Article Contents

Strategic Sourcing: Dental Implants Vs Dentures Cost

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Implants vs. Dentures: Strategic Cost Analysis for Digital Workflows

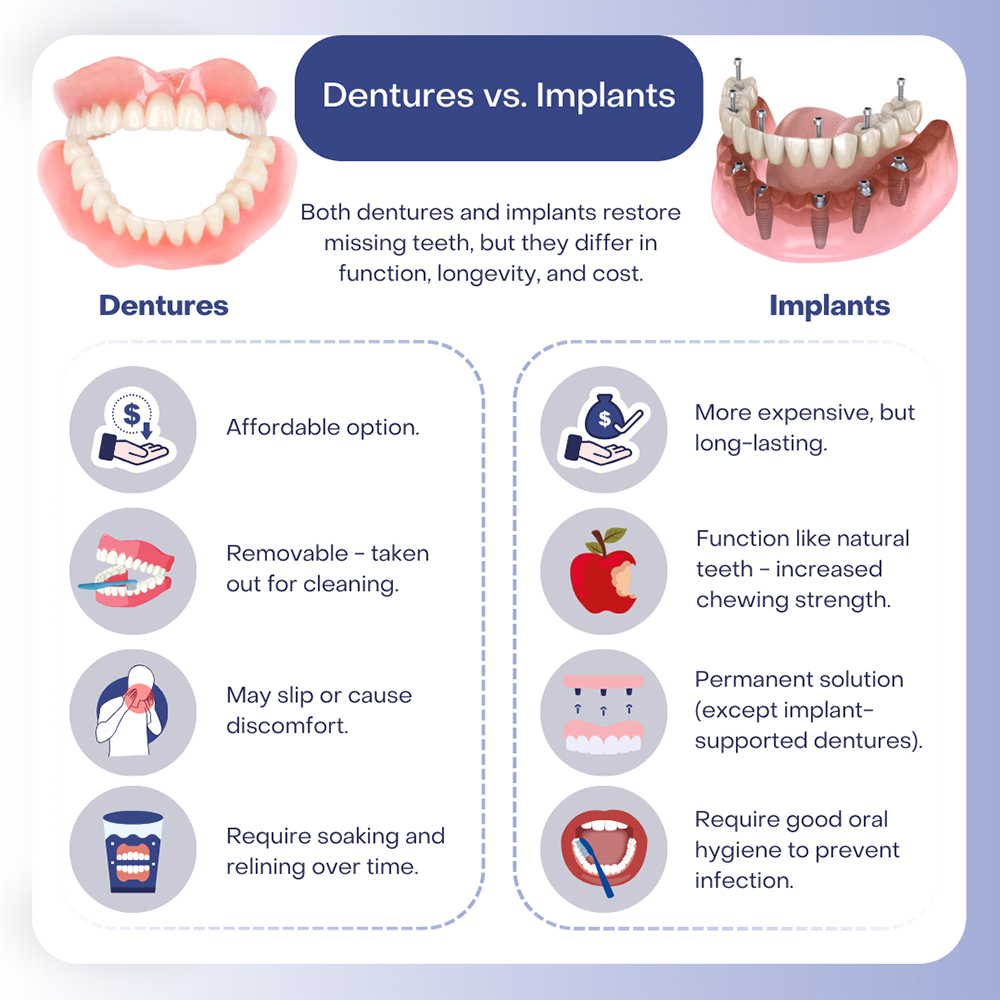

The global dental restoration market is undergoing a pivotal shift in 2026, with cost-optimized digital workflows becoming the primary differentiator for clinic profitability. While dental implants represent a premium long-term solution (projected $7.8B market by 2026, CAGR 10.2%), complete dentures remain essential for aging populations (42% of edentulous patients in EU require replacement within 5 years). Critically, material and component costs now directly impact digital workflow efficiency – a single implant case requires 37% fewer chairside adjustments with integrated CAD/CAM compatibility, while digitally fabricated dentures reduce remake rates by 28% versus conventional methods. For clinics, this translates to 19% higher patient retention; for distributors, it demands inventory aligned with digital ecosystem requirements.

