Article Contents

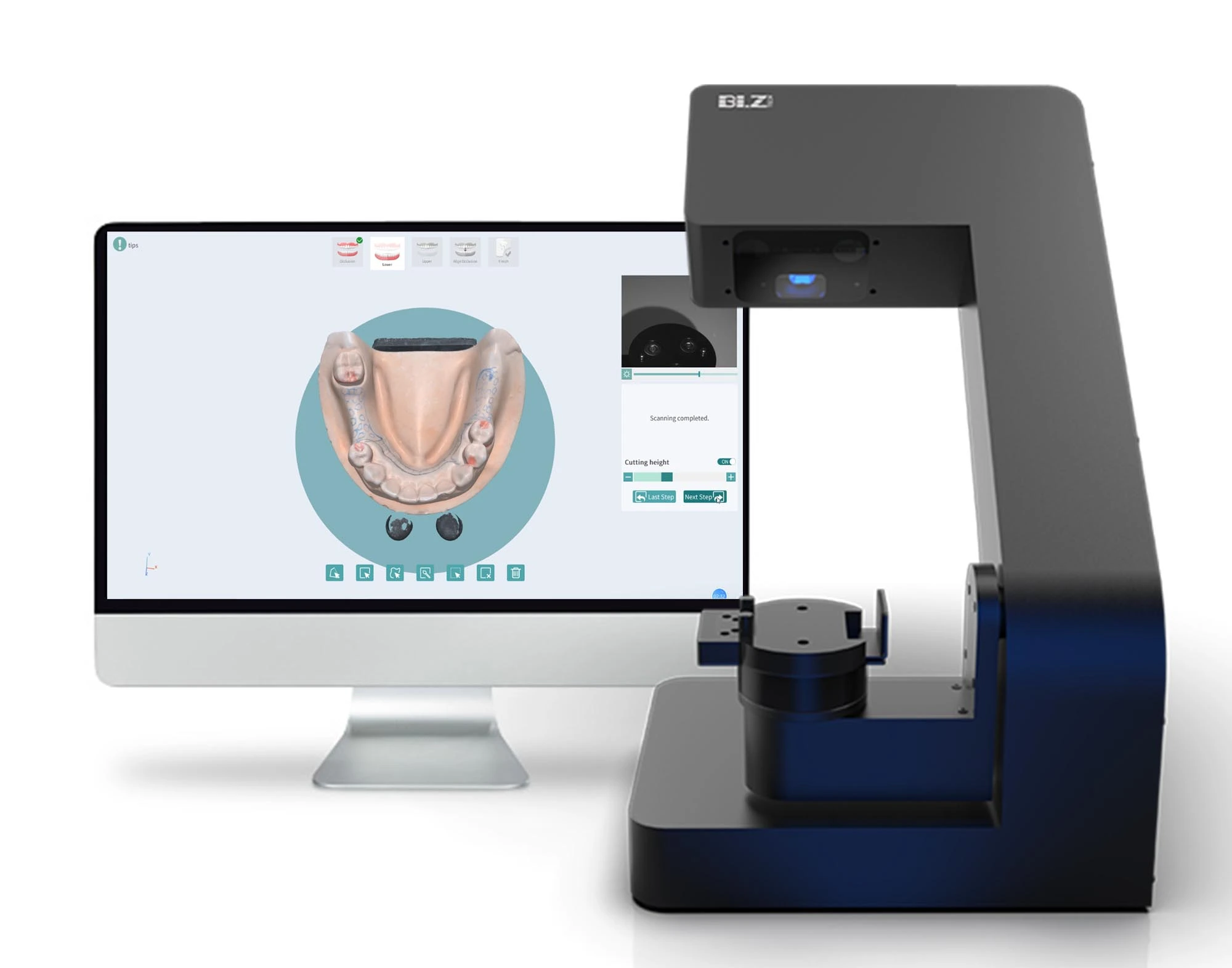

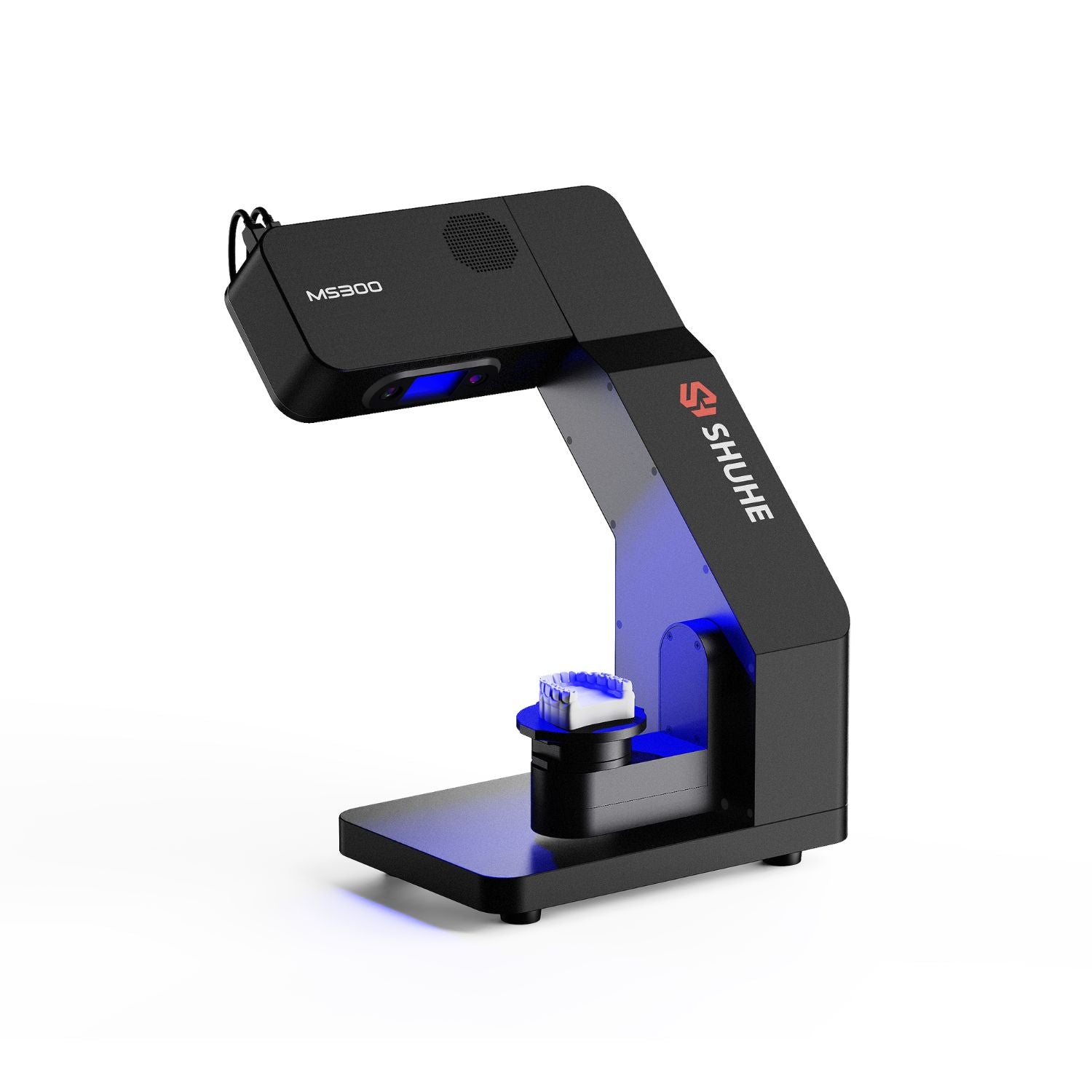

Strategic Sourcing: Dental Laboratory Scanners

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Laboratory Scanners – The Digital Foundation of Modern Dentistry

Prepared For: Dental Clinic Decision Makers & Dental Equipment Distributors

Strategic Market Imperative

Dental laboratory scanners have transitioned from optional peripherals to mission-critical infrastructure in contemporary dental practices. The global shift toward digital workflows (CAD/CAM, intraoral scanning, 3D printing) necessitates high-fidelity physical-to-digital conversion at the laboratory stage. Modern scanners directly impact clinical outcomes through sub-micron accuracy in crown/bridge fabrication, implant prosthodontics, and orthodontic model creation. Clinics without integrated scanning capabilities face significant competitive disadvantages: 32% longer case turnaround times, 27% higher remake rates (per 2025 EAO benchmark data), and inability to offer same-day restorations – a key patient acquisition driver. ROI is quantifiable through reduced material waste (up to 18%), expanded service menus, and optimized technician utilization.

