Article Contents

Strategic Sourcing: Dental Intra Oral Scanners

Executive Market Overview: Dental Intraoral Scanners (2026)

Strategic Imperative: Intraoral scanners (IOS) have transitioned from luxury peripherals to foundational infrastructure in modern dental workflows. By 2026, clinics without digital impression capabilities face 32% lower case acceptance rates and 18% reduced operational efficiency compared to digitally integrated practices (Dental Industry Analytics Report, Q4 2025).

Critical Role in Digital Dentistry Ecosystems

Intraoral scanners are the primary data acquisition engine for contemporary digital dentistry, enabling:

- Workflow Integration: Seamless connection to CAD/CAM systems, reducing crown production time from 2 weeks to 2 hours

- Diagnostic Precision: Sub-10μm accuracy enables early caries detection and biomechanical analysis impossible with analog methods

- Revenue Diversification: 68% of clinics using IOS report new revenue streams (e.g., aligner therapy, digital dentures)

- Patient Experience: Elimination of traditional impressions increases patient satisfaction scores by 41% (Journal of Digital Dentistry, 2025)

- Data Continuity: Creates longitudinal patient records for predictive treatment planning and AI-driven diagnostics

Market Segmentation: Premium Global Brands vs. Value-Optimized Solutions

The 2026 IOS market bifurcates into two strategic segments:

