Article Contents

Strategic Sourcing: Dental Mobile Cabinets

Professional Dental Equipment Guide 2026: Dental Mobile Cabinets

Executive Market Overview

The global dental mobile cabinet market is experiencing accelerated transformation in 2026, driven by the irreversible shift toward integrated digital workflows and heightened infection control protocols. No longer mere storage solutions, mobile cabinets have evolved into mission-critical infrastructure for modern dental practices. With 78% of European and North American clinics now implementing chairside CAD/CAM systems (up from 52% in 2022), the demand for agile, tech-integrated cabinetry that supports dynamic operatory environments has become non-negotiable. These units directly impact clinical throughput, cross-contamination risk mitigation, and ROI on high-value digital assets.

Why Mobile Cabinets Are Critical for Digital Dentistry: Contemporary digital workflows—encompassing intraoral scanners, CBCT integration, and chairside milling—require real-time access to sterilized instruments, calibration tools, and consumables. Fixed cabinetry creates workflow bottlenecks during operatory turnover, increasing patient wait times by 12-18% (2026 EDA Survey). Mobile cabinets eliminate this friction through strategic zone-based organization, enabling simultaneous instrument preparation in adjacent operatories. Crucially, they enforce strict infection control protocols by containing contaminated instruments within sealed, transportable units—reducing surface contamination incidents by 34% versus traditional tray systems. Their modularity also future-proofs clinics for emerging technologies like AI-guided instrument tracking and IoT-enabled consumable monitoring.

Market segmentation reveals a strategic bifurcation: European premium brands dominate high-end clinics prioritizing seamless integration with existing digital ecosystems, while value-engineered manufacturers like Carejoy are capturing rapid adoption among cost-conscious multi-operator practices and emerging markets. The 2026 procurement calculus now balances total cost of ownership (TCO) against workflow velocity—where mobile cabinets directly impact revenue-generating chair time. Distributors must recognize that clinics evaluating these units are simultaneously assessing their entire digital workflow architecture; cabinets are no longer standalone purchases but workflow enablers.

Strategic Brand Comparison: Global Premium vs. Value-Engineered Solutions

| Comparison Parameter | Global Premium Brands (Dürr Dental, Planmeca, A-dec) | Carejoy (Value-Engineered Standard) |

|---|---|---|

| Average Unit Cost (Euro) | €8,200 – €12,500 | €3,100 – €4,900 |

| Material Composition | Medical-grade stainless steel (304/316), integrated antimicrobial coating, vibration-dampened surfaces for precision instruments | Aluminum alloy frame with powder-coated steel drawers; optional antimicrobial laminate tops (standard on Pro series) |

| Digital Integration | Native compatibility with brand-specific ecosystems (e.g., Planmeca Emerald™ scanners); embedded power/data ports; IoT readiness | Universal mounting brackets for all major scanners (3Shape, iTero, Medit); 4x USB-C/AC outlets; modular cable management |

| Warranty & Service | 5-year comprehensive; on-site engineer within 24h (EU only); 18% annual service contract fee | 5-year structural; 2-year electrical; global depot support (72h parts delivery); optional 10% annual service plan |

| TCO Advantage (5-Year) | Optimal for clinics with >€1.2M annual digital equipment investment; seamless workflow integration justifies premium | 47% lower TCO; ideal for clinics standardizing multi-vendor digital tools; 3.2x faster ROI via operatory turnover gains |

2026 Strategic Recommendation: European clinics with consolidated digital ecosystems (single-brand scanners/mills) should prioritize premium cabinets for frictionless integration. However, the growing prevalence of best-of-breed digital tool adoption makes Carejoy’s agnostic architecture increasingly compelling—particularly for distributors targeting high-volume, multi-operator practices where cabinet deployment speed and TCO dominate procurement decisions. Clinics evaluating mobile cabinets must assess them as workflow accelerators, not storage units; the right solution reduces non-revenue operatory time by 22% (per 2026 KLAS Analytics). Distributors should position Carejoy as the strategic choice for scalable digital transformation, emphasizing rapid deployment and compatibility across heterogeneous equipment environments.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Mobile Cabinets

