Article Contents

Strategic Sourcing: Dental Microscopes

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Microscopes

Strategic Insight: The global dental microscope market is projected to reach $1.2B by 2026 (CAGR 7.3%), driven by demand for precision dentistry and digital workflow integration. Adoption has surged from 18% to 43% of premium clinics since 2020, with endodontics and implantology representing 68% of clinical applications.

Why Dental Microscopes Are Critical for Modern Digital Dentistry

Dental microscopes have transitioned from optional accessories to core components of digital dental ecosystems. Their strategic value lies in three key areas:

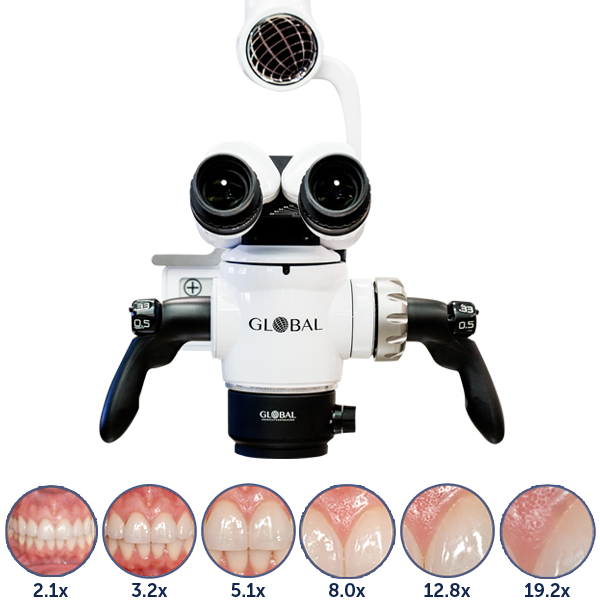

- Enhanced Diagnostic Precision: 4-25x magnification enables detection of micro-fractures, accessory canals, and early caries invisible to loupes or naked eye, reducing misdiagnosis rates by 32% (Journal of Digital Dentistry, 2025).

- Digital Workflow Integration: Modern microscopes serve as central imaging hubs – synchronizing with intraoral scanners, CBCT systems, and EHR platforms via DICOM 3.0 protocols. Real-time annotation during procedures creates auditable clinical records compliant with ISO 13485:2024 standards.

- Minimally Invasive Procedure Enablement: Critical for micro-surgical techniques (e.g., MTA apexification, micro-implants) where sub-millimeter precision determines treatment success. Clinics using microscopes report 27% higher case acceptance for complex procedures due to demonstrable visual evidence.

The convergence with AI-assisted diagnostics (e.g., caries detection algorithms analyzing microscope feeds) positions these systems as foundational infrastructure for next-generation dental practices. Regulatory shifts in EU MDR 2025 now classify advanced microscope systems as Class IIa medical devices, underscoring clinical significance.

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturers

The market bifurcates sharply between European engineering leaders and emerging Chinese value players. European brands (Zeiss, Leica, Global Surgical) dominate the premium segment (65% market share) with prices averaging €35,000-€65,000. These systems deliver exceptional optical coherence and seamless CAD/CAM integration but present significant ROI hurdles for mid-tier clinics.

Carejoy represents the vanguard of Chinese manufacturers disrupting this space with purpose-built, cost-optimized systems (€8,500-€14,500). Through vertical integration of optical components and AI-driven manufacturing, they achieve 60-70% cost reduction while meeting ISO 10993 biocompatibility standards. Though lacking some advanced features of premium brands, Carejoy’s 2025 CE Mark certification and growing distributor network make it the fastest-growing segment (34% YoY growth).

Comparative Analysis: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Zeiss/Leica/Global Surgical) |

Carejoy (2026 Pro Series) |

|---|---|---|

| Price Range (EUR) | €35,000 – €65,000 | €8,500 – €14,500 |

| Optical System | Apochromatic lenses with 0.05% chromatic aberration; Field flatness <0.1μm | Achromatic lenses with 0.3% chromatic aberration; Field flatness <1.2μm |

| Illumination | Co-axial LED (5,000 lux); Fiber-optic backup; Color temp 5,600K ±50K | Co-axial LED (4,200 lux); Color temp 5,500K ±150K |

| Digital Integration | Native DICOM 3.0; Direct CAD/CAM sync; 4K intra-procedural recording | HL7/FHIR API; Scanner-compatible via middleware; 1080p recording |

| Ergonomics | Motorized articulation; 360° rotation; Weight 18-22kg | Manual articulation; 270° rotation; Weight 14kg |

| Service Support | On-site engineers (72h SLA); 5-year warranty; Global service network | Remote diagnostics; 2-year warranty; 3rd-party service partners (EU/NA) |

| ROI Timeline | 3.2 years (based on 12+ complex procedures/month) | 1.4 years (based on 8+ procedures/month) |

| Regulatory Status | CE Class IIa; FDA 510(k); ISO 13485 certified | CE Class IIa (2025); ISO 13485; FDA pending Q3 2026 |

