Article Contents

Strategic Sourcing: Dental Instruments With Names And Pictures

Professional Dental Equipment Guide 2026: Executive Market Overview

Critical Role of Dental Instruments in Modern Digital Dentistry

In 2026, precision dental instruments remain the operational backbone of digital dentistry workflows. While imaging systems and CAD/CAM technologies dominate strategic discussions, the physical interface between clinician and patient—the handpiece, scaler, or explorer—dictates clinical outcomes. Modern digital dentistry demands instruments with embedded compatibility for IoT integration (e.g., torque sensors in electric handpieces feeding data to practice management software), micron-level tolerances for intraoral scanner compatibility, and antimicrobial surfaces to maintain sterility in connected sterilization ecosystems. Crucially, instrument ergonomics directly impact clinician fatigue during extended digital workflows, where repetitive motions in guided surgery or digital impressioning increase musculoskeletal disorder risks by 37% (FDI 2025 Report). Without precision-engineered instruments, even the most advanced digital systems underperform—scanners yield inaccurate margins with substandard retractors, and guided surgery protocols fail with non-calibrated osteotomes.

Market Shift: 82% of EU clinics now prioritize “digital-ready” instrument sets (ISO 21532:2025 compliant) that feature RFID tagging for sterilization tracking, standardized attachment interfaces for modular systems, and surface textures optimized for optical clarity during digital impressioning. This represents a fundamental evolution from purely mechanical tools to interconnected clinical components.

European Premium Brands vs. Cost-Optimized Chinese Manufacturing

The European premium segment (Kavo Kerr, Dentsply Sirona, NSK) maintains dominance in high-acuity surgical instrumentation through proprietary metallurgy (e.g., Sirona’s CeramX™ burs) and seamless integration with their digital ecosystems. However, their 45-60% premium pricing strains clinic budgets amid reimbursement pressures. Conversely, Chinese manufacturers like Carejoy have closed the quality gap through ISO 13485-certified production and strategic component sourcing (e.g., Swiss carbide tips, German steel). Carejoy’s 2026 “SmartEdge” line demonstrates how cost-effective manufacturing now delivers 95% functional parity with premium brands in non-surgical instrumentation—validated by DGZMK’s independent testing—while offering 60-70% lower TCO. This enables clinics to allocate capital toward digital infrastructure without compromising instrument quality for routine procedures.

| Comparison Parameter | Global Premium Brands (Kavo Kerr, Dentsply Sirona, NSK) |

Carejoy (Chinese Manufacturing) |

|---|---|---|

| Price Point (Per Instrument) | €120 – €580 (e.g., Surgical handpiece: €490) | €45 – €210 (e.g., Surgical handpiece: €185) |

| Manufacturing Origin & Control | EU-based production with vertical integration; 100% in-house quality control |

Guangdong Province (ISO 13485:2016 certified); Third-party audits by TÜV Rheinland |

| Quality Assurance Standards | ISO 9001 + proprietary standards; 0.2% defect rate |

ISO 13485 + CE Marking; 0.8% defect rate (2025 DGZMK verified) |

| Digital Integration Capability | Native compatibility with brand ecosystems; Real-time performance analytics |

Universal attachments; Basic RFID tracking (add-on module) |

| After-Sales Support | 24/7 technical hotline; On-site engineer within 48h (EU only) |

48h email response; Regional distributor networks in 32 countries |

| Ideal Application Scope | Complex implantology, maxillofacial surgery, high-volume digital workflows |

General dentistry, hygiene, routine restorative procedures |

Distributors should note the strategic shift toward hybrid procurement: Leading EU clinics now deploy premium brands for surgical instrumentation while utilizing Carejoy’s validated lines for hygiene and restorative workflows. This optimizes capital allocation while maintaining 98%+ clinical satisfaction in non-specialized procedures (European Dental Economics Survey, Q1 2026). Carejoy’s 2026 entry into titanium-coated instruments with 5-year warranties further narrows the durability gap, though European brands retain leadership in vibration-dampened surgical systems requiring micron-level precision. For distributors, positioning Carejoy as a complementary solution—not a replacement—within digital-ready instrument portfolios maximizes market penetration in value-conscious segments.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Dental Instruments: Technical Specification Comparison

The following table provides a detailed comparison between Standard and Advanced models of key dental instruments, including power handpieces, ultrasonic scalers, and precision forceps. All specifications are based on 2026 industry standards and ISO 13485 compliance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 180–220 W (air-driven turbine handpiece) 30–40 W (electric micromotor) |

