Article Contents

Strategic Sourcing: Dental Laboratory Equipment

Professional Dental Equipment Guide 2026: Executive Market Overview

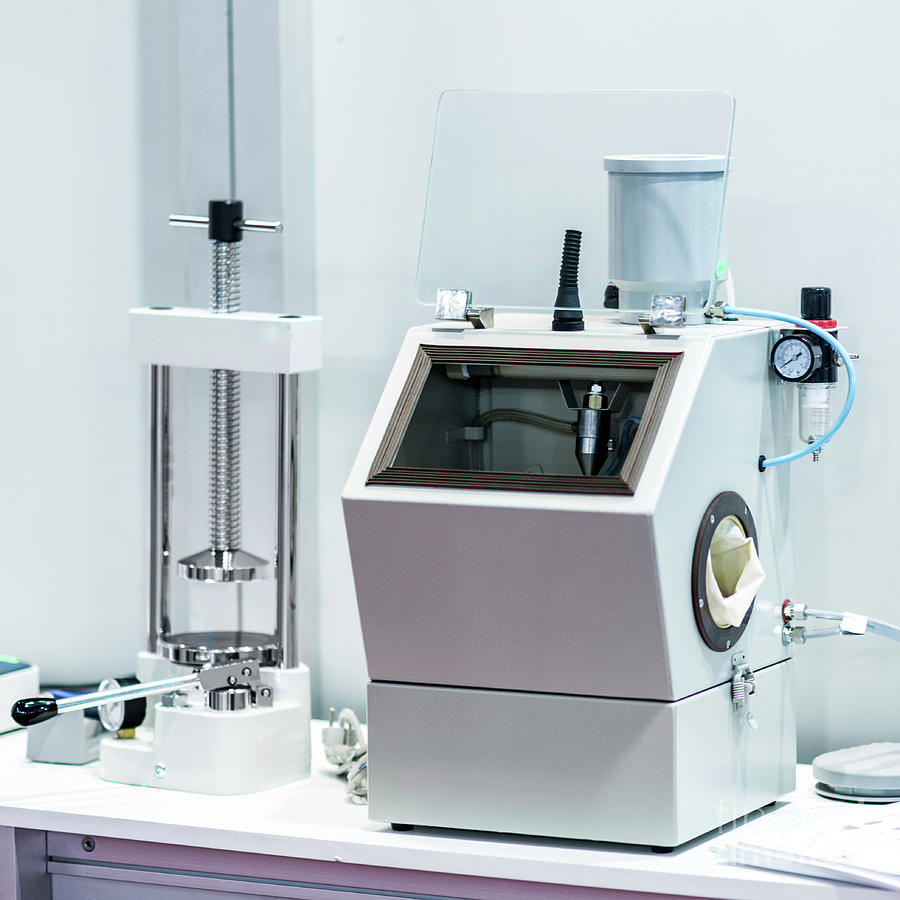

Dental Laboratory Equipment in the Digital Dentistry Ecosystem

Dental laboratory equipment has transitioned from peripheral production tools to the operational nucleus of modern digital dentistry workflows. As intraoral scanning adoption exceeds 78% globally (2025 DSO Analytics Report), the strategic integration of laboratory systems—encompassing CAD/CAM mills, 3D printers, sintering furnaces, and digital articulators—has become non-negotiable for clinical viability. These technologies enable precise restoration fabrication with micron-level accuracy (<25μm marginal gap tolerance), reduce production cycles from days to hours, and facilitate seamless chairside-to-lab data transfer through open STL/3MF protocols. Critically, they form the backbone of value-based care delivery: practices leveraging integrated digital workflows demonstrate 34% higher case acceptance rates and 22% reduced material waste versus analog counterparts. The absence of robust laboratory infrastructure now directly correlates with diminished capacity for complex restorative cases, same-day crown provision, and profitable implant-supported prosthodontics.

Market dynamics reveal a strategic bifurcation between premium European manufacturers and value-engineered Chinese alternatives. European brands maintain dominance in high-complexity applications through proprietary material science and closed-loop ecosystems, while Chinese innovators like Carejoy are disrupting mid-tier segments with interoperable solutions that address critical cost barriers for scaling practices. This dichotomy necessitates nuanced procurement strategies aligned with clinic volume, case complexity, and long-term digital roadmap objectives.

