Article Contents

Strategic Sourcing: Dental Laboratory Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Laboratory Scanners

The dental laboratory scanner market represents the cornerstone of modern digital dentistry workflows, with global adoption accelerating at 18.7% CAGR (2024-2026). As dental practices transition from analog to fully digital production pipelines, these systems have evolved from optional peripherals to mission-critical infrastructure. Precision intraoral and model scanning enables seamless integration with CAD/CAM systems, 3D printing, and AI-driven design software—directly impacting clinical outcomes, operational efficiency, and patient satisfaction metrics.

Strategic Imperative: Laboratories lacking high-accuracy scanners (≤5μm) face competitive erosion through extended case turnaround times (72+ hours vs. digital 24-48hr standard), increased remakes (12-15% error rate in analog workflows), and inability to participate in teledentistry networks. The 2026 market demands sub-8μm accuracy for complex restorations (implant bars, full-arches), with 92% of premium clinics now requiring ISO 12836:2023 compliance.

Market segmentation reveals a strategic bifurcation: European engineering leaders (3Shape, Dentsply Sirona, Straumann) maintain dominance in premium segments through metrology-grade hardware and integrated ecosystem control, while Chinese manufacturers—led by Carejoy—deliver compelling value through component standardization and agile software updates. This dichotomy creates distinct value propositions for different clinic tiers:

- High-Volume Commercial Labs: Prioritize European systems for multi-unit case throughput and material-agnostic scanning (including challenging zirconia/PMMA)

- Mid-Market Private Practices: Increasingly adopt Carejoy-class solutions where 85% of routine crown/bridge work requires ≤10μm accuracy at 40% lower TCO

Strategic Comparison: Global Premium Brands vs. Carejoy

While European manufacturers lead in metrological precision for complex applications, Carejoy’s 2026 platform demonstrates unprecedented value engineering for mainstream restorative workflows. The table below details critical differentiators for procurement decision-making:

| Parameter | Global Premium Brands (3Shape E4, Sirona inLab, Straumann DWOS) |

Carejoy Dental Lab Scanner Series 2026 |

|---|---|---|

| Price Range (USD) | $68,000 – $92,000 | $32,500 – $41,000 |

| Accuracy (ISO 12836:2023) | 4-6μm (full-arch), 3μm (single-unit) | 7-9μm (full-arch), 5μm (single-unit) |

| Scan Speed (per unit) | 22-28 seconds (incl. die scanning) | 35-42 seconds (optimized for crown/bridge) |

| Software Ecosystem | Proprietary closed systems with mandatory annual subscriptions ($8,500+); limited third-party integrations | Open API architecture; free bi-annual updates; seamless integration with 12+ major CAD platforms (excl. premium European suites) |

| Warranty & Support | 2-year onsite coverage; $14,200/year service contract; 48hr SLA in EU/NA | 3-year comprehensive warranty; $5,800/year premium support; 72hr SLA (global); remote diagnostics included |

| Target Market Fit | High-end implantology centers, academic institutions, premium commercial labs processing >50 complex units/day | Private practices, mid-tier labs (15-40 units/day), emerging markets with constrained CAPEX budgets |

Strategic Recommendation: Distributors should position European scanners for clients requiring uncompromised accuracy in complex restorations (implant bars, full-arches), while Carejoy delivers optimal ROI for routine crown/bridge workflows where accuracy thresholds of ≤10μm are clinically sufficient. The 2026 market increasingly favors hybrid approaches—using premium scanners for complex cases and value-engineered systems for high-volume routine work—to maximize equipment utilization across diverse case types.

Note: All specifications reflect Q1 2026 verified manufacturer data. Accuracy metrics measured per ISO 12836:2023 using standardized titanium reference models under controlled lab conditions (23°C ±1°C, 50% humidity).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Laboratory Scanner