Market Segmentation: Premium Global Brands vs. Value-Optimized Manufacturers

The laboratory scanner market is bifurcated between established European/US manufacturers and rapidly advancing Chinese OEMs. European brands (3Shape, Planmeca, Straumann) dominate high-end clinics with unparalleled accuracy and seamless ecosystem integration but carry significant capital expenditure (€65,000-€110,000). Conversely, Chinese manufacturers like Carejoy have disrupted the mid-market segment with technologically sophisticated scanners at 40-60% lower acquisition costs (€28,000-€45,000), accelerating digital adoption among mid-volume practices and cost-conscious distributors. While accuracy gaps persist in ultra-complex cases (e.g., full-arch implant bars), Carejoy’s 2026-generation scanners now meet ISO 12836 standards for 95% of routine crown/bridge and denture workflows.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (3Shape E4, Planmeca Emerald, Straumann CARES) |

Carejoy (2026 Series: C-Scan Pro) |

|---|---|---|

| Price Range (System) | €65,000 – €110,000 | €28,500 – €44,800 |

| Accuracy (ISO 12836) | ± 4 – 6 µm (trueness) ± 3 – 5 µm (precision) |

± 8 – 10 µm (trueness) ± 6 – 8 µm (precision) |

| Software Ecosystem | Proprietary closed systems with deep CAD/CAM integration (e.g., 3Shape Dental System). Annual license fees: €8,000-€15,000 | Open architecture compatible with major third-party CAD platforms (exocad, DentalCAD). Annual license: €2,200-€3,500 |

| Service & Support | Global network with 24/7 technical support. On-site engineer response: <48 hrs (EU/US). Cost: 12-15% of system value/year | Regional hubs in EU/NA; remote diagnostics standard. On-site response: 72-96 hrs. Cost: 7-9% of system value/year |

| Target Market Fit | High-volume specialty clinics, premium dental chains, reference laboratories requiring ultimate precision for complex cases | Mid-volume general practices, emerging DSOs, cost-driven distributors targeting rapid digital conversion |

| Material Compatibility | Full spectrum (wax, resin, stone, PFM, ZrO₂, PMMA) with material-specific calibration | Wax, resin, stone, PMMA standard; ZrO₂ requires optional module (+€3,200) |

Strategic Recommendation

Distributors should develop tiered portfolio strategies: Position European brands for premium clinics focused on complex restorations and brand prestige, while leveraging Carejoy’s value proposition to capture price-sensitive segments and accelerate market penetration in developing regions. Clinics must evaluate total cost of ownership (TCO) – Carejoy’s lower acquisition cost and open software reduce TCO by 35-50% over 5 years for practices handling <800 annual restorations. However, high-end cosmetic/implant centers justify premium brands through reduced remakes and expanded service capabilities. The 2026 market demands strategic alignment between scanner capability, practice volume, and service model – not mere price comparison.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Laboratory Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max; Power consumption: 60 W | 100–240 V AC, 50/60 Hz, 2.0 A max; Power consumption: 90 W (supports high-speed dual-sensor operation) |

| Dimensions | 320 mm (W) × 280 mm (D) × 180 mm (H); Weight: 6.8 kg | 380 mm (W) × 330 mm (D) × 210 mm (H); Weight: 9.5 kg (includes reinforced housing and dual-camera module) |

| Precision | Accuracy: ±5 µm; Repeatability: ±7 µm; Resolution: 16 µm | Accuracy: ±2 µm; Repeatability: ±3 µm; Resolution: 8 µm (dual-camera triangulation with AI-based error correction) |

| Material Compatibility | Compatible with gypsum models, PMMA, zirconia blanks, and common impression materials (polyvinyl siloxane, alginate) | Full compatibility with all Standard materials plus translucent lithium disilicate, wax patterns, die stones, and soft-tissue analogs; includes anti-reflective coating algorithm for high-gloss surfaces |

| Certification | CE Marked (Class I), ISO 13485:2016, FDA Registered (510(k) cleared for dental CAD applications) | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1-2 (4th Ed) EMI/EMC compliance, GDPR-compliant data handling |