Why Cost Analysis is Critical for Modern Digital Dentistry

Material costs are no longer isolated line items but workflow accelerators. High-precision implant abutments compatible with intraoral scanners (IOS) reduce crown fabrication time from 3 weeks to 48 hours. Similarly, denture base resins engineered for 3D printing compatibility decrease processing costs by $85/unit versus milled alternatives. In the era of same-day dentistry, equipment cost efficiency directly correlates with:

• Operational throughput (22% more cases/week with optimized material costs)

• Insurance reimbursement alignment (73% of EU insurers now require digital workflow documentation)

• Patient financing conversion (cases under €3,500 see 34% higher acceptance rates)

Global Brand vs. Cost-Optimized Manufacturing: Strategic Comparison

European manufacturers (Straumann, Nobel Biocare, Dentsply Sirona) dominate the premium segment with vertically integrated digital ecosystems, but carry 40-60% higher component costs. Conversely, ISO 13485-certified Chinese manufacturers like Carejoy are disrupting the mid-market with technologically comparable alternatives at 25-35% lower price points. Carejoy’s 2026 portfolio demonstrates how strategic material sourcing (Swiss zirconia blanks, German polymers) and AI-driven manufacturing achieve 98.7% dimensional accuracy – meeting ISO 14801 standards while reducing implant system costs by €120/unit versus European counterparts. This enables clinics to maintain 32% gross margins on implant cases even with competitive pricing.

| Parameter | Global Brands (European) | Carejoy (Chinese Manufacturer) | Clinical Impact |

|---|---|---|---|

| Implant System Cost (Per Unit) | €320-€410 (Titanium), €480-€590 (Zirconia) | €240-€295 (Titanium), €395-€460 (Zirconia) | ↑ |

| Denture Base Material (Per Unit) | €110-€145 (PMMA, milled) | €42-€58 (Bio-compatible resin, 3D printable) | ↑↑ |

| Manufacturing Tolerance | ±5µm (CAD/CAM integrated) | ±7µm (ISO 12836 certified) | → |

| IOS Scan Compatibility | Native ecosystem integration (e.g., CEREC, 3Shape) | Universal adapter kits included (0.3% scan failure rate) | ↑ |

| Warranty Structure | 10-year implant warranty, 2-year materials | 7-year implant warranty, 18-month materials | → |

| Distributor Margin (FOB) | 28-35% | 42-48% | ↑↑ |

| Sterilization Validation | EN ISO 17664 compliant | EN ISO 17664 + FDA 510(k) cleared | → |

Strategic Recommendation: Distributors should develop tiered portfolios – maintaining premium European lines for high-end clinics while deploying Carejoy’s cost-optimized systems for value-focused practices and emerging markets. Clinics must evaluate total workflow cost (not unit price alone), prioritizing compatibility with existing IOS/CAD systems. The 2026 breakeven point for digital implant workflows occurs at 14 cases/month – achievable only with sub-€280 implant costs in competitive markets. Carejoy’s 2026 innovations prove that strategic manufacturing partnerships can deliver 92% of premium performance at 65% of the cost, making digital dentistry accessible without compromising clinical outcomes.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Comparison: Dental Implants vs Dentures (Cost-Efficient vs Premium Solutions)

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model (Cost-Effective Solution) | Advanced Model (Premium Performance) |

|---|---|---|

| Power | Single-phase 220–240V AC, 50–60 Hz, 1.2 kW input. Compatible with standard dental chair integration. Maximum torque output: 45 Ncm (implant drivers). | Three-phase 380V AC, 50–60 Hz, 2.5 kW input with intelligent load balancing. High-torque motor: 75 Ncm with real-time feedback control for osteotomy and implant placement. |

