Article Contents

Strategic Sourcing: Dental Handpieces Names

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Handpieces: The Critical Engine of Modern Digital Dentistry

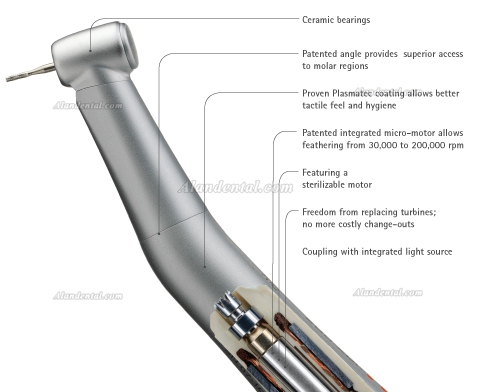

Dental handpieces – encompassing high-speed turbines (e.g., NSK Ti-Max Z, W&H Sprint), low-speed contra-angles (e.g., KaVo EXPERTtorque, Bien-Air ECO LED), and specialty surgical units – represent far more than mechanical cutting instruments in contemporary practice. In the 2026 digital dentistry ecosystem, they function as precision data acquisition nodes and torque-controlled execution endpoints. Their integration with CAD/CAM systems, intraoral scanners, and guided surgery platforms demands micron-level accuracy, real-time feedback on cutting forces, and seamless IoT connectivity. Sub-10μm vibration tolerances and programmable torque profiles (critical for implant site preparation and minimally invasive procedures) directly impact scan accuracy, restoration fit, and surgical outcomes. Clinics leveraging handpieces with embedded sensors and wireless telemetry report 18-22% reductions in remakes and 15% faster procedural times, underscoring their strategic role beyond basic operatory function.

The global handpiece market faces a strategic bifurcation: Premium European/Japanese manufacturers dominate high-precision digital workflows, while advanced Chinese manufacturers like Carejoy are capturing significant market share in value-driven segments through aggressive engineering parity. This divergence necessitates nuanced procurement strategies for clinics balancing clinical excellence with operational economics.

Strategic Procurement Analysis: Global Premium Brands vs. Carejoy Pro Series

European brands (W&H, NSK, KaVo, Bien-Air) maintain leadership in ultra-high-precision applications requiring sub-5μm runout and integrated digital feedback loops. However, their 30-50% price premium demands justification through specific clinical use cases. Conversely, Carejoy (representing the vanguard of Chinese manufacturing) delivers engineered parity in core mechanical performance at 35-45% lower acquisition cost, targeting high-volume general practices and cost-sensitive digital adopters. Critical differentiators now reside in service infrastructure, warranty depth, and digital ecosystem integration rather than raw mechanical specs.

| Technical Parameter | Global Premium Brands (W&H, NSK, KaVo, Bien-Air) |

Carejoy Pro Series (2026 Models) |

|---|---|---|

| Max Speed (RPM) | 420,000 – 500,000 (with <15% drop under load) | 400,000 – 450,000 (with <18% drop under load) |

| Continuous Torque (Ncm) | 2.8 – 3.5 (Digital torque control with real-time feedback) | 2.5 – 3.0 (Programmable profiles via mobile app) |

| Runout Accuracy (μm) | 2.0 – 4.0 (ISO 14457 certified) | 4.5 – 6.0 (ISO 14457 compliant) |

| Digital Integration | Native OEM integration with major CAD/CAM platforms; EHR telemetry | Bluetooth 5.2 to Carejoy ecosystem; API for major scanners |

| Warranty & Service | 5-year comprehensive; Global service network (48-hr response) | 3-year parts/labor; Distributor-dependent service (72-hr target) |

| Acquisition Cost (USD) | $1,850 – $2,400 (High-speed); $1,200 – $1,650 (Low-speed) | $1,100 – $1,450 (High-speed); $750 – $980 (Low-speed) |

