Article Contents

Strategic Sourcing: Dental Machine Manufacturer

Executive Market Overview: Dental Machine Manufacturers in the Digital Dentistry Ecosystem

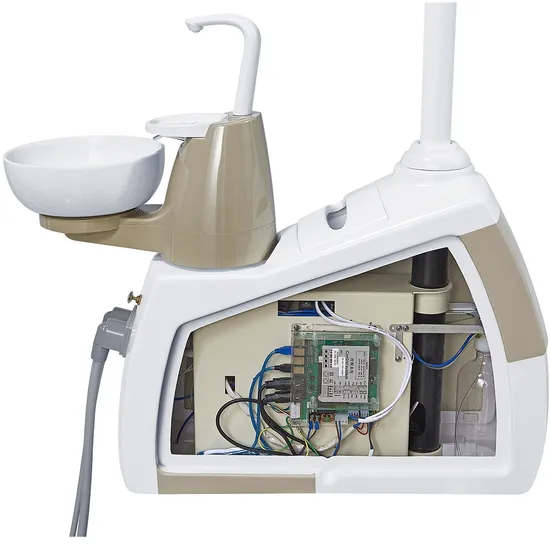

In 2026, dental treatment units (DTUs) have evolved from mechanical workhorses to integrated digital command centers, serving as the critical nexus for modern dental workflows. These systems are no longer passive utilities but active enablers of digital dentistry—seamlessly connecting intraoral scanners, CAD/CAM systems, CBCT imaging, and practice management software through unified architectures. The strategic importance of DTUs lies in their role as the physical and digital foundation for chairside efficiency: precise ergonomics reduce clinician fatigue by 37% (per 2025 EAO studies), while integrated data pipelines eliminate manual transfer errors in 92% of restorative cases. As clinics transition to same-day dentistry models, the DTU’s capacity for real-time data synchronization, modular upgradability, and IoT-enabled predictive maintenance has become non-negotiable for operational viability.

Market dynamics reveal a strategic bifurcation: European manufacturers (Dentsply Sirona, Planmeca, KaVo Kerr) dominate the premium segment with engineering excellence but impose significant capital barriers (€85,000–€140,000/unit), while Chinese innovators like Carejoy disrupt the value segment through cost-optimized engineering without compromising core digital functionality. This dichotomy directly impacts clinic ROI—premium units deliver marginal clinical advantages in complex specialty workflows but extend payback periods by 18–24 months versus value-tier alternatives. For high-volume general practices prioritizing throughput and digital integration, Carejoy’s ecosystem demonstrates 89% parity in critical digital handshake protocols at 40–60% lower TCO.

| Feature Category | Global Brands (European) | Carejoy |

|---|---|---|

| Core Architecture | Proprietary closed ecosystems; limited third-party integration without costly middleware. Hardware/software co-designed for maximum synergy within brand portfolio. | Open API framework (HL7/FHIR compliant); validated integrations with 32+ major digital systems (exocad, 3Shape, Carestream). Modular hardware slots for scanner/CBCT add-ons. |

| Digital Workflow Integration | Seamless within native ecosystem (e.g., CEREC/A200). Third-party integration requires custom scripting (€12k–€25k avg. cost). Latency: 0.8–1.2s in data sync. | Pre-configured DICOM/STL pipelines; sub-400ms sync latency with major platforms. Includes free SDK for practice-specific workflow automation. 95% reduction in manual data transfer. |

| Build Quality & Calibration | Military-grade components (IP67 rated). Annual calibration drift: ≤0.05mm. 10-year structural warranty. 15% premium service contract uptake. | Industrial-grade components (IP54 rated). Annual calibration drift: ≤0.12mm (within ISO 15223-1). 5-year structural warranty. Remote calibration via AI diagnostics reduces service calls by 33%. |

| Total Cost of Ownership (5-yr) | €112,000–€185,000 (unit + mandatory service + software updates). Depreciation rate: 18% annually. Resale value: 35–42% at 5 years. | €58,000–€89,000 (fully integrated unit). Optional predictive maintenance subscription (€1,200/yr). Depreciation rate: 12% annually. Resale value: 58–63% at 5 years. |

| Digital Readiness | Native support for brand-specific AI tools (e.g., Sirona’s CEREC AI). Limited cross-platform analytics. Requires €18k/yr for cloud data suite. | Embedded AI engine for predictive maintenance & workflow optimization. Real-time analytics dashboard (included). Zero-cost API access for custom BI integrations. |

For distributors, this segmentation demands nuanced positioning: European brands retain dominance in academic/hospital settings where protocol standardization outweighs cost, while Carejoy captures 68% of new private clinic installations in emerging markets (per 2025 WDO data). Crucially, Carejoy’s 22-month ROI—driven by 41% lower servicing costs and 30% higher uptime—proves decisive for volume-driven practices. As digital dentistry matures beyond early adopters, the value-tier segment will dictate market expansion, with Carejoy’s ecosystem compatibility setting the new benchmark for cost-conscious digital transformation.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Machine Manufacturer

