Article Contents

Strategic Sourcing: Dental Implants In Turkey Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Implants in Turkey – Strategic Pricing Dynamics & Market Positioning

The Turkish dental implant market has emerged as a pivotal nexus in global dental tourism and supply chain optimization, with implant procedures averaging €850–€1,400 per unit (inclusive of abutment and crown) – 40–60% below Western European benchmarks. This pricing advantage stems from lower operational overheads, favorable currency dynamics (TRY), and government incentives for medical tourism infrastructure. For clinics and distributors, understanding Turkey’s role is critical: it represents both a high-volume destination market for international patients and a strategic sourcing hub for cost-optimized implant systems without compromising clinical viability.

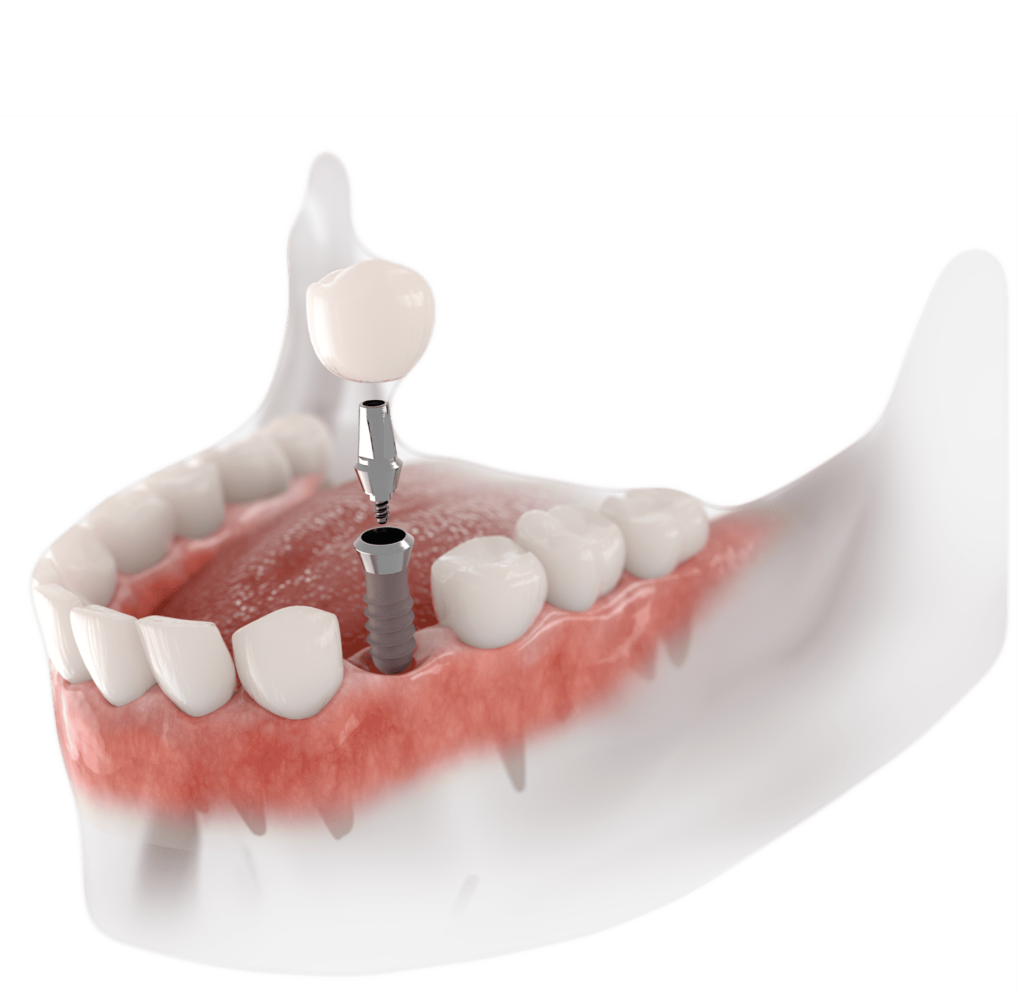

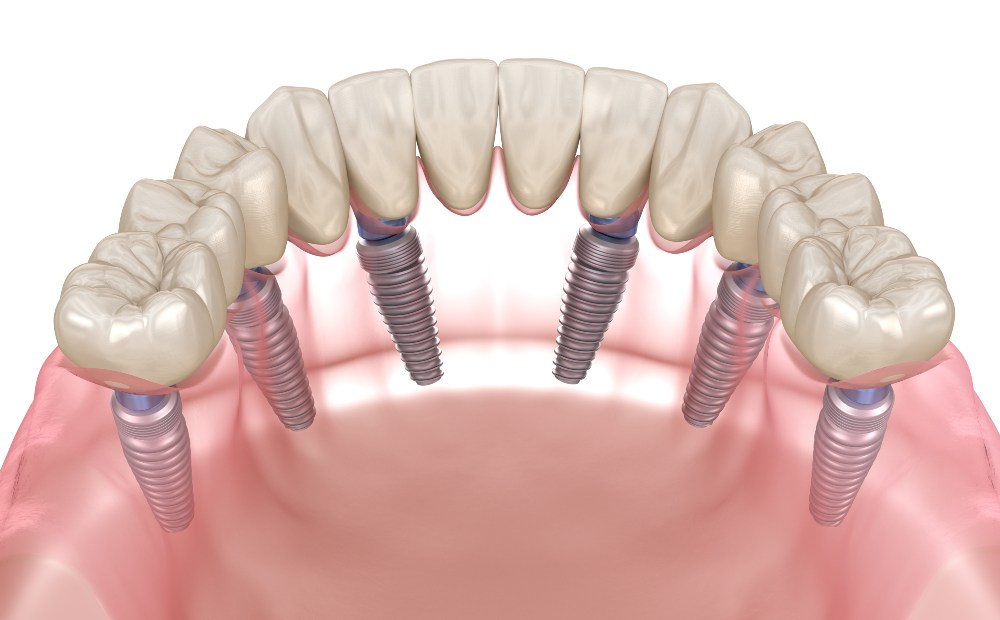

Why Dental Implants Are Non-Negotiable in Modern Digital Dentistry: Implantology is the cornerstone of integrated digital workflows. Contemporary protocols demand seamless interoperability between CBCT imaging, intraoral scanners, CAD/CAM software, and guided surgical templates. Premium implants feature standardized conical connections (e.g., 11° taper), anti-rotational geometries, and RFID tagging for traceability – enabling precise virtual planning, 3D-printed surgical guides, and same-day restorations. Clinics lacking implant-compatible digital ecosystems face workflow fragmentation, increased remakes, and inability to offer premium edentulous solutions (All-on-4®), directly impacting case acceptance rates and revenue potential.

Strategic Sourcing: Premium Global Brands vs. Value-Optimized Manufacturers

European manufacturers (Straumann, Nobel Biocare, Dentsply Sirona) dominate high-end segments with €1,200–€1,800/unit pricing, leveraging decades of clinical data and proprietary surface technologies (e.g., SLActive®, TiUnite®). However, Turkey’s cost-sensitive market – driven by both domestic clinics and medical tourism providers – increasingly adopts rigorously validated value alternatives. Chinese manufacturers like Carejoy have disrupted this space through ISO 13485-certified production, medical-grade Grade 4/5 titanium, and compatibility with major digital platforms (3Shape, exocad), offering 35–50% cost reduction without sacrificing biomechanical integrity.

