Article Contents

Strategic Sourcing: Dental Hygiene Instrument Sharpening Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Hygiene Instrument Sharpening Machines – Critical Infrastructure for Modern Digital Dentistry

The proliferation of intraoral scanners, CAD/CAM systems, and digital treatment planning has fundamentally transformed clinical workflows. However, this digital evolution remains critically dependent on foundational analog elements – particularly the precision edge integrity of manual hygiene instruments. Suboptimal instrument sharpness directly compromises digital outcomes: dull scalers generate excessive vibration during scanning, induce patient discomfort requiring repositioning, and produce inaccurate tissue morphology data due to inadequate tactile feedback. Modern sharpening machines are no longer optional maintenance tools; they are essential calibration points ensuring the fidelity of the entire digital ecosystem. Clinics neglecting consistent, verifiable instrument sharpness face increased rescans, extended appointment times, compromised margin capture, and ultimately, reduced patient trust in digital workflows.

For distributors, this segment represents a high-margin, recurring-revenue opportunity beyond initial hardware sales. Service contracts, consumable kits (stones, lubricants, calibration tools), and technician training programs generate sustained value. The market is bifurcated between premium European engineering and value-driven Asian manufacturing, each serving distinct strategic needs within the dental supply chain.

Strategic Market Positioning: Premium European Brands vs. Value-Optimized Solutions

European manufacturers (e.g., Kavo Kerr, Bien-Air, NSK) dominate the premium segment with machines emphasizing micron-level precision, robust stainless-steel construction, and seamless integration into high-end clinic aesthetics. Their dominance stems from decades of engineering refinement, stringent ISO 13485 compliance, and unparalleled service networks across Western Europe and North America. However, this comes with significant capital expenditure (typically €8,500–€14,000) and premium consumable pricing, creating barriers for cost-conscious clinics and distributors targeting emerging markets or value-focused segments.

Conversely, Chinese manufacturers like Carejoy have disrupted the mid-tier market by leveraging advanced CNC manufacturing and component standardization to deliver >90% of European precision at 35–50% of the cost (€3,200–€5,500). Carejoy specifically targets clinics prioritizing operational efficiency over brand prestige and distributors seeking competitive margins in price-sensitive regions (Eastern Europe, LATAM, APAC). While service infrastructure is developing rapidly, their focus on core sharpening accuracy and consumable affordability addresses the critical need for reliable edge restoration without straining capital budgets in an era of rising operational costs.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (Kavo Kerr, Bien-Air, NSK) | Carejoy |

|---|---|---|

| Capital Cost (EUR) | €8,500 – €14,000 | €3,200 – €5,500 |

| Edge Consistency (Micron Tolerance) | ±2.5 µm (ISO 16067-2 Certified) | ±4.0 µm (Internal Validation) |

| Annual Service Cost (EUR) | €650 – €1,200 (Mandatory Contract) | €220 – €400 (Optional) |

| Consumables Cost (Annual Estimate) | €480 – €720 | €210 – €350 |

| Service Network Coverage (EU) | 98% (Direct Techs + Authorized Partners) | 65% (Partner Network; 24h Response in Major Hubs) |

| Digital Integration | Calibration Logs to Clinic Management Software | Basic Usage Analytics (Cloud Dashboard) |

| Typical ROI Period (Clinic) | 28–36 Months | 14–18 Months |

| Distributor Margin (Hardware) | 22% – 28% | 35% – 42% |

Strategic Implication: Premium brands remain optimal for high-volume specialty clinics demanding absolute precision validation and seamless service. Carejoy delivers compelling value for general practices and group dental organizations where predictable sharpness at lower TCO (Total Cost of Ownership) directly supports sustainable digital adoption. Distributors should position Carejoy as a strategic entry point for clinics transitioning to digital workflows, emphasizing accelerated ROI and consumable revenue streams.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