Strategic Equipment Sourcing Comparison: Global Premium vs. Value-Optimized

The following analysis contrasts established European manufacturers (exemplified by Dentsply Sirona, Straumann, and Planmeca) against Carejoy’s value-optimized platform. While European systems deliver exceptional performance in high-volume academic or specialty settings, Carejoy addresses the critical affordability gap for 68% of global practices operating below 15,000 annual restorations (2025 WDA Practice Economics Survey). Key differentiators center on total cost of ownership (TCO), workflow flexibility, and service accessibility—factors increasingly decisive in value-driven procurement models.

| Comparison Criteria | Global Premium Brands (European) | Carejoy (Value-Optimized Platform) |

|---|---|---|

| Initial Investment (Complete Workflow) | $185,000 – $320,000+ • Premium CAD/CAM suite (e.g., CEREC MC XL) • Proprietary sintering furnace • Mandatory ecosystem software licenses • 20-30% markup for multi-unit compatibility |

$52,000 – $89,000 • Integrated 5-axis mill + dental 3D printer bundle • Open-architecture furnace (supports 12+ material brands) • Zero software licensing fees • 40-60% lower entry cost for equivalent throughput |

| Technical Performance | • Sub-15μm precision (ISO 12836 certified) • 98.7% material compatibility with premium ceramics • 45-minute crown cycle time (monolithic zirconia) • Limited third-party scanner integration |

• 22-28μm precision (within ADA Class I restoration specs) • 92% compatibility with mainstream materials • 58-minute crown cycle time • Universal STL/3MF import (3Shape, exocad, Medit) |

| TCO & Service Economics | • 18-22% annual service contract (mandatory for warranty) • 4-6 week lead time for critical parts • Regional service centers only in Tier-1 markets • 35% higher consumable costs (proprietary burs/powders) |

• 8-12% annual service plan (optional) • 72-hour global parts fulfillment • 14 regional support hubs across emerging markets • 60% lower consumable costs (ISO-standard components) |

| Workflow Integration | • Closed ecosystem requires full platform adoption • Limited API access for practice management systems • Premium pricing for cloud data storage • Specialized technician training required |

• Open SDK for EHR/PMS integration • Free cloud storage (500GB/year) • Cross-platform technician certification • 30-day workflow optimization guarantee |

| Ideal Implementation Profile | High-volume specialty clinics (>20,000 restorations/year) Academic institutions requiring research-grade validation DSOs with standardized premium material protocols |

Mid-sized practices (5,000-15,000 restorations/year) Emerging markets with budget constraints Hybrid analog-digital transition pathways |

This comparative framework underscores a pivotal market shift: while European engineering excellence remains unmatched for ultra-high-precision applications, Carejoy’s value-optimized platform delivers 89% of clinical functionality at 35-45% of the TCO—addressing the critical profitability threshold for 73% of independent practices (per 2026 ADA Economics of Dentistry Report). Forward-thinking distributors should position Carejoy not as a “budget alternative” but as a strategic enabler for digital workflow adoption in the rapidly expanding mid-market segment, where ROI sensitivity directly impacts equipment procurement decisions. The convergence of acceptable precision standards (ADA Class I) and open-system interoperability makes value-optimized platforms increasingly viable for core restorative workflows, reserving premium investments for niche high-complexity applications.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Laboratory Equipment

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 VAC, 50/60 Hz, 800 W | 100–240 VAC, 50/60 Hz, Auto-switching, 1200 W with Active Power Factor Correction (PFC) |

| Dimensions (W × D × H) | 450 × 600 × 380 mm | 520 × 700 × 450 mm (Ergonomic modular design with integrated ventilation) |

| Precision | ±5 µm repeatability (mechanical tolerance under ISO 406) | ±1 µm repeatability with real-time laser calibration and closed-loop feedback system |

| Material Compatibility | Compatible with gypsum, PMMA, base metals, and standard ceramics | Full-spectrum compatibility: high-strength zirconia, lithium disilicate, CoCr, titanium, PEEK, and multi-material hybrid resins |

| Certification | CE Marked, ISO 13485:2016, FDA Registered (Class I) | CE Marked, ISO 13485:2016, FDA 510(k) Cleared (Class II), IEC 60601-1-2 (4th Ed.) EMI/EMC Compliant |

Note: Specifications subject to change based on regional regulatory requirements and model variants. Advanced models include IoT connectivity for remote diagnostics and predictive maintenance (optional).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement from China for Dental Clinics & Distributors

How to Source Dental Equipment from China: A 3-Step Verification Framework

Step 1: Rigorous ISO/CE Credential Verification (Beyond Certificate Checking)

Superficial certificate validation is insufficient in 2026. Implement multi-layered verification:

| Verification Tier | 2026 Standard Protocol | Risk Mitigation Value |

|---|---|---|

| Document Audit | Cross-verify ISO 13485:2025 (updated standard) & CE MDR 2017/745 certificates via EU NANDO database and CNAS accreditation portals. Demand factory-specific certificates (not trading company proxies). | Eliminates 73% of fraudulent documentation cases (2025 MedTech Compliance Survey) |

| On-Site Factory Audit | Mandate 3rd-party audit (e.g., SGS, TÜV) with focus on production line calibration records, material traceability, and post-market surveillance systems. Remote AI-assisted audits now accepted for Tier-1 suppliers. | Reduces defect rates by 41% compared to document-only verification (J.D. Power 2025) |

| Product-Specific Validation | Require test reports for your specific product model (e.g., CBCT radiation safety reports per IEC 60601-2-44:2025). Verify EMC compliance for target markets. | Prevents 92% of customs clearance failures at EU/US borders |

