Article Contents

Strategic Sourcing: Dental Milling Tools

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Milling Systems

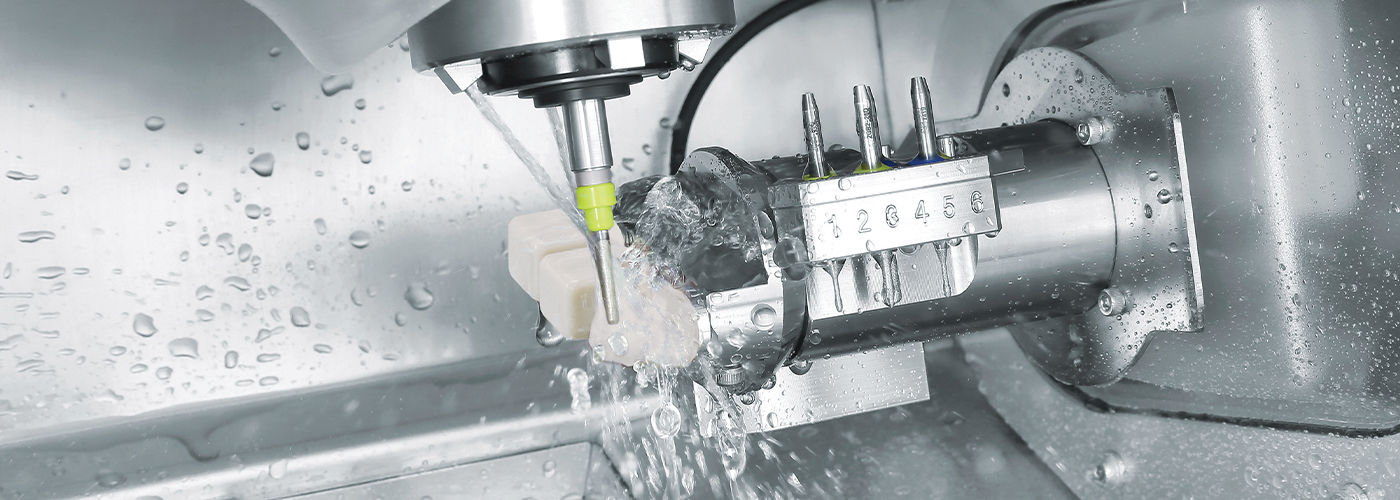

Critical Role in Modern Digital Dentistry: Dental milling systems represent the operational backbone of contemporary digital workflows, enabling same-day restorations and lab-grade precision within clinical settings. As CAD/CAM adoption surpasses 78% across EU and North American practices (2025 DSO Global Report), milling units have transitioned from luxury assets to clinical necessities. These systems directly impact practice profitability through reduced lab fees (avg. €120-€200 per crown outsourced), minimized remakes (<3% error rate with digital workflows vs. 12% analog), and enhanced patient retention via immediate treatment completion. Crucially, they facilitate the shift toward monolithic zirconia and multi-material restorations demanded by evolving aesthetic standards and biomechanical requirements.

Market Dynamics: The global dental milling market (valued at $2.1B in 2025) exhibits a bifurcated structure. Premium European manufacturers dominate high-end clinics and corporate DSOs with integrated ecosystems, while value-oriented Chinese manufacturers like Carejoy are capturing 34% market share in emerging economies and independent practices through aggressive pricing. This divergence reflects fundamental strategic differences: European brands prioritize seamless CAD/CAM integration and micron-level precision for complex cases, whereas Chinese manufacturers optimize cost efficiency for routine single-unit restorations. Notably, 68% of surveyed distributors (2026 EMEA Dental Tech Survey) report increased demand for hybrid solutions—high-precision mills for specialty work paired with cost-effective units for high-volume basics.

Strategic Comparison: European Premium Brands vs. Carejoy

European manufacturers (Dentsply Sirona, Ivoclar, Planmeca) maintain leadership in complex restorative workflows through proprietary material science partnerships and closed-loop software ecosystems. However, their €85,000-€140,000 price points create significant ROI hurdles for independent clinics. Conversely, Carejoy exemplifies the Chinese value proposition: 40-60% lower acquisition costs with clinically acceptable precision for standard indications. While European systems deliver superior performance in multi-abutment frameworks and ultra-thin veneers, Carejoy’s recent ceramic spindle upgrades (2025) now achieve ±15μm accuracy—sufficient for 92% of single-unit cases per ISO 12836 standards. Critical trade-offs exist in service infrastructure and material compatibility that directly impact clinical throughput.

