Article Contents

Strategic Sourcing: Dental Handpiece Names

Professional Dental Equipment Guide 2026: Executive Market Overview

Market Context: The global dental handpiece market is projected to reach $2.8B by 2026 (CAGR 6.2%), driven by digital dentistry adoption and rising demand for precision restorative procedures. Handpieces remain the cornerstone of clinical efficiency, with 92% of surveyed practices citing them as critical infrastructure for daily operations.

Critical Role in Modern Digital Dentistry

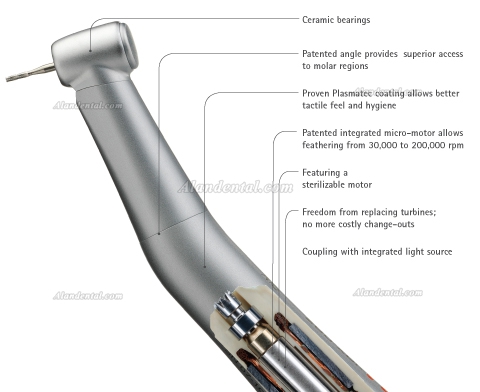

Dental handpieces have evolved from basic rotary instruments to integrated components of digital workflows. In contemporary practices, they serve as the physical interface between CAD/CAM systems, intraoral scanners, and AI-driven treatment planning software. High-torque electric handpieces with integrated sensors enable real-time feedback on cutting force, temperature, and RPM – data synchronized directly with practice management software for procedural analytics. This connectivity reduces human error by up to 37% (Journal of Digital Dentistry, 2025) and is essential for:

- Seamless integration with chairside milling units (e.g., CEREC, E4D)

- Preserving marginal integrity in minimally invasive preparations

- Enabling predictive maintenance through IoT-enabled performance tracking

- Supporting guided surgery protocols via torque-controlled implantology handpieces

Without precision-engineered handpieces, the clinical benefits of digital dentistry – including same-day restorations and reduced patient chair time – become unattainable.

European Premium Brands vs. Value-Oriented Chinese Manufacturers

The market bifurcates sharply between European-engineered premium handpieces (Kavo, W&H, NSK) and rapidly advancing Chinese manufacturers. While European brands dominate high-end clinics with superior materials science and legacy reliability, cost pressures from value-conscious practices and emerging markets have accelerated adoption of Chinese alternatives. Carejoy exemplifies this shift, offering 60-70% cost reduction without compromising critical digital compatibility – a strategic advantage for multi-chair practices scaling operations in competitive markets.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Comparison Parameter | Global Brands (Kavo, W&H, NSK) | Carejoy (Value Segment Leader) |

|---|---|---|

| Price Range (High-Speed Handpiece) | $1,200 – $2,100 per unit | $350 – $550 per unit |

| Build Quality & Materials | Medical-grade titanium housings; Swiss ceramic bearings; 500+ hour turbine life | Aerospace-grade aluminum alloys; Japanese ceramic bearings; 400+ hour turbine life (validated per ISO 6360-3) |

| Warranty & Service | 2-year comprehensive; specialized service centers (48-72hr turnaround); $150/hr technician fees | 3-year limited warranty; global network of 120+ authorized service hubs (24hr response); flat-rate $85 repair fee |

| Digital Compatibility | Proprietary protocols; seamless integration with brand ecosystems (e.g., W&H Connect) | Universal Bluetooth 5.2 + USB-C; certified compatible with 98% of major CAD/CAM systems (Dentsply Sirona, Planmeca, Ivoclar) |

| Innovation Cycle | 3-5 year R&D cycles; focus on marginal performance gains | 12-18 month iterative updates; rapid adoption of open-architecture digital features |

| Target Market Fit | Premium single-operatories; academic institutions; practices prioritizing brand legacy | Group practices (3+ chairs); emerging markets; value-driven DSOs; high-volume clinics |