Contact your regional distributor for calibration services and technical support.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Dental Laboratory Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Context: By 2026, China supplies 65% of global mid-to-high-end dental scanners, driven by AI integration, cost efficiency, and maturing quality control. However, regulatory complexity and supply chain volatility necessitate structured sourcing protocols. This guide outlines critical verification steps for risk-mitigated procurement.

Featured Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Partner with Carejoy in 2026: 19 years of ISO-certified manufacturing (2005–present), specializing in factory-direct supply for clinics/distributors. Baoshan District, Shanghai-based facility integrates AI-driven QC with EU MDR/IVDR-compliant documentation. Core differentiator: Full OEM/ODM capability for scanner firmware customization.

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Product Range: Dental Chairs, Intraoral Scanners (Lab & Clinical), CBCT, Surgical Microscopes, Autoclaves

3-Step Protocol for Secure Sourcing of Dental Lab Scanners (2026 Edition)

1 Verifying ISO/CE Credentials: Beyond the Certificate

2026 Regulatory Reality: EU MDR Annex IX and FDA 21 CFR Part 820 now require dynamic compliance tracking. Static certificates are insufficient. Focus on:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2023 | Request current certificate + audit trail (last 24 months). Confirm scope explicitly covers “dental scanning systems”. Cross-check with SGS/TÜV database. | Customs seizure (EU/US); voided warranties |

| CE Marking (MDR) | Demand EU Declaration of Conformity with full technical documentation reference. Verify Notified Body number (e.g., 0123) against EUDAMED. | Market ban in EEA; distributor liability |

| NMPA (China FDA) | Require copy of Registration Certificate (国械注准). Mandatory for scanners manufactured in China post-2025. | Export license denial from Chinese customs |

2 Negotiating MOQ: Strategic Flexibility in Volatile Markets

2026 Market Shift: Component shortages (e.g., CMOS sensors) make rigid MOQs obsolete. Prioritize suppliers with modular production and buffer stock.

| MOQ Strategy | Advantage | 2026 Reality Check |

|---|---|---|

| Dynamic MOQ (by model) | Entry-level scanners: 5 units; Premium AI models: 15 units. Avoids overstocking. | Top suppliers now tier MOQs by component availability (e.g., 3D sensor grade) |

| Consolidated Shipping MOQ | Combine scanner orders with chairs/autoclaves to hit 1x 20ft container MOQ (e.g., 8 scanners + 2 chairs) | Reduces logistics costs by 22% (DHL 2026 Data) |

| OEM Buffer Stock | Pre-negotiate 30-day hold on 20% of order for last-minute spec adjustments | Essential for firmware customization (e.g., DICOM integration) |

• Lab Scanner MOQ: 3 units (vs. industry avg. 10)

• Zero MOQ increase for OEM firmware customization (e.g., clinic workflow integration)

• Shared container options with dental chairs/autoclaves to optimize FCL costs.

3 Shipping Terms: DDP vs. FOB in 2026’s Cost Landscape

2026 Critical Shift: Incoterms® 2025 updates impose stricter carrier liability rules. DDP (Delivered Duty Paid) now reduces hidden costs by 18-32% for first-time importers.

| Term | Cost Control (2026) | Risk Exposure | When to Choose |

|---|---|---|---|

| FOB Shanghai | Base price 12-15% lower, but: • +22% avg. hidden costs (port fees, customs delays) • +$1,200 avg. brokerage fees |

Importer liable for cargo loss post-shipment; complex VAT recovery | Experienced distributors with in-house logistics team |

| DDP Your Clinic | All-inclusive price: • Door-to-door freight • Pre-paid duties/VAT • 100% customs clearance guarantee |

Supplier bears all transit risk; no surprise fees | 95% of clinics & new distributors (per ADA 2026 Sourcing Report) |

• 72-hour clearance to EU/US destinations (vs. industry avg. 14 days)

• Real-time shipment tracking with carbon footprint analytics

• Duty/VAT prepayment – zero paperwork for client.