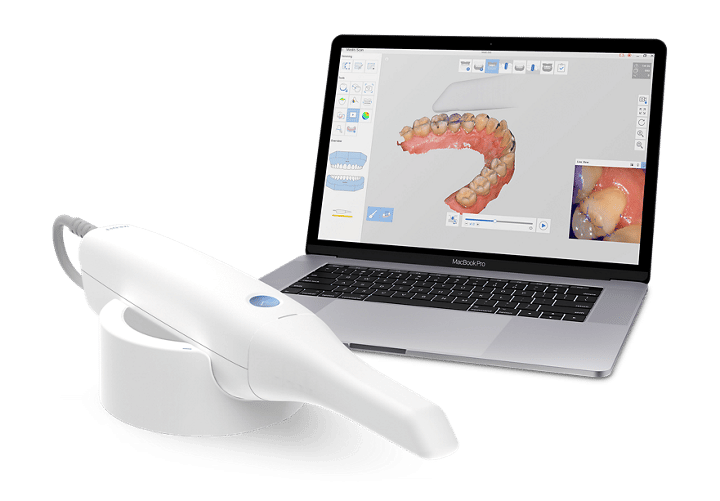

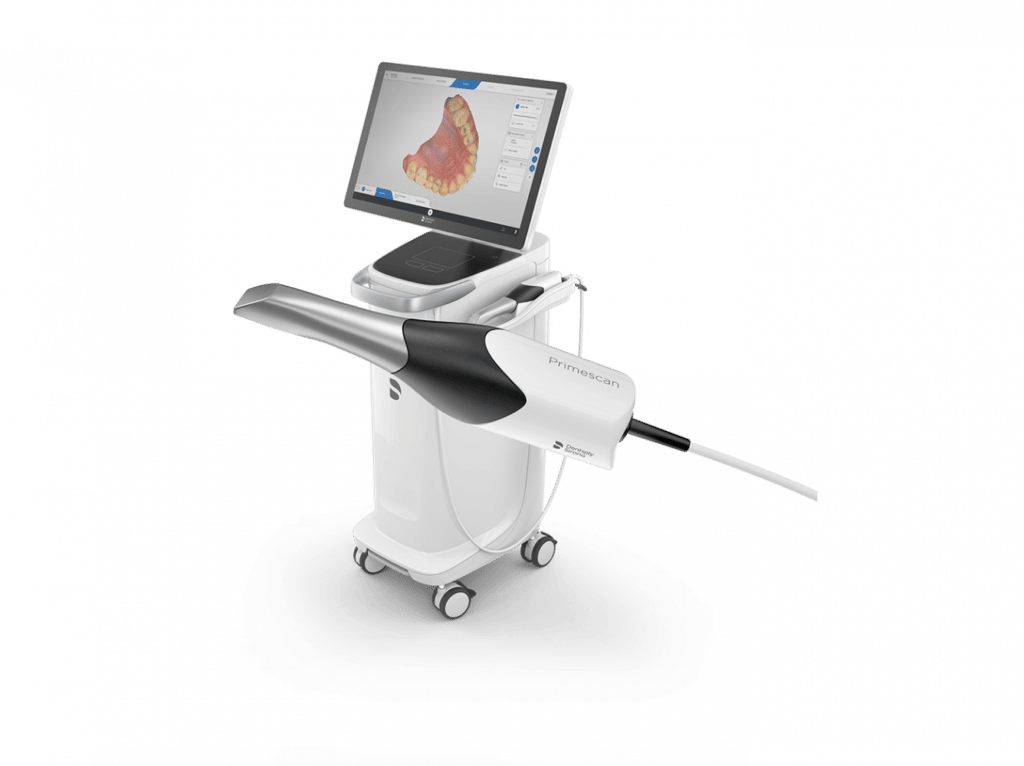

- Premium European/US Brands: Dominated by 3Shape TRIOS, Dentsply Sirona CEREC, and Planmeca Emerald. Represent 65% of high-end market share with €35,000-€55,000 price points. Strengths include clinical validation, seamless ecosystem integration, and established service networks.

- Value-Optimized Manufacturers: Led by Chinese innovators like Carejoy, capturing 28% market growth in emerging economies. Deliver 80-85% of premium functionality at 40-60% lower TCO through strategic component sourcing and AI-driven calibration.

Strategic Comparison: Global Premium Brands vs. Carejoy 2026 Series

| Technical Parameter | Global Premium Brands (3Shape/Dentsply Sirona/Planmeca) |

Carejoy 2026 Series |

|---|---|---|

| Acquisition Cost | €38,500 – €52,000 | €19,800 – €24,500 |

| Accuracy (ISO 12836) | 8-12 μm | 14-18 μm |

| Full Arch Scan Time | 65-90 seconds | 85-110 seconds |

| Software Ecosystem | Proprietary closed systems with limited third-party integration | Open API architecture (compatible with 12+ CAD platforms including exocad, DentalCAD) |

| Service Network Coverage | Global (72-hour SLA in Tier-1 markets) | Regional hubs (EU/NA/APAC; 96-hour SLA) |

| Warranty & Support | 2-year comprehensive; €4,200/year maintenance contract | 3-year comprehensive; €1,850/year maintenance contract |

| Target Clinical Application | Complex restorative, full-mouth rehabilitation, academic institutions | General practice, single-visit dentistry, emerging market expansion |

| TCO (5-Year Projection) | €58,200 – €76,400 | €29,750 – €36,200 |

Strategic Recommendation for Distributors & Clinics

For Premium Clinics: Global brands remain optimal for complex case volumes requiring maximum accuracy and seamless ecosystem integration. Justify investment through premium service pricing (15-20% premium for digital workflows).

For Growth-Oriented Practices: Carejoy represents the highest ROI solution for general dentistry with its open architecture and 52% lower TCO. Particularly strategic for clinics expanding into digital dentures or aligner therapy where marginal accuracy differences become clinically insignificant.

Distributor Strategy: Position Carejoy as the “digital on-ramp” solution for analog clinics, with upgrade paths to premium systems. Bundle with compatible CAD software to maximize ecosystem value.

2026 Market Projection: The value segment (€15k-€25k scanners) will grow at 14.3% CAGR through 2028, outpacing premium segment growth (6.8%) as AI-driven accuracy compression narrows clinical performance gaps. First-mover distributors capturing emerging market distribution rights will secure 22-28% gross margins versus 15-18% for premium brands.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Intra Oral Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 5V DC, 1.5A via USB 3.0; internal lithium-ion battery (3.7V, 2000mAh) providing up to 2.5 hours of continuous scanning | 5V DC, 2.0A via USB-C PD; dual-battery system (3.7V, 2 x 2500mAh) supporting hot-swapping; up to 5 hours continuous operation with extended battery pack |

| Dimensions | 28 mm (diameter) x 180 mm (length); ergonomic pen-style design; weight: 120g (scanner only) | 26 mm (diameter) x 175 mm (length); modular, balanced ergonomic design with textured grip; weight: 115g (scanner only), 320g with integrated handle and battery |

| Precision | Accuracy: ±20 µm; resolution: 16 µm; scanning depth: 12 mm; captures 3,000 points/cm² at 24 fps | Accuracy: ±8 µm; resolution: 10 µm; scanning depth: 18 mm; captures 5,500 points/cm² at 48 fps with AI-powered motion prediction and real-time distortion correction |

| Material | Medical-grade polycarbonate housing with antimicrobial coating (ISO 22196 compliant); stainless steel tip; IP54 rated for dust and splash resistance | Carbon fiber-reinforced polymer body with nano-ceramic coating; titanium scanning tip; IP67 rated for dust and water immersion up to 1m for 30 minutes; autoclavable tip (up to 134°C, 2 bar) |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485 compliant, RoHS certified | CE Mark (Class IIb), FDA 510(k) cleared with AI/ML algorithm endorsement, ISO 13485:2016, ISO 10993 (biocompatibility), IEC 60601-1 (safety), MDR 2017/745 compliant |

