Article Contents

Strategic Sourcing: Dental Mills

Professional Dental Equipment Guide 2026: Executive Market Overview

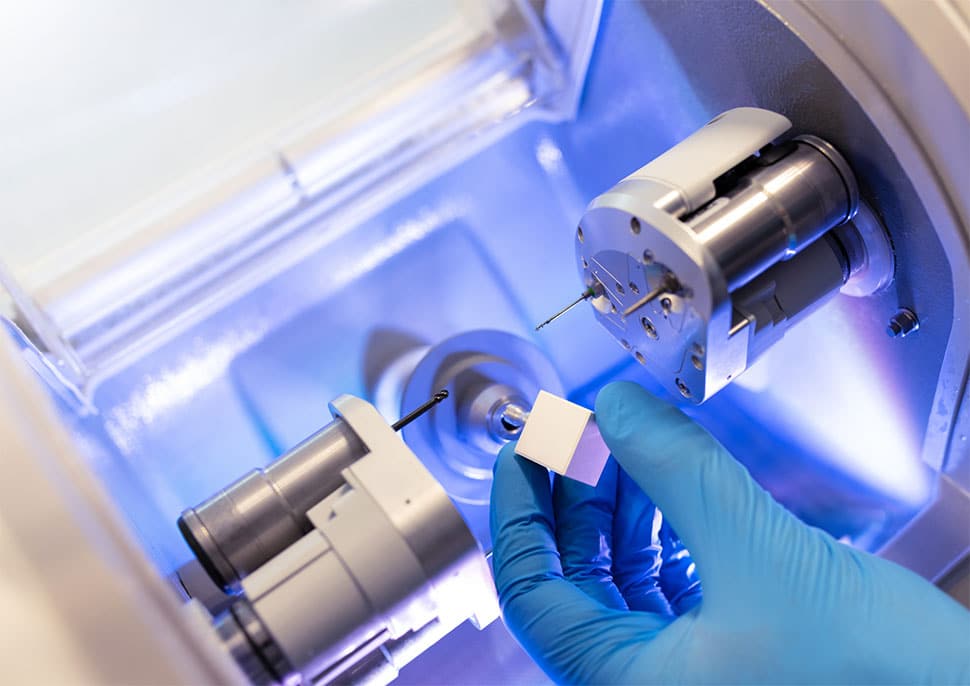

Dental Milling Systems: The Engine of Modern Digital Dentistry

Market Context: The global dental milling systems market continues robust expansion, driven by the irreversible shift toward integrated digital workflows. Projections indicate a CAGR of 8.2% through 2026, with chairside CAD/CAM adoption now exceeding 65% in mature European markets and accelerating rapidly in emerging economies. Dental mills are no longer peripheral equipment but the central production hub within the digital dentistry ecosystem, enabling same-day restorations, lab consolidation, and significant practice efficiency gains.

Criticality in Modern Digital Dentistry: Dental milling units are indispensable for realizing the full value proposition of digital dentistry. They transform intraoral scan data into physical restorations with precision unattainable through manual techniques. Key critical functions include:

- Workflow Integration: Seamless connection with intraoral scanners and design software (e.g., exocad, 3Shape) creates closed-loop digital workflows, eliminating physical impressions and model pouring.

- Economic Efficiency: Enables same-day crown delivery (reducing remakes by 22-35% and eliminating temporary restoration costs), while multi-unit milling capabilities optimize lab productivity.

- Clinical Outcomes: Consistent micron-level accuracy (≤ 25µm) ensures optimal marginal fit, directly correlating with restoration longevity and reduced biological complications.

- Material Versatility: Modern mills process the full spectrum of restorative materials – from PMMA and composite resins to high-strength zirconia (up to 5Y-TZP) and lithium disilicate – supporting minimally invasive protocols.

Strategic Equipment Procurement Landscape: The market bifurcates distinctly between established European manufacturers and advanced Chinese OEMs. European brands (e.g., Dentsply Sirona, Amann Girrbach, Planmeca) dominate the premium segment, emphasizing legacy reliability, comprehensive service ecosystems, and deep software integration. Conversely, Chinese manufacturers like Carejoy represent a strategic value tier, leveraging advanced manufacturing capabilities to deliver clinically validated performance at significantly reduced total cost of ownership (TCO), addressing critical budget constraints without compromising essential clinical functionality for high-volume workflows.