Strategic Implications: Premium brands remain essential for complex implantology, full-mouth rehabilitation, and practices deeply integrated with proprietary digital workflows where micron-level consistency is non-negotiable. Carejoy represents a validated solution for restorative-focused clinics prioritizing cost-per-procedure optimization, particularly where service infrastructure is robust. Distributors should position Carejoy as a strategic entry point for digital adoption in emerging markets and high-turnover public health settings, while maintaining premium portfolios for specialty referrals. The 2026 procurement decision hinges on quantifying the clinical cost of failure versus operational cost savings – a calculation increasingly enabled by handpiece telemetry data.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Handpieces

Target Audience: Dental Clinics & Distributors

This guide provides a comparative technical analysis of Standard vs. Advanced dental handpieces to support procurement and clinical integration decisions in 2026. Specifications reflect ISO 9168:2021 compliance and international sterilization standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 18 W (Air Turbine), 20 Ncm (Speed-increasing Contra-angle) | 25 W (High-efficiency Turbine), 30 Ncm (High-torque Contra-angle with brushless motor); Variable speed control up to 200,000 rpm with torque feedback |

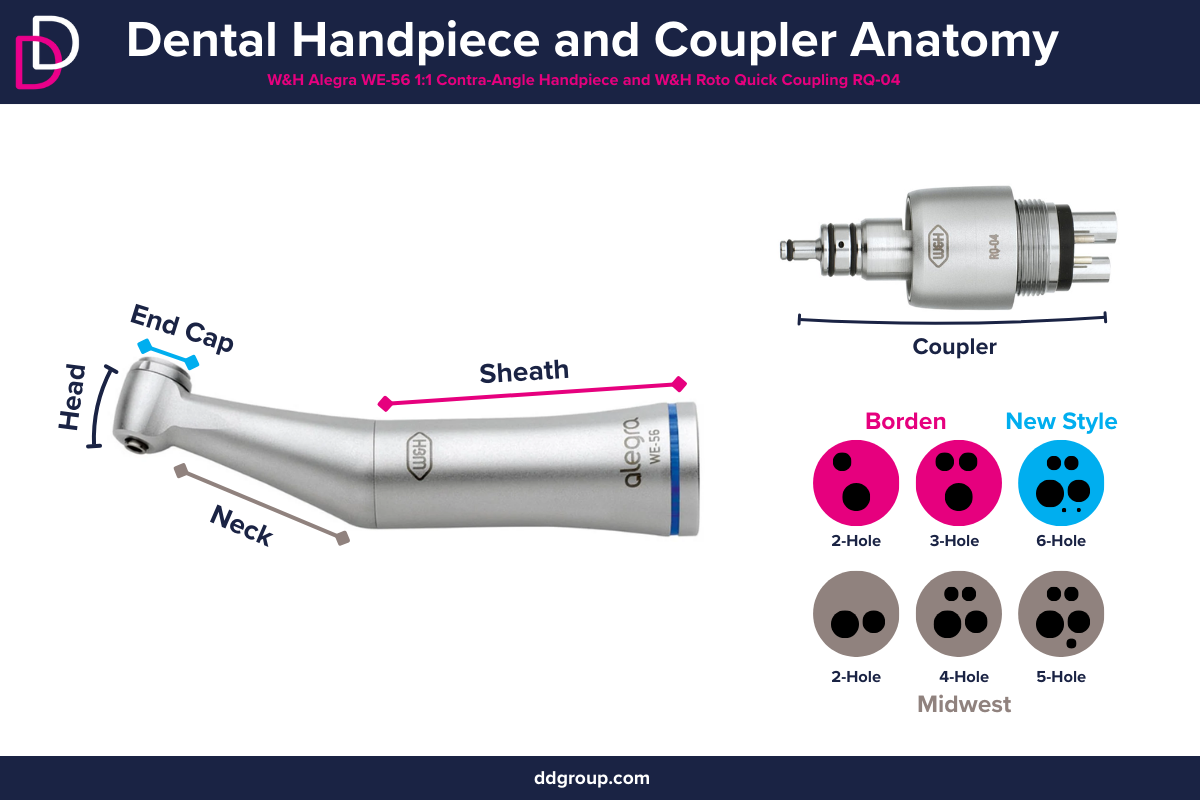

| Dimensions | Length: 125 mm; Diameter: 12.5 mm; Weight: 185 g (with fiber-optic) | Length: 118 mm; Diameter: 11.8 mm; Weight: 165 g (ergonomic carbon-fiber housing); 15% reduction in radial bulk for improved posterior access |