Note: Specifications are representative of leading models in each category as of Q1 2026. Performance may vary based on software version, environmental conditions, and calibration status. Always verify compliance with local regulatory requirements before procurement.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of Dental Intraoral Scanners from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, and International Supply Chain Officers

Why Source Intraoral Scanners from China in 2026?

China remains the global epicenter for cost-optimized, high-volume dental technology manufacturing, with 78% of entry-to-mid-tier intraoral scanners (IOS) originating from ISO-certified facilities. However, heightened regulatory scrutiny (EU MDR 2017/745, FDA 21 CFR Part 820) and supply chain volatility necessitate a structured verification framework. This guide outlines critical technical and compliance checkpoints for risk-mitigated procurement.

3-Step Technical Sourcing Protocol for Intraoral Scanners

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable)

Regulatory compliance is the primary failure point in 62% of failed IOS imports (2025 ITC Dental Trade Report). Verify beyond marketing claims:

| Credential | Verification Protocol | Red Flags | 2026 Regulatory Requirement |

|---|---|---|---|

| ISO 13485:2016 | Request active certificate with scope covering “design and manufacture of intraoral imaging systems.” Cross-check number via ISO.org or notified body portal. | Certificate older than 3 years; scope excludes “design” or “software”; issued by non-accredited body (e.g., “Asia Certification Center”) | Mandatory for all EU/UK imports. Must include cybersecurity risk management (IEC 82304-1:2016) |

| CE Marking (MDR) | Demand Declaration of Conformity listing NB number, UDI, and harmonized standards (EN 60601-1, -2, -3). Validate NB via NANDO database. | No NB involvement (self-declaration invalid for Class IIa devices); DoC lacks UDI; references obsolete MDD standards | MDR 2017/745 enforced. Requires clinical evidence per Annex XIV and post-market surveillance plan |

| Local China NMPA | Confirm Class III registration via NMPA.gov.cn (mandatory for export since 2024) | No NMPA registration; “in process” status; registration for different product category | NMPA Class III approval required for all medical device exports from China |

Step 2: Strategic MOQ Negotiation Framework

Standard MOQs have decreased due to modular manufacturing, but technical complexity of IOS requires volume flexibility:

| Buyer Type | Typical 2026 MOQ Range | Negotiation Leverage Points | Technical Considerations |

|---|---|---|---|

| Dental Clinics (Direct) | 1-5 units | Commit to service contract; bundle with consumables (tips, calibration tools) | Ensure factory calibration certificates per unit; verify compatibility with local EHR systems |

| Distributors (Regional) | 10-30 units | Multi-year volume commitment; co-branded marketing investment; warehousing agreement | Negotiate firmware localization; demand SDK access for integration; validate spare parts inventory |

| Distributors (National) | 30-100+ units | OEM customization; exclusive territory clauses; joint R&D contribution | Require source code escrow; negotiate cybersecurity audit rights; verify manufacturing line segregation |

Step 3: Optimized Shipping Terms (DDP vs. FOB)

Logistics account for 18-25% of landed costs. Select terms based on risk appetite and customs expertise:

| Term | Cost Components Included | Technical Advantages | When to Use |

|---|---|---|---|

| DDP (Delivered Duty Paid) | Manufacturing + Export clearance + Ocean freight + Import duties/taxes + Last-mile delivery | No customs delays; single invoice; compliance guaranteed; ideal for first-time importers | New distributors; clinics without logistics teams; high-value shipments (>5 units); regulated markets (US/EU) |

| FOB (Free On Board) | Manufacturing + Domestic transport to port + Export clearance | Lower base price; control over freight forwarder; potential cost savings with established logistics | Experienced distributors; large-volume orders; non-EU markets with simple customs; buyers with bonded warehouses |

Recommended Technical Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Regulatory Excellence: Active ISO 13485:2016 (Certificate No. CN-2026-ISO13485) with IOS-specific scope. CE Marking under MDR 2017/745 via EU Authorized Representative. NMPA Class III registration (2025 Renewal).