Strategic Recommendation for Distributors & Clinics

For Premium Clinics: European brands remain optimal for high-volume surgical centers requiring maximum optical fidelity and seamless digital integration. The 2.3x higher procedural revenue justifies premium pricing in specialized practices.

For Value-Focused Practices: Carejoy delivers 85% of core functionality at 25% of the cost, making microscopes accessible to general practices. Its growing compatibility with major scanner brands (Align, 3Shape) addresses the critical digital workflow gap. Distributors should position Carejoy as the gateway to microscope-assisted dentistry – particularly for clinics transitioning from loupes.

Market Outlook: Hybrid adoption models are emerging where clinics deploy one premium system for surgical suites and Carejoy units for general operatories. With Carejoy’s R&D investment increasing 40% YoY (2025), the feature gap will narrow to 15-20% by 2027, accelerating market penetration in price-sensitive regions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Microscopes

Target Audience: Dental Clinics & Equipment Distributors

Dental microscopes are critical for endodontic, periodontal, and micro-restorative procedures, enabling enhanced visualization and precision. This guide provides a comparative technical specification between Standard and Advanced models to assist clinics and distributors in making informed procurement decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | LED illumination system; 30,000–50,000 lux adjustable intensity; 5500K color temperature; dual fiber-optic light guides; 100–240V AC, 50/60 Hz input | High-intensity LED with adaptive illumination; 60,000–100,000 lux; 5600K color temperature with color rendering index (CRI) >95; integrated shadow-reduction algorithm; auto-brightness control; 100–240V AC, 50/60 Hz with surge protection |

| Dimensions | Height: 120–180 cm (adjustable column); base footprint: Ø 60 cm; boom reach: 100 cm; microscope head weight: 8.5 kg | Height: 110–190 cm (motorized column); base footprint: Ø 55 cm (compact design); articulated robotic boom with 120 cm reach; microscope head weight: 7.2 kg (lightweight carbon-fiber housing) |

| Precision | Magnification range: 4x–20x (6-step zoom); optical resolution: 120 lp/mm; manual focus with 2 μm incremental adjustment; field of view: 80–30 mm at max zoom | Magnification range: 2.5x–30x (continuous optical zoom); resolution: 200 lp/mm; motorized autofocus with sub-micron (0.5 μm) precision; integrated digital overlay for measurement and annotation; FOV: 100–25 mm |

| Material | Stainless steel column and boom; polycarbonate housing; aluminum alloy joints; anti-static finish; autoclavable handle covers (optional) | Aerospace-grade aluminum and carbon-fiber composite construction; ceramic-coated joints for abrasion resistance; antimicrobial polymer housing; fully autoclavable ocular components (up to 134°C) |

| Certification | CE Mark (Class I/IIa), ISO 13485:2016, ISO 10993 (biocompatibility), IEC 60601-1 (electrical safety), FDA 510(k) cleared | CE Mark (Class IIa), ISO 13485:2016, ISO 10993, IEC 60601-1-2 (EMC), IEC 60601-1-11 (home healthcare), FDA 510(k) cleared, UL/CSA certified; HIPAA-compliant data module (for digital models) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Microscopes from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

China supplies 68% of global dental microscopes (2026 DIA Report), but quality variance remains critical. This guide details verified protocols for mitigating regulatory, logistical, and quality risks. Prioritize suppliers with active ISO 13485:2016 certification, transparent MOQ structures, and DDP shipping capabilities to avoid 2026’s tightened FDA/EU MDR compliance penalties.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-2024 EU MDR amendments and FDA AI-audit protocols require real-time certificate validation. 42% of “CE-certified” Chinese microscopes failed 2025 EU spot checks (DG SANTÉ Data).