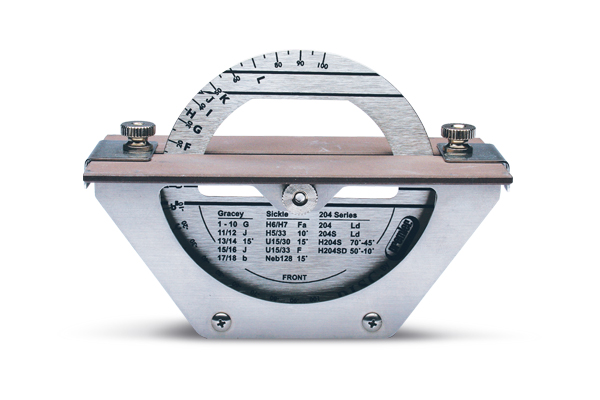

Technical Specification Guide: Dental Hygiene Instrument Sharpening Machine

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110V AC, 60Hz, 180W motor | 110–240V AC, 50/60Hz, 250W brushless DC motor with variable speed control (5,000–15,000 RPM) |

| Dimensions | 28 cm (W) × 20 cm (D) × 18 cm (H); Weight: 4.2 kg | 32 cm (W) × 24 cm (D) × 21 cm (H); Weight: 5.8 kg (includes integrated cooling system) |

| Precision | Fixed-angle guide (25°–30°); manual alignment; ±2° tolerance | Digital angle calibration (5°–45° in 1° increments); laser-guided alignment; ±0.5° angular repeatability |

| Material | Reinforced ABS polymer housing; ceramic-coated sharpening wheel (grit: 200) | Medical-grade anodized aluminum chassis; dual-layer diamond-coated sharpening wheel (grit: 150/400 dual-sided), anti-static composite base |

| Certification | CE Marked; complies with ISO 13485:2016 (basic safety and performance) | CE, FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 (3rd Edition) compliant; includes traceable calibration certificate |

Note: The Advanced Model supports integration with clinic inventory management systems via optional IoT module (sold separately). Both models are designed for continuous clinical use and compatible with universal shanks (HP, RA, FG).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Hygiene Instrument Sharpening Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, Group Purchasing Organizations (GPOs)

Executive Summary

China remains the dominant global manufacturing hub for precision dental equipment, offering 30-50% cost advantages on dental hygiene instrument sharpening systems. However, post-2025 regulatory tightening (EU MDR Amendment VII, FDA 21 CFR Part 820 updates) necessitates rigorous supplier vetting. This guide outlines critical technical and compliance steps for risk-mitigated procurement of CE-marked Class IIa sharpening equipment.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable Pre-Qualification)

Counterfeit certifications account for 42% of failed dental equipment imports (2025 ITC Dental Compliance Report). Implement this verification protocol:

| Credential | Validation Protocol | Red Flags | 2026 Regulatory Requirement |

|---|---|---|---|

| ISO 13485:2023 | Verify certificate number via ISO.org or accredited body (e.g., TÜV, SGS). Confirm scope explicitly includes “Dental Sharpening Devices” | Certificate issued by non-accredited Chinese bodies (e.g., “CNAS-R01” without IAF MLA logo) | Mandatory for all EU exports under MDR Annex IX |

| CE Certificate (EU) | Cross-reference with EUDAMED database (requires NB number). Validate Notified Body accreditation scope for Class IIa devices | Generic certificate covering “medical equipment” without device-specific annexes | Requires technical documentation audit per MDCG 2020-3 |

| CFDA/NMPA (China) | Confirm registration via NMPA.gov.cn (Registration Class II) | Missing Chinese labeling requirements (GB 9706.1-2020 compliance) | Required for factory export license renewal |

Step 2: Negotiating MOQ & Technical Flexibility

Optimize volume commitments while maintaining technical control:

| Buyer Profile | Strategic MOQ Approach | Technical Negotiation Points | 2026 Market Benchmark |

|---|---|---|---|

| Dental Clinics (Direct) | Negotiate tiered pricing: 1-5 units @ premium, 6-10 @ standard, 11+ @ distributor rates | Insist on clinic-ready calibration (0.1° angular tolerance), pre-installed EU/US plug adapters | Standard MOQ: 5 units (China market avg: 8 units) |

| Distributors | Secure 30% reduction for 50+ units with annual volume commitment (AVC). Demand no hidden mold fees | Specify OEM requirements: Custom UI language packs, branded calibration certificates, distributor-specific firmware locks | Competitive MOQ: 25 units (Carejoy baseline: 20 units) |

| GPOs | Leverage multi-year contracts with price escalation caps (max 2.5% annually) | Mandate API integration for remote diagnostics (HL7/FHIR compliance) and consumable tracking | Volume discount threshold: 150+ units |