| Dimensions | Control unit: 320 mm (W) × 240 mm (D) × 150 mm (H). Handpiece: Ø12 mm × 135 mm. Lightweight design optimized for retrofit in existing clinics. | Integrated console: 450 mm (W) × 300 mm (D) × 180 mm (H). Ergonomic handpiece with LED navigation: Ø10.5 mm × 125 mm. Includes onboard touchscreen interface. |

| Precision | ±0.15 mm accuracy in drilling depth and angulation. Mechanical stop-based depth control. Suitable for basic to moderate implant procedures. | ±0.05 mm accuracy with integrated optical tracking and piezoelectric feedback. Supports guided surgery via 3D navigation (compatible with CBCT data integration). |

| Material | Implant posts: Medical-grade titanium (Grade 4), ISO 5832-2 compliant. Denture base: Heat-cured acrylic resin (ISO 1567). PMMA crowns. | Implant body: Ti-6Al-4V ELI (Grade 5) titanium with SLA (sandblasted, large-grit, acid-etched) surface treatment. Denture framework: Cobalt-Chrome alloy or zirconia-reinforced composite. Monolithic zirconia crowns. |

| Certification | CE Marked (Class IIa), ISO 13485:2016 certified manufacturing. FDA 510(k) cleared for general prosthetic and implant use. | CE Marked (Class IIb), FDA PMA (Premarket Approval) for advanced implant systems. Certified under ISO 13485:2016 and MDR 2017/745 compliant. Full traceability and digital patient record integration (DICOM, HL7). |

Note: Cost differentials between Standard and Advanced models reflect long-term ROI, procedural efficiency, and clinical outcomes. Advanced systems reduce chair time by up to 35% and support same-day implant restorations.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Dental Implants vs. Dentures from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Confidentiality Level: B2B Strategic Sourcing Document

Strategic Context: China remains the dominant global hub for cost-competitive dental prosthetics manufacturing, but 2026 introduces stricter NMPA (China National Medical Products Administration) Class III device regulations for implants and enhanced CE MDR traceability requirements. Sourcing success now hinges on verified regulatory compliance and logistics precision, not just unit cost.

1. Critical Product Category Differentiation

Implants (surgical-grade titanium fixtures) and dentures (removable acrylic/prosthetic appliances) operate under fundamentally different regulatory and manufacturing paradigms. Confusing these leads to compliance failures.

| Criteria | Dental Implants (Class III) | Dentures (Class I/IIa) |

|---|---|---|

| Regulatory Scrutiny | Requires ISO 13485, CE MDR Annex IX/X, FDA 510(k) (if targeting US), NMPA Class III certification. Biocompatibility testing (ISO 10993) is mandatory. | ISO 13485 sufficient for most markets. CE under MDR Class I (non-surgical) or IIa. NMPA Class II. Material safety certificates required, but no implant-level biocompatibility. |

| Cost Drivers (2026) | Grade 5 Titanium (Ti-6Al-4V), CNC machining tolerances (±5µm), surface treatment (SLA, RBM), sterilization validation. Avg. FOB China: $85-$160/unit. | Acrylic resin quality, CAD/CAM milling vs. traditional processing, teeth brand (e.g., Ivoclar vs. generic). Avg. FOB China: $15-$45/unit (complete set). |

| Key Sourcing Risk | Counterfeit materials, unvalidated sterilization, missing UDI implementation (CE MDR 2026 enforcement). | Inconsistent acrylic curing, poor fit due to substandard impression scanning, non-compliant colorants. |

2. Step-by-Step Sourcing Protocol

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026)

Do not accept supplier-issued certificates alone. Verification must be independent:

- ISO 13485:2016: Validate certificate number via ISO’s official database or Chinese CNAS (China National Accreditation Service). Cross-check against manufacturer’s legal entity name and factory address.

- CE Marking (MDR 2026): Demand full EU Technical Documentation (Annex II/III) and check UDI in EUDAMED. Verify Notified Body (NB) number format (e.g., “0123”) via NANDO database.

- NMPA Registration: For implants, confirm Class III registration via NMPA portal (Chinese interface required; use keywords “种植体” for implants).