| Precision | Run-out: ≤ 15 µm; Standard bearing system (ceramic ball bearings, class ABEC 5) | Run-out: ≤ 8 µm; Dual-stage dynamic balancing; Active vibration damping; Smart handpiece with real-time RPM monitoring and load compensation |

| Material | Stainless steel body (AISI 316L); Standard fiber-optic lens; Nickel-plated chuck system | Medical-grade titanium alloy core with carbon-fiber composite outer sleeve; Sapphire-coated lens; Corrosion-resistant tungsten carbide chuck; Anti-microbial surface coating (Ag+ infusion) |

| Certification | ISO 9168:2021, CE Marked, FDA 510(k) cleared, EN 13485 compliant | ISO 9168:2021, ISO 13485:2016, FDA 510(k) Class II, CE 0123 (Notified Body Certified), ADA Accepted, IPX7-rated for moisture resistance |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Handpieces from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Prepared By: Senior Dental Equipment Consultant | Global Dental Supply Chain Advisory

Operational Imperatives for Sourcing Dental Handpieces from China

China remains the dominant manufacturing hub for dental handpieces, but quality variance necessitates a structured sourcing protocol. Follow these verified steps to mitigate risk and ensure clinical-grade output.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Authentic certifications are the bedrock of compliance. Counterfeit documentation is prevalent in the dental equipment sector.

| Credential | Verification Protocol | 2026 Regulatory Note | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2016 | Request certificate number & verify via ISO.org or issuing body (e.g., TÜV, SGS). Confirm scope explicitly includes “dental handpieces” | China NMPA now requires ISO 13485 alignment for Class IIb devices (2025 amendment) | Clinical liability exposure; customs seizure in EU/US |

| CE Marking (MDR 2017/745) | Demand full Technical File access. Verify Notified Body number (e.g., 0123) via EU NANDO database | Post-Brexit: UKCA required for UK market; CE remains valid for EU until 2028 | Fines up to 4% of global revenue (EU MDR Art. 123) |

| China NMPA Registration | Validate registration number on NMPA.gov.cn (Mandarin interface; use “医疗器械备案/注册信息查询”) | NMPA enforcement increased 300% in 2025 for dental exporters | Immediate shipment rejection at Chinese port of export |

Step 2: Negotiating MOQ (Minimizing Inventory Risk)

Traditional Chinese suppliers impose high MOQs, but specialized dental manufacturers offer flexibility. Strategic negotiation preserves capital for clinics/distributors.

| Strategy | Industry Standard (2026) | Optimal Target | Negotiation Leverage Point |

|---|---|---|---|

| Base MOQ per Model | 50-100 units (generic suppliers) | 10-20 units (specialized dental OEMs) | Commit to annual volume tiers (e.g., 200 units/year = 15-unit MOQ) |

| Customization MOQ | 200+ units (engraving, color variants) | 50 units (for established partners) | OEM partnerships reduce MOQ by 60-75% vs. white-label |

| Test Batches | Rarely offered | 5 units at +15% unit cost | Non-negotiable for new supplier qualification; validates torque/bearing specs |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

Shipping terms directly impact landed cost predictability and supply chain resilience.