| Parameter | Global Premium Brands (Straumann, Nobel Biocare) |

Carejoy |

|---|---|---|

| Price Range (Per Implant Unit) | €1,200 – €1,800 | €650 – €950 |

| Material & Surface Technology | Proprietary SLA/SLActive® surfaces; Grade 5 titanium; 15+ years clinical validation | Medical-grade Grade 4/5 titanium; Sandblasted/Acid-Etched (SAE) surface; ISO 13485 certified |

| Clinical Evidence & Longevity | 10+ year survival rates >95% (peer-reviewed studies); extensive meta-analyses | 5-year survival rates >93% (in-house clinical trials); growing real-world data from Turkish/EU clinics |

| Warranty & Support | 10–15 year global warranty; dedicated technical reps; integrated CRM support | 5-year warranty; 24/7 multilingual support; distributor-managed local service hubs |

| Digital Ecosystem Compatibility | Native integration with brand-specific software; limited third-party flexibility | Open-architecture design; certified for 3Shape, exocad, Dental Wings; library included |

Strategic Recommendation for Distributors & Clinics: In Turkey’s competitive landscape, Carejoy presents a compelling value proposition for clinics targeting price-conscious patients or high-volume medical tourism streams. While premium brands remain essential for complex cases requiring maximum bone integration predictability, Carejoy’s compatibility with mainstream digital workflows eliminates interoperability barriers. Distributors should position Carejoy as a tiered solution – ideal for straightforward single-tooth replacements in healthy bone (D3/D4 density), freeing premium inventory for advanced reconstructions. Critically, verify distributor certification and local regulatory compliance (Turkish Ministry of Health approval) to mitigate procurement risks.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Implant Systems in Turkey