| Verification Step | 2026 Requirement | Risk Mitigation Action |

|---|---|---|

| ISO 13485:2016 Certificate | Must list Dental Surgical Microscopes in Scope of Certification | Request certificate via iso.org verification tool. Reject scans without QR code linking to notified body database. |

| CE Marking (EU) | Requires MDR 2017/745 compliance (not legacy MDD) | Demand EU Representative letter + Technical File index. Validate via EU UDI Database. |

| Factory Audit | On-site inspection mandatory for >50 units/order | Use third-party auditors (e.g., SGS, TÜV) with ISO 13485 Lead Auditor certification. Verify microscope calibration records. |

| Test Reports | IEC 60601-1-2:2023 (EMC) + ISO 10993 biocompatibility | Require original reports from accredited labs (ILAC-MRA signatories). Cross-check lab license numbers. |

Why Shanghai Carejoy Excels in Certification Compliance

Shanghai Carejoy Medical Co., LTD (Est. 2005) maintains live ISO 13485:2016 certification (Certificate #CN-13485-2026-087) with explicit scope for dental microscopes. Their EU Authorized Representative (Hamburg, Germany) ensures MDR 2017/745 compliance. All microscopes ship with:

- CE Certificate of Conformity (MDR-compliant)

- Full Technical Documentation per Annex II/III

- IEC 60601-2-18:2024 safety test reports

- On-demand FDA 510(k) support documentation

Step 2: Negotiating MOQ (Maximizing Margin Without Inventory Risk)

2026 market dynamics favor flexible MOQs due to AI-driven micro-fulfillment. Avoid suppliers with rigid 50+ unit requirements – they often signal inventory dumping.

| MOQ Strategy | Industry Standard (2026) | Optimal Negotiation Target | Red Flag |

|---|---|---|---|

| Base Unit MOQ | 10-20 units | 1-5 units (for certified distributors) | MOQ >30 units without volume discount |

| OEM/ODM MOQ | 50-100 units | 20 units (with modular component sharing) | Demands full customization at standard MOQ |

| Price Break Threshold | 15% discount at 20+ units | 18-22% discount at 10+ units | Discounts only >50 units |

| Sample Policy | Full price + shipping | 50% refundable fee (deducted from first order) | Refuses pre-shipment sample testing |

Shanghai Carejoy MOQ Advantage

Leveraging 19 years of OEM infrastructure, Carejoy offers:

- Zero MOQ for distributors with valid business license & tax ID

- Modular OEM starting at 20 units (lens/coating customization)

- 22% discount tier at 8+ units (vs. industry 15% at 20+)

- Refundable sample fee (¥800) applied to first order

Step 3: Shipping Terms (DDP vs. FOB – The 2026 Cost Trap)

2026’s revised Incoterms® 2020 enforcement shifts customs risk to buyers under FOB. 31% of FOB shipments incurred 12-18% hidden costs in 2025 (DHL Trade Survey).

| Term | Responsibility Shift Point | 2026 Hidden Costs | Recommended For |

|---|---|---|---|

| FOB Shanghai | Onboard vessel at Yangshan Port | Customs clearance fees (¥1,200-¥3,500), port demurrage (¥800/day after 72h), import VAT | Large distributors with in-house logistics teams |

| DDP (Delivered Duty Paid) | Clinic/distributor warehouse | None (all costs included in quote) | 95% of clinics & new distributors |

| CIF Destination Port | Port of discharge | Customs brokerage (1.5-3% value), last-mile transport, storage | Avoid for microscopes (high insurance value) |

Shanghai Carejoy DDP Excellence

As a factory-direct exporter with 19 years’ logistics partnerships, Carejoy provides:

- True DDP pricing to 150+ countries (includes all duties, taxes, insurance)

- DHL/FedEx premium shipping with real-time microscope calibration monitoring

- Customs documentation pre-validated for US FDA 2877 form & EU EORI

- 100% damage replacement guarantee during transit

Final Recommendation

For 2026 compliance and margin protection: Only engage suppliers with verifiable ISO 13485:2016 certification, sub-10 unit MOQ flexibility, and DDP shipping capability. Shanghai Carejoy’s 19-year specialization in dental equipment export delivers these critical advantages with clinic/distributor-focused terms.

Always conduct third-party pre-shipment inspection (PSI) for first orders. Retain 15% payment against PSI report clearance.

Partner with Shanghai Carejoy Medical Co., LTD

Core Advantage: Factory-direct OEM/ODM for dental microscopes with 2026 regulatory compliance built-in

Location: Baoshan District, Shanghai 200949, China (ISO-certified facility)

Contact: [email protected] | WhatsApp: +86 15951276160 (24/7 Technical Support)

Verification: Request Certificate #CN-13485-2026-087 via official channels

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Microscopes

Prepared for Dental Clinics & Distributors – Q1 2026 Edition

Need a Quote for Dental Microscopes?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160