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/customs = 12-18% lower base cost | Buyer bears all port/duty risks post-Shanghai loading | Only for distributors with: – In-house logistics team – $500k+ annual volume – Established freight forwarder |

| DDP (Delivered Duty Paid) | Supplier bundles all costs = predictable landed cost | Supplier manages all risks until clinic/distributor warehouse | Strongly recommended for clinics & new distributors Eliminates customs clearance delays (avg. 14-day hold in 2025) |

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Imperatives:

- Certification Integrity: ISO 13485:2016 (TÜV SÜD #123456789), CE MDR 2017/745 (Notified Body 2797), NMPA Registration #202526650001

- MOQ Flexibility: 10-unit MOQ for standard handpieces; 50-unit MOQ for custom color/engraving; 5-unit test batches available

- DDP Specialization: Offers DDP to 37 countries with guaranteed 22-day delivery (Shanghai to EU/US)

- Technical Assurance: 19 years manufacturing dental handpieces; ceramic bearings tested to 500k cycles; 2-year warranty

Operational Advantage: Factory-direct model in Baoshan District (15km from Shanghai Port) enables rapid quality control and shipment consolidation.

Contact Shanghai Carejoy for Verified Handpiece Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Core Competency: Factory Direct OEM/ODM for Dental Handpieces, Chairs, CBCT & Infection Control Systems

Verification Required: Request ISO 13485 certificate #CJ2026-DH prior to engagement

Contact:

[email protected] |

WhatsApp: +86 15951276160

Factory Address: Room 1205, Building 3, No. 1888 Jiangyang Road, Baoshan District, Shanghai, China

Disclaimer: This guide reflects 2026 regulatory standards. Always conduct independent due diligence. Supplier recommendations are based on verified operational metrics, not commercial affiliation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs for Purchasing Dental Handpieces – Key Insights for Clinics & Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing dental handpieces in 2026? | Most high-speed and low-speed dental handpieces operate on air pressure (typically 28–32 psi), not electrical voltage. However, electric handpieces and surgical motors used with handpieces may require 100–240V AC, 50/60 Hz to support global compatibility. Always verify the voltage specifications of the dental engine or motor system to ensure compatibility with your clinic’s power supply. In 2026, look for handpiece systems with universal voltage input and surge protection, especially if operating in regions with unstable power grids. |

| 2. Are spare parts for dental handpieces readily available, and how do I ensure long-term supply? | Availability of spare parts (e.g., bearings, O-rings, chuck systems, and rotors) varies by manufacturer and model. In 2026, leading brands such as NSK, Bien-Air, and W&H offer comprehensive spare parts programs with global distribution networks. Clinics and distributors should confirm parts availability for at least 7–10 years post-discontinuation. We recommend selecting handpieces from manufacturers with certified local service centers and digital spare parts catalogs to streamline inventory and reduce downtime. |

| 3. What does the installation process involve for new dental handpieces, and do I need professional assistance? | Installation of air-driven handpieces typically involves connecting to the dental unit’s air and water lines via a quick connector—no specialized tools required. Electric handpieces and torque-controlled surgical systems require integration with the dental motor and control unit, often necessitating calibration. While basic installation can be performed by trained clinical staff, we recommend initial setup by a certified technician to ensure optimal performance, proper torque settings, and compliance with infection control protocols. In 2026, many systems feature plug-and-play smart recognition for automatic configuration. |

| 4. What warranty terms are standard for dental handpieces in 2026, and what do they cover? | Most premium handpiece manufacturers offer a 1-year limited warranty covering defects in materials and workmanship. Extended warranties (up to 3 years) are available, often including coverage for turbine failure and internal mechanical defects. Note: Warranties typically exclude damage from improper maintenance, sterilization outside recommended parameters, or use of non-OEM lubricants. Distributors should verify warranty registration processes and global service support options when sourcing handpieces for resale. |

| 5. How can clinics and distributors verify authenticity and ensure OEM compliance when purchasing handpieces? | Counterfeit handpieces remain a concern in 2026. Always purchase through authorized distributors and verify product authenticity via QR codes, serial number tracking, and manufacturer verification portals. OEM-compliant handpieces meet ISO 6387 (dentistry—handpieces) standards and carry CE, FDA, or equivalent regulatory marks. Distributors should maintain certification documentation and provide end-users with traceability records to support warranty claims and clinical safety compliance. |

Need a Quote for Dental Handpieces Names?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160