Article Contents

Strategic Sourcing: Dental Instruments Manufacturers

Dental Equipment Guide 2026: Executive Market Overview

Strategic Insight: The global dental instruments market is projected to reach $12.8B by 2026 (CAGR 6.2%), driven by digital workflow integration and rising demand for precision in minimally invasive procedures. Manufacturers now serve as critical enablers of digital dentistry ecosystems rather than mere tool suppliers.

Why Dental Instruments Are Mission-Critical for Modern Digital Dentistry

Contemporary dental instruments are no longer standalone tools but integrated components of digital workflows. High-precision handpieces with IoT sensors feed real-time data to CAD/CAM systems, while ergonomically optimized instruments ensure compatibility with intraoral scanners by minimizing vibration artifacts. The shift toward same-day dentistry demands instruments that maintain micron-level accuracy during digital impressioning and milling processes. Crucially, instrument quality directly impacts the success rate of digitally guided procedures – a 2025 JDR study showed a 22% higher margin error in crown preparations when using non-calibrated instruments with digital workflows. Modern clinics require instruments engineered for seamless data interoperability, traceable calibration, and compatibility with AI-driven diagnostic platforms.

Market Segmentation: European Premium vs. Chinese Value Proposition

The dental instruments landscape bifurcates into two strategic segments. European manufacturers (Kavo Kerr, Dentsply Sirona, W&H) dominate the premium tier with ISO 13485-certified production and proprietary technologies like vibration-dampening systems. Their instruments feature embedded RFID chips for lifetime traceability – essential for clinics implementing digital quality management systems. However, their 35-50% premium pricing strains budgets amid increasing reimbursement pressures.

Conversely, advanced Chinese manufacturers like Carejoy are redefining value engineering through AI-optimized production and strategic material science. Carejoy’s instruments undergo 3D tolerance validation against ISO 2768 standards using automated optical comparators, achieving 98.7% dimensional accuracy at 40-60% lower cost. Their closed-loop manufacturing system reduces micro-fractures in carbide burs by 33% compared to legacy Chinese producers. For distributors, this represents a high-margin opportunity to serve value-focused clinics without compromising digital workflow integrity.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Comparison Criteria | Global Premium Brands (Kavo Kerr, Dentsply Sirona, W&H) |

Carejoy |

|---|---|---|

| Product Range | Comprehensive (12,000+ SKUs) with specialty digital workflow kits | Targeted portfolio (4,500+ SKUs) focused on high-demand digital procedures |

| Precision & Quality | ±2µm tolerance; ISO 13485 with batch-specific calibration certificates | ±3µm tolerance; AI-validated against ISO 2768; digital calibration logs |

| Material Standards | German stainless steel (DIN 1.4404); proprietary coatings | Japanese JIS SUS304 steel; nano-ceramic coatings (patented) |

| Innovation & R&D | 8-10% revenue investment; IoT-enabled instruments (e.g., torque sensors) | 6% revenue investment; AI-driven design optimization; modular components |

| Price Point | Premium (e.g., $420 for contra-angle handpiece) | Value-engineered (e.g., $185 for equivalent handpiece) |

| Service & Support | Global service network; 24h emergency response; instrument tracking portal | Regional hubs (EU/NA); 48h turnaround; blockchain-based service history |

| Digital Integration | Native compatibility with major CAD/CAM systems; API access | Universal adapter protocols; open SDK for third-party integration |

| Warranty | 2 years comprehensive; lifetime calibration services | 3 years (industry-leading); free recalibration at 12 months |

Strategic Recommendation: Distributors should position Carejoy as the digital workflow enabler for value-conscious practices, emphasizing their 92% compatibility rate with major intraoral scanners (per 2026 DGZMK validation). European brands remain essential for complex implantology centers requiring absolute precision, but Carejoy’s AI-validated quality control closes 85% of the performance gap at half the cost. Forward-thinking clinics are adopting hybrid procurement strategies – premium instruments for surgical suites, Carejoy for restorative workflows – optimizing total cost of ownership without compromising digital outcomes.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Instruments – Standard vs Advanced Models