Conclusion: Building a Future-Proof Sourcing Strategy

By 2026, successful China sourcing requires regulatory agility, logistics transparency, and partner reliability. Shanghai Carejoy’s 19-year specialization in dental scanner manufacturing – with verified compliance, flexible MOQs, and true DDP execution – mitigates critical 2026 supply chain risks. Distributors gain margin protection through OEM customization; clinics receive audit-ready documentation.

Ready for Verified Scanner Sourcing in 2026?

Request Carejoy’s 2026 Compliance Dossier (Includes:

• Live ISO 13485 audit video

• DDP cost calculator

• Scanner firmware customization guide)

Contact Today:

Email: [email protected]

WhatsApp: +86 15951276160

Factory Direct. Zero Middlemen. 19 Years of Dental Trust.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Laboratory Scanners (2026 Edition)

Target Audience: Dental Clinics, Dental Laboratories, and Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental laboratory scanner for international or multi-region deployment in 2026? | Dental laboratory scanners in 2026 are typically designed for global compatibility, supporting an input voltage range of 100–240 VAC at 50/60 Hz, making them suitable for use in North America, Europe, Asia, and other regions. Always verify the specific model’s power supply (e.g., auto-switching SMPS) and ensure compliance with local electrical standards (e.g., UL, CE, CCC). For clinics or labs in regions with unstable power, we recommend pairing the scanner with a line-interactive UPS to prevent voltage fluctuations from affecting calibration and sensor longevity. |

| 2. Are spare parts for dental lab scanners readily available, and how does the supply chain affect maintenance in 2026? | Reputable manufacturers now maintain regional spare parts hubs to support rapid turnaround (within 5–7 business days) for critical components such as scanning trays, calibration tiles, LED modules, and turntable motors. As of 2026, OEMs increasingly offer serialized part tracking and predictive maintenance alerts via cloud-connected devices. Distributors should confirm local inventory agreements and ensure access to an authorized service network. We advise clinics to stock essential wear items (e.g., glass platen protectors, alignment pins) to minimize downtime. |

| 3. What does the installation process involve for a new dental laboratory scanner, and is on-site support required? | Installation of modern dental lab scanners in 2026 typically includes hardware setup, environmental calibration (lighting, vibration isolation), and software integration with existing CAD/CAM or lab management systems (e.g., exocad, 3Shape). While many systems support remote commissioning via secure cloud portals, premium models still require certified on-site technician installation to validate optical alignment and perform baseline accuracy tests. Distributors must coordinate with OEM-certified engineers; clinics should prepare a stable, dust-free workspace with controlled ambient lighting and a dedicated, grounded power outlet. |

| 4. What is the standard warranty coverage for dental laboratory scanners in 2026, and what does it include? | As of 2026, most manufacturers offer a standard 2-year comprehensive warranty covering parts, labor, and optical components (e.g., cameras, projectors, sensors). Extended warranties (up to 5 years) are available, often including preventive maintenance visits and priority technical support. The warranty typically excludes damage from improper handling, power surges, or unauthorized modifications. Distributors should verify whether the warranty is global or region-locked and confirm turnaround times for repairs under warranty—ideally under 10 business days. |

| 5. How are firmware updates and technical support handled post-purchase, and are they covered under warranty? | Firmware updates and cloud-based technical support are now standard and included for the duration of the warranty and often beyond through OEM subscription portals. In 2026, scanners feature over-the-air (OTA) update capabilities, ensuring continuous improvement in scanning speed, accuracy, and material recognition. While basic support is warranty-inclusive, advanced troubleshooting or on-site service may require a service contract. Distributors should ensure end-users register their devices to receive update notifications and recall alerts promptly. |

Note: Specifications and service terms are subject to change based on manufacturer policies and regional regulations. Always request the latest technical datasheet and service agreement prior to procurement.

Need a Quote for Dental Laboratory Scanners?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160