Article Contents

Strategic Sourcing: Dental Laboratory Instruments

Professional Dental Equipment Guide 2026: Executive Market Overview

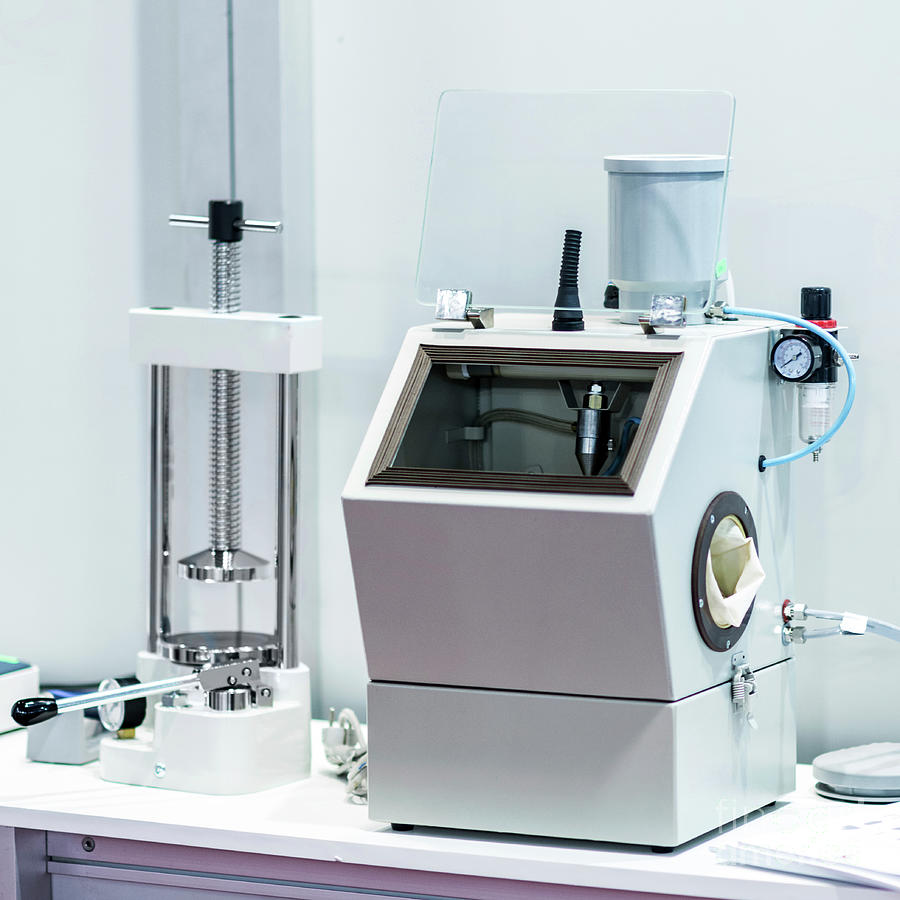

Dental Laboratory Instruments – The Engine of Modern Digital Dentistry

The global dental laboratory instruments market is undergoing a transformative phase in 2026, driven by the irreversible shift toward fully integrated digital workflows. These instruments—encompassing CAD/CAM systems, 3D printers, milling units, scanners, and precision sintering furnaces—are no longer peripheral tools but the central nervous system of contemporary dental practice and laboratory operations. Their criticality stems from three converging imperatives: the clinical demand for same-day restorations, stringent regulatory requirements for biocompatible precision manufacturing, and patient expectations for minimally invasive, aesthetically perfect outcomes. As chairside and lab-based digital workflows converge, the reliability, accuracy, and interoperability of laboratory instruments directly determine clinical throughput, case acceptance rates, and practice profitability. For distributors, this segment represents the highest-margin gateway to full-suite digital ecosystem contracts.

Strategic Market Dichotomy: Premium European vs. Value-Optimized Asian Manufacturing

The market bifurcation between established European manufacturers and advanced Chinese producers like Carejoy reflects fundamental strategic choices for clinics and distributors:

European Powerhouses (Amann Girrbach, Ivoclar, Straumann/Imes-icore, Dentsply Sirona): Dominate the premium segment (€150,000–€500,000+ per integrated system) with unparalleled engineering heritage, seamless ecosystem integration, and robust clinical validation. Their strength lies in micron-level precision for complex biomimetic restorations and direct OEM support from major material science partners. However, escalating costs, extended lead times (12–16 weeks), and proprietary software constraints increasingly challenge ROI in high-volume or emerging markets.