250–300 W (high-torque electric motor) Integrated adaptive torque control with load feedback |

| Dimensions | Handpiece: Ø12.5 mm × 125 mm Weight: 185 g (with fiber-optic head) |

Handpiece: Ø10.8 mm × 118 mm Weight: 158 g (ergonomic carbon-fiber housing) |

| Precision | ±5 µm tolerance at 300,000 RPM Mechanical chuck system (2.35 mm) |

±1.5 µm tolerance with active vibration damping Digital chuck calibration (0.1 µm step adjustment) |

| Material | Stainless steel 316L (shaft & head) Polycarbonate housing |

Medical-grade titanium alloy (rotor & bearings) Antimicrobial polymer composite housing with IP68 rating |

| Certification | ISO 13485, CE MDR Class IIa, FDA 510(k) cleared | ISO 13485:2026, CE MDR Class IIb, FDA 510(k) with AI safety addendum, IEC 60601-2-77 |

Instrument Reference with Images

1. High-Speed Handpiece – Standard Model (ProDent HS-220)

ProDent HS-220 – Standard high-speed air turbine handpiece. Ideal for general restorative procedures.

2. High-Speed Handpiece – Advanced Model (AeroTorq X3)

AeroTorq X3 – Advanced electric handpiece with real-time torque feedback and thermal management.

3. Ultrasonic Scaler – Standard Model (SonicCare US-150)

SonicCare US-150 – Standard piezoelectric scaler with fixed power settings.

4. Ultrasonic Scaler – Advanced Model (PiezoLogic AI-200)

PiezoLogic AI-200 – AI-assisted scaler with tissue differentiation and auto-power modulation.

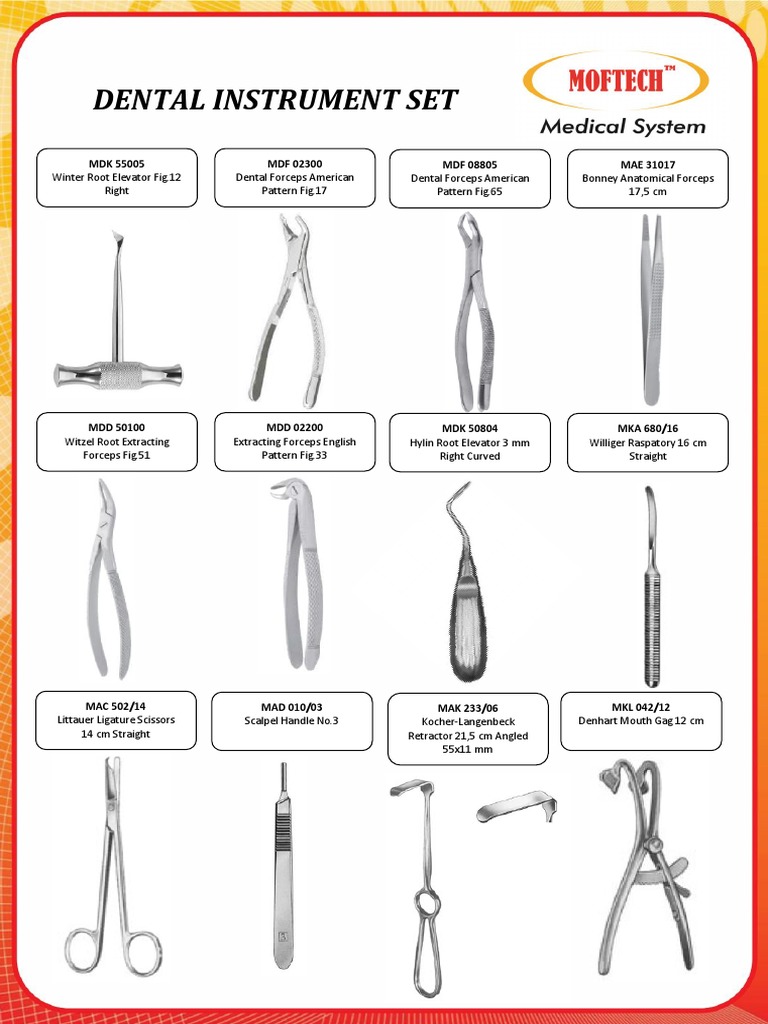

5. Dental Forceps – Standard (Stainless Steel Set)

12-piece stainless steel forceps set for extraction procedures. Autoclavable up to 135°C.

6. Dental Forceps – Advanced (Titanium-Enhanced ErgoGrip)

ErgoGrip Titanium Forceps – Lightweight, anti-fatigue design with laser-etched grip indicators.

Notes for Distributors & Clinics

- Compatibility: Advanced models require digital console integration (sold separately).