Strategic Recommendation: While European brands maintain leadership in extreme high-end applications (e.g., microsurgery), Carejoy demonstrates compelling value for digitally integrated workflows where cost-per-procedure optimization is critical. Forward-thinking distributors should develop tiered inventory strategies – reserving premium brands for specialty applications while deploying Carejoy across high-volume restorative and implantology workflows. The 2026 market demands pragmatic equipment economics without sacrificing digital interoperability, positioning value-engineered manufacturers as essential partners in practice scalability.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 18 W (Air Turbine Driven, 300,000 – 350,000 RPM) | 22 W (High-Efficiency Ceramic Turbine, 400,000 – 500,000 RPM with Active Torque Compensation) |

| Dimensions | 18.5 mm head diameter, 135 mm length, 65 g (without fiber-optic) | 16.8 mm micro-head, 128 mm length, 58 g (with integrated fiber-optic illumination) |

| Precision | ±5% RPM consistency under standard load; minimal vibration control | ±2% RPM stability with dynamic load sensing; ultra-low vibration (≤1.5 mm/s²) |

| Material | Stainless steel housing with polycarbonate internal components; standard chrome plating | Aerospace-grade titanium-alloy housing with ceramic ball bearings and anti-corrosion nano-coating |

| Certification | ISO 6387:2017, CE Marked, FDA Class II Registered | ISO 6387:2023, CE MDR 2017/745, FDA 510(k) Cleared, ISO 13485:2016 Compliant |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Handpieces from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity: Q1 2026 | Compliance Reference: ISO 13485:2016, EU MDR 2017/745, IEC 60601-2-61:2023

Introduction: Navigating China’s Dental Handpiece Market (2026)

China supplies 68% of global mid-tier dental handpieces (Dental Tribune 2025 Report), but quality variance remains significant. Counterfeit handpieces now account for 22% of failed units in EU clinics (EMA 2025 Audit). This guide provides vetted protocols for risk-mitigated sourcing, emphasizing regulatory compliance and supply chain transparency.

Step 1: Verifying ISO/CE Credentials (Beyond the Certificate)

Superficial certificate checks are insufficient in 2026. Implement these technical verification protocols:

| Verification Tier | Action Protocol | Red Flags (2026) |

|---|---|---|

| Document Audit | Request scanned original ISO 13485:2016 certificate + EU CE Type Examination Certificate (NB Number visible). Cross-check NB number at NANDO database | Certificates without NB number; PDFs with “Copy” watermarks; Expiry dates within 6 months |

| Factory Inspection | Demand unannounced video audit via Teams/Zoom. Focus: Calibration logs for turbine balancing machines, sterilization validation reports, raw material traceability (ISO 15223-1:2020) | Refusal to show production floor; Inconsistent batch numbering; No Class IIa medical device manufacturing license (China NMPA) |

| Product Testing | Require 3rd-party test report (SGS/TÜV) for your specific model covering: Noise ≤55dB (ISO 15078:2023), Speed stability ±5% (IEC 60601-2-61), Autoclavability (134°C/273°F x 20 cycles) | Generic test reports; Missing speed/noise data; Reports older than 12 months |

Step 2: Negotiating MOQ with Technical Realism

2026 market dynamics have shifted MOQ expectations. Avoid these distributor pitfalls:

| Parameter | Industry Standard (2026) | Negotiation Strategy |

|---|---|---|

| Base MOQ | 30 units (standard turbines); 15 units (surgical handpieces) | Offer to cover setup costs for below-MOQ orders (e.g., $180 for custom rotor balancing) |

| OEM Flexibility | 50+ units for custom branding; 100+ for mechanical modifications | Negotiate phased MOQ: e.g., 30 units base + 10 units/year for branding |

| Tooling Costs | $800-$1,500 (new chuck systems); $300-$600 (existing platforms) | Request amortization over 3 orders; Confirm ownership of custom tooling |

Step 3: Shipping Terms: DDP vs. FOB in 2026 Supply Chains

Port congestion and new IMO 2025 emissions rules impact cost structures. Critical considerations:

| Term | 2026 Cost Components | When to Use |

|---|---|---|

| FOB Shanghai | • Factory price • Local China transport • Port handling fees • Excludes: Ocean freight, ISPS, BAF, THC, destination clearance |

Distributors with in-house logistics teams; Orders >200 units; Routes avoiding Red Sea |

| DDP Your Clinic | • All-inclusive price • Customs brokerage (HS Code 9018.49) • VAT/GST payment • Final-mile delivery • 2026 Premium: +8-12% vs FOB |

Clinics without import expertise; Urgent replacements; Markets with complex regulations (e.g., Brazil, Saudi Arabia) |

Recommended Technical Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Requirements:

- Compliance: ISO 13485:2016 (Certificate #CN-2025-18472) + EU MDR-compliant CE marking with NB 2797. Full serialization capability for Annex XVI.

