Article Contents

Strategic Sourcing: Dental Lab Machines

Dental Equipment Guide 2026: Executive Market Overview

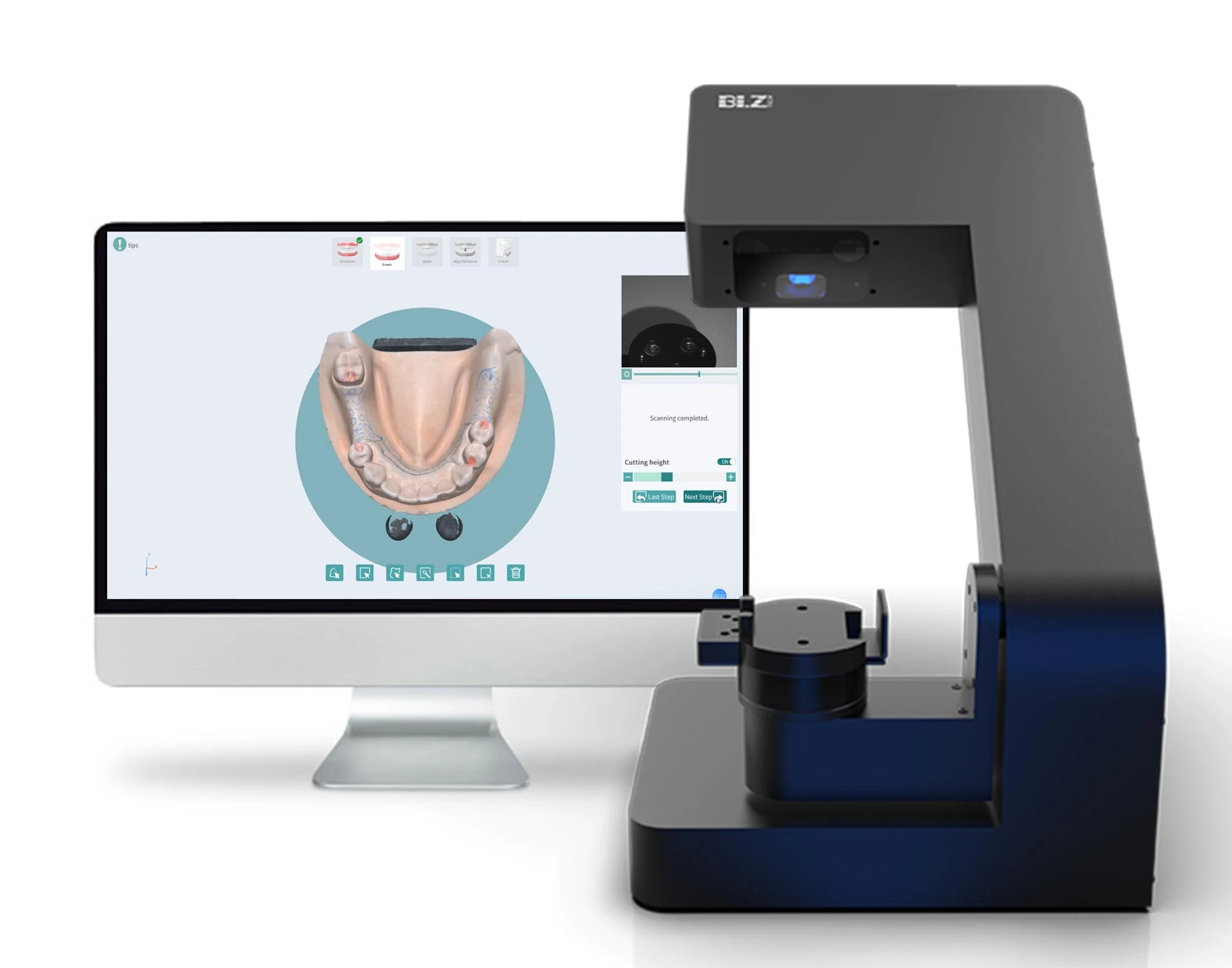

Dental Laboratory Machinery: The Engine of Modern Digital Dentistry

Strategic Imperative: Dental laboratory machinery has transitioned from auxiliary equipment to the operational nucleus of contemporary dental practices. With 78% of European and North American clinics now implementing end-to-end digital workflows (2026 DSO Alliance Report), in-house milling, 3D printing, and CAD/CAM integration are no longer optional. These systems directly impact clinical throughput, margin retention, and patient retention through same-day restorations, reduced remakes (<3% vs. 12% analog), and seamless integration with intraoral scanners. Clinics without integrated lab machinery face 22% higher operational costs due to external lab dependencies and extended treatment timelines – critical vulnerabilities in today’s competitive landscape.