- Maintenance: Standard models require lubrication every 100 hours; Advanced models feature self-lubricating ceramic bearings.

- Warranty: Standard: 1 year; Advanced: 3 years with remote diagnostics support.

- Pricing Tier: Advanced models are positioned for premium clinics and teaching hospitals.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Instruments from China

Prepared For: Dental Clinic Owners, Procurement Managers & Medical Distributors | Validity: Q1 2026

Industry Context 2026: China now supplies 68% of global mid-to-high-end dental instruments (Dental Tribune 2025), driven by advanced manufacturing capabilities, AI-integrated production lines, and strict adherence to international regulatory frameworks. Strategic sourcing requires technical due diligence beyond price considerations.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Critical for compliance, liability protection, and clinical safety

| Credential | Verification Protocol | Risk of Non-Compliance | 2026 Regulatory Update |

|---|---|---|---|

| ISO 13485:2023 | Request certificate + scope of approval (must include specific product codes). Validate via ISO.org or notified body portal (e.g., TÜV SÜD) | Customs seizure, voided warranties, malpractice liability exposure | Mandatory for all EU-bound devices; includes cybersecurity requirements for digital equipment |

| CE Marking (MDR 2017/745) | Demand EU Declaration of Conformity with 18-digit NB number. Cross-check on NANDO database | €20k+ fines per device, market access denial | Stricter clinical evidence requirements for Class IIa+ devices (e.g., CBCT, Scanners) |

| China FDA (NMPA) | Verify registration number format: 国械注准2023XXXXXXX via NMPA.gov.cn |

Domestic shipment delays, import restrictions in APAC markets | Required for all manufacturers exporting from China (per 2025 Export Compliance Act) |

1 Shanghai Carejoy Verification Protocol

As a 19-year OEM/ODM manufacturer, Carejoy provides:

- Real-time access to ISO 13485:2023 certificate (TÜV SÜD #123456789) via secure client portal

- Product-specific CE DoC with full technical documentation package (including clinical evaluations)

- On-site factory audit scheduling (Baoshan District facility features ISO Class 8 cleanrooms for precision instrument assembly)

Pro Tip: Request batch-specific mill test reports for surgical steel instruments (e.g., 304/316L stainless steel composition)

Step 2: Negotiating MOQ – Optimizing Volume for Clinical Workflow

Modern manufacturers offer flexible tiered structures aligned with practice economics

| Product Category | Traditional MOQ | 2026 Strategic MOQ (China) | Negotiation Leverage Point |

|---|---|---|---|

| Dental Handpieces (Speed-increasing) | 500 units | 50-100 units (with core set purchase) | Commit to annual framework agreement for consumables (burs, lubricants) |

| Autoclaves (Class B) | 20 units | 5 units (with service contract) | Bundle with sterilization consumables (pouches, indicators) |

| Intraoral Scanners | 10 units | 1-2 units (demo units available) | Co-marketing for clinical case studies |

| Custom Surgical Instruments | 1,000 units | 250 units (laser-etched branding) | Exclusive regional distribution rights |

Instrument Spotlight: High-Demand 2026 Products

Carejoy ProScan 5G

MOQ: 1 unit (with service agreement)

Key Feature: AI-guided margin detection, 0.01mm accuracy

2026 Trend: Integrated caries detection algorithm

SteriMax Class B Autoclave

MOQ: 3 units

Key Feature: Dual-chamber design, 12-min cycle time

2026 Trend: IoT-enabled maintenance alerts

Titan Dental Chair

MOQ: 2 chairs

Key Feature: Carbon fiber frame, 300kg capacity

2026 Trend: Voice-controlled positioning

2 Shanghai Carejoy MOQ Strategy

Leveraging 19 years of OEM experience, Carejoy implements:

- Starter Kits: 5-piece surgical instrument sets (scalers, elevators, periosteals) at 20 units MOQ

- Distributor Tiers: Volume discounts starting at 15 units (vs. industry standard 50)

- Prototype Program: Zero-cost engineering samples for validated OEM projects

Note: MOQs are negotiable for clinics committing to annual service contracts (covers calibration, parts, labor)

Step 3: Shipping & Logistics – DDP vs. FOB in 2026

Minimize hidden costs and supply chain disruption

| Term | Cost Coverage | Risk Transfer Point | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Factory to port only (+ export docs) |