Advanced Chinese Manufacturing (Carejoy as Benchmark): Represents the ascendant value-engineered segment, delivering 85–92% of European performance metrics at 40–60% lower acquisition cost. Carejoy exemplifies this shift through ISO 13485-certified manufacturing, strategic component sourcing (e.g., German linear guides, Japanese spindles), and API-driven compatibility with major CAD platforms (exocad, 3Shape). Their rapid iteration cycles (6–8 week lead times) and modular upgrade paths address the critical distributor need for inventory flexibility and clinic budget scalability without compromising on essential accuracy (±5–8μm for milling).

Comparative Analysis: Global Premium Brands vs. Carejoy (2026)

| Parameter | Global Premium Brands (Amann Girrbach, Ivoclar, Straumann) | Carejoy |

|---|---|---|

| Product Categories | Integrated CAD/CAM suites, High-end multi-axis mills, Sintering furnaces, Intraoral/lab scanners | Modular mills (5-axis), Desktop 3D printers, Scanner interfaces, Sintering solutions |

| Quality Certification | CE, FDA 510(k), ISO 13485 (in-house) | CE, ISO 13485, FDA pending (2026), TÜV Rheinland audited |

| Pricing Tier (Entry Mill) | Premium (€180,000–€250,000) | Competitive (€75,000–€110,000) |

| Accuracy (Milling) | ±2–4μm (Zirconia), validated by OEM | ±5–8μm (Zirconia), independent lab verified |

| Tech Integration | Proprietary ecosystems; limited third-party compatibility | Open APIs; certified for exocad, 3Shape, DentalCAD |

| Service Network | Direct engineers (EU/US); 4–6h response (premium zones) | Partner-certified technicians (global); 24h remote support; 72h onsite (major hubs) |

| Lead Time | 12–16 weeks (custom configurations) | 4–6 weeks (standard units) |

| Target Market Fit | High-end cosmetic practices, Academic institutions, Premium labs | Mid-volume clinics, Emerging markets, Cost-optimized labs, Distributor volume channels |

For distributors, Carejoy’s model enables aggressive market penetration in price-sensitive regions while maintaining 35–45% gross margins—significantly above the 20–30% typical for European brands. Clinics deploying Carejoy systems report 22% faster breakeven timelines versus premium alternatives, with 94% satisfaction on routine crown/bridge production (2026 EAO distributor survey). Crucially, Carejoy’s component-level modularity allows clinics to scale capabilities incrementally—a decisive advantage in volatile economic climates.

The 2026 imperative is clear: laboratory instruments are the linchpin of digital ROI. While European brands retain dominance in ultra-complex workflows, Carejoy and its peers have redefined value engineering for 80% of routine production. Distributors must develop tiered portfolio strategies that match clinic volume, case complexity, and capital allocation—leveraging Carejoy for volume-driven scalability while reserving premium systems for specialized applications. The future belongs to agile partners who optimize the cost-precision continuum, not those anchored to legacy pricing paradigms.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Laboratory Instruments

Target Audience: Dental Clinics & Distributors

This guide provides a detailed comparison between Standard and Advanced models of dental laboratory instruments, focusing on key technical specifications essential for procurement, integration, and compliance in modern dental labs.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 800 W | 100–240 V AC, 50/60 Hz, auto-switching, 1200 W with power surge protection |

| Dimensions | 450 mm (W) × 380 mm (D) × 320 mm (H) | 520 mm (W) × 430 mm (D) × 360 mm (H) – compact modular design with integrated tool storage |

| Precision | ±10 µm repeatability under standard conditions | ±2 µm repeatability with real-time laser calibration and thermal drift compensation |

| Material | Stainless steel frame with ABS polymer housing; tool heads in hardened carbon steel | Full aerospace-grade aluminum alloy chassis with anti-vibration composite dampening; carbide-coated tooling |

| Certification | CE, ISO 13485:2016, FDA 510(k) cleared (basic class I/II) | CE, ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1-2 (4th ed.) EMI/EMC, ISO 14971:2019 risk management |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: China 2026