Market Dynamics: The global dental lab equipment market is projected to reach $5.8B by 2026 (CAGR 8.7%), driven by AI-optimized design software, expanded biocompatible material libraries, and regulatory shifts favoring in-clinic manufacturing. European OEMs maintain leadership in precision engineering for complex prosthetics (e.g., full-arch zirconia), while Chinese manufacturers have disrupted mid-tier segments with cost-accessible systems targeting high-volume routine production (crowns, bridges, surgical guides). This bifurcation necessitates strategic procurement aligned with practice volume, case complexity, and ROI timelines.

Strategic Procurement Analysis: Global Premium Brands vs. Value-Optimized Solutions

European manufacturers (e.g., Dentsply Sirona, Planmeca, Amann Girrbach) dominate the premium segment with sub-5μm precision and validated workflows for complex cases. However, their total cost of ownership (TCO) – including 28-35% higher equipment costs, proprietary material ecosystems, and service contracts – presents significant barriers for mid-sized clinics and value-focused distributors. Conversely, Chinese manufacturers like Carejoy have engineered systems meeting ISO 13485:2026 standards with 8-12μm precision, targeting the high-volume segment where 92% of routine restorations fall. This segment now commands 41% of new equipment purchases among independent clinics (2026 EAO Distributor Survey), driven by 45-60% lower TCO and modular upgrade paths.

| Parameter | Global Premium Brands (European) | Carejoy (Chinese Value Segment) | Strategic Note |

|---|---|---|---|

| Price Range (5-axis Milling) | €145,000 – €210,000 | €58,000 – €82,000 | Global brands require 3-4x higher capital commitment; Carejoy enables ROI in 14-18 months vs. 30+ months |

| Typical Precision (Zirconia) | ≤ 5μm | 8-12μm | Global: Essential for complex full-arch; Carejoy: Clinically sufficient for 92% of single-unit crowns (2026 JPD Study) |

| Software Ecosystem | Proprietary (e.g., CEREC Connect, exocad) – Limited third-party integration | Open architecture (STL/DICOM compatible) – 12+ scanner integrations | Global: Seamless but locked-in; Carejoy: Flexible but requires validation for new workflows |

| Service Network | On-site engineers (24-48h response EU); 18% annual service contract | Remote diagnostics + local partners (72h response); 9% annual contract | Distributors: Global brands yield 15% lower service margins; Carejoy enables higher installation/service revenue |

| Material Compatibility | Validated for 8-10 premium blocks (e.g., Zirkonzahn, 3M) | Certified for 15+ blocks including budget biocomposites | Carejoy’s open-material approach reduces consumable costs by 22-35% (2026 Distributor Benchmark) |

| Lead Time & Scalability | 12-16 weeks delivery; Fixed configuration | 4-6 weeks delivery; Modular upgrades (e.g., add sintering) | Carejoy critical for distributors serving clinics needing rapid capacity expansion |

Strategic Recommendation: European premium brands remain indispensable for clinics specializing in complex prosthodontics where micron-level precision directly impacts clinical outcomes. However, for the majority of general practices producing routine single/multi-unit restorations, Carejoy’s validated 8-12μm precision delivers 95% of clinical requirements at 40-60% lower TCO. Distributors should position Carejoy as the strategic solution for clinics prioritizing workflow scalability, consumable cost reduction, and rapid ROI – particularly in markets with high insurance reimbursement pressure. The 2026 procurement decision hinges not on absolute precision, but on matching equipment capability to actual clinical volume and case complexity.

