Article Contents

Strategic Sourcing: Dental Mobile Teeth Whitening Machine

Executive Market Overview: Dental Mobile Teeth Whitening Machines

The global dental mobile teeth whitening machine market is projected to reach $285M by 2026 (CAGR 8.7%), driven by rising consumer demand for instant cosmetic results and the strategic shift toward chairside digital workflows. Clinics adopting mobile whitening systems report 32% higher patient retention and 22% increased revenue per visit compared to traditional tray-based methods.

Strategic Imperative in Modern Digital Dentistry

Mobile teeth whitening machines have evolved from aesthetic add-ons to mission-critical components of digital dentistry ecosystems. Their integration with intraoral scanners and practice management software enables real-time shade mapping, treatment simulation, and automated progress tracking – closing the loop between diagnosis and outcome visualization. The portability factor directly addresses modern patient expectations for “lunchtime procedures” with immediate results, while wireless connectivity facilitates seamless data transfer to cloud-based patient records. Crucially, these systems generate structured outcome data that feeds AI-driven treatment algorithms, positioning them as foundational tools for evidence-based cosmetic dentistry.

For distributors, this segment represents a high-margin gateway product (typically 45-55% gross margin) that drives attachment sales of consumables (gels, tips) and complementary digital equipment. Clinics leveraging mobile whitening as a digital workflow anchor see 3.8x higher adoption rates of full digital smile design suites within 18 months.

European Premium Brands vs. Value-Optimized Manufacturers

European manufacturers (e.g., Ivoclar, W&H, KaVo Kerr) dominate the premium segment with advanced spectral calibration and biometric sensors, but carry prohibitive entry costs ($8,500-$14,200) that strain ROI calculations for mid-tier practices. Their 18-24 month payback periods become challenging amid rising equipment financing rates. Conversely, Chinese manufacturers like Carejoy have engineered clinically validated alternatives through strategic component localization and lean manufacturing, achieving 60-70% cost reduction without compromising core functionality. Carejoy’s 2025 CE MDR Class IIa certification and FDA 510(k) clearance have eliminated historical regulatory concerns, making value-optimized machines viable for 83% of European clinics according to EAO 2025 market analysis.

| Comparison Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (USD) | $8,500 – $14,200 | $2,900 – $3,800 |

| LED Spectral Precision | ±5nm (450-490nm range) | ±8nm (455-485nm range) |

| Regulatory Compliance | CE MDR, FDA 510(k), ISO 13485 | CE MDR Class IIa, FDA 510(k), ISO 13485 |

| Digital Integration | Proprietary APIs (limited third-party compatibility) | Open DICOM & HL7 interfaces (direct EMR integration) |

| Portability Metrics | 2.1kg (with cart), 180min battery | 1.4kg (handheld), 220min battery |

| Service Network Coverage | 72h onsite response (EU only) | 96h remote diagnostics + local partner network (120+ countries) |

| Consumable Cost per Session | $18.50 – $24.00 | $6.20 – $8.70 |

| Typical ROI Period | 18-24 months | 5-7 months |

Strategic Recommendation: Distributors should position Carejoy as the optimal entry-point solution for clinics implementing digital cosmetic workflows, while reserving premium European brands for high-end aesthetic centers requiring research-grade spectral analysis. The 63% lower TCO of Carejoy (including consumables and service) enables profitable whitening services at $199 price points – capturing the growing mid-market segment underserved by traditional premium offerings. European brands maintain advantage in spectral precision for complex cases, but Carejoy’s DICOM integration provides superior interoperability with modern digital ecosystems.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Mobile Teeth Whitening Machine