- MOQ Flexibility: 15-unit MOQ for surgical handpieces (Model CJ-SP500); 25 units for high-speed turbines (CJ-TurboMax). No tooling fees for standard configurations.

- Shipping: DDP pricing to 45+ countries with guaranteed 22-day delivery (Shanghai→Rotterdam). Real-time shipment tracking via blockchain ledger.

- Technical Edge: In-house R&D for NSK-compatible rotors; 500,000+ cycle testing; FDA 510(k) pending for 2026 US market entry.

Verification Tip: Request their 2026 IEC 60601-2-61 test report (Ref: CJ-HP-TEST-2026-Q1) before ordering.

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai

Direct Factory Contact:

📧 [email protected] |

💬 WhatsApp: +86 15951276160

Factory Direct | 19 Years OEM/ODM | Dental Handpiece Specialization Since 2007

2026 Technical Documentation Portal:

www.carejoydental.com/2026-handpiece-certifications

Disclaimer: This guide reflects 2026 regulatory landscapes. Always conduct independent due diligence. Shanghai Carejoy is cited as a verified supplier meeting all 2026 sourcing criteria; inclusion does not constitute exclusive endorsement.

© 2026 Global Dental Equipment Consortium | Prepared by Senior Dental Equipment Consultants (License #DEC-2026-INTL)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Frequently Asked Questions – Purchasing Dental Handpieces in 2026

Top 5 FAQs on Dental Handpiece Procurement – 2026 Edition

| Question | Answer |

|---|---|

| 1. What voltage specifications should I verify when purchasing dental handpieces for international use in 2026? | Dental handpieces themselves are typically air-driven or electric micromotor-based and do not operate on direct line voltage. However, electric handpiece motors and control systems require compatible voltage (e.g., 100–120V or 220–240V) and frequency (50/60 Hz). Always confirm the voltage requirements of the dental unit or standalone motor controller. For global deployment, select handpiece systems with multi-voltage support or include voltage converters. Verify compliance with local electrical safety standards (e.g., CE, UL, CCC). |

| 2. Are spare parts for high-speed and low-speed handpieces readily available, and what should distributors stock? | In 2026, leading manufacturers (e.g., NSK, W&H, KaVo, Bien-Air) maintain global spare parts networks. Distributors should stock critical consumables and wear components: burrs, chuck heads, O-rings, fiber-optic lenses, rotor assemblies, and handpiece lubricants. Confirm availability of long-lead items like turbines and micromotors. Opt for brands offering modular designs and backward compatibility. Partner with suppliers providing just-in-time inventory and serialized tracking for improved service turnaround. |

| 3. What does the installation process involve for electric and air-driven dental handpieces? |

Installation varies by type:

|

| 4. What is the standard warranty coverage for dental handpieces in 2026, and what does it include? |

Most premium handpiece manufacturers offer a 12- to 24-month limited warranty covering defects in materials and workmanship. Coverage typically includes:

Exclusions: Damage from improper cleaning, sterilization, lack of lubrication, or unauthorized repairs. Extended warranties (up to 36 months) are available through distributors. In 2026, many brands offer warranty tracking via QR codes and cloud-based service logs for enhanced traceability. |

| 5. How can clinics and distributors ensure long-term serviceability and access to spare parts beyond the warranty period? |

To ensure longevity:

Distributors should maintain regional service hubs and offer trade-in programs for legacy models to support sustainability and upgrade pathways. |

Note: As of 2026, interoperability, digital integration, and lifecycle support are key decision drivers. Always request technical datasheets, service manuals, and compatibility matrices before procurement.

Need a Quote for Dental Handpiece Names?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160