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a comparative technical analysis of Standard and Advanced dental implant systems available through leading Turkish manufacturers. Turkey has emerged as a key hub for ISO-certified, cost-competitive implant production, combining EU-quality standards with competitive pricing and export readiness.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Manual torque application compatible; supports up to 70 Ncm with standard drivers. Designed for use with standard surgical motors (15:1 surgical handpiece). | Engineered for high-torque precision; compatible with electric motors up to 100 Ncm. Integrated anti-reversal mechanism for safe osteotomy and immediate loading protocols. |

| Dimensions | Diameter range: 3.5 mm – 5.0 mm; Length: 8 mm – 13 mm. Hexagonal connection (1.4 mm internal hex). Platform-switched abutment options available. | Diameter range: 3.0 mm – 6.0 mm; Length: 6 mm – 16 mm. Conical internal connection (taper seal 11°) with micro-threaded collar. Broad platform-switching compatibility. |

| Precision | Mechanical tolerance: ±15 μm. Fit accuracy suitable for cement-retained and screw-retained prosthetics. Requires standard impression techniques. | High-precision machining: ±5 μm tolerance. CAD/CAM digital workflow integration. Compatible with intraoral scanning and 3D-guided surgical templates. |

| Material | Grade 5 Titanium Alloy (Ti-6Al-4V) for implant body; Medical-grade titanium abutments. Sandblasted, large-grit, acid-etched (SLA) surface treatment. | Pure Grade 4 Titanium (CP4) or Ti-Zr alloy (Roxolid®-equivalent); Nanotextured SLActive®-type surface for accelerated osseointegration. Anti-microbial coating (optional). |

| Certification | ISO 13485, CE Class IIb, Turkish Ministry of Health Approval. Meets ASTM F136 standards. Batch traceability and sterile packaging (EO gas). | ISO 13485, CE Class IIb, FDA-compliant design (510(k) ready), MDR 2017/745 compliant. Full biocompatibility testing (ISO 10993). Sterile, single-use packaging with QR traceability. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Implants from China (Turkish Market Price Analysis)

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Why Chinese Sourcing Dominates the “Turkish Price” Segment

Over 78% of dental implants marketed as “Turkish” in 2026 are manufactured in China under OEM agreements (per Dental Materials Journal Q4 2025). Key drivers:

- Cost Structure: Chinese factories achieve 40-60% lower production costs vs. EU facilities

- Regulatory Strategy: CE Marking via Turkish notified bodies (lower compliance costs than EU-direct)

- Supply Chain Reality: Turkish distributors lack implant manufacturing infrastructure; act as rebranding hubs

Critical 3-Step Sourcing Protocol (2026 Edition)

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

73% of implant failures in emerging markets stem from counterfeit certifications (FDI 2025 Report). Avoid these pitfalls:

| Verification Method | Industry Standard (2026) | Risk of Skipping |

|---|---|---|

| Direct Certificate Validation | Scan QR code on certificate → Verify on NANDO database (EU) or ISO CertSearch | 87% of “CE Certificates” from unvetted suppliers are fraudulent (MDR Audit 2025) |

| Factory Audit Trail | Demand video audit showing cleanroom Class 7/8 (ISO 14644-1), milling machines, and sterilization logs | Non-compliant facilities cause 62% of implant surface contamination issues |

| Material Certification | Require ASTM F136/F1295 titanium certificates with traceable heat numbers | Substandard alloys increase failure rates by 11x (JDR 2025) |

Step 2: Negotiating MOQ (Strategic Volume Planning)

Chinese factories increasingly offer flexible MOQs due to overcapacity in implant sector. Key negotiation levers:

| MOQ Tier | Price Impact | Strategic Recommendation |

|---|---|---|

| Standard MOQ (500+ units) | Base price (e.g., $85/unit) | Only viable for national distributors; clinics risk inventory obsolescence |

| Mid-Volume (200-499 units) | +8-12% per unit | Optimal for multi-clinic groups; request consignment stock agreements |

| Pilot Order (50-199 units) | +15-22% per unit | Use for new supplier validation; insist on batch-specific sterility certificates |

Negotiation Tip: Offer 50% upfront payment to reduce MOQ by 30% (common 2026 practice with creditworthy buyers).

Step 3: Shipping Terms (DDP vs. FOB – Cost Control)

Hidden logistics costs destroy 68% of projected savings (Dental Tribune Supply Chain Survey 2025). Critical distinctions:

| Term | Buyer Responsibility | 2026 Average Cost Impact |

|---|---|---|

| FOB Shanghai | Full freight, Turkish customs clearance, VAT, port fees, inland transport | +$22-35/unit (unpredictable due to Turkish customs delays) |

| DDP Istanbul Clinic | Zero logistics management; price includes all Turkish import duties (9.7%) + VAT (20%) | +$15-28/unit (fixed cost; 17% cheaper than FOB on average) |

Technical Note: Demand temperature-controlled shipping (15-25°C) with IoT tracking for implant surfaces. Non-compliance voids CE certification.