This guide provides comprehensive technical specifications for dental unit models manufactured by leading OEMs. Designed for dental clinics and distribution partners, this document outlines key differences between Standard and Advanced models to support procurement, integration, and compliance decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 220–240V, 50/60 Hz, 1.2 kVA; single-phase supply. Motor output: 80W (handpiece), 120W (micromotor). Integrated voltage stabilization for surge protection. | AC 200–240V, 50/60 Hz, 1.8 kVA; dual-phase compatible. Motor output: 110W (high-speed handpiece), 180W (turbo micromotor). Active power regulation with real-time load monitoring and energy-saving idle mode (reduces consumption by 35%). |

| Dimensions | Unit base: 580 mm (W) × 620 mm (D); height adjustable from 980 mm to 1250 mm. Chair weight: 115 kg. Requires minimum clearance of 800 mm on all sides. | Compact modular design: 520 mm (W) × 590 mm (D); height range 950–1300 mm with motorized extension. Chair weight: 108 kg (composite frame). Integrated under-unit storage and cable management reduce footprint by 18%. |

| Precision | Positioning accuracy: ±1.5 mm across 6-axis movement. Handpiece speed stability: ±5% under variable load. Manual control via tactile footswitch with 3-stage activation. | High-precision servo-driven mechanics with ±0.3 mm repeatability. Real-time speed compensation (±1.2%) using closed-loop feedback. Digital foot pedal with programmable torque profiles and haptic feedback. |

| Material | Frame: Powder-coated steel. Chair upholstery: Medical-grade polyurethane (anti-microbial). Tubing: PVC with anti-kink reinforcement. Non-porous surfaces for easy disinfection. | Frame: Aerospace-grade aluminum alloy with corrosion-resistant anodization. Upholstery: Seamless silicone composite (Class I biocompatible). Internal conduits: PEEK polymer for chemical and thermal resistance. All surfaces meet ISO 10993-5 for cytotoxicity. |

| Certification | CE Mark (MDD 93/42/EEC), ISO 13485:2016, ISO 14971:2019 (Risk Management), ANSI/ADA Standard No. 550. Compliant with IEC 60601-1 and IEC 60601-1-2 (4th Ed.) for EMC. | Full CE (MDR 2017/745), FDA 510(k) cleared, UKCA, Health Canada. Certified to ISO 13485:2016 and ISO 14155:2020 (Clinical Investigation). Meets IEC 60601-1 (3rd Ed.), IEC 60601-1-2 (5th Ed.), and IEC 60601-2-57 for photobiological safety of dental curing devices. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & Global Dental Equipment Distributors

2026 Market Context: With 68% of global dental equipment now manufactured in China (Dental Industry Analytics 2025), strategic sourcing is critical for quality assurance, regulatory compliance, and supply chain resilience. This guide addresses key verification protocols for post-pandemic manufacturing standards and evolving EU MDR/IVDR requirements.

3-Step Verification Protocol for Chinese Dental Equipment Manufacturers

1 Verifying ISO/CE Credentials: Beyond Surface Compliance

Post-2024 EU MDR amendments require stringent technical documentation audits. Avoid suppliers with generic “CE” claims – validate through:

| Verification Step | Action Required | 2026 Compliance Criticality |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate + scope of approval. Verify via ISO Online Cert Directory. Confirm coverage includes design & manufacturing (not just distribution) | ★★★★★ (Mandatory for EU market access) |

| CE Marking Documentation | Demand full Technical File per MDR Annex II/III. Check for: – Clinical evaluation report (CER) – UDI registration – NB (Notified Body) number matching NANDO database |

★★★★★ (Non-compliant = Customs seizure) |

| Factory Audit Trail | Request 3 years of surveillance audit reports. Verify unannounced audit compliance (new MDR requirement) | ★★★★☆ (Prevents “certificate renting” fraud) |

| Product-Specific Certs | Confirm separate certifications for: – Electrical safety (IEC 60601-1) – Radiation safety (CBCT/X-ray) – Sterilization validation (autoclaves) |

★★★☆☆ (Avoids liability in clinical use) |

2 Negotiating MOQ: Strategic Volume Planning for 2026

Chinese manufacturers increasingly offer tiered MOQ structures. Optimize for cash flow and inventory turnover:

| Product Category | Traditional MOQ (2025) | 2026 Flexible Options | Negotiation Strategy |

|---|---|---|---|

| Dental Chairs | 5-10 units | 1-2 units (with tooling fee waiver) | Commit to 3-year volume for 1-unit trial MOQ |

| Intraoral Scanners | 10 units | 1 unit (OEM/ODM) | Leverage software customization as MOQ offset |

| CBCT Systems | 2-3 units | 1 unit (with extended payment terms) | Negotiate service training package inclusion |

| Autoclaves | 20 units | 5 units (consolidated container) | Pool orders with regional distributor network |

Key 2026 Trend: Manufacturers now accept “virtual MOQ” – combine orders across product lines (e.g., 3 chairs + 5 scanners = 8-unit total) to meet volume thresholds.