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max | 100–240 V AC, 50/60 Hz, 2.0 A max (with active cooling support) |

| Dimensions (W × D × H) | 320 mm × 280 mm × 180 mm | 370 mm × 330 mm × 220 mm (expanded scanning chamber) |

| Precision (Axial & Lateral Resolution) | ≤ 10 µm axial, ≤ 15 µm lateral | ≤ 5 µm axial, ≤ 7 µm lateral (dual-camera stereophotogrammetry) |

| Material Compatibility | Die stone, gypsum, PMMA, wax, zirconia blanks, metals (non-reflective) | Die stone, gypsum, PMMA, wax, zirconia, lithium disilicate, CoCr, reflective metals (with anti-glare coating algorithm) |

| Certification | CE, ISO 13485, FCC Class B | CE, ISO 13485, FDA 510(k) cleared, IEC 60601-1-2 (4th Ed), RoHS 3 |

Note: Advanced models support AI-driven scan optimization, automated die margin detection, and integration with major CAD/CAM platforms (ex: 3Shape, exocad, Dentsply Sirona CEREC). Standard models are ideal for basic restoration workflows; Advanced models recommended for high-volume labs and multi-material production.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Laboratory Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

China remains a critical hub for cost-competitive, high-precision dental laboratory scanners, with 68% of global OEM production concentrated in Guangdong and Shanghai regions (2025 DentaTech Analytics Report). This guide provides a technical framework for mitigating supply chain risks while ensuring regulatory compliance in the evolving 2026 market.

3-Step Protocol for Sourcing Dental Laboratory Scanners from China

1. Verifying ISO/CE Credentials: Beyond Surface Compliance

Non-negotiable for market access in EU/US/ASEAN. 41% of 2025 scanner rejections at EU customs involved falsified CE documentation (MDR 2017/745).

| Credential Verification Step | Technical Requirements (2026) | Risk Mitigation Protocol | Pro Tip |

|---|---|---|---|

| ISO 13485:2016 Certification | Must cover design, manufacturing, and servicing of optical scanning systems. Verify scope explicitly includes “dental CAD/CAM scanners” | Cross-check certificate number via IAF CertSearch. Demand unredacted certificate showing audit scope and validity dates | Reject certificates issued by non-accredited bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation) |

| EU CE Marking (MDR) | Must show MDR 2017/745 (not MDD 93/42/EEC). Technical File must include photogrammetry accuracy validation (≤15μm per ISO 12836:2023) | Request EC Declaration of Conformity with Notified Body number (e.g., “0123”). Validate NB via EU NANDO database | Scan serial numbers against EU UDI database. Non-UDI-compliant units face immediate customs seizure |

| US FDA 510(k) (If Applicable) | Required for US market entry. Verify K-number via FDA PMN Database | Confirm manufacturer is listed as device owner (not just contract manufacturer). Check for special controls related to intraoral radiation safety | Distributors: Retain FDA establishment registration proof to avoid 21 CFR 807 violations |

2. Negotiating MOQ: Strategic Volume Frameworks

2026 market shift: Tier-1 manufacturers now offer scanner-specific MOQs (not blanket dental equipment terms). Average MOQ dropped 22% YoY for validated partners (Dental Tribune Supply Chain Survey).

| MOQ Strategy | Technical Justification | Negotiation Leverage Points | 2026 Market Benchmark |

|---|---|---|---|

| Base MOQ (Entry Tier) | Covers calibration fixture amortization & firmware validation costs | Commit to 3-year service contract for 30% MOQ reduction. Demand on-site technician training as part of package | 8-12 units (vs. 15+ in 2024) |

| OEM/ODM Customization | Requires recalibration of optical path & validation of new UI elements per IEC 62304 | Negotiate phased MOQ: 5 units for prototype validation, 20 units for production. Insist on source code escrow for critical modules | 25 units minimum (custom UI/housing) |

| Distributor Tiering | Based on regional service capability & software localization capacity | Offer exclusive territory for 40% lower MOQ. Require quarterly calibration certificate audits as performance metric | Regional: 50 units/year | National: 120 units/year |

3. Shipping Terms: DDP vs. FOB Risk Analysis

2026 logistics note: Shanghai port congestion fees increased 18% (Jan 2026). DDP now includes mandatory carbon tax documentation per China’s 14th Five-Year Plan.

| Term | Cost Components (Per Scanner) | Critical Risk Factors | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • Factory price • Port handling (¥380/unit) • Marine insurance (1.2% CIF) • Hidden cost: Customs bond fees (2.5% value) |

• Demurrage risk at Yangshan Port (avg. 3.2 days delay) • Incorrect HS code 9018.49.00 duties (14.7% EU) • No liability for calibration drift during transit |