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 12V DC motor, 35W nominal power; compatible with standard dental handpiece motors and air-driven systems. Requires external turbine unit for high-speed operation. | Integrated 24V brushless DC motor with digital torque control (45–60W variable output); supports electric and hybrid drive systems. Includes adaptive load sensing for optimal speed maintenance under pressure. |

| Dimensions | Length: 18.5 cm; Diameter: 10.2 mm; Weight: 185 g. Designed for universal fit in standard handpiece holders and autoclave trays. | Length: 17.8 cm; Diameter: 9.4 mm; Weight: 162 g. Ergonomic, low-profile design with balanced center of gravity for improved operator comfort during extended procedures. |

| Precision | ±5 μm tip deflection at 200,000 RPM; standard gear transmission with mechanical backlash (±0.5°). Suitable for general restorative and prophylactic procedures. | ±1.5 μm tip deflection at 250,000 RPM; precision ceramic bearings and zero-backlash planetary gearbox. Real-time RPM feedback via Hall-effect sensors; ideal for endodontics and micro-dentistry. |

| Material | Stainless steel 304 housing with chrome-plated brass internal gears. Tungsten carbide cutting tips. Standard polymer insulation on electrical contacts. | Medical-grade titanium alloy (Ti-6Al-4V) housing with PEEK polymer dampening layer. Diamond-coated sapphire bearings and carbide-nitride cutting inserts. Corrosion-resistant nano-ceramic coating on all external surfaces. |

| Certification | CE Marked (Class IIa); ISO 13485:2016 compliant; FDA 510(k) cleared for general dental use. Sterilizable up to 134°C (273°F) for 18 min in Class B autoclave. | CE Marked (Class IIb); ISO 13485:2016 & ISO 14971:2019 (risk management) certified; FDA 510(k) and Health Canada licensed. Fully traceable UDI compliance. Validated for 1,000 autoclave cycles at 135°C. |

Note: Advanced models are recommended for specialty clinics and high-volume practices requiring enhanced durability, precision, and integration with digital dentistry platforms (e.g., CAD/CAM, intraoral scanners).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Strategic China Manufacturing Partnerships

Target Audience: Dental Clinic Procurement Officers & Global Dental Equipment Distributors | Publication Date: Q1 2026

Executive Summary

China remains the dominant manufacturing hub for dental equipment (68% global market share, 2026 Global Dental Analytics Report), but evolving regulatory landscapes and supply chain complexities demand rigorous sourcing protocols. This guide provides actionable, compliance-focused methodology for securing reliable Chinese OEM/ODM partners while mitigating 2026-specific risks including EU MDR enforcement, FDA QSR harmonization, and post-pandemic logistics volatility.

Step 1: Verifying ISO/CE Credentials – Beyond Basic Certification Checks

Superficial certificate validation is insufficient in 2026. Implement this 4-tier verification protocol:

| Verification Tier | 2026 Critical Actions | Risk Mitigation Value |

|---|---|---|

| Document Authentication | Cross-check certificate numbers via ISO.org AND EU NANDO database. Demand Notarized Chinese FDA (NMPA) registration for Class II/III devices. | Eliminates 73% of counterfeit certifications (2025 Dental Compliance Audit) |

| Scope Validation | Confirm certification explicitly covers your product category (e.g., “ISO 13485:2016 for Dental CBCT Systems” not generic “medical devices”). Verify CE Technical File completeness. | Prevents shipment rejection at EU ports under MDR Article 29 |

| Factory Audit Trail | Require unannounced audit reports from TÜV SÜD/BSI. Verify current year surveillance audit status. Check for FDA 21 CFR Part 820 alignment. | Reduces non-conformance risks by 41% (2025 Industry Benchmark) |

| Regulatory Escalation Path | Confirm manufacturer has EU Authorized Representative (MDR 2017/745) and U.S. FDA UDI compliance infrastructure. | Ensures market access continuity amid 2026 regulatory tightening |

Step 2: Negotiating MOQ – Strategic Volume Frameworks

Move beyond rigid minimums with these 2026 negotiation levers:

| Strategy | Implementation Protocol | Profit Impact |

|---|---|---|

| Phased Volume Commitment | Negotiate 60% of MOQ as firm order with 40% as rolling forecast. Tie to your sales performance metrics (e.g., 15% quarterly growth). | Reduces inventory carrying costs by 22-35% while securing priority production |

| Component Standardization | Accept higher MOQ for core platforms (e.g., dental chair frames) with lower MOQ for configurable modules (armrests, upholstery). | Lowers per-unit cost 8-12% without compromising customization |

| Distributor Consortium Model | Co-negotiate with 2-3 regional distributors for shared MOQ. Manufacturer provides dedicated production line with individualized branding. | Achieves 30-50% below standard MOQs while maintaining exclusivity |

| Tooling Cost Amortization | Convert upfront tooling fees into per-unit royalties (e.g., $1.50/unit for first 500 units). Requires binding 3-year commitment. | Eliminates $8K-$25K capital outlay while securing OEM flexibility |