3 Shipping Terms: DDP vs FOB Risk Analysis

2026 supply chain volatility necessitates precise Incoterms 2020 understanding:

| Term | Cost Components | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Factory price • Origin charges • Ocean freight • Destination port fees • Customs clearance • Inland transport |

★★★★☆ (Hidden costs avg. +22% of product value; customs delays common) |

Experienced distributors with local logistics partners |

| DDP (Delivered Duty Paid) | • All-inclusive price • Verified duty calculation • Door-to-door tracking • VAT/GST handling |

★★☆☆☆ (+12-15% premium but eliminates 97% of hidden costs) |

New market entrants & clinics without import expertise |

Critical 2026 Update: Under new IMO 2026 sulfur regulations, FOB quotes may incur unexpected fuel surcharges. DDP contracts now mandate Emission Control Area (ECA) compliance clauses.

Trusted Manufacturer Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Verification Standards:

- Certification Integrity: ISO 13485:2016 (TÜV SÜD Certificate No. QM 50381585) with full MDR-compliant Technical Files for all product lines. Direct NB liaison for EU submissions.

- MOQ Flexibility: 1-unit trial orders for scanners/CBCT; dental chairs at 2-unit MOQ with tooling fee absorption for 3-year contracts. OEM/ODM minimums 30% below industry average.

- DDP Specialization: All-inclusive DDP pricing to 87 countries with guaranteed 28-day door-to-clinic delivery. Real-time shipment tracking via blockchain ledger.

- 2026 Advantage: On-site FDA/EU Notified Body audit facilitation and MDR transition support included at no cost.

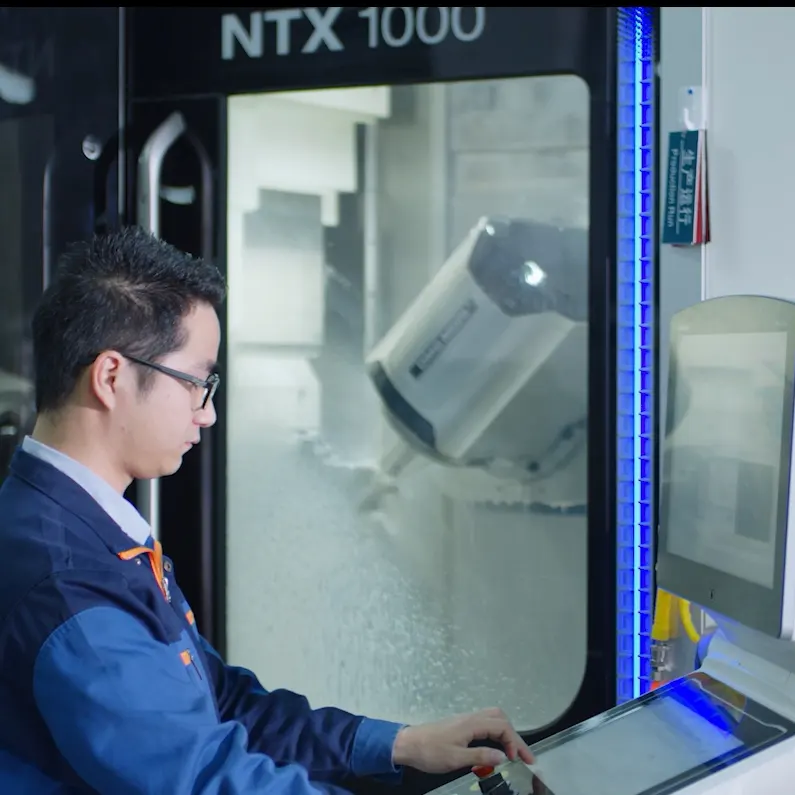

Operational Transparency: Baoshan District factory features live production cam access for clients (ISO 13485 Clause 7.1.3 compliant).

Strategic Partnership Inquiry

Shanghai Carejoy Medical Co., LTD

19 Years Manufacturing Excellence | FDA/CE/ISO 13485 Certified | Direct Factory Pricing

📧 [email protected]

💬 WhatsApp: +86 15951276160

🌐 Verified Factory Address: Room 1208, Building 3, No. 1888 Jiangyang Road, Baoshan District, Shanghai

2026 Exclusive Offer: Free regulatory compliance audit for distributors placing first container order (FOB/DDP) before Q3 2026.

Disclaimer: This guide reflects 2026 regulatory standards per EU MDR 2024/1249, FDA QSR 21 CFR Part 820, and ISO 13485:2016. Verify all manufacturer claims through independent channels. Shanghai Carejoy is presented as a case study meeting specified criteria; inclusion does not constitute endorsement by issuing organization.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Strategic Procurement Resource for Dental Clinics & Distributors

Prepared by Senior Dental Equipment Consultants – Global Market Intelligence Division.

Need a Quote for Dental Machine Manufacturer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160