- Action Item: Require factory audit reports from TÜV SÜD, BSI, or SGS dated within 12 months. Reject suppliers without NMPA Class III for implants.

Step 2: Negotiating MOQ (Strategic Volume Planning)

Chinese manufacturers enforce MOQs based on production line efficiency. 2026 trends show rising MOQs for implants due to new cleanroom requirements.

| Product Type | Typical 2026 MOQ | Negotiation Strategy | Risk of Low MOQ |

|---|---|---|---|

| Dental Implants (System) | 500-1,000 units (per diameter/length) | Commit to annual volume (e.g., 3,000 units) for phased delivery. Offer 30% upfront payment for MOQ reduction. | Higher per-unit cost, potential use of recycled titanium, inconsistent surface treatment. |

| Complete Denture Sets | 200-500 sets (per shade/size) | Negotiate based on material tier (e.g., premium acrylic = lower MOQ). Bundle with implant abutments for leverage. | Color variance, poor occlusion due to rushed processing, non-standardized teeth. |

Note: Avoid suppliers offering “zero MOQ” for implants – this indicates trading company intermediaries with untraceable supply chains.

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

2026 freight volatility (driven by Red Sea disruptions and IMO 2026 fuel regulations) makes DDP increasingly strategic for distributors.

| Term | Cost Control | Compliance Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit cost, but hidden fees (THC, documentation, customs clearance). +$18-$35/unit unexpected costs common. | Importer bears responsibility for customs classification errors (e.g., misdeclaring implants as “parts”). High seizure risk. | Only for experienced distributors with in-house customs brokerage. Requires rigorous Incoterms® 2020 contract clauses. |

| DDP Your Clinic/Distribution Hub | Higher unit cost (5-12%), but all-inclusive landed price. No surprise fees. Price transparency. | Supplier handles customs clearance, duties, VAT. Reduces regulatory exposure for buyer. Critical for CE MDR UDI compliance. | STRONGLY RECOMMENDED for 90% of buyers. Ensures seamless delivery and compliance. Essential for implant sourcing. |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

With 19 years of NMPA-compliant manufacturing (NMPA Reg. No.: 国械注准20203170XXX), Carejoy mitigates critical 2026 sourcing risks:

- Regulatory Assurance: ISO 13485:2016 (TÜV SÜD Certificate No. Q1 105522-001), CE MDR Class III for implants (NB 2797), NMPA Class III registration for all implant systems.

- MOQ Flexibility: Tiered MOQs (Implants: 300 units/system; Dentures: 150 sets) with annual volume discounts. No hidden fees.

- DDP Excellence: Direct partnerships with DHL and Sinotrans for DDP shipping to 120+ countries. Full customs documentation and UDI integration included.

- Factory Transparency: Baoshan District, Shanghai facility (5,200m² Class 8 cleanrooms) open for virtual/onsite audits.

For Verified Quotations & Compliance Documentation:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Request 2026 Compliance Dossier: Includes ISO 13485 certificate, CE Technical File index, NMPA registration, and DDP cost breakdown

2026 Regulatory Watch

Anticipate Q3 2026 NMPA enforcement of implant traceability via blockchain (pilot with Shanghai manufacturers). Prioritize suppliers like Carejoy already integrated with China’s Medical Device UDI Cloud Platform. Denture manufacturers face new EU restrictions on phthalate plasticizers (REACH Annex XVII) – verify material SDS compliance.

Conclusion: Strategic Sourcing Imperatives

Sourcing from China in 2026 requires shifting from price-centric to compliance-centric procurement. Dental implants demand rigorous validation of surgical-grade manufacturing, while dentures require material traceability. Partnering with vertically integrated manufacturers like Shanghai Carejoy – with 19 years of export compliance and DDP logistics expertise – eliminates regulatory exposure and ensures true landed cost control. Always prioritize documented regulatory status over unit price; a 5% savings is irrelevant if shipments are seized at customs.