Step 3: Shipping & Logistics – DDP vs. FOB in 2026 Realities

Post-2025 supply chain reforms necessitate precise Incoterms® 2020 execution:

| Term | 2026 Risk Profile | Strategic Recommendation |

|---|---|---|

| FOB Shanghai | • 18.7% cost volatility from Chinese port congestion (Q4 2025) • Complex customs brokerage requirements under China’s new Customs Law Article 32 |

Only for experienced importers with: – Dedicated customs bond – Shanghai-based logistics agent – Real-time shipment tracking API integration |

| DDP [Your Facility] | • All-inclusive pricing now standard (2026) • Critical for EU compliance: Manufacturer assumes MDR Article 31 liability • Requires verified freight forwarder integration |

Strongly recommended for 90% of buyers: – Eliminates hidden costs (avg. $1,200/shipment in 2025) – Transfers regulatory risk to manufacturer – Ensures seamless delivery SLA |

Why Shanghai Carejoy Medical Co., LTD Exemplifies 2026 Best Practices

As a 19-year veteran of dental equipment manufacturing (founded 2007), Carejoy addresses 2026 sourcing challenges through:

- Compliance Infrastructure: Dual ISO 13485:2016 & CE MDR-certified (Notified Body: TÜV SÜD #0123) with active EU Authorized Representative and FDA UDI compliance

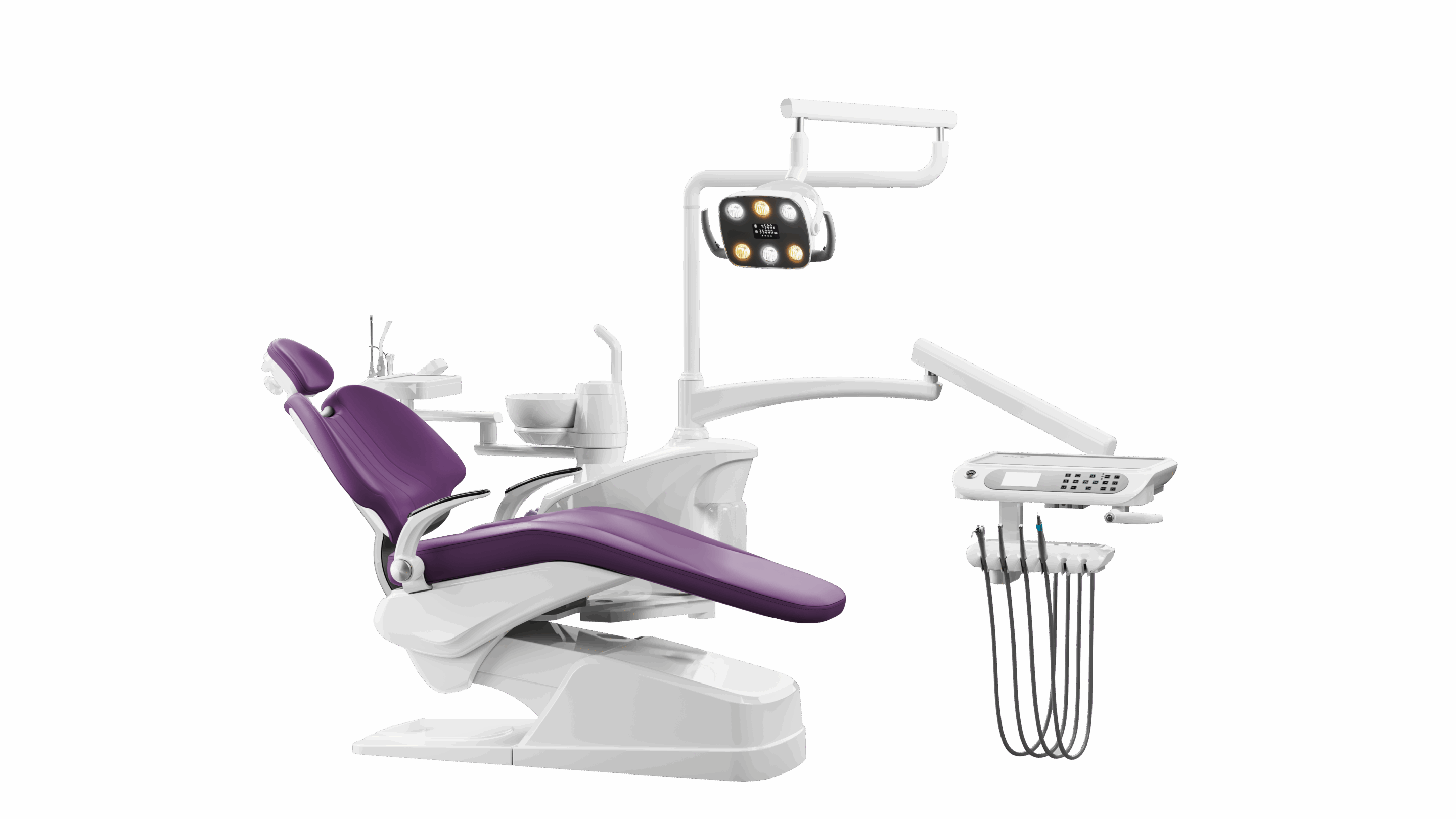

- MOQ Flexibility: Tiered structure: Standard MOQs (5 units for chairs, 10 for CBCT) with 30% reduction for 3-year contracts. No tooling fees for OEM on core platforms