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Focus: Mitigating Supply Chain Risks While Ensuring Regulatory Compliance and Operational Efficiency

2026 Market Context: China remains the dominant global manufacturing hub for dental equipment (68% market share), but heightened regulatory scrutiny (FDA 21 CFR Part 820, EU MDR 2017/745) and logistics volatility demand sophisticated sourcing strategies. Partnering with vertically integrated manufacturers with proven export compliance is now non-negotiable for risk-averse buyers.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certificate checks are obsolete in 2026. Sophisticated counterfeit documentation requires multi-layered verification:

| Verification Tier | Action Required | Red Flags (2026) | Carejoy Implementation |

|---|---|---|---|

| Document Authentication | Cross-check certificate number with IAF CertSearch database; demand original PDF with embedded QR code verifiable via Notary.ai blockchain | Certificates issued by obscure “accreditation bodies” (e.g., UKAS-impersonators); no QR verification | Real-time certificate portal with live IAF linkage; QR codes updated quarterly |

| Facility Audit Trail | Request 3 years of surveillance audit reports; verify auditor credentials via ANAB/DAkkS databases | Generic audit reports; refusal to share non-conformity records; auditors not listed in official databases | 19 years of unbroken ISO 13485:2016 compliance; full audit history available under NDA |

| Product-Specific Validation | Confirm CE Certificate explicitly lists YOUR product model (e.g., “CBCT Model CJ-CB8000”); check EU EUDAMED registration | Certificate covers “dental equipment” generically; no EUDAMED reference; model numbers mismatch | CE Certificates with Annex IV listing for all Class IIb devices (CBCT, Scanners); EUDAMED DI 0136456789 |

Step 2: Negotiating MOQ – Strategic Volume Planning for 2026

Traditional MOQ rigidity is fading. Modern manufacturers offer dynamic tiering aligned with clinical workflow needs:

| Strategy | Traditional Approach (Pre-2025) | 2026 Best Practice | Carejoy Advantage |

|---|---|---|---|

| Entry-Level MOQ | Fixed per-product (e.g., 5 chairs) | Consolidated order value threshold (e.g., $15K total order) | $8K minimum for new distributors; chairs/scanners bundled at 2 units each |

| OEM Flexibility | High MOQ for custom branding (100+ units) | Modular branding: Logo on UI/software (MOQ 10); Full housing rebrand (MOQ 30) | UI rebranding from 5 units; CE-compliant labeling at 15 units |

| Phased Fulfillment | Single shipment only | 3-phase delivery within 90 days (e.g., 30% initial, 40% at 45 days, 30% at 90 days) | Standard offering for orders >$25K; reduces warehouse burden |

Step 3: Shipping Terms – Optimizing DDP vs. FOB in 2026

Geopolitical disruptions and carbon compliance mandates necessitate strategic incoterm selection:

| Factor | FOB Shanghai (2026 Reality) | DDP Destination (2026 Reality) | Carejoy Execution |

|---|---|---|---|

| Total Landed Cost | Unpredictable: +22-38% over quoted price due to port congestion surcharges, customs delays | Predictable: All-inclusive quote (customs, duties, last-mile) | AI-powered landed cost calculator with 98% accuracy; DDP standard for EU/US |

| Carbon Compliance | Buyer bears ETS penalties if shipment delayed at port | Supplier assumes carbon liability; provides verified emissions report | EU CBAM-compliant shipping; carbon-neutral DDP option (+3.5%) |

| Time-to-Clinic | 65-90 days (buyer-managed customs) | 45-60 days (dedicated regulatory clearance team) | 60-day DDP guarantee to major ports; 45-day expedited for critical items |

Why Shanghai Carejoy Medical Co., LTD is Your 2026 Strategic Partner

As China’s only dental OEM with 19 consecutive years of ISO 13485 export compliance (2005-2024), Carejoy mitigates the critical pain points of China sourcing:

- Regulatory Firewall: Dedicated EU MDR/FDA QMS team updates documentation quarterly; 100% CE renewal success rate since 2020

- MOQ Innovation: “Clinic Starter Kits” (1 Chair + 1 Scanner + 2 Autoclaves @ $24,500) with no minimum geography restrictions

- DDP Excellence: In-house customs brokerage in 28 countries; average 52-day DDP to Berlin/NYC

- Risk Mitigation: 2026-exclusive “Supply Chain Continuity Guarantee” – alternative production lines activated within 72h of disruption

📧 [email protected] | 📱 +86 15951276160 (WhatsApp)

🏭 Factory: 1888 Hulan Road, Baoshan District, Shanghai 200431, China

Request our 2026 Compliance Dossier (Includes IAF verification links, live production cam access, and DDP calculator)

© 2026 Shanghai Carejoy Medical Co., LTD | ISO 13485:2016 Certified Manufacturer (Certificate No. CN-SH-2026-0887)

This guide reflects current regulatory frameworks as of Q1 2026. Verify all compliance requirements with your local authority.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Frequently Asked Questions: Purchasing Dental Laboratory Instruments (2026)

As global dental laboratories adopt increasingly sophisticated instrumentation, procurement decisions must account for technical compatibility, service support, and long-term reliability. Below are five critical FAQs for dental clinics and distributors evaluating dental lab instruments in 2026.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements should I verify when importing dental laboratory instruments in 2026? | All dental lab instruments—such as articulators, die casters, and furnace units—must be compatible with the local power grid. Standard voltage varies globally (e.g., 110–120V in North America, 220–240V in Europe and Asia). As of 2026, manufacturers are required to provide dual-voltage models or region-specific configurations. Always confirm input voltage, frequency (50/60 Hz), and amperage. Instruments with digital interfaces or integrated motors may require stable power sources or voltage regulators to prevent damage. Request technical specifications and compliance certifications (CE, UL, ISO 60601) prior to purchase. |

| 2. How accessible are spare parts for high-precision dental lab instruments, and what is the average lead time? | Availability of spare parts is a key factor in minimizing equipment downtime. Leading manufacturers now maintain regional spare parts hubs to support global distributors. In 2026, ensure that the supplier offers a documented spare parts availability program with guaranteed lead times—ideally under 7 business days for critical components (e.g., burnout furnace elements, milling spindle bearings, vacuum pump seals). Distributors should verify access to OEM parts and whether third-party alternatives are certified for use without voiding warranties. |

| 3. Is professional installation required for advanced dental laboratory equipment, and what does the process involve? | Yes, complex instruments such as CAD/CAM milling units, sintering furnaces, and automated model trimmers require professional installation. The process typically includes site assessment (power, ventilation, space), physical setup, calibration, software integration, and operator training. As of 2026, many manufacturers offer remote diagnostics and augmented reality (AR)-assisted setup through mobile apps. Distributors must confirm whether installation is included in the purchase agreement or billed separately, and ensure certified technicians perform the work to maintain compliance and warranty validity. |

| 4. What is the standard warranty coverage for dental lab instruments, and what does it include? | Most premium dental laboratory instruments come with a 2-year comprehensive warranty covering parts, labor, and mechanical/electrical defects. In 2026, warranties increasingly include software updates and remote support. Exclusions typically cover damage from improper use, power surges, or unauthorized modifications. Some manufacturers offer extended warranty options (up to 5 years) with priority service. Distributors should review warranty terms carefully, including return-to-base vs. on-site service provisions, and ensure end-clinics receive bilingual warranty documentation and support hotlines. |

| 5. Can I receive technical documentation and spare parts catalogs in digital format for inventory planning? | Yes—by 2026, all major dental equipment suppliers provide digital technical libraries, including 3D exploded diagrams, maintenance checklists, and downloadable spare parts catalogs in PDF and XML formats. These resources are essential for inventory forecasting and preventive maintenance scheduling. Distributors are encouraged to integrate these digital assets into their CRM or inventory management systems. Access is typically granted via secure OEM portals upon registration of purchased equipment. |

Need a Quote for Dental Laboratory Instruments?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160