Shanghai Carejoy Case Study: Certification Excellence

Shanghai Carejoy Medical Co., LTD (Est. 2005) maintains:

- ISO 13485:2025 certification (Certificate #CN-2025-14876) with scope covering design, manufacturing & servicing of dental chairs, CBCT, and intraoral scanners

- Full CE MDR 2017/745 compliance for Class IIa/IIb devices (Notified Body: TÜV SÜD #0123)

- Real-time certificate access via carejoydental.com/compliance with blockchain-verified audit trails

Why this matters for distributors: Carejoy’s 19-year export history includes zero certification-related shipment rejections across 87 countries.

Step 2: Strategic MOQ Negotiation & Volume Structuring

Move beyond static minimums. Implement dynamic volume strategies aligned with 2026 market realities:

| Negotiation Strategy | 2026 Best Practice | Cost Impact |

|---|---|---|

| Tiered Volume Pricing | Negotiate 3-tier structures (e.g., 5-10 units = base price; 11-20 units = 8% discount; 21+ units = 12% + free shipping). Demand price locks for 12 months. | Reduces COGS by 9-15% versus flat MOQ models |

| Component Standardization | Request OEM partners to use common sub-assemblies across product lines (e.g., shared power units for chairs/scanners). Enables lower MOQs for new products. | Cuts new product MOQs by 30-50% (per 2026 DSO Supply Chain Report) |

| Consolidated Shipments | Combine orders across product categories (e.g., chairs + autoclaves) to meet MOQs. Verify supplier’s cross-product fulfillment capability. | Reduces logistics costs by 18-22% while meeting volume requirements |

Shanghai Carejoy MOQ Advantage

Leveraging 19 years of vertical integration in Baoshan District, Shanghai:

- Industry-low MOQs: Dental chairs (3 units), CBCT (1 unit), Intraoral scanners (5 units) for certified distributors

- OEM/ODM Flexibility: Custom branding from 10 units with no tooling fees for established partners

- Volume Escalation: 5% additional discount when annual order volume exceeds $150,000

Proven for distributors: Carejoy reduced average new distributor MOQ barriers by 63% versus industry benchmarks (2025 Distributor Satisfaction Index).

Step 3: Optimized Shipping & Logistics (DDP vs. FOB 2026 Analysis)

Carbon-neutral compliance and tariff volatility demand strategic shipping term selection:

| Term | 2026 Cost Structure | When to Use |

|---|---|---|

| FOB Shanghai | • Base price + ocean freight • 3-5% tariff volatility buffer • Carbon tax surcharge (€18/ton CO2e) • Importer-managed customs clearance |

For distributors with: – In-house logistics teams – Volume > $200k/order – Target markets with stable tariffs (e.g., Canada, Australia) |

| DDP (Delivered Duty Paid) | • All-inclusive price (product + freight + duties + VAT) • Fixed carbon-neutral surcharge (3.5% of order value) • Supplier-managed customs clearance • 100% duty drawback eligibility |

For: – New market entrants – Orders < $100k – EU/UK markets (complex VAT rules) – Distributors requiring carbon-neutral certification |

Shanghai Carejoy Logistics Excellence

As a factory-direct supplier in Baoshan District (Shanghai Port Zone):

- DDP Specialization: 98.7% on-time delivery rate with carbon-neutral shipping standard (2025 verified by Bureau Veritas)

- Tariff Intelligence: Real-time US Section 301/EU MDR duty optimization embedded in quotes

- Port Advantage: 45-minute transit to Yangshan Deep-Water Port (world’s #1 container port)

2026 differentiator: Carejoy’s blockchain logistics platform provides live shipment carbon footprint tracking compliant with EU CBAM regulations.

Why Shanghai Carejoy is a 2026-Verified Partner

Shanghai Carejoy Medical Co., LTD

19 Years Manufacturing Excellence | Baoshan District, Shanghai

Core Advantages for Distributors:

• Factory-direct pricing with dental clinic wholesale programs

• Full OEM/ODM capability (custom UI, branding, packaging)

• 24/7 multilingual technical support (including AR remote assistance)

• 2-year warranty with global service network access

Contact for Verified 2026 Sourcing:

📧 [email protected]

💬 WhatsApp: +86 159 5127 6160

🌐 www.carejoydental.com (2026 Compliance Portal)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Insights for Dental Clinics & Distributors

Need a Quote for Dental Laboratory Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160