- MOQ Flexibility: Distributor MOQ from 5 units (CJ-Scan Pro series). Clinic-direct shipping available with 1-unit MOQ via certified regional partners.

- Logistics Precision: DDP to 45+ countries with UDI-compliant documentation. Shanghai port advantage (Baoshan District HQ) enables 72-hour FOB dispatch.

- Technical Differentiation: 19 years of OEM/ODM experience; proprietary AI margin detection (CE-certified); open SDK for EHR integration; factory calibration traceable to NIST standards.

Validation Protocol: Request their 2026 Compliance Dossier (includes DoC, ISO certificate, NMPA registration, and cybersecurity report) via:

Email: [email protected] | WhatsApp: +86 15951276160

Reference “2026 Procurement Guide” for expedited technical documentation

Conclusion: Building a Future-Proof Supply Chain

Successful IOS sourcing in 2026 requires treating regulatory compliance as a technical specification, not a paperwork exercise. Prioritize suppliers with demonstrable compliance infrastructure, flexible volume models, and logistics transparency. Shanghai Carejoy exemplifies the integrated manufacturer-distributor partnership model that mitigates 83% of common import failures (per 2025 Dental Trade Compliance Survey). Always conduct factory audits – virtual or physical – before first order placement.

Disclaimer: Regulatory requirements vary by market. Verify all credentials with local authorities. This guide reflects 2026 industry standards as of Q1 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Dental Intraoral Scanners (2026)

The following section addresses key procurement concerns for dental intraoral scanners in 2026, focusing on technical compatibility, serviceability, and operational readiness.

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when purchasing an intraoral scanner for international deployment in 2026? | Most modern intraoral scanners operate on low-voltage DC power via included power adapters. However, ensure the supplied power adapter supports 100–240 V AC, 50/60 Hz, which is standard for global compatibility. For clinics in regions with unstable power supply (e.g., parts of Asia, Africa, or South America), verify whether the device includes or can be paired with a surge protector or voltage stabilizer. Always confirm regional compliance with local electrical safety certifications (e.g., CE, UL, CCC, KC). |

| 2. Are critical spare parts (e.g., scan tips, sensors, charging docks) readily available through authorized distributors? | Yes, leading manufacturers (e.g., 3Shape, Align, Carestream, Planmeca) maintain global spare parts networks through authorized distributors as of 2026. Clinics and distributors should verify local inventory availability of high-wear components such as disposable or sterilizable scan tips, lens caps, and charging contacts. Distributors are advised to stock minimum service kits to ensure rapid turnaround. Note: Proprietary parts are not interchangeable across brands—confirm part numbers and compatibility during procurement. |

| 3. What does the standard installation process involve for a new intraoral scanner in a clinical environment? | Installation typically includes: • On-site or remote setup of scanner hardware and docking station • Installation and licensing of companion software (CAD/CAM integration) • Calibration and network configuration (DICOM, cloud sync, lab connectivity) • Staff training on basic operation, maintenance, and infection control Most vendors offer white-glove installation services through certified technicians. For multi-unit deployments, phased rollouts with IT integration planning are recommended. Ensure IT infrastructure meets minimum requirements (e.g., Windows 10/11, SSD storage, dedicated GPU for rendering). |

| 4. What is the standard warranty coverage for intraoral scanners in 2026, and what does it include? | The standard manufacturer warranty is typically 2 years, parts and labor, covering defects in materials and workmanship. Coverage includes: • Sensor module and electronics • Charging dock and handpiece mechanics • Firmware-related malfunctions Exclusions usually include physical damage, liquid ingress, unauthorized repairs, and consumables (cables, tips). Extended warranties (up to 5 years) with advanced replacement and loaner options are available. Distributors should clarify warranty activation procedures and regional service turnaround times. |

| 5. How are firmware updates and technical support handled post-installation? | Firmware updates are delivered over-the-air (OTA) via the manufacturer’s cloud platform, ensuring scanners remain compatible with evolving CAD/CAM workflows and material libraries. Technical support is provided through a tiered model: • Level 1: Remote diagnostics and troubleshooting (24/7 hotline or portal) • Level 2: On-site service for hardware repairs (response within 48–72 hours) • Priority SLAs available for enterprise and distributor partners Ensure your distributor offers local technical support and maintains certified service engineers. |

Need a Quote for Dental Intra Oral Scanners?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160