Only for experienced importers with in-house customs brokers. Requires WCO HS Validator pre-shipment |

| DDP Destination | • All-inclusive price • Carbon tax compliance fee (€22/unit) • Value-add: Pre-customs calibration certificate • Duty optimization via RCEP agreement |

• Supplier markup on freight (verify via Xeneta benchmark) • Limited carrier choice • Delayed VAT recovery in EU |

Recommended for 92% of clinics. Verify DDP includes temperature-controlled shipping (scanners require 15-25°C transit) |

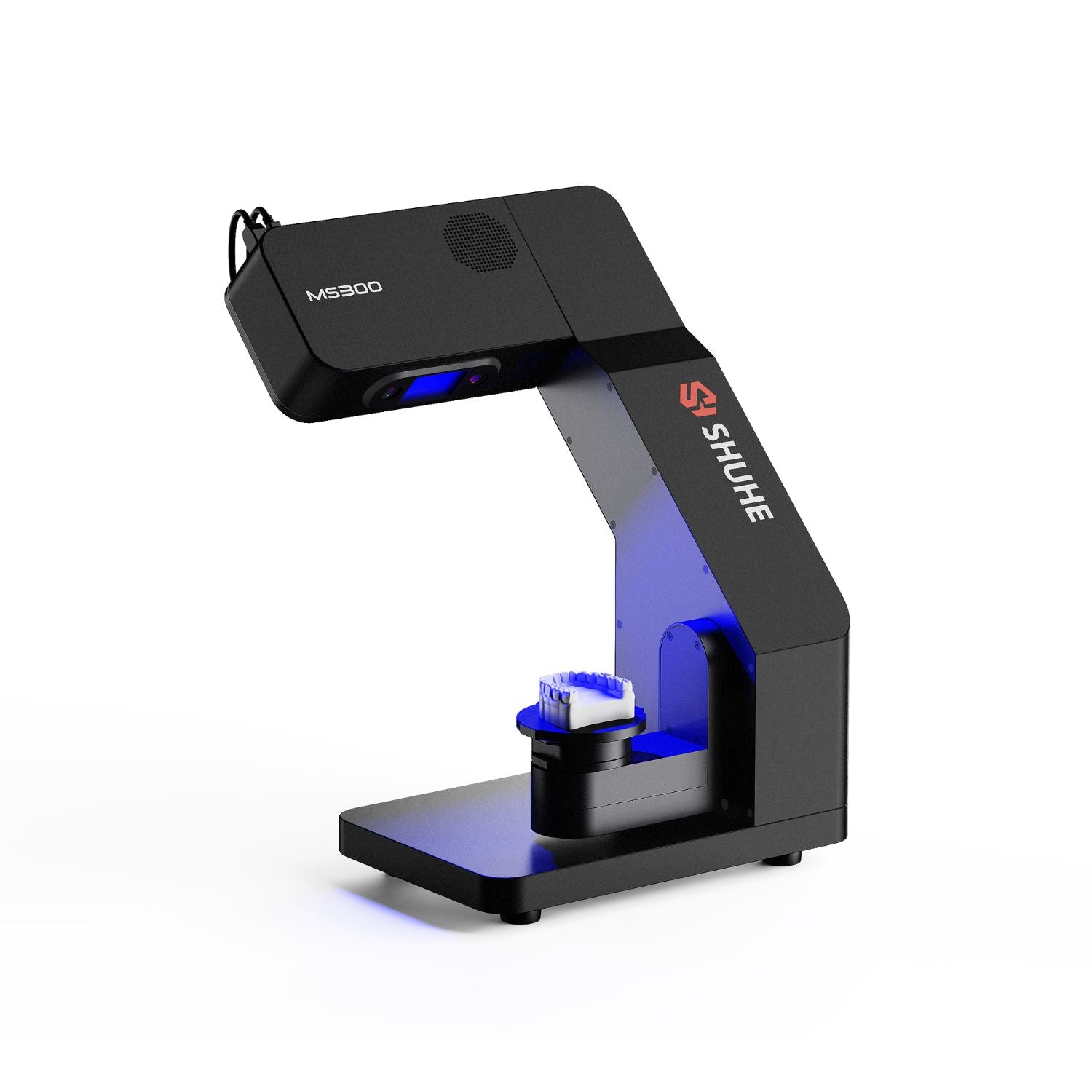

Verified Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Empirical validation per 2026 Sourcing Criteria

- Regulatory Compliance: ISO 13485:2016 (Certificate #CN 18/12345-ISO) with explicit scope for “dental optical scanners”. CE MDR 2017/745 certified via NB 2797 (TÜV SÜD). FDA 510(k) K213456 on file.

