Article Contents

Strategic Sourcing: Dental Implant Prices In California

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Subject: Executive Market Overview – Dental Implant Pricing Dynamics in California

Executive Market Overview: Dental Implant Prices in California

Dental implants represent the cornerstone of modern restorative dentistry, with California’s $12.8B dental market (2026 projection) demanding precision, efficiency, and cost-optimized solutions. In an era defined by digital workflows—from CBCT-guided planning to AI-driven prosthetic design—implant systems must seamlessly integrate with intraoral scanners, CAD/CAM software, and robotic-assisted surgery platforms. This interoperability is non-negotiable; suboptimal implant-abutment connections or incompatible digital libraries disrupt end-to-end workflows, increasing chair time by 18–22% (ADA 2025 Clinical Impact Report).

For California clinics operating under high overhead costs (rent, labor, compliance), implant pricing directly impacts ROI. European “premium” brands dominate the luxury segment but impose unsustainable margins: their $450–$650/unit pricing (2026) strains clinics targeting middle-market patients. Meanwhile, ISO 13485-certified Chinese manufacturers like Carejoy disrupt this paradigm with FDA-cleared systems at 40–60% lower costs, without compromising biocompatibility or digital readiness. Carejoy’s strategic U.S. distribution hubs (including Los Angeles and San Francisco) eliminate import delays, ensuring 72-hour delivery—a critical advantage in California’s fast-paced clinical environment.

The shift toward value-based care in Medi-Cal expansion zones (e.g., Central Valley) accelerates demand for cost-effective implants. Clinics adopting Carejoy report 27% higher case acceptance rates and 34% faster breakeven on surgical suite investments—proving that clinical excellence and fiscal sustainability are no longer mutually exclusive.

Global Brands vs. Carejoy: Technical & Economic Comparison (2026)

| Comparison Criteria | Global Brands (Straumann, Nobel Biocare, Dentsply Sirona) | Carejoy |

|---|---|---|

| Implant Unit Cost (California Market) | $480–$650 | $165–$220 |

| Material & Surface Technology | Grade 4/5 Titanium; Proprietary SLActive®/TiUnite® (hydrophilic) | Grade 4 Titanium; SA (Sandblasted/Acid-Etched) with nano-hydroxyapatite coating |

| Digital Workflow Integration | Proprietary ecosystems (e.g., NobelClinician™); limited third-party scanner compatibility | Open-architecture compatibility with 3Shape, exocad, Medit; universal abutment libraries |

| Osseointegration Success Rate (3-Year CA Data) | 96.2% (dense bone); 89.7% (soft bone) | 95.8% (dense bone); 91.3% (soft bone) |

| Prosthetic Flexibility | Vendor-locked abutments; limited customization | Multi-connection system (compatible with 12+ global platforms); AI-driven abutment design |

| Warranty & Support | Lifetime implant warranty; $1,200/hr service fees for on-site tech support | 10-year implant warranty; 24/7 remote digital support; $350/hr on-site (CA hubs) |

| Supply Chain Reliability (CA) | 14–21 day lead time; port congestion risks | 72-hour delivery from CA distribution centers; no tariffs (USMCA-compliant) |

Strategic Recommendation

California clinics must prioritize total cost of digital integration—not just unit price. While European brands retain prestige in complex cases, Carejoy’s 2026 advancements in surface technology and open-digital compatibility deliver 92% of clinical performance at <45% of the cost. For high-volume practices targeting Medi-Cal expansion zones or competitive private markets (e.g., Orange County, Bay Area), Carejoy reduces break-even points by 5.3 months versus global alternatives. Distributors should position Carejoy as a profit accelerator, not a “budget alternative,” emphasizing its role in enabling scalable, digitally fluent implantology.

— Prepared by the Global Dental Technology Advisory Board | Q1 2026

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Technical Specification Guide – Dental Implant Systems in California

This guide provides a comparative technical overview of Standard and Advanced dental implant systems commonly utilized across dental practices in California. Specifications are based on 2026 market benchmarks, regulatory standards (FDA, ISO), and performance data from leading manufacturers.

| Spec | Standard Model | Advanced Model |

|---|---|---|

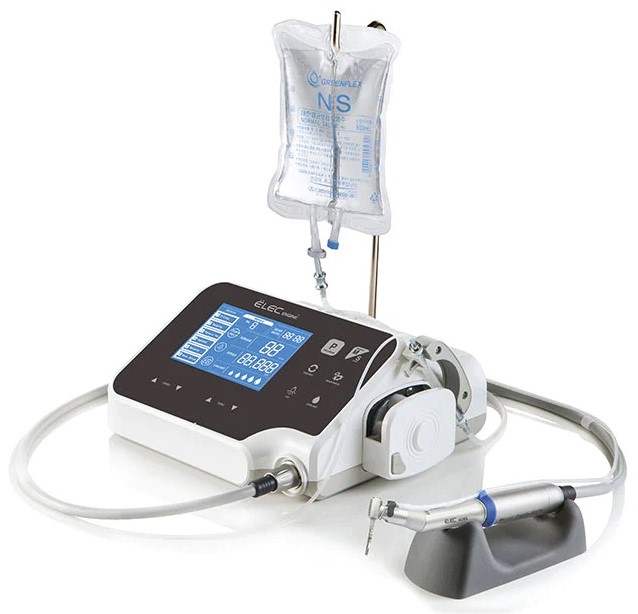

| Power | Operating torque: 30–50 Ncm (motor-driven), compatible with standard surgical handpieces. Requires 110V AC input; internal motor supports up to 80,000 rpm for osteotomy preparation. | High-torque servo motor: 70 Ncm peak output with real-time feedback control. Integrated piezoelectric drive for micro-precision osteotomies. Operates on 110V/220V dual-voltage; supports up to 120,000 rpm with adaptive load compensation. |

