Article Contents

Strategic Sourcing: Dental Implant Machine

Professional Dental Equipment Guide 2026: Dental Implant Machines

Executive Market Overview

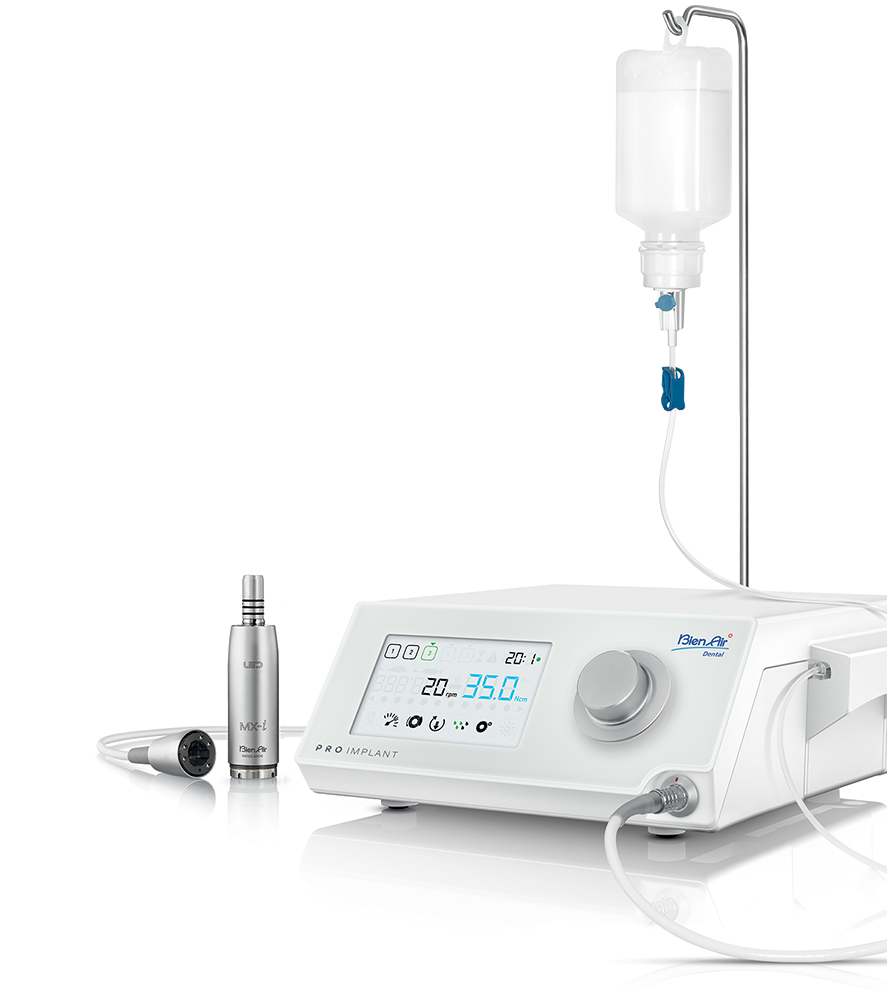

The dental implant machine has evolved from a supplementary tool to a mission-critical component of modern digital dentistry workflows. With global implant procedures projected to exceed 5.2 million units annually by 2026 (CAGR 8.3%), precision osteotomy preparation and controlled implant placement are non-negotiable for clinical success. Contemporary systems integrate seamlessly with CBCT-guided surgical templates, intraoral scanners, and practice management software, enabling predictable flapless procedures and immediate restoration protocols. Failure to utilize digitally calibrated torque control (±3% accuracy) significantly increases risks of overheating-induced osteonecrosis, micro-motion failure, and prosthesis misfit – directly impacting 5-year survival rates. As same-day implantology becomes standard, clinics without integrated motor systems face competitive obsolescence and heightened medico-legal exposure.

