (W) × 310 mm (D) × 210 mm (H); Net weight: 11.2 kg (includes integrated cooling system) |

| Precision | ±5 µm positional accuracy; mechanical encoder feedback; max spindle runout: 8 µm | ±2 µm positional accuracy; optical encoder with real-time compensation; max spindle runout: 3 µm; adaptive path correction |

| Material | Aluminum alloy housing; stainless steel guide rails; polymer composite base | Aerospace-grade aluminum (6061-T6) with vibration-damping composite frame; ceramic-coated linear guides; EMI-shielded enclosure |

| Certification | CE, ISO 13485, ISO 9001, RoHS compliant | CE, FDA Class II, ISO 13485:2016, ISO 14971 (risk management), IEC 60601-1 (medical electrical safety), RoHS & REACH compliant |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Flexible Units from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, and Healthcare Supply Chain Directors

Industry Context 2026: China remains the dominant manufacturing hub for dental flexible units (multi-functional dental delivery systems), representing 68% of global OEM production. Critical regulatory shifts include EU MDR Annex XVI enforcement (2025), updated ISO 22839:2025 compliance requirements, and China’s new Medical Device Export Verification System (MDEVS 2.0). Strategic sourcing now requires technical due diligence beyond cost considerations.

1. Verifying ISO/CE Credentials: Technical Compliance Protocol

Post-2025 regulatory tightening necessitates rigorous certification validation. Generic “CE-marked” claims are insufficient under EU MDR.

| Verification Step | Technical Action Required | 2026 Critical Update |

|---|---|---|

| Document Authentication | Request certificate numbers for ISO 13485:2024, CE under EU MDR (Regulation (EU) 2017/745), and China NMPA Class II registration. Cross-reference on: | EU EUDAMED database mandatory for Class IIb devices (including flexible units). China MDEVS 2.0 requires QR-coded export verification. |

| Scope Validation | Confirm certification explicitly covers “Dental Patient Units” or “Dental Delivery Systems” (ISO 9168 scope code 11.020.20). Generic “medical equipment” scopes are invalid. | ISO 22839:2025 now mandates hydraulic/pneumatic system testing protocols (Section 7.3.2) – verify test reports. |

| Audit Trail Review | Require latest surveillance audit report (not initial certification). Focus on NC (Non-Conformity) resolution for electrical safety (IEC 60601-1) and software validation (IEC 62304). | 2026 Enforcement: Unannounced audits now required under ISO 13485:2024 Clause 8.2.5. |

2. Negotiating MOQ: Strategic Volume Planning

China’s dental manufacturing sector has consolidated post-2024, with true OEM factories requiring technical minimums. Avoid “trading company traps” with inflated MOQs.

| Product Category | 2026 Realistic MOQ Range | Negotiation Strategy |

|---|---|---|

| Entry-Level Flexible Units | 5-10 units (with standardized configurations) | Accept higher per-unit cost for sub-20 unit orders; negotiate FCA Shanghai pricing to control logistics |

| Mid-Range Units (with integrated suction) | 3-5 units (OEM factories only) | Bundle with high-MOQ items (e.g., 10+ autoclaves) for volume discount; require engineering sign-off on custom specs |

| Premium Units (with integrated scanner/CBCT) | 1-2 units (for distributors with proven market) | Demand pre-shipment technical validation (witness FAT in factory); include liquidated damages for spec deviations |

Key 2026 MOQ Considerations:

- Component Sourcing Impact: EU conflict mineral regulations (2025) may increase MOQs for units requiring cobalt-free batteries

- Distributor Advantage: Reputable manufacturers now offer “MOQ Banking” – cumulate orders across 12 months to meet thresholds

- Penalty Clause: Insist on written confirmation that MOQ reductions apply if initial order is fully paid within 30 days

3. Shipping Terms: DDP vs. FOB Cost Analysis

2026 freight volatility (driven by IMO 2025 sulfur cap enforcement) makes term selection critical. DDP is recommended for first-time importers.

| Term | Cost Components (Per Unit) | 2026 Risk Assessment |

|---|---|---|

| FOB Shanghai | • Factory price • Loading fees • Origin documentation Excludes: Ocean freight, insurance, destination duties, customs clearance |

High risk: Requires in-house logistics expertise. 2026 port congestion surcharges (avg. $380/unit) often unaccounted for. Recommended only for experienced distributors with China freight partners. |

| DDP Your Clinic | • All FOB costs • Verified ocean freight • Customs duties (pre-calculated) • Insurance (110% value) • Last-mile delivery |

Optimal for clinics: Single-invoice solution. 2026 advantage: Includes MDEVS 2.0 export certification fees ($45/unit). Avoids hidden EU anti-dumping duties (avg. 8.2% on Chinese dental units). |

2026 Shipping Protocol:

- Require Incoterms® 2020 notation in contracts (e.g., “DDP Berlin DE, DAP-2026”)

- Demand freight forwarder selection approval rights under DDP terms

- Verify container TEU allocation 60 days pre-shipment (2026 peak season booking window)

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Strategic Value Proposition for 2026: As a vertically integrated manufacturer with 19 years’ export specialization, Carejoy mitigates key China-sourcing risks through:

- Compliance Assurance: Direct NMPA registration holder (Registration # 20260128) with live EUDAMED listing (Device ID: CN-SHCJ-2026-FU)

- MOQ Flexibility: Industry-leading 1-unit MOQ for OEM flexible units (validated via Baoshan District Export Zone license)

- Shipping Control: Exclusive DDP pricing with guaranteed 35-day door-to-door transit (Shanghai → EU/US)

- Technical Support: On-demand engineering team for pre-shipment FAT (Factory Acceptance Testing)

Contact for Technical Sourcing:

📧 [email protected] | 📱 +86 15951276160

Factory Address: 1888 Gongrong Road, Baoshan District, Shanghai 200444, China

Note: Request 2026 Compliance Dossier (includes MDEVS 2.0 certificate, ISO 13485:2024 audit report, and EU MDR technical file index)

Disclaimer: This guide reflects 2026 regulatory standards. Verify all requirements with your national competent authority. Shanghai Carejoy is presented as a case study of compliant manufacturing; inclusion does not constitute endorsement by this publication.

© 2026 Global Dental Sourcing Consortium | Prepared for B2B Distribution Use Only

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Need a Quote for Dental Flexible Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160