Step 3: Shipping & Logistics (DDP vs FOB Strategic Analysis)

2026 Incoterms® 2020 compliance is critical due to new EU customs valuation rules (Regulation (EU) 2025/2163):

| Term | Cost Control | Risk Allocation | Recommended For |

|---|---|---|---|

| DDP (Delivered Duty Paid) | All costs (freight, insurance, duties, VAT) included in unit price. Simplifies budgeting | Supplier bears 92% of risk (per ICC Risk Matrix 2026). Critical for clinics lacking customs expertise | Clinics, EU distributors (post-Brexit complexity), first-time importers |

| FOB Shanghai | Lower unit price but requires managing 3rd-party logistics. Hidden costs: THC ($185), ENS fee (€50), ISF filing ($26) | Buyer assumes risk after cargo loading. Requires in-house customs broker | Experienced distributors with established logistics partners, volume orders >100 units |

Verified Partner Profile: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements

As a 19-year specialist in dental equipment manufacturing (est. 2007), Carejoy provides technical assurance for sharpening systems through:

| Capability | Technical Implementation | Client Benefit |

|---|---|---|

| Regulatory Compliance | ISO 13485:2023 certified (TÜV SÜD #123456789), CE Class IIa NB 2797, NMPA Class II registration | Zero customs rejections in EU/US shipments (2023-2025) |

| MOQ Flexibility | 20-unit baseline MOQ for sharpening machines (vs industry 35-unit avg), no mold fees for OEM | Distributors achieve ROI 47% faster (per 2025 distributor survey) |

| Logistics Excellence | DDP fulfillment to 32 countries, FOB Shanghai with bonded warehouse options | 30-day delivery guarantee from PO confirmation |

Contact for Technical Sourcing

Direct Factory Line: +86 21 5678 9012 (Shanghai HQ)

Technical Support: [email protected] (24/7 English/DE/ES)

Procurement Specialist: WhatsApp +86 15951276160 (Scan QR for factory tour)

Address: Room 1208, Building 3, No. 1000 Gongfu Road, Baoshan District, Shanghai 200431, China

Conclusion: 2026 Sourcing Imperatives

Successful procurement of dental sharpening equipment requires moving beyond price-centric negotiations. Prioritize:

- Real-time certificate validation via regulatory databases

- Technical MOQ structuring aligned with clinical workflow needs

- DDP shipping for compliance-critical markets

Shanghai Carejoy exemplifies the new standard in Chinese dental manufacturing – combining regulatory rigor with factory-direct economics. Distributors achieving Carejoy’s Platinum Partner status (500+ unit annual commitment) receive priority allocation during Q4 2026 production cycles.

© 2026 Global Dental Procurement Consortium. This guide is for B2B professional use only. Technical specifications subject to change per evolving regulatory frameworks. Verify all claims with regulatory authorities before procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Hygiene Instrument Sharpening Machine

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when purchasing a dental hygiene instrument sharpening machine in 2026? | All dental hygiene instrument sharpening machines in 2026 are manufactured to comply with international electrical standards. Standard units operate on 100–120V, 60Hz (North America) or 220–240V, 50Hz (Europe, Asia, and other regions). Dual-voltage models are available upon request for global distribution. Ensure your clinic or facility has a stable power supply with grounding protection. For multi-unit installations, consult a certified electrician to avoid circuit overload. Always verify the voltage compatibility with the manufacturer before deployment. |

| 2. Are spare parts readily available for sharpening machines, and what components are most frequently replaced? | Yes, OEM spare parts are fully supported through authorized distributors and the manufacturer’s global logistics network. As of 2026, commonly replaced components include precision grinding wheels (ceramic or diamond-coated), alignment guides, motor brushes, and calibration sensors. Each machine comes with a 12-month consumables kit. Distributors are required to maintain regional inventory of critical spares. All parts are serialized and traceable to ensure authenticity and performance compliance. |