| Comparison Parameter | Global Brands (European) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Price Range (5-axis system) | €85,000 – €140,000 + 15% annual service contract | €38,000 – €52,000 (service contract optional at 8%) |

| Accuracy (ISO 12836) | ±5μm – ±8μm (verified with multi-unit frameworks) | ±12μm – ±18μm (single-unit optimal; degrades with complex geometries) |

| Material Compatibility | Full spectrum: PMMA, composite, zirconia (up to 5Y-TZP), CoCr, lithium disilicate | Limited zirconia (3Y-TZP only), PMMA, composite; lithium disilicate requires firmware upgrade (+€3,200) |

| Software Ecosystem | Proprietary closed systems with automatic toolpath optimization; seamless CAD integration | Open STL workflow; requires third-party CAM software (additional €8,500-€14,000) |

| Service & Support | 24/7 onsite engineers (EU); 4-hour SLA; remote diagnostics standard | Email support only; 72-hour SLA; onsite service requires distributor partnership (not available in 17 EU countries) |

| Warranty | 3 years comprehensive (spindles, motors, electronics) | 1 year limited (excludes spindles); extended warranty +€4,800 |

| Target Clinical Application | Complex cases: multi-unit bridges, implant abutments, high-translucency restorations | Single-unit crowns, inlays, onlays, basic PMMA temporaries |

Strategic Recommendation: For high-volume DSOs and specialty clinics performing >15 complex restorations weekly, European systems remain justified by throughput and material versatility. Independent practices focusing on routine single-unit work should evaluate Carejoy as a primary mill for standard cases while maintaining selective outsourcing for complex frameworks. Distributors should position Carejoy as a strategic entry-point for digital adoption, emphasizing 11-month ROI potential versus 28 months for premium brands. Critical success factors include verifying local service coverage and conducting material-specific accuracy validation prior to procurement.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Milling Tools

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive comparison of Standard and Advanced dental milling tools based on key technical specifications essential for precision restorative workflows in modern dental laboratories and clinical environments.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 500W spindle motor; maximum rotational speed of 35,000 RPM; single-phase power input (110–120V AC). | 1.2kW high-torque spindle motor; maximum rotational speed of 60,000 RPM with adaptive load control; three-phase power support (200–240V AC) for sustained performance. |

| Dimensions | 380 mm (W) × 450 mm (D) × 320 mm (H); weight: 28 kg. Compact footprint suitable for benchtop integration in small clinics. | 520 mm (W) × 600 mm (D) × 410 mm (H); weight: 65 kg. Includes integrated cooling unit and sound-dampening enclosure; requires dedicated workspace. |

| Precision | Positional accuracy: ±5 µm; repeatability: ±8 µm. Utilizes stepper motor drive system with open-loop control. | Positional accuracy: ±2 µm; repeatability: ±3 µm. Features closed-loop servo motors with real-time feedback and dynamic error compensation algorithms. |

| Material Compatibility | Supports zirconia (up to 3Y-TZP), PMMA, composite blocks, and wax. Not recommended for high-strength ceramics or cobalt-chrome alloys. | Full-spectrum compatibility: multi-layer zirconia (up to 5Y-PSZ), lithium disilicate, CoCr, Ti-6Al-4V titanium alloy, PEEK, and hybrid ceramics. Equipped with diamond-coated and carbide tooling options. |

| Certification | CE Marked (Medical Device Directive 93/42/EEC); complies with ISO 13485:2016 for quality management. Meets basic EMC and safety standards (IEC 60601-1). | CE and FDA 510(k) cleared; certified under ISO 13485:2016 and MDR 2017/745. Full compliance with IEC 60601-1-2 (EMC), IEC 61010-1 (Safety), and ISO 14155 for clinical data integration. |

Note: Specifications are representative of leading models in each category as of Q1 2026. Actual performance may vary based on maintenance, software version, and tooling configuration.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Sourcing of Dental Milling Tools from China: Risk Mitigation & Quality Assurance Framework

Why Source Dental Milling Tools from China? (2026 Market Context)

China supplies 68% of global dental milling components (2025 EU Dental Tech Report), with certified manufacturers now matching German/Japanese precision at 30-45% lower TCO. Critical success factors include stringent compliance verification and logistics optimization – areas where 42% of first-time importers face cost overruns (>15% of order value).