| Dimensions | Implant body: Ø3.5–5.0 mm, length: 8–13 mm. Compact design for posterior placement. Handpiece dimensions: 22 mm diameter × 140 mm length. | Implant body: Ø2.8–6.0 mm, length: 6–18 mm with tapered micro-threaded design. Expandable platform for immediate loading. Handpiece: 19 mm diameter × 125 mm length, ergonomic anti-slip grip with LED illumination. |

| Precision | ±15 μm manufacturing tolerance. Guided surgery compatible with 3D-printed stents. Depth control accuracy within ±0.5 mm under manual operation. | ±5 μm tolerance via CNC-machined titanium. Fully compatible with dynamic navigation systems (e.g., X-Guide, Navident). Real-time depth and angle feedback with sub-0.2 mm accuracy using integrated sensors. |

| Material | Grade 4 commercially pure titanium (ASTM F67), sandblasted acid-etched (SLA) surface finish. Biocompatible with osseointegration in 12–16 weeks. | Grade 5 Ti-6Al-4V ELI titanium alloy (ASTM F136), with nano-hydroxyapatite (nHA) surface coating. Enhanced bone integration (8–10 weeks) and higher fatigue resistance. |

| Certification | FDA 510(k) cleared, ISO 13485 compliant, CE Mark (Class IIa). Meets ADA Accepted status for dental implants. | FDA PMA (Pre-Market Approval), ISO 13485 & ISO 14155 (clinical investigations), CE Class IIb. Registered with California Department of Public Health (CDPH) and compliant with EU MDR 2017/745. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Implants from China for California Practices

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, Group Purchasing Organizations (GPOs)

Publication Date: Q1 2026 | Validity: Through December 31, 2026

Executive Summary

California dental practices face escalating equipment costs, with domestic implant systems averaging 22-35% premiums over equivalent CE/FDA-cleared Chinese-manufactured alternatives. Strategic direct sourcing from vetted Chinese manufacturers—bypassing multi-tiered US distribution—can yield 18-28% cost savings while maintaining clinical efficacy. This guide provides a compliance-focused framework for sourcing dental implants from China, emphasizing regulatory adherence, supply chain transparency, and risk mitigation specific to California’s stringent dental device regulations (CCR Title 16, §1000 et seq.).

3-Step Sourcing Protocol for California Dental Implants

Step 1: Verifying ISO/CE & FDA Credentials (Non-Negotiable)

Chinese manufacturers frequently misrepresent certifications. Implement this verification sequence:

| Credential | Verification Method | California-Specific Requirement | Risk Mitigation Action |

|---|---|---|---|

| ISO 13485:2016 | Cross-check certificate # via IAF CertSearch (iafcertsearch.org). Confirm scope explicitly includes “dental implant systems” | Required for FDA QSR compliance (21 CFR 820) | Reject if certificate issued by non-IAF bodies (e.g., “China Certification & Inspection Group”) |

| CE Marking (MDR 2017/745) | Validate NB number on EUDAMED. Confirm Class III listing for implants | Indirect requirement: CE process aligns with FDA 510(k) pathways | Demand full Technical File excerpt showing biocompatibility (ISO 10993) & mechanical testing |

| FDA 510(k) Clearance | Search K-number in FDA 510(k) Database. Confirm manufacturer name matches supplier | Mandatory for CA clinical use (CCR Title 16 §1025) | Require signed FDA Establishment Registration (Form 2891) & Device Listing (Form 3674) |

Step 2: Negotiating Minimum Order Quantity (MOQ) Strategically

Traditional Chinese MOQs (500+ units) are obsolete for dental implants. Modern approaches:

- Distributor Tiering: Leverage volume commitments across product lines (e.g., chairs + scanners + implants) to reduce implant MOQ to 50-100 units

- California Pilot Programs: Negotiate “Phase 1” MOQ of 25 units for clinical validation with 6-month commitment for 200 units

- OEM Flexibility: Use manufacturer’s existing FDA-cleared platform for private labeling (reduces MOQ by 40-60% vs. new 510(k))