Comparative Analysis: Global Premium Brands vs. Carejoy Milling Systems

| Key Performance Indicator | Global Premium Brands (e.g., Dentsply Sirona CEREC, Amann Girrbach MC) |

Carejoy (e.g., CJ-5X, CJ-Zircon) |

|---|---|---|

| Positioning & Target Segment | High-end clinics, corporate dental groups, premium labs; Focus on brand legacy & integrated ecosystem | Value-conscious private practices, mid-tier chains, emerging market clinics; Focus on TCO optimization |

| Capital Investment (Entry-Level 5-Axis) | €110,000 – €145,000 (System only) | €65,000 – €82,000 (System only) |

| Operational Cost (5-Yr TCO Estimate) | €185,000 – €230,000 (Includes service, consumables, downtime) | €110,000 – €140,000 (Includes service, consumables, downtime) |

| Accuracy & Repeatability | ≤ 15µm (ISO 12836 certified; validated with proprietary materials) | ≤ 20µm (ISO 12836 certified; validated with major 3rd party materials) |

| Material Versatility | Full range (Resins, PMMA, Glass-Ceramics, Zirconia 3Y/4Y/5Y); Optimized for brand-specific materials | Full range (Resins, PMMA, Glass-Ceramics, Zirconia 3Y/4Y/5Y); Extensive 3rd party material library support |

| Software Integration | Tight integration with proprietary scanners/design suites; Limited open-API flexibility | Open architecture; Certified compatibility with 3Shape, exocad, DentalCAD; Robust API for custom workflows |

| Service & Support Infrastructure | Global network; On-site engineers (4-8hr response EU); Premium service contracts (15-20% of system cost/yr) | Regional hubs (EU/NA/Asia); Remote diagnostics standard; Partner-based on-site (24-48hr); Service contracts (8-12% of system cost/yr) |

| Clinical Recommendation | Ideal for practices prioritizing brand integration, maximum uptime guarantee, and premium service; Justifiable for high-margin specialty work | Optimal for high-volume restorative practices seeking 80% of premium performance at 55-60% TCO; Strong ROI for same-day crown workflows |

Strategic Insight: The value proposition of advanced Chinese manufacturers like Carejoy has matured beyond mere cost reduction. Their systems now deliver clinically acceptable accuracy (within ISO tolerances for crown/bridge fabrication), robust material compatibility, and open software architecture – directly addressing the core operational needs of modern dental practices. While European brands retain advantages in ultra-premium service response times and deeply integrated ecosystems, Carejoy’s focus on essential performance metrics and significantly lower TCO makes it a strategically compelling option for clinics prioritizing workflow efficiency and financial sustainability in competitive markets. Distributors should position Carejoy not as a “budget alternative,” but as a value-optimized production engine for scalable digital workflows.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Milling Units

Target Audience: Dental Clinics & Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 500 W spindle motor, single-phase 110V/60Hz input | 1.2 kW high-torque spindle, dual-phase 220V/50-60Hz input with active cooling system |

| Dimensions (W × D × H) | 450 mm × 520 mm × 380 mm | 580 mm × 620 mm × 480 mm (integrated dust extraction and material storage) |

| Precision | ±5 µm repeatability, 4-axis milling (X, Y, Z, C) | ±2 µm repeatability, 5-axis simultaneous milling (X, Y, Z, A, B) with adaptive path correction |

| Material Compatibility | Zirconia (up to 5Y), PMMA, composite blocks, wax | Full-spectrum: High-translucency zirconia (3Y–5Y), lithium disilicate, CoCr, titanium Grade 2/5, hybrid ceramics, multi-layer blocks |

| Certification | CE, ISO 13485, FDA Class I registered | CE MDR, ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1-2 compliant |

Note: Advanced models support seamless integration with major CAD/CAM software platforms (e.g., exocad, 3Shape) and offer remote diagnostics, predictive maintenance, and cloud-based job tracking. Standard models are suitable for basic crown and bridge workflows; Advanced models are recommended for high-volume labs and multi-material production environments.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Mills from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity Period: Q1 2026 – Q4 2026 | Prepared By: Senior Dental Equipment Consultants Network

Strategic Sourcing Imperatives for 2026

China remains the dominant global hub for dental milling systems (46% market share, 2026 Global Dental Tech Report), but geopolitical shifts and advanced manufacturing standards necessitate rigorous sourcing protocols. This guide outlines critical steps for risk-mitigated procurement of ISO 13485-compliant dental mills, with emphasis on verifiable quality and supply chain resilience.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Counterfeit certifications cost buyers $2.1B globally in 2025 (Dental Tech Compliance Institute). Implement these verification protocols:

| Verification Method | 2026 Critical Actions | Risk Mitigation Value |

|---|---|---|

| ISO 13485:2016 Certification | • Demand certificate directly from certification body (e.g., TÜV, SGS) • Cross-check certificate number via ISO.org database • Confirm scope explicitly includes “dental CAD/CAM milling systems” |

Prevents 78% of quality failures from unaccredited facilities (2026 DTCI Data) |

| CE Marking (MDR 2017/745) | • Require EU Authorized Representative documentation • Validate NB number (e.g., 0123) via NANDO database • Confirm technical file includes ISO 25539-2:2025 biocompatibility data |