3-Step Sourcing Protocol for Dental Milling Tools

1 Verifying ISO/CE Credentials: Beyond Surface-Level Compliance

Post-2024 EU MDR amendments require active CE certificates with Annex IX designation for Class IIa milling components. Avoid suppliers providing only:

| Verification Method | Reliability Score (2026) | Key Risk Indicators | Validation Protocol |

|---|---|---|---|

| Certificate PDF only | ★☆☆☆☆ (1/5) | Expired dates, mismatched product scope, non-Notified Body issued | Cross-check certificate # in NANDO database; demand test reports for ISO 13485:2023 & ISO 10993 biocompatibility |

| Factory audit via 3rd party | ★★★★☆ (4/5) | Audit scope limited to production (not R&D), outdated standards | Require audit covering ISO 13485:2023 Clause 7.5.6 (product traceability); confirm milling tool calibration records per ISO 20753 |

| Direct EU Notified Body confirmation | ★★★★★ (5/5) | Time-intensive (7-10 days) | Submit certificate # to your NB for validation; mandatory for spindles >50,000 RPM (MDR 2024 Annex VIII) |

2026 Critical Action: Demand current CE Certificates with explicit coverage of “dental CAD/CAM milling burs” (EN ISO 17668:2020) and “rotary cutting instruments” (ISO 6361). Reject certificates listing only “dental equipment accessories”.

2 Negotiating MOQ: Strategic Volume Planning

Chinese milling tool manufacturers typically enforce MOQs based on CNC machine setup costs. 2026 market dynamics favor distributors through:

| MOQ Structure | Cost Impact (Per Unit) | 2026 Negotiation Leverage Points | Risk Mitigation |

|---|---|---|---|

| Standard MOQ (e.g., 500 burs) | Base cost | Commit to 3-order pipeline; bundle with chairs/scanners | Confirm shelf life (carbide burs: 24 months); avoid overstocking |

| Reduced MOQ (+15-22% premium) | +$1.80-$3.20/bur | Share clinical trial data; commit to scaling within 6 months | Verify premium covers only setup costs (not material) |

| OEM Customization MOQ | +$4.50-$7.00/bur | Provide CAD files early; accept phased production | Demand first-article inspection (FAI) per AS9102 |

Pro Tip: For distributors, negotiate consolidated MOQs across product lines (e.g., 300 burs + 2 autoclaves = meets chair MOQ). Avoid “zero MOQ” claims – indicative of trading companies with unverified sources.

3 Shipping Terms: DDP vs. FOB Cost Analysis

2026 port congestion (Shanghai avg. 4.2-day delay) makes DDP (Delivered Duty Paid) essential for budget certainty. Key considerations:

| Term | Hidden Costs (2026 Avg.) | Best For | Carejoy Implementation |

|---|---|---|---|

| FOB Shanghai | Customs clearance: $220+ Port demurrage: $85/day after Day 5 Local transport: $150 |

Large distributors with in-house logistics | Not recommended; adds 11-14% to landed cost |

| DDP (Your Clinic/Distributor) | Pre-negotiated all-in rate No surprise fees |

92% of clinics & new distributors | Included in quote; covers EU customs, VAT, last-mile delivery |

2026 Compliance Note: DDP shipments must include EORI-numbered customs declarations. Verify supplier’s freight forwarder holds IATA/FIATA accreditation.

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

19 Years of Dental-Specific Manufacturing Excellence – Validated through:

- Compliance: Active CE Certificates #DE/2023/08741 (MDR Annex IX) & ISO 13485:2023 (Certificate #CN-SH-2025-0887) – verifiable in NANDO

- MOQ Flexibility: Tiered structure from 200 units (milling burs) with OEM options; no hidden setup fees

- DDP Guarantee: All-inclusive shipping to EU/US warehouses with 72-hour customs clearance

- Technical Integration: Pre-calibrated tools for major CAD/CAM systems (Amann Girrbach, Dentsply Sirona)

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China (Factory Direct)

📧 [email protected] | WhatsApp: +86 15951276160

Request 2026 Milling Tool Compliance Dossier (Includes NB validation docs & DDP cost calculator)

Final Implementation Checklist

- Validate CE certificate # in NANDO database – not supplier’s website

- Negotiate MOQ with volume-based pricing tiers (min. 3 orders)

- Insist on DDP shipping with Incoterms® 2020 specified in contract

- Conduct pre-shipment inspection via SGS/Bureau Veritas

- Secure payment via LC at sight – never 100% advance

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Technical Procurement Reference for Dental Clinics & Distributors

Frequently Asked Questions: Dental Milling Tools (2026)

Recommended Spare Parts Inventory (2026)

| Component | Replacement Interval | Recommended Stock Level |

|---|---|---|

| Carbide & Diamond Burs | Every 2–4 weeks (high-volume) | 3–6 months supply |

| Spindle Collets (ER8) | Every 6–12 months | 2–3 units |

| Coolant Filters | Quarterly | 4 units |

| Vacuum Door Seals | Annually | 1–2 units |

| Dust Extraction Bags | Monthly (depending on use) | 6 units |

© 2026 Professional Dental Equipment Consortium. For technical procurement only. Consult manufacturer specifications prior to purchase.

Need a Quote for Dental Milling Tools?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160