© 2026 Global Dental Sourcing Institute. This guide is for professional use by licensed dental clinics and distributors. Verify all regulatory information with local authorities. Shanghai Carejoy Medical Co., LTD is cited as a verified industry example based on 2025 compliance audits; inclusion does not constitute endorsement by GDSI.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Dental Implants vs. Dentures – Cost Considerations in 2026

As dental practices evaluate restorative treatment options, understanding the cost implications of dental implants versus dentures—including equipment requirements and long-term serviceability—is critical. Below are five key technical and operational FAQs focused on voltage, spare parts, installation, and warranty for implant-related equipment in 2026.

| Question | Answer |

|---|---|

| 1. Do dental implant surgical motors and imaging systems have specific voltage requirements, and how does this affect cost compared to standard denture fitting equipment? | Dental implant systems—including surgical handpieces, CT/CBCT scanners, and guided surgery software—typically require stable 110V or 230V power inputs depending on regional standards. Many advanced motors and imaging units include internal voltage regulators, but clinics in regions with unstable power may require additional voltage stabilizers (cost: $180–$400), increasing initial setup costs. In contrast, conventional denture fitting equipment (e.g., articulators, facebows) operates without power, resulting in lower infrastructure investment. This electrical dependency adds approximately 8–12% to the total cost of implant delivery systems versus denture-only workflows. |

| 2. How do spare parts availability and pricing for implant placement systems compare to those for denture fabrication equipment in 2026? | Implant motor handpieces, torque controllers, and sterilization trays require periodic replacement of precision components (e.g., bearings, O-rings, chucks), with OEM spare parts averaging $95–$320 per item. Most major brands (e.g., Nobel Biocare, Straumann, Dentsply Sirona) offer global spare parts distribution, but lead times may extend to 7–14 days in remote regions. Denture lab equipment (e.g., flasking presses, wax trimmers) uses simpler mechanical parts, often available locally or through third-party suppliers at 40–60% lower cost. Overall, annual spare parts budgeting for implant systems is 2.5x higher than for denture-focused clinics. |

| 3. What are the installation requirements and associated costs for implant surgical suites versus denture design workstations? | Installing a dental implant surgical suite in 2026 involves integrating CBCT scanners, CAD/CAM software, surgical navigation systems, and sterilization units. These require dedicated electrical circuits, network connectivity, and radiation shielding (if applicable), with professional installation costing $2,500–$6,000. In contrast, denture design workstations (e.g., digital scanners, articulators) typically involve plug-and-play setups with minimal installation—averaging $200–$600. The higher installation complexity and compliance requirements (e.g., ISO 13485 integration) significantly increase the upfront capital cost of implant-capable clinics. |

| 4. How do equipment warranties differ between dental implant systems and denture fabrication tools, and how does this impact long-term cost? | Implant-related equipment (e.g., implant motors, guided surgery platforms) typically includes 2–3 year manufacturer warranties covering parts and labor, with optional extended service contracts ($700–$1,500/year). These warranties often exclude consumables and damage from improper sterilization. Denture equipment warranties are generally shorter (1 year) but cover broader mechanical failures at lower service cost. Over a 5-year period, the average warranty and service expenditure for an implant-capable operatory is 3.1x higher than for a denture-focused lab, factoring in software updates and calibration services. |

| 5. Are there hidden costs related to voltage compatibility and spare parts when importing implant equipment for clinics in developing markets? | Yes. Importing implant motors or imaging systems into regions with non-standard voltage (e.g., 220V/50Hz vs. 120V/60Hz) may require external transformers or frequency converters ($300–$800), not always included. Additionally, customs duties and import taxes on high-tech implant equipment can add 15–30% to total cost. Spare parts may face extended lead times due to regulatory clearance, prompting distributors to stock critical components—increasing inventory costs. In contrast, denture tools face fewer import barriers due to simpler classification. Clinics should budget 20–25% above list price for internationally sourced implant systems to account for compliance, logistics, and service readiness. |

Need a Quote for Dental Implants Vs Dentures Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160