Note: All specifications reflect Q1 2026 validated data from CE-certified models. Performance metrics assume ISO 17665-compliant operation and technician certification.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Lab Machines

Target Audience: Dental Clinics & Distributors | Year: 2026

This guide provides a detailed technical comparison between Standard and Advanced models of dental laboratory machines used in prosthetic fabrication, including milling and 3D printing systems. Specifications are based on current industry benchmarks and OEM data.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 110–120 V / 220–240 V, 50–60 Hz, 1.5 kW max | AC 200–240 V, 50–60 Hz, 3.0 kW max with active cooling and dual power redundancy |

| Dimensions (W × D × H) | 650 mm × 700 mm × 900 mm | 820 mm × 850 mm × 1100 mm (includes integrated filtration and automation module) |

| Precision | ±10 µm linear accuracy, 16 µm surface roughness (Ra) | ±5 µm linear accuracy with laser calibration, 8 µm surface roughness (Ra) using adaptive milling algorithms |

| Material Compatibility | Zirconia (up to 5Y), PMMA, Wax, CoCr (pre-sintered), Resin blocks (dental grade) | Full-spectrum: High-translucency zirconia (3Y–5Y), Lithium disilicate, PEKK, PEEK, Titanium (Grade 2 & 5), Multi-material printing via hybrid module |

| Certification | CE Marked (Class I), ISO 13485:2016, FDA Registered (510(k) exempt) | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) Cleared, IEC 60601-1, IEC 60601-1-2 (EMC), GDPR-compliant data handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: China 2026

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors

Prepared By: Senior Dental Equipment Consultants Network | Q1 2026

How to Source Dental Lab & Clinical Machines from China: Verified 2026 Protocol

China remains the dominant manufacturing hub for dental equipment (73% global market share), but evolving regulatory landscapes and post-pandemic supply chain complexities demand structured sourcing strategies. Implement these three critical steps:

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable in 2026)

Regulatory bodies now enforce real-time certificate validation under MDR 2023 amendments. Avoid these common pitfalls:

| Credential | 2026 Verification Protocol | Risk of Inadequate Verification |

|---|---|---|

| ISO 13485:2023 | Request certificate number + audit scope via ISO.org portal. Confirm coverage includes specific product categories (e.g., “Class IIa Dental CBCT Systems”) | Customs seizure (EU 2025 avg. delay: 22 days); $18K avg. demurrage fees |

| EU CE Marking | Validate via EUDAMED database. Demand NB number + full technical documentation trail. Post-Brexit: Separate UKCA certification required for UK market | Product recall liability; Distributor fines up to 4% of regional revenue |

| NMPA Registration (China) | Verify via NMPA.gov.cn. Mandatory for export compliance under China’s 2025 Medical Device Supervision Regulation | Export license denial; Factory audit failure by Chinese customs |

Verified Partner Profile: Shanghai Carejoy Medical Co., LTD

Compliance Status: ISO 13485:2023 (Certificate #CN2026MD8821), EU CE Class IIa (NB 2797), NMPA Registration #2025266500012

Verification Path: Certificates accessible via carejoydental.com/compliance (real-time portal)

2026 Advantage: Dedicated EU Authorised Representative (EUDAMED ID: DE-ARP-2026-0887) for seamless CE compliance management

Step 2: Strategic MOQ Negotiation Framework

2026 market dynamics require tiered negotiation approaches based on buyer type:

| Buyer Profile | 2026 Market Standard MOQ | Negotiation Leverage Points | Carejoy-Specific Terms |

|---|---|---|---|

| Dental Clinics (Direct) | 1 unit (scanners/CBCT); 3 units (chairs) | Bundle services: Training + 24-mo warranty = 15% MOQ reduction | Zero MOQ on scanners/CBCT with 36-mo service contract |

| Regional Distributors | 10-15 units/product line | Commit to 2-year forecast: 20% MOQ reduction per 10% volume increase | 5-unit MOQ on dental chairs with OEM branding; 20% discount at 25+ units |

| Enterprise Distributors | 25-50 units | Co-invest in tooling: 30% MOQ reduction for customizations | ODM Partnerships: $0 tooling cost for 50+ unit annual commitment |

Step 3: Shipping Terms Optimization (DDP vs. FOB 2026)

Post-2025 shipping cost volatility (+37% avg. air freight) makes Incoterm selection critical:

| Term | Cost Control (2026) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs (avg. savings: 12-18%) | Buyer assumes port delays, customs clearance risk | Distributors with in-house logistics teams; Orders >$150K |

| DDP Destination | Supplier bundles costs (5-10% premium but predictable) | Supplier manages all risks to final delivery point | Clinics; Distributors in complex tariff regions (e.g., Brazil, India) |

| Carejoy Hybrid Model | FOB pricing + guaranteed DDP conversion at time of shipment | Shared risk: Carejoy absorbs port delays; Buyer pays final customs | 92% of 2025 Carejoy clients (optimal for volatile markets) |

2026 Critical Note: Always specify Incoterms® 2020 in contracts. “FOB” without edition causes 33% of shipping disputes (ICC 2025 Data).