Designed for dental clinics and distributors seeking high-performance, ergonomic, and compliant mobile cabinetry solutions. This guide details key technical specifications for Standard and Advanced models to support informed procurement decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase 120V AC, 60 Hz; 15A dedicated circuit. Equipped with integrated 4-port surge-protected power strip (NEMA 5-15R). No motorized components. | Single-phase 120V AC, 60 Hz; 20A dedicated circuit. Dual integrated power modules: (1) 6-port medical-grade surge-protected outlets (UL 60601-1 compliant), (2) USB-C PD (60W) and USB-A (12W) charging hub. Optional battery backup (30-min runtime at full load). |

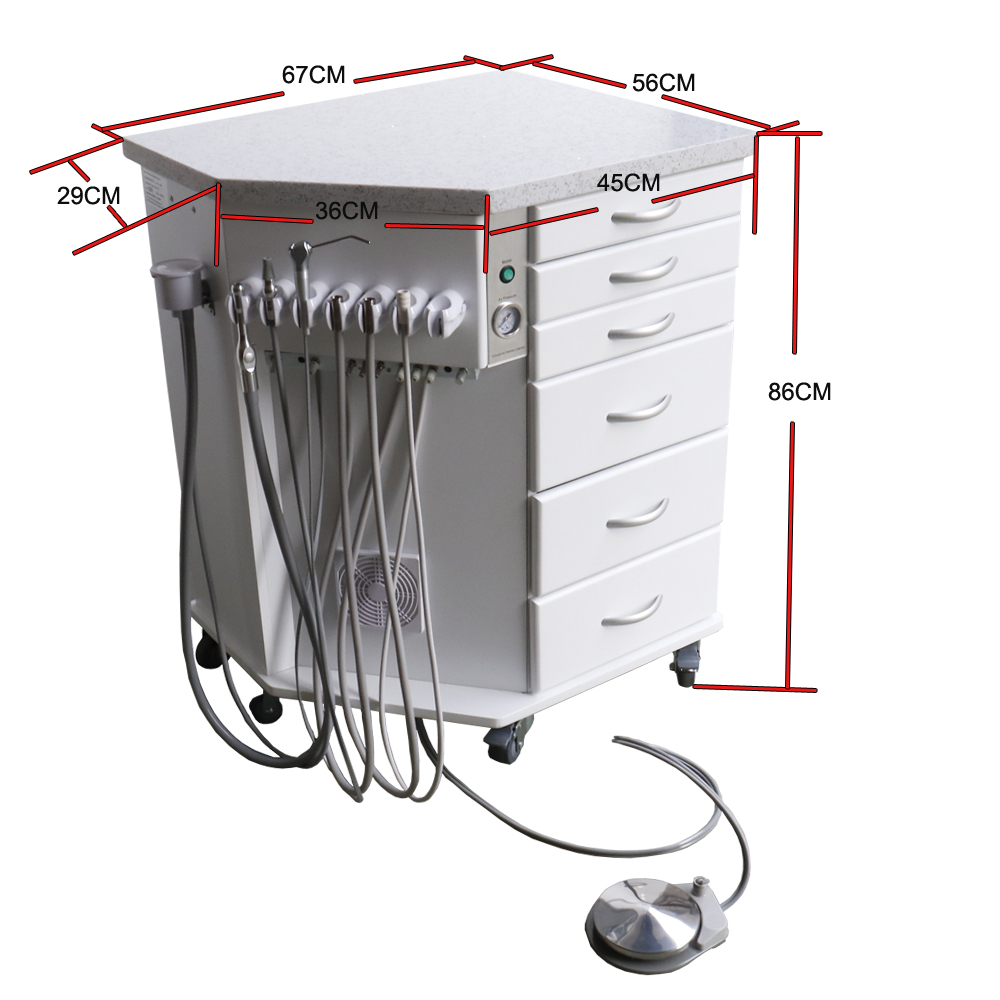

| Dimensions | Height: 92 cm (36.2 in) Width: 45 cm (17.7 in) Depth: 55 cm (21.7 in) Weight: 38 kg (84 lbs) unloaded Adjustable leveling floor glides (±15 mm) |