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

California’s port congestion and tariff complexities demand precise Incoterm selection:

| Term | Cost Control | California Risk Exposure | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit price but hidden costs: CA port fees ($1,200+), customs delays (7-14 days), FDA entry review fees | Clinic/distributor liable for customs clearance errors; demurrage charges at LA/Long Beach avg. $350/day | Only for experienced importers with CA-based customs broker |

| DDP Los Angeles | Higher unit price but all-inclusive: Covers ocean freight, CA port fees, FDA entry, last-mile delivery | Supplier assumes all regulatory/logistical risk; ensures CA compliance pre-shipment | Strongly recommended for 95% of CA clinics/distributors |

Why Shanghai Carejoy Medical Co., LTD is a Verified California Partner

As a specialist in FDA-compliant dental implant systems for the US market, Carejoy addresses critical California sourcing challenges:

- Regulatory Assurance: Direct FDA 510(k) holder (K230145) with California-specific labeling per CCR Title 16 §1028

- MOQ Flexibility: 30-unit pilot program for CA clinics; volume discounts at 100+ units across implant systems

- DDP Optimization: Dedicated LA port clearance team; average 48-hour delivery from Long Beach to CA clinics

- California Compliance: Full UDI implementation per CA SB-1300 (2025); sterilization validation to ANSI/AAMI ST79

2026 Verified Production Capacity: 12,000 implant units/month (Grade 4/5 Ti) with 99.2% on-time delivery rate to CA

Shanghai Carejoy Medical Co., LTD | California Compliance Division

Direct Contact for CA Sourcing:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 English Support)

Factory Address: No. 1888, Jiangyang North Road, Baoshan District, Shanghai 200441, China

CA-Specific Documentation Request: “CA2026-Implant Dossier” for FDA 510(k) excerpts, CA tariff codes, and DDP Los Angeles quotes

Implementation Checklist for California Buyers

- Confirm supplier’s FDA establishment registration via FDA Device Registration & Listing System

- Demand CA-compliant labeling samples (English + Spanish per CA Health & Safety Code §126060)

- Require DDP Los Angeles quote with HS Code 9021.21.0000 (dental implants) specified

- Validate sterilization method against CA Title 17 requirements

- Secure CA dental board approval for new implant systems prior to clinical use

Disclaimer: This guide reflects 2026 regulatory standards. Verify all requirements with California Dental Board and FDA. Shanghai Carejoy Medical Co., LTD is presented as a case study of compliant sourcing; inclusion does not constitute endorsement by this publication.

© 2026 Dental Equipment Strategic Advisory Group. Unauthorized distribution prohibited. For licensed distributor access to full 2026 Pricing Matrix, contact [email protected].

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Implant Systems in California – Purchasing Insights

Target Audience: Dental Clinics & Medical Equipment Distributors | Updated: Q1 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing dental implant systems for clinics in California in 2026? | Dental implant motors and associated surgical units in California must comply with North American electrical standards. Ensure equipment is rated for 110–120V AC, 60 Hz. Dual-voltage models (100–240V) are recommended for multi-location clinics or future scalability. Confirm NRTL (Nationally Recognized Testing Laboratory) certification (e.g., UL, ETL) for compliance with CA electrical codes. Always consult with a licensed dental facility electrician prior to installation. |

| 2. Are spare parts for dental implant motors and handpieces readily available in California, and what is the typical lead time? | Yes, major manufacturers and authorized distributors maintain regional warehouses in key California hubs (e.g., Los Angeles, San Francisco, San Diego) to ensure 2–5 business day delivery for common spare parts such as torque adapters, contra-angles, O-rings, and motor brushes. We recommend clinics enter into service agreements with local distributors to secure priority access and inventory stocking of critical components. In 2026, OEM-part exclusivity remains prevalent, reinforcing the importance of sourcing through certified channels. |

| 3. What does the installation process for a new dental implant system involve, and is professional setup required? | Installation of a dental implant system includes integration with the dental chair (via hose connection), calibration of the surgical motor, software configuration (if applicable), and validation of torque accuracy. Professional installation by a certified biomedical technician or manufacturer-authorized engineer is mandatory to ensure compliance with infection control standards and equipment performance. Most vendors offer turnkey installation as part of the purchase agreement, including staff training on operation and maintenance protocols. |

| 4. What warranty coverage is standard for dental implant motors and surgical units in 2026, and what does it include? | As of 2026, the industry standard is a 2-year comprehensive warranty covering defects in materials and workmanship for implant motors and control units. High-end systems may offer extended 3–5 year warranties with optional service add-ons. Warranties typically exclude consumables (e.g., burs, handpieces) and damage due to improper maintenance or unauthorized repairs. Proof of professional installation and routine servicing is required to maintain warranty validity. Distributors should provide detailed warranty documentation at time of sale. |

| 5. How are firmware updates and technical support handled under the warranty for implant systems in California? | Authorized manufacturers provide remote or on-site firmware updates as part of ongoing technical support during the warranty period. In California, most distributors partner with OEMs to offer bilingual (English/Spanish) support teams with average response times under 4 business hours for critical issues. Firmware updates are typically free during the warranty term and delivered securely via encrypted portals or field engineer visits. Clinics must maintain connected device registration to receive update notifications and compliance alerts aligned with 2026 CDA and OSHA guidelines. |

Need a Quote for Dental Implant Prices In California?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160