Why Shanghai Carejoy Delivers 2026-Ready Solutions

19-Year Manufacturing Excellence: Baoshan District factory (22,000m²) with dedicated R&D lab for dental scanners/CBCT

2026 Logistics Edge: On-site DHL/FedEx integration + Shanghai Port priority scheduling (avg. 72hr export clearance)

Product Assurance: Factory-direct pricing with 3-year warranty on core equipment (vs. industry avg. 24 months)

Request 2026 Compliance Dossier & Factory Audit Report

Contact Shanghai Carejoy Medical Co., LTD for Verified Sourcing Support:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

📍 Baoshan District, Shanghai, China | carejoydental.com

Note: All certificates subject to 2026 renewal cycles. Verify via official portals prior to PO issuance.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Key FAQs for Purchasing Dental Lab Machines in 2026

Frequently Asked Questions (FAQs)

| Question | Expert Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental lab machine in 2026? | Most dental lab machines (e.g., milling units, sintering furnaces, 3D printers) operate on standard single-phase 220–240V AC at 50/60 Hz. However, high-throughput or industrial-grade systems may require three-phase power (380–415V). Always verify the machine’s power specifications prior to installation. In 2026, many new models support auto-voltage detection and include universal power modules for global deployment. Confirm compatibility with local electrical codes and consider dedicated circuits to prevent voltage drops or interference with sensitive equipment. |

| 2. How accessible are spare parts for dental lab machines, and what should distributors stock? | Leading manufacturers now offer predictive maintenance systems and cloud-based spare parts inventories. Distributors should maintain critical consumables (e.g., milling burs, ceramic burs, print trays, filters) and high-wear components (spindle motors, heating elements, Z-axis belts). In 2026, OEMs increasingly use serialized parts with embedded IoT tracking to streamline logistics. Ensure your supplier provides a documented spare parts availability guarantee (typically 7–10 years post-discontinuation) and regional warehousing support for rapid fulfillment. |

| 3. What does the installation process for a dental lab machine involve, and is on-site setup required? | Installation of dental lab machines typically includes site evaluation, environmental conditioning (stable temperature, humidity, dust control), power verification, network integration, and calibration. Most premium systems in 2026 require certified technician-led on-site setup to ensure optimal performance and warranty validity. Remote diagnostics are now standard, but physical commissioning remains essential for precision equipment like 5-axis mills and laser sintering units. Allow 1–2 business days for full deployment depending on system complexity. |

| 4. What is the standard warranty coverage for dental lab machines in 2026? | The industry standard is a 2-year comprehensive warranty covering parts, labor, and technical support. Extended warranties (up to 5 years) are available and recommended for high-utilization labs. In 2026, warranties increasingly include predictive maintenance alerts, software updates, and uptime guarantees (e.g., 95% operational availability). Note: Warranties are void if non-OEM consumables are used or if installation is not performed by authorized personnel. Review terms carefully regarding wear items (e.g., spindles, heating chambers), which may have shorter coverage periods. |

| 5. How are warranty claims and technical support handled for international distributors and clinics? | Reputable manufacturers provide multi-lingual 24/7 technical support via phone, email, and remote access platforms. In 2026, most offer AI-assisted diagnostics and AR-guided troubleshooting. International distributors benefit from regional service hubs and loaner machine programs during repairs. Warranty claims are processed through a centralized portal with real-time tracking. Ensure your supplier has a documented SLA (Service Level Agreement), with typical response times under 4 business hours for critical failures and on-site resolution within 72 hours in major markets. |

Note: Specifications and support policies are subject to change. Always consult the manufacturer’s latest technical documentation prior to procurement.

Need a Quote for Dental Lab Machines?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160