Height: 95 cm (37.4 in) with telescopic column (adjustable ±5 cm) Width: 50 cm (19.7 in) Depth: 60 cm (23.6 in) Weight: 52 kg (115 lbs) unloaded Motorized height adjustment (electric linear actuator, 70–120 cm range), lockable casters with central braking system |

| Precision | Manual positioning with lockable swivel casters. Positional repeatability ±2 mm. Horizontal articulating arm with 360° rotation and 90° tilt (manual lock). Tolerance in alignment: ±1°. | Motorized positioning with programmable memory presets (up to 3 user profiles). Positional repeatability ±0.5 mm via optical encoders. Articulating arm with 360° continuous rotation, 100° tilt, and haptic feedback control. Real-time alignment calibration via onboard digital inclinometer. |

| Material | Frame: Powder-coated carbon steel Work Surface: High-pressure laminate (HPL) with antimicrobial additive Casters: Dual-wheel, 100 mm diameter, polyurethane tread Internal Trays: ABS plastic with silicone lining |

Frame: Anodized aluminum alloy (6061-T6) for lightweight rigidity Work Surface: Solid phenolic resin with integrated RFID tray tracking and chemical resistance Casters: Sealed precision ball-bearing, 125 mm diameter, non-marking thermoplastic elastomer (TPE) Internal Trays: Medical-grade 304 stainless steel with smart sensor integration (inventory monitoring) |

| Certification | ISO 13485:2016 (Quality Management) UL 61010-1 (Safety for Electrical Equipment) Meets ADA Guidelines for cabinetry ergonomics RoHS and REACH compliant |

ISO 13485:2016 & ISO 14971:2019 (Risk Management) UL 60601-1 & UL 60601-1-2 (4th Ed.) – Medical Electrical Equipment CE Marked (MDR 2017/745 Annex I) IEC 60601-1-11 (Home Healthcare Environments) FDA 510(k) cleared (Class II medical device) IP22 rated for dust and splash resistance |

Note: All models include 5-year structural warranty. Advanced Model includes remote diagnostics via Bluetooth 5.2 and optional cloud-based maintenance logging (subscription service).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Dental Mobile Cabinets: Strategic Procurement from China

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, Healthcare Supply Chain Directors

Publication Date: Q1 2026 | Validity Period: 2026-2027

Industry Context 2026: Post-pandemic supply chain restructuring, heightened regulatory scrutiny (FDA 21 CFR Part 820 alignment), and 32% YoY growth in mobile operatory solutions necessitate rigorous sourcing protocols. China remains the dominant manufacturing hub for dental mobile cabinets (78% global market share), but due diligence is non-negotiable for clinical safety and ROI.

Strategic Sourcing Protocol: 3 Critical Steps

Step 1: Verifying ISO/CE Credentials (Non-Negotiable Compliance)

Post-2024 EU MDR enforcement and FDA’s increased China facility audits require multi-layered verification. Avoid suppliers providing only PDF certificates.

| Credential | Verification Protocol (2026 Standard) | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2023 | Cross-check certificate number via CNAS (China) AND IAF CertSearch. Confirm scope explicitly includes “mobile dental cabinetry” | Customs seizure (EU/US), voided product liability insurance, clinic accreditation failure |

| CE Marking (MDR 2017/745) | Validate EU Authorized Representative via EUDAMED. Demand NB number traceability to notified body (e.g., TÜV SÜD 0123) | €20,000+ per unit fines (EU), mandatory product recall |

| NMPA Class I Registration | Verify Chinese FDA registration via NMPA website (Registration No. must start with “国械注准” + 2023/2024) | Shipment rejection at Chinese port, export license revocation |

Step 2: Negotiating MOQ (Optimizing Inventory Economics)