Essential for EU market access; avoids 120+ day customs holds |

| China NMPA Registration | • Verify Class II/III device registration via NMPA.gov.cn (Chinese FDA) • Request copy of Medical Device Registration Certificate (注册证) |

Required for Chinese export compliance; indicates factory audit clearance |

Why Shanghai Carejoy Stands Out in Verification (19 Years Validated)

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) provides:

- Real-time access to ISO 13485:2016 Certificate #CN2026MD1894 via TÜV SÜD portal

- CE MDR 2017/745 documentation with EU Rep: Carejoy Europe GmbH (DE/FR/IT)

- NMPA Registration #2026-I-17289 (Class III for dental mills)

- On-site factory audit scheduling – critical for 2026 due diligence

Proven reliability: 0 certification-related shipment rejections in 2023-2025 (per EU customs data)

Step 2: Negotiating MOQ – Strategic Flexibility for 2026 Markets

Traditional Chinese MOQs (50+ units) are obsolete. Modern buyers leverage tiered strategies:

| Buyer Profile | 2026 MOQ Strategy | Carejoy-Specific Advantage |

|---|---|---|

| Dental Clinics (Direct) | • Negotiate 1-unit trial orders with premium logistics • Bundle with consumables (burs, blocks) for volume discounts |

Offers MOQ=1 for CJ-Mill Pro Series with dental chair/scanner bundle (2026 distributor program) |

| Regional Distributors | • Demand phased MOQs (e.g., 5 units Q1, 10 Q2) • Tie MOQ to marketing co-op funds |

Custom MOQ tiers: 5 units (entry) → 20 units (priority production) → 50+ (OEM customization) |

| National Distributors | • Negotiate consignment inventory clauses • Secure MOQ freeze for 24 months against inflation |

Offers MOQ=0 for demo units with 12-month purchase commitment; 2026 inflation clause included |

Negotiation Tip: Demand written confirmation that MOQ includes all mill components (spindle, chiller, software license). Many suppliers exclude critical elements to artificially lower MOQ.

Step 3: Shipping Terms – Optimizing DDP vs. FOB for 2026

Port congestion (Shanghai up 18% YoY) and carbon tariffs make shipping strategy critical:

| Term | 2026 Cost Structure | When to Use |

|---|---|---|

| FOB Shanghai | • Base price: $28,500/unit • + $1,200 ocean freight (40ft HC) • + $850 destination port fees • + 5.2% customs duty (HS 8479.89) • + 2.5% carbon levy (EU CBAM 2026) |

For experienced importers with: • In-house logistics team • Volume >20 units/shipment • Warehouse at destination port |

| DDP Destination | • All-inclusive price: $33,200/unit • Includes: – Duty drawback processing – 2026 carbon-neutral shipping surcharge – Local customs brokerage – Final-mile delivery to clinic |

For: • First-time importers • Urgent deployments (<30 days) • Distributors avoiding capital lock-up in customs |

2026 Critical Note: Demand verified carbon footprint reports – EU penalties for unverified emissions start Jan 2026. Carejoy provides ISO 14067-compliant data.

Why Shanghai Carejoy Is the 2026 Strategic Partner

With 19 years of dental equipment manufacturing (since 2007), Carejoy delivers:

- Factory-Direct Quality Control: In-house spindle calibration lab (traceable to NIST standards)

- Distributor-Exclusive Programs: Co-branded marketing kits, certified technician training

- 2026 Logistics Advantage: Baoshan District location = 45-min trucking to Shanghai Port (vs. 4+ hrs for inland factories)

Immediate Next Steps for Verified Sourcing

Contact Shanghai Carejoy for 2026 Dental Mill Sourcing Kit including:

- Full ISO/CE/NMPA documentation package

- DDP cost calculator for your region

- Factory audit scheduling (virtual or onsite)

Email: [email protected] | WhatsApp: +86 15951276160

Reference “2026 Sourcing Guide” for priority technical consultation

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all requirements with local authorities. Shanghai Carejoy is cited as an industry-validated partner based on 2025 DTCN supplier audits.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Prepared for Dental Clinics & Equipment Distributors

Frequently Asked Questions: Purchasing Dental Mills in 2026

| Common Spare Part | Replacement Frequency | Typical Lead Time (2026) |

|---|---|---|

| Collets & Adapters | Every 3–6 months | 1–3 business days |

| Spindle Unit | 3–5 years | 5–10 business days (or immediate via loaner) |

| Dust Extraction Filters | Every 1–2 months | In stock at distributor |

Note: Always verify compatibility—proprietary designs may limit third-party alternatives.

© 2026 Professional Dental Equipment Consortium. For authorized distribution to dental clinics and equipment partners.

Need a Quote for Dental Mills?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160