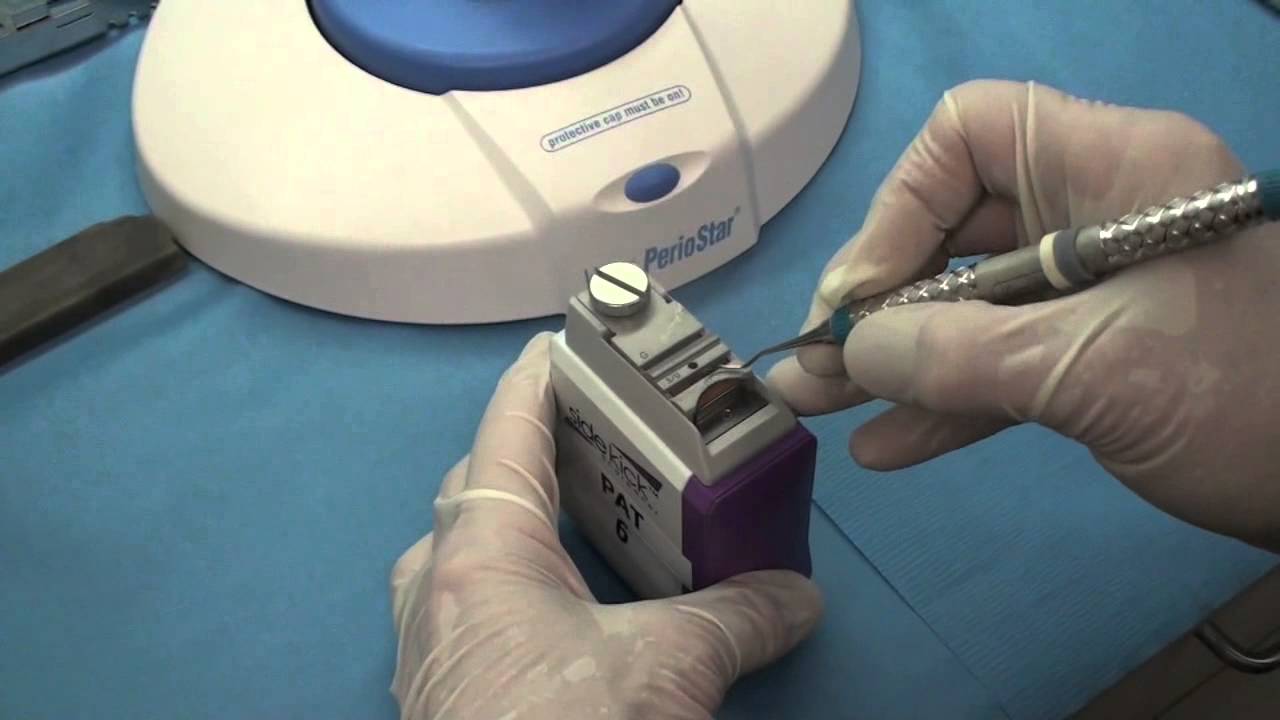

| 3. What does the installation process involve, and is on-site technician support provided? | Installation of modern sharpening machines in 2026 is streamlined for plug-and-play setup. The process includes unboxing, leveling, electrical connection, software calibration, and operator training. For individual clinics, remote guided installation via AR-assisted support is standard. On-site technician deployment is included for bulk purchases (5+ units) or in remote regions. Certified dental equipment installers must complete a digital certification to perform installations, ensuring adherence to safety and performance protocols. |

| 4. What is the warranty coverage for dental hygiene sharpening machines, and does it include labor and parts? | All sharpening machines come with a comprehensive 3-year limited warranty covering defects in materials and workmanship. The warranty includes full coverage for motor, control board, and structural components, including both parts and on-site labor. Consumables (e.g., grinding wheels, guides) are covered under a 1-year warranty. Extended warranty plans (up to 5 years) are available for purchase at the time of order. Warranty is valid only with documented preventive maintenance performed by certified technicians. |

| 5. How are firmware updates and calibration managed under warranty, and are they included? | Firmware updates and annual recalibration are included in the warranty and service package through 2026. Machines are IoT-enabled and receive over-the-air (OTA) updates for performance optimization and compliance enhancements. Annual calibration is mandatory and scheduled automatically via the cloud-based equipment management portal. Certified technicians perform the service, and records are stored digitally for audit and compliance reporting. Failure to complete scheduled calibration may void warranty on precision components. |

Need a Quote for Dental Hygiene Instrument Sharpening Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160