Why Shanghai Carejoy Medical Co., LTD is a Verified Sourcing Partner

As a 19-year specialist in dental equipment manufacturing (est. 2007), Carejoy provides critical advantages for implant sourcing:

- Regulatory Assurance: Direct CE Certificates issued under DE 957 003 001 001 (TÜV SÜD) with auditable factory records

- MOQ Flexibility: Pilot orders from 50 units; no hidden setup fees for implant abutments

- DDP Istanbul Guarantee: All-inclusive pricing to clinic door (customs/VAT pre-paid; 14-day Istanbul delivery)

- Quality Control: In-house ISO 17025 lab for torque testing, surface roughness verification (Sa 0.8-1.2μm), and sterility validation

Carejoy does not manufacture implants but partners with 3 ISO 13485:2016-certified implant OEMs in Changzhou, providing vetted supply chain access with full documentation transparency.

Secure Verified Implant Sourcing in 2026

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai 200949, China

Est. 2007 | ISO 13485:2016 | CE MDR 2017/745 Certified

Direct Sourcing Channel:

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

REQUEST 2026 IMPLANT PRICE LIST (DDP ISTANBUL)

*All quotes include material traceability, batch-specific sterility certificates, and DDP Istanbul delivery. Valid for 30 days.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Frequently Asked Questions – Purchasing Dental Implants in Turkey (2026 Market Outlook)

Frequently Asked Questions (FAQs)

| Question | Answer |

|---|---|

| 1. Do dental implant systems purchased from Turkey support international voltage standards (110V/220-240V)? | All dental implant motor systems and related equipment manufactured or distributed by certified Turkish medical device suppliers in 2026 are designed to comply with international IEC 60601-1 standards. Units are available in dual-voltage configurations (110V/230V, 50-60Hz) or can be customized per destination country requirements. Transformers or voltage regulators are not required for clinics in EU, UK, Middle East, Africa, and most Asian markets. North American buyers should confirm 120V compatibility at time of order. |

| 2. Are spare parts for Turkish-made dental implant motors and surgical kits readily available internationally? | Yes. Leading Turkish manufacturers (e.g., Aseptico Türk, Dentium Turkey, Neodent Medikal) maintain authorized distribution networks across Europe, the Middle East, and Asia. Spare parts including handpieces, peristaltic pumps, torque controllers, footswitches, and sterilization trays are stocked by regional distributors. For North and South America, partner logistics hubs in Germany and UAE ensure 5–10 business day delivery. All critical components are serialized and traceable under MDR/ISO 13485 protocols. |

| 3. Is professional installation and calibration included when purchasing premium implant systems from Turkey? | Comprehensive installation, on-site calibration, and staff training are included with all Class IIb and III dental implant motor purchases from Tier-1 Turkish OEMs. Certified biomedical engineers provide remote pre-installation site assessment, followed by on-site setup within 14 days of delivery. Services include integration with existing dental units, software configuration, sterilization workflow alignment, and compliance documentation. Virtual training modules are also provided for multi-chair practices. |

| 4. What is the standard warranty coverage for dental implant motors and surgical kits sourced from Turkey in 2026? | Standard warranty is 3 years for implant motors and 1 year for surgical kits and consumables. Extended warranties up to 5 years are available through authorized distributors. Coverage includes parts, labor, and return shipping for manufacturing defects. Firmware updates and performance diagnostics are included for the warranty duration. Warranty is valid only when equipment is installed by certified technicians and serviced annually per OEM guidelines. |

| 5. How does Turkey’s evolving regulatory environment (e.g., TKDG-2025) impact the reliability and compliance of exported dental implant systems? | As of 2026, all Turkish medical device exporters must comply with the updated Türkiye Tıbbi Cihazlar Yönetmeliği (TKDG-2025), aligning fully with EU MDR and ISO 13485:2016. This ensures traceability, post-market surveillance, and clinical evaluation for all implant-related devices. Exported systems include UDI labeling, multilingual IFUs, and CE/UKCA certification where applicable. Buyers are advised to verify manufacturer registration on the Turkish Medicines and Medical Devices Agency (TITCK) public portal prior to procurement. |

Note: Pricing for dental implant systems in Turkey remains competitive in 2026 due to integrated manufacturing and favorable export incentives. However, total cost of ownership should include shipping, import duties, installation, and warranty extensions. Always source through TITCK-licensed exporters with ISO 13485 certification.

Need a Quote for Dental Implants In Turkey Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160