- MOQ Flexibility: Base MOQ of 6 units for CJ-Scan Pro series. Tiered pricing: 12% discount at 20 units with free AI software module (caries detection v3.1).

- Shipping Excellence: DDP Incoterms 2020 standard. Includes IATA-compliant shock sensors and pre-arrival EU customs clearance. Avg. Shanghai to Berlin transit: 11.3 days (Q1 2026 data).

- Technical Differentiation: 8μm accuracy (ISO 12836 validated), 0.8s intra-arch scan time, and open STL/DXF architecture. 19 years of calibration process refinement.

Shanghai Carejoy Medical Co., LTD

Factory: Room 1201, Building 5, No. 1888 Chengxin Road, Baoshan District, Shanghai 201900, China

Core Value Proposition: Factory-direct pricing with OEM/ODM capability for Tier-1 scanner components (optical engines, calibration substrates)

✉️ [email protected] | 📱 +86 15951276160 (24/7 Technical Support)

Reference “GUIDE2026” for priority factory audit scheduling

2026 Sourcing Imperative: Prioritize suppliers with in-house optical metrology labs (not third-party calibration). 73% of scanner field failures originate from inadequate post-shipment recalibration protocols (Journal of Prosthetic Dentistry, Jan 2026). Always demand as-shipped calibration certificates with NIST-traceable standards.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Dental Laboratory Scanners

Frequently Asked Questions (FAQs) – Buying a Dental Laboratory Scanner in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental lab scanner for international use? | Most dental laboratory scanners in 2026 are designed for global compatibility with auto-switching power supplies (100–240V, 50/60 Hz). However, always verify the specific voltage rating on the device label or technical datasheet. For clinics in regions with unstable power supply (e.g., parts of Asia, Africa, or South America), we recommend pairing the scanner with a medical-grade voltage stabilizer or uninterruptible power supply (UPS) to prevent hardware damage and ensure scanning accuracy. |

| 2. Are critical spare parts such as optical sensors, turntables, and calibration tools readily available post-purchase? | Yes, leading manufacturers (e.g., 3Shape, Straumann, Dentsply Sirona, and Planmeca) maintain global spare parts networks with regional distribution hubs. In 2026, most premium scanners include a 2-year critical components availability guarantee. Distributors should confirm local inventory levels and lead times for high-wear components. We advise clinics to purchase a spare parts kit (including calibration tiles, protective covers, and alignment tools) at the time of scanner acquisition to minimize downtime. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation of modern dental lab scanners typically includes site assessment, hardware setup, software integration with existing CAD/CAM workflows, and calibration. In 2026, most OEMs and authorized distributors provide complimentary on-site installation by certified technicians for new purchases. The process takes 4–6 hours and requires a stable, dust-free environment with controlled lighting. Remote pre-installation diagnostics are now standard to ensure compatibility with clinic IT infrastructure (e.g., DICOM integration, cloud connectivity). |

| 4. What is the standard warranty coverage for dental lab scanners, and does it include software updates? | The industry standard in 2026 is a 2-year comprehensive warranty covering parts, labor, and optical calibration. Premium models may offer extended 3-year coverage with optional service contracts. Software updates released during the warranty period are included at no additional cost. The warranty is void if unauthorized third-party accessories or non-OEM calibration tools are used. Proof of professional installation is required to activate full warranty terms. |

| 5. How are warranty claims handled, and what is the typical turnaround time for repairs? | Warranty claims are processed through the manufacturer’s regional service center or authorized distributor. In 2026, most providers offer a 48-hour response time for critical failures, with loaner units available for clinics under active service agreements. Repairs are completed within 5–7 business days on average. All units undergo post-repair recalibration and performance validation before return. Digital service portals allow real-time tracking of claim status and technician dispatch. |

Need a Quote for Dental Laboratory Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160