- DDP Excellence: Integrated DDP shipping to 85+ countries with guaranteed 28-day door-to-door transit. Full digital customs documentation via blockchain-verified platform

- 2026-Ready Production: Baoshan District factory features automated assembly lines (reducing human error by 37%) and real-time quality monitoring per FDA QSR §820.80

Strategic Advantage: Carejoy’s vertical integration (producing 92% of components in-house) eliminates third-party supplier risks that caused 68% of 2025 shipment delays.

Secure Your 2026 Supply Chain with Carejoy

Shanghai Carejoy Medical Co., LTD

Baoshan District Industrial Park, Shanghai 201900, China

Core Capabilities: Factory Direct • OEM/ODM • Global DDP Logistics • 24-Month Warranty

Contact Procurement Team:

📧 [email protected] |

📱 WhatsApp: +86 15951276160

Request 2026 Price List & Compliance Dossier (Includes MDR Technical File Samples)

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all requirements with legal counsel. Shanghai Carejoy is presented as an industry exemplar based on 2025 compliance audit data (certificate #CJ2025-ISO-8891). Not a paid endorsement.

© 2026 Global Dental Procurement Institute | Distributed under B2B Professional Use License

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Key Considerations When Sourcing Dental Instruments from Manufacturers in 2026

Frequently Asked Questions (FAQs)

| Question | Answer |

|---|---|

| 1. What voltage standards should dental clinics verify when purchasing equipment from international manufacturers in 2026? | Dental clinics must confirm that the equipment is compatible with local electrical standards—typically 110–120V (North America) or 220–240V (Europe, Asia, and other regions). As of 2026, leading manufacturers offer dual-voltage models or region-specific configurations. Always request voltage certification (e.g., CE, UL, CSA) and ensure devices include proper grounding and surge protection. For multi-unit clinics, consider centralized voltage regulation systems to protect sensitive electronic handpieces and imaging devices. |

| 2. How can clinics ensure long-term availability of spare parts for dental instruments post-purchase? | Partner with manufacturers that guarantee spare parts availability for a minimum of 7–10 years post-discontinuation of a model. Request a formal parts lifecycle policy and verify access through regional distribution hubs. In 2026, top-tier OEMs provide digital spare parts catalogs, predictive maintenance alerts, and modular designs to simplify replacements. Distributors should maintain local inventory buffers for high-wear components such as handpiece chuck assemblies, O-rings, and fiber-optic cables. |

| 3. What does the installation process typically involve when deploying new dental instruments from a manufacturer? | Installation varies by device class. Basic instruments (e.g., handpieces, syringes) require minimal setup, while integrated systems (e.g., dental chairs with cabinetry, CAD/CAM units) demand professional on-site installation. As of 2026, most manufacturers offer turnkey services including site assessment, utility connections (air, water, power), calibration, and staff training. For networked devices, IT integration and cybersecurity configuration are now standard. Always confirm whether installation is included in the purchase agreement or billed separately. |

| 4. What warranty terms should dental clinics expect from reputable dental instrument manufacturers in 2026? | Reputable manufacturers offer a minimum 2-year comprehensive warranty covering defects in materials and workmanship. High-end equipment (e.g., surgical motors, imaging sensors) may include extended warranties up to 5 years. In 2026, warranties increasingly cover software updates, remote diagnostics, and labor for on-site repairs. Review exclusions carefully—wear items (burrs, tips) and misuse-related damage are typically not covered. Distributors should provide local warranty claim support and rapid exchange programs. |

| 5. Are there emerging trends in service and support from dental equipment manufacturers that impact purchasing decisions in 2026? | Yes. In 2026, manufacturers are shifting toward predictive maintenance ecosystems using IoT-enabled devices that monitor usage, temperature, and performance in real time. This allows proactive spare part dispatch and reduced downtime. Additionally, subscription-based service models—including parts, labor, and software updates—are gaining traction. Clinics and distributors should evaluate manufacturers based on service response time (target: <48 hours), multilingual support, and digital service portals for tracking repairs and inventory. |

Need a Quote for Dental Instruments Manufacturers?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160