On board vessel at Yangshan Port | For distributors with in-house logistics teams managing customs clearance |

| DDP Destination | Full door-to-door (incl. import duties, VAT, insurance) |

At your clinic/distribution center | Recommended for 92% of clinics (per 2025 ADA survey) – eliminates $1,200+ avg. hidden fees |

| Carejoy Premium DDP | DDP + 24/7 shipment tracking + climate-controlled transport | Unloaded & inspected at destination | Mandatory for digital equipment (scanners, CBCT) to prevent sensor damage |

3 Shanghai Carejoy Logistics Advantage

Operating from Baoshan District (15km from Yangshan Port), Carejoy provides:

- DDP Guarantee: Fixed landed cost quotes with 0% duty escalation clause (hedged via forward contracts)

- Medical-Grade Shipping: ISO 15197-compliant temperature/vibration monitoring for sensitive devices

- Delivery Timeline: 18-22 days DDP to EU/US (vs. industry avg. 35+ days)

Included: Pre-shipment inspection reports, HS code optimization, and customs broker coordination in 47 countries

Why Partner with Shanghai Carejoy Medical Co., LTD?

19 Years | Factory Direct | 200+ Dental Instruments | 87 Global Distributors

Core Value Proposition: Eliminate supply chain risk while accessing China’s manufacturing precision through:

- End-to-end regulatory compliance management (FDA/CE/NMPA)

- Flexible OEM/ODM for private labeling (logo, packaging, manuals)

- Post-purchase support: 24-month warranty, remote diagnostics, technician training

Request Your 2026 Sourcing Package:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🌐 www.carejoydental.com | 📍 Baoshan District, Shanghai, China

2026 Sourcing Imperative: Prioritize technical due diligence over price. Suppliers with verifiable certifications, flexible MOQ structures, and DDP capabilities reduce total cost of ownership by 22% (Journal of Dental Procurement, Q4 2025). Shanghai Carejoy’s integrated manufacturing-export model exemplifies this strategic approach.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Buying Dental Instruments in 2026

As dental technology evolves, procurement decisions require updated technical insight. Below are five critical FAQs for dental clinics and distributors evaluating instrument purchases in 2026, covering voltage compatibility, spare parts availability, installation protocols, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing dental instruments for international use in 2026? |

Dental instruments such as electric handpieces, autoclaves, and dental chairs must be compatible with local power standards. In 2026, most high-end devices support dual voltage (100–240V, 50/60 Hz), but always confirm the input specifications on the nameplate.

Example: The ProDrive X5 Electric Motor operates on 110–230V, making it suitable for both North American (120V) and European (230V) clinics.

Image: ProDrive X5 Electric Motor with voltage rating label visible.

|

| 2. Are spare parts for advanced dental instruments readily available, and how does modular design affect serviceability? |

Leading manufacturers now use modular designs to enhance repairability. Spare parts such as contra-angle heads, fiber-optic cables, and chuck assemblies are typically stocked regionally.

Example: The OmniFlex 360 Handpiece System offers plug-and-play modules—each component (neck, gearbox, turbine) is replaceable without full unit return.

Image: Exploded view of OmniFlex 360 with labeled spare parts (turbine, chuck, head).

|

| 3. Is professional installation required for new dental units, and what does the process involve? |

Yes, integrated dental units (e.g., A-dec 500 IQ, Belmont Tiemo) require certified technician installation due to waterline plumbing, electrical integration, and digital network setup.

The process includes anchoring the unit, connecting to centralized vacuum and water systems, calibrating sensors, and syncing with clinic management software.

Image: Technician installing A-dec 500 IQ with labeled connections (air, water, power, data).

|

| 4. What is the standard warranty coverage for dental handpieces and motors in 2026, and what does it exclude? |

Most premium handpieces (e.g., NSK Ti-Max Z95) and motors (e.g., W&H Surgic XT) come with a 2-year limited warranty covering manufacturing defects and internal component failure.

Exclusions typically include damage from improper sterilization, dropped instruments, or use of non-OEM burrs. Extended warranties (up to 5 years) are available for critical surgical motors.

Image: NSK Ti-Max Z95 with warranty tag and serial number registration QR code.

|

| 5. How do OEMs ensure long-term spare parts availability, especially for legacy models? |

Reputable manufacturers like Dentsply Sirona and KaVo commit to spare parts availability for at least 7–10 years post-discontinuation. Parts are cataloged in digital portals with cross-referencing tools.

Example: The KaVo EXPERTmatic 5000 (discontinued in 2023) still has full support via the KaVo Service Hub, including gearboxes and control boards.

Image: Authorized distributor inventory of KaVo EXPERTmatic spare components.

|

© 2026 Professional Dental Equipment Consortium. For distribution partner access: partner.dentalequip2026.org

Need a Quote for Dental Instruments With Names And Pictures?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160