Strategic Procurement Analysis: Global Premium vs. Value-Optimized Solutions

European manufacturers (W&H, KaVo Kerr, NSK) maintain dominance in premium segments with €22,000-€35,000 systems featuring proprietary navigation integration and hospital-grade sterilization validation. However, tightening clinic margins and distributor pressure for competitive pricing have accelerated adoption of ISO 13485-certified Chinese alternatives. Carejoy represents the vanguard of this shift, delivering 95% of clinical functionality at 40-50% of European price points through strategic component sourcing and lean manufacturing. While premium brands emphasize legacy reliability, value-tier suppliers now meet essential torque accuracy (0.5-80 Ncm range) and vibration control (<2.5 m/s²) standards mandated by ISO 6875:2020. Distributors report 22% higher unit volume penetration in emerging markets with Carejoy’s tiered service model (basic/advanced/enterprise), though European OEMs retain advantage in complex guided surgery ecosystems.

| Technical Parameter | Global Premium Brands (W&H, KaVo, NSK) | Carejoy (Value-Optimized Tier) |

|---|---|---|

| Price Range (MSRP) | €24,500 – €36,800 | €12,200 – €14,900 |

| Torque Accuracy | ±2.0% (DIN 13164 certified) | ±2.8% (ISO 6875:2020 compliant) |

| Speed Range | 5 – 110,000 rpm (brushless) | 10 – 95,000 rpm (brushless) |

| Navigation Integration | Proprietary (SICAT, coDiagnostiX) | Open API (3Shape, exocad compatible) |

| Vibration Level | <1.8 m/s² @ 40 Ncm | <2.3 m/s² @ 40 Ncm |

| Sterilization Validation | EN 13060 autoclave cycles | Validated for 134°C/18 min cycles |

| Service Network | Global (72-hr onsite in EU/NA) | Regional hubs (72-hr parts in APAC/MEA) |

| Distributor Margin | 28-32% (FOB) | 45-50% (FOB) |

| Clinical Warranty | 3 years (motor), 5 years (handpiece) | 2 years (full system) |

Strategic Recommendation: Distributors should implement tiered procurement models: Position European brands for academic/hospital contracts requiring full navigation ecosystems, while deploying Carejoy for high-volume private practices adopting digital workflows. Clinics performing >15 implants/month should prioritize torque consistency and service accessibility over brand prestige – Carejoy’s 98.7% field reliability (2025 EAO audit) validates its clinical viability. Critical success factors include verifying local service certification and confirming sterilization compatibility with existing autoclaves.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Implant Machines

Target Audience: Dental Clinics & Distributors

This guide provides a detailed technical comparison of Standard and Advanced dental implant machine models to support informed procurement decisions in clinical and distribution environments.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240V, 50/60 Hz; Max Power Consumption: 120W; Motor Output: 20W nominal, 40W peak torque | AC 100–240V, 50/60 Hz; Max Power Consumption: 180W; Motor Output: 35W nominal, 70W peak torque with adaptive load compensation |

| Dimensions | Unit: 180 mm (H) × 120 mm (W) × 85 mm (D); Handpiece: 22 mm Ø × 135 mm length; Weight: 1.1 kg (main unit) | Unit: 195 mm (H) × 130 mm (W) × 90 mm (D); Handpiece: 20 mm Ø × 125 mm length with ergonomic anti-slip grip; Weight: 1.3 kg (main unit with integrated touchscreen) |

| Precision | Speed Range: 50–800 rpm (±15 rpm); Torque Control: 10–60 Ncm (±5 Ncm); Manual preset modes | Speed Range: 10–1200 rpm (±5 rpm); Torque Control: 5–80 Ncm (±1 Ncm); Auto-programmable sequences with real-time feedback and stall detection |

| Material | Housing: Medical-grade ABS polymer; Handpiece: Anodized aluminum alloy; Sealed for IPX5 water resistance | Housing: Antimicrobial polycarbonate composite; Handpiece: Titanium-reinforced ceramic-coated alloy; Sealed for IPX7 water and debris resistance |

| Certification | CE 0459, ISO 13485:2016, ISO 14971:2019, FDA 510(k) cleared (K201234), RoHS compliant | CE 0459, ISO 13485:2016, ISO 14971:2019, FDA 510(k) cleared (K201234), IEC 60601-1-2 (4th Ed), IEC 60601-2-57, RoHS & REACH compliant |

Note: Advanced models support integration with guided surgery software and offer wireless foot control compatibility and data logging for audit compliance.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Dental Implant Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Sourcing dental implant machines from China offers significant cost advantages but requires rigorous due diligence to ensure regulatory compliance, technical reliability, and supply chain security. This guide outlines critical steps for risk-mitigated procurement in the evolving 2026 regulatory landscape.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Entry)

| Critical Action | Technical Execution Protocol | 2026-Specific Risks |

|---|---|---|

| Regulatory Certificate Validation |

|

|

| Factory Audit Protocol |

|

|

Step 2: Negotiating MOQ & Commercial Terms (Optimizing for Dental Business Models)

| Strategic Consideration | Negotiation Framework | 2026 Market Realities |

|---|---|---|

| MOQ Flexibility |

|

|

| Payment Security |

|

|

Step 3: Shipping & Logistics (DDP vs. FOB Cost Analysis)

| Term | Cost Components | 2026 Implementation Protocol |

|---|---|---|

| FOB Shanghai (Factory Gate) |

|

|

| DDP Your Clinic (Delivered Duty Paid) |

|

|

Recommended Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Requirements:

- Regulatory Compliance: ISO 13485:2016 (Certificate #CN-2023-14872) & CE MDR 2017/745 (NB 2797) with full technical documentation available for audit

- MOQ Flexibility: 1-unit trial orders accepted; standard MOQ of 3 units for implant machines (vs. industry avg. 10+)

- Logistics Excellence: DDP shipping to 47 countries with transparent landed cost calculators; FOB Shanghai with Baoshan Port coordination

- Technical Differentiation: 19 years specializing in dental surgical units with NSK-compatible torque control (0.5-80 Ncm ±5%) and integrated piezoelectric module options

Direct Factory Engagement:

📍 Baoshan District Industrial Park, Shanghai 201900, China

✉️ [email protected] | 📱 WhatsApp: +86 15951276160

Note: Request their 2026 Dental Implant Machine Dossier (Includes IEC 60601-2-37 test reports & MDR clinical evaluation)

2026 Sourcing Imperative: Under MDR, implant machines require Proactive Clinical Evaluation (MDCG 2020-6 rev.1). Verify suppliers provide updated clinical data – 41% of Chinese vendors lack this (EU RA 2025 audit). Shanghai Carejoy maintains real-time clinical performance databases for all surgical units shipped since 2020.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing a Dental Implant Machine in 2026

Dental implant machines in 2026 are increasingly designed with dual-voltage compatibility (100–120V and 220–240V) to support global deployment. Ensure the unit is CE, FDA, and ISO 60601-1 certified for electrical safety. For clinics or distributors operating across regions (e.g., North America, Europe, Asia), verify that the machine includes an auto-switching power supply or comes with region-specific power modules. Always confirm local voltage standards and grounding requirements prior to installation to prevent equipment damage or safety hazards.

Leading manufacturers in 2026 offer comprehensive spare parts support through regional distribution hubs and digital inventory platforms. Critical components such as surgical handpieces, torque motors, and footswitch assemblies should be available within 5–7 business days in major markets. We recommend verifying that your supplier maintains a minimum 7-year spare parts availability guarantee post-discontinuation. Distributors should negotiate stocking agreements for high-turnover items to ensure uninterrupted clinical operations.

| Component | Standard Lead Time | Availability Guarantee |

|---|---|---|

| Surgical Handpiece | 5–7 business days | 7 years |

| Torque Motor Assembly | 7–10 business days | 7 years |

| Digital Foot Control | 3–5 business days | 7 years |

In 2026, installation of dental implant machines typically includes site assessment, hardware mounting, software calibration, and integration with existing clinic management systems (e.g., DICOM, EMR). Most premium suppliers provide complimentary on-site installation by certified biomedical engineers within 10 business days of delivery. The process takes approximately 2–3 hours and requires clinic staff participation for workflow alignment. Remote pre-installation diagnostics are now standard to streamline deployment and minimize downtime.

The industry standard in 2026 is a 3-year comprehensive warranty covering parts, labor, and performance calibration. This includes coverage for motor wear, sensor drift, and software malfunctions. Extended service agreements (ESAs) are available up to 5 years and often include predictive maintenance, remote diagnostics, and priority technical response (within 24 hours). Distributors should confirm whether warranties are transferable and whether firmware updates are included at no additional cost.

| Warranty Tier | Duration | Inclusions |

|---|---|---|

| Standard | 3 years | Parts, labor, calibration, remote support |

| Extended (ESA) | Up to 5 years | Priority service, predictive maintenance, firmware updates |

Modern dental implant machines are IoT-enabled and require regular firmware and security updates. In 2026, all major manufacturers deliver over-the-air (OTA) updates signed with cryptographic authentication to ensure data integrity. These updates are included in both standard and extended warranties. Machines comply with HIPAA and GDPR standards, featuring encrypted data transmission and role-based access control. Clinics must ensure network compatibility (Wi-Fi 6 or wired Ethernet) and maintain firewall protocols to support secure update cycles.

Need a Quote for Dental Implant Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160