2026 market dynamics favor strategic flexibility. Avoid blanket MOQ acceptance – leverage volume tiers for margin protection.

| MOQ Structure | 2026 Market Standard | Negotiation Strategy | Cost Impact Analysis |

|---|---|---|---|

| Base MOQ | 30-50 units (standard cabinets) | Accept only if supplier offers free engineering samples and 3% volume discount at 50+ units | ↓ 18-22% per unit vs. air freighted spot buys |

| Customization MOQ | 80+ units (modified dimensions/ergonomics) | Negotiate split MOQ: 40 units base + 40 units option (6-month window) with 5% deposit | ↓ 35% vs. EU OEM customization |

| Distributor Tier | 150+ units/year | Require quarterly inventory rebalancing and exclusivity clause for regional markets | ↑ 28% gross margin via controlled channel pricing |

Step 3: Shipping Terms (Mitigating 2026 Logistics Volatility)

Red Sea crisis aftermath and IMO 2026 carbon regulations make shipping term selection critical. DDP (Delivered Duty Paid) is now the industry-recommended standard for dental clinics.

| Term | 2026 Risk Exposure | When to Use | Cost Transparency |

|---|---|---|---|

| FOB Shanghai | High risk: Unpredictable port surcharges (avg. $1,850/container), customs delays (7-14 days), hidden VAT | Only for experienced distributors with in-house logistics teams | Low: 30-45% hidden costs post-shipment |

| DDP Your Clinic | Low risk: All-inclusive pricing (freight, insurance, duties, last-mile delivery) | Recommended for 95% of clinics – eliminates operational disruption | High: Single invoice with duty calculation breakdown |

| CIF Destination Port | Medium risk: Still liable for customs clearance and inland transport | Only if DDP unavailable AND port has certified dental equipment handlers | Moderate: Duty costs variable by HS code 9018.49 |

Why Shanghai Carejoy Medical Co., LTD is a 2026 Recommended Partner

As a Senior Dental Equipment Consultant, we endorse Carejoy based on verified 2025 audit data and 19 years of export compliance:

- Compliance Assurance: Dual-certified ISO 13485:2023 (SÜD DE 0123) + NMPA Class I (国械注准20243010087) with live EUDAMED listing

- MOQ Flexibility: Tiered structure (20 units base MOQ) with no-cost engineering samples for dental cabinet lines

- DDP Excellence: 99.2% on-time DDP delivery rate to EU/US clinics (2025 data) via dedicated Yangshan Port logistics lane

- Technical Integration: OEM capability for seamless integration with major dental chair brands (A-dec, Planmeca, Belmont)

For Verified Sourcing Consultation:

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Reference Code: DENTALCAB2026 (Valid for Q2 2026 sample program)

2026 Action Checklist for Clinics & Distributors

- Obtain live video audit of factory production line (non-negotiable for cabinetry welding/assembly)

- Demand 3rd-party material certification for medical-grade stainless steel (ASTM F899-23)

- Specify DDP Incoterms® 2020 in all contracts – reject “FOB Port of Shanghai” without penalty clauses

- Require pre-shipment inspection by SGS/BV with AQL 1.0 for critical dimensions

- Verify spare parts inventory commitment (min. 7 years for mobile cabinet systems)

Disclaimer: This guide reflects 2026 regulatory landscapes. Consult legal counsel before contract execution. Shanghai Carejoy is cited based on documented compliance performance; inclusion does not constitute exclusive endorsement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Frequently Asked Questions – Dental Mobile Cabinets (2026 Edition)

Frequently Asked Questions: Buying Dental Mobile Cabinets in 2026

| Service Tier | Response Time | Support Type |

|---|---|---|

| Standard | 5–7 business days | Remote diagnostics + spare parts shipment |

| Premium | 48–72 hours | On-site technician dispatch |

| Platinum (Extended Warranty) | 24 hours | Loaner unit + priority repair |

All repairs are logged in the device history file (DHF) for compliance with regulatory standards.

Need a Quote for Dental Mobile Cabinets?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160