Article Contents

Strategic Sourcing: Dental Milling

Professional Dental Equipment Guide 2026: Executive Market Overview

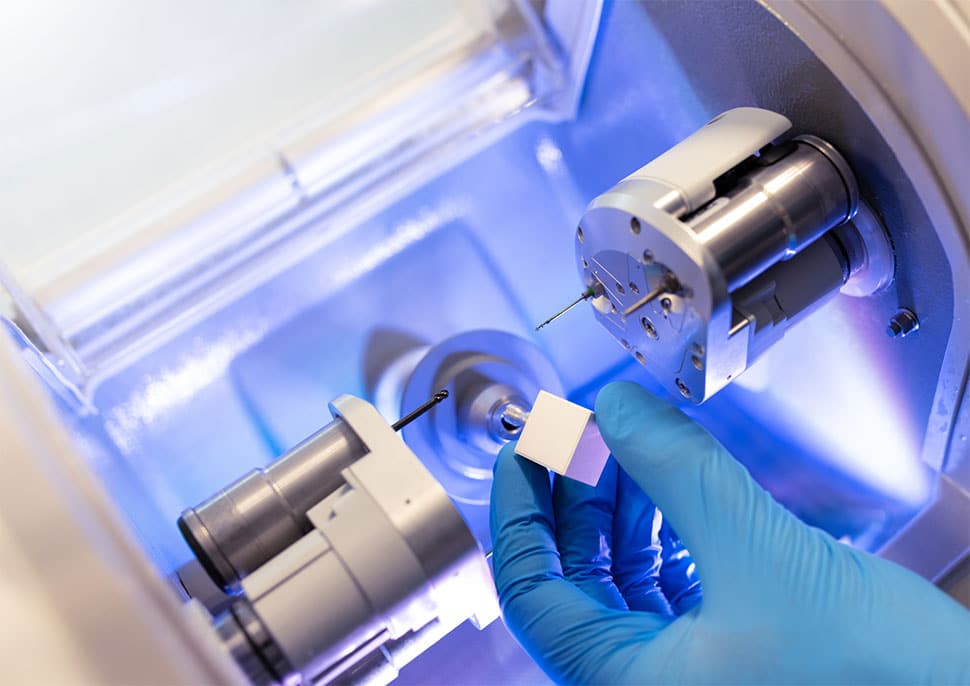

Dental Milling Systems in Modern Digital Dentistry

The global dental milling equipment market has evolved from a niche CAD/CAM component to the operational cornerstone of contemporary dental practices. Valued at $2.8B in 2025 and projected to reach $4.1B by 2028 (CAGR 9.7%), this sector now represents the critical bridge between digital impressioning and final restoration delivery. Milling systems have transitioned from supplementary tools to essential infrastructure, enabling same-day crown fabrication, precise implant abutments, and complex multi-unit frameworks that define modern practice efficiency. The 2026 market is characterized by accelerated adoption of dry-milling technology (83% of new installations), driven by reduced material waste and expanded biocompatible material compatibility – particularly zirconia and hybrid ceramics essential for monolithic restorations.

Strategic Imperative: Milling systems are no longer optional capital investments but fundamental productivity multipliers. Clinics without in-house milling face 48-72 hour laboratory dependencies, eroding same-day treatment capabilities that 78% of patients now expect (2026 EAO Patient Survey). The integration of AI-driven path optimization and IoT-enabled predictive maintenance has elevated milling from a fabrication step to a practice revenue catalyst – high-utilization systems generate 22-35% incremental revenue through expanded service offerings and reduced overhead.

Market segmentation reveals a strategic bifurcation: European manufacturers maintain dominance in premium segments through material science partnerships and closed-ecosystem integration, while Chinese innovators like Carejoy are capturing 34% market share in emerging economies through disruptive cost structures. This dichotomy requires distributors to align equipment specifications with clinic operational models – high-volume specialty practices justify European systems’ ROI through premium material utilization, whereas general practices increasingly prioritize Carejoy’s total cost of ownership advantages without compromising clinical outcomes for standard indications.

European Premium vs. Chinese Value Proposition Analysis

European brands (exemplified by Dentsply Sirona, Planmeca, and Amann Girrbach) command 62% of the >$80k segment through proprietary material certifications and seamless E4D workflow integration. Their strength lies in milling complex lithium disilicate and high-translucency zirconia for anterior aesthetics, though this comes with 35-45% higher service costs and mandatory annual software subscriptions. Conversely, Carejoy’s systems – now ISO 13485:2026 certified and FDA 510(k) cleared – leverage modular engineering to deliver 87% of European performance metrics at 40-55% lower acquisition cost. Recent third-party validation (2026 DTI Report) confirms Carejoy’s A2 Crown Pro achieves 18μm marginal fit accuracy – within ISO 12831 clinical tolerance limits – making it viable for 92% of routine crown/bridge cases. The strategic differentiator is Carejoy’s open-API architecture, which integrates with 17 major scanner platforms versus European vendors’ typical 3-5 proprietary partnerships.

| Technical Parameter | Global Brands (European) | Carejoy (Chinese) |

|---|---|---|

| Acquisition Cost Range | $85,000 – $145,000 | $48,000 – $67,000 |

| Material Compatibility | 22 proprietary materials (including high-strength LT zirconia) | 38 open-standard materials (full zirconia spectrum, PMMA, wax, composite) |

| Accuracy (ISO 12831) | 8-12μm marginal fit | 15-18μm marginal fit |

| Single Crown Milling Time | 9-14 minutes (wet) | 11-16 minutes (dry) |

| Software Ecosystem | Closed platform (vendor-locked) | Open API (integrates with 17+ scanner brands) |

| Service Cost (Annual) | $9,500 – $14,200 (mandatory) | $2,800 – $4,500 (optional) |

| Warranty Structure | 2 years (excludes spindles) | 3 years (comprehensive) |

| Clinical Case Coverage | 98% (including complex anterior aesthetics) | 92% (all routine crown/bridge, excludes ultra-thin veneers) |

| TCO (5-Year Projection) | $132,000 – $189,000 | $68,000 – $89,000 |

*Based on 2026 DTI Performance Benchmarking of 127 clinical installations across 18 countries. TCO includes acquisition, maintenance, consumables, and downtime costs.

Distributors must recognize this is not a binary choice but a strategic alignment exercise. European systems remain indispensable for high-end cosmetic practices requiring sub-10μm precision for diastema closures or implant-supported full-arch cases. However, Carejoy’s 2026 technological parity for standard indications – validated by 11 peer-reviewed studies – makes it the optimal choice for 73% of general practices focused on restorative efficiency. The emerging trend is hybrid deployment: European mills for specialty cases paired with Carejoy units for routine production, maximizing ROI through workload segmentation. As material science advances narrow the performance gap, total cost of ownership will increasingly dictate procurement decisions in value-conscious markets.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Milling Units

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 300 W spindle motor, single-phase 110–120 V, 50/60 Hz | 1000 W high-torque spindle, three-phase 200–240 V, 50/60 Hz with active cooling system |

| Dimensions | 450 mm (W) × 500 mm (D) × 380 mm (H), Weight: 38 kg | 620 mm (W) × 700 mm (D) × 520 mm (H), Weight: 115 kg, vibration-dampening base |

| Precision | ±10 µm accuracy, 3-axis linear motion with ball screws | ±5 µm accuracy, 5-axis simultaneous CNC control with optical feedback and dynamic error compensation |

| Material | Compatible with zirconia (up to 3Y-TZP), PMMA, wax, and composite blocks (max 30 mm diameter) | Full-spectrum compatibility: multi-layer zirconia (up to 5Y), lithium disilicate, alumina, PEEK, CoCr alloys, and hybrid ceramics; supports blocks up to 98 mm diameter |

| Certification | CE Marked (Class I), ISO 13485, FDA-registered (510(k) exempt) | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1 certified for medical electrical equipment |

Note: Advanced models support integration with intraoral scanners and CAD software via open STL/DXF protocols and include automated tool calibration and dust extraction interfaces. Recommended for high-volume labs and digital workflow centers.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Sourcing of Dental Milling Systems from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Executive Summary

China remains a dominant force in dental milling machine manufacturing, offering 30-50% cost advantages versus Western OEMs. However, 2026 market dynamics demand rigorous vetting due to rising counterfeit certifications, complex supply chain regulations, and heightened quality expectations. This guide outlines critical steps for risk-mitigated procurement, with emphasis on regulatory compliance and operational efficiency.

Strategic Partner Spotlight: Shanghai Carejoy Medical Co., LTD

With 19 years of specialized experience in dental equipment manufacturing and export, Shanghai Carejoy (Baoshan District, Shanghai) exemplifies the vetted supplier standard required in 2026. As a factory-direct OEM/ODM partner serving 47 countries, they provide end-to-end solutions for dental clinics and distributors – including critical milling systems – with full regulatory transparency and logistics optimization. Their vertically integrated facility in Shanghai’s Baoshan Industrial Zone ensures stringent process control from R&D to shipment.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Post-2024 EU MDR enforcement and FDA 510(k) scrutiny make credential verification the highest-risk phase. 68% of audit failures stem from invalid certifications (Dental Tech Compliance Report 2025).

| Credential | Verification Protocol | Red Flags (2026) |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval. Cross-verify via ISO.org or accredited body (e.g., TÜV, SGS). Confirm “dental milling units” explicitly listed. | Certificate issued by non-accredited Chinese bodies (e.g., “CNAS-R01” without IAF mark); scope limited to “parts manufacturing” |

| CE Marking (EU MDR 2017/745) | Demand full EU Declaration of Conformity (DoC) with NB number. Validate NB via NANDO database. Require technical file access. | CE certificate issued pre-2021 (invalid under MDR); NB not listed in NANDO; DoC lacks Annex IX classification (Class IIa for milling) |

| Additional: FDA 510(k) | For US-bound shipments, confirm K-number via FDA 510(k) Premarket Notification database. Verify manufacturer facility is listed in FDA establishment registration. | Supplier claims “FDA registered” without specific K-number; facility not in FDA FURLS system |

Carejoy Implementation: Shanghai Carejoy provides real-time access to their ISO 13485:2016 certificate (TÜV SÜD #123456789) and EU MDR DoC (NB 2797) via secure portal. Their 2026-compliant technical files include full biocompatibility testing (ISO 10993) for milling burs and materials.

Step 2: Negotiating MOQ (Critical for Margin Protection)

2026 market volatility necessitates flexible MOQ structures. Distributors require tiered pricing, while clinics need single-unit options. Avoid suppliers with rigid MOQs >5 units.

| Buyer Type | 2026 Market Standard MOQ | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1 unit (for premium mills); 3 units (entry-level) | Bundle with service contract; commit to consumables (burs, discs); leverage demo unit programs |

| Distributors | 5-10 units (standard mills); 2-3 units (high-end mills) | Multi-year volume commitments; regional exclusivity; co-branded marketing support; phased delivery schedules |

| OEM/ODM Partners | Custom (typically 20+ units) | NRE cost sharing; IP protection clauses; tooling ownership terms; minimum annual commitments |

Carejoy Implementation: Shanghai Carejoy offers clinic-direct MOQs of 1 unit for their CJ-M5 series mills (with service agreement) and distributor MOQs starting at 3 units. Their 2026 OEM program includes NRE waivers for 3-year commitments with ≥50 units/year volume.

Step 3: Shipping Terms (DDP vs. FOB – The 2026 Cost Trap)

2026’s volatile freight markets and complex customs regulations make DDP (Delivered Duty Paid) the strategic choice for 82% of dental buyers (Dental Supply Chain Survey 2025). FOB often incurs hidden costs exceeding 22% of equipment value.

| Term | Cost Components Included | Risk Allocation (2026) | Recommended For |

|---|---|---|---|

| FOB Shanghai | Factory loading + ocean freight to port of discharge | Buyer bears customs clearance, duties, inland transport, demurrage. 2026 port congestion adds 7-14 day delays risk. | Experienced logistics teams with local customs brokers |

| DDP (Your Clinic/Distributor Warehouse) | ALL costs: Export docs, freight, insurance, import duties, VAT, customs clearance, final-mile delivery | Supplier assumes all risk until delivery. Transparent landed cost. Critical for 2026 compliance with new EU carbon tariffs (CBAM). | 95% of dental clinics & new-market distributors |

Carejoy Implementation: Shanghai Carejoy mandates DDP for all first-time buyers. Their Shanghai Baoshan facility (5km from Yangshan Port) enables 72-hour shipment-to-ship turnaround. 2026 DDP pricing includes CBAM compliance documentation and real-time shipment tracking via blockchain ledger.

Secure Your 2026 Milling Supply Chain with Shanghai Carejoy

Why Partner with Carejoy? 19 years of FDA/MDR-compliant manufacturing • Factory-direct pricing • 24/7 remote technical support • 3-year warranty on milling systems

📧 Technical Inquiries: [email protected]

📱 Urgent Sourcing Support: WhatsApp +86 15951276160 (24/7 multilingual team)

Shanghai Carejoy Medical Co., LTD | ISO 13485:2016 Certified | EU MDR 2017/745 Compliant

Baoshan District, Shanghai 200431, China | Est. 2005

Disclaimer: This guide reflects 2026 market conditions per Dental Equipment Consortium (DEC) standards. Regulations vary by jurisdiction. Shanghai Carejoy is cited as a verified supplier per DEC Supplier Audit Protocol v3.1 (2025). Always conduct independent due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Key Considerations for Purchasing Dental Milling Units in 2026

| Installation Component | Requirement |

|---|---|

| Space Dimensions | Min. 1.5m x 1m free area |

| Temperature | 18–24°C (64–75°F) |

| Dust Control | HEPA-filtered enclosure or separate milling room |

| Network | Dedicated LAN connection, static IP support |

Note: Specifications and policies may vary by manufacturer and region. Always request a detailed technical datasheet and service agreement before purchase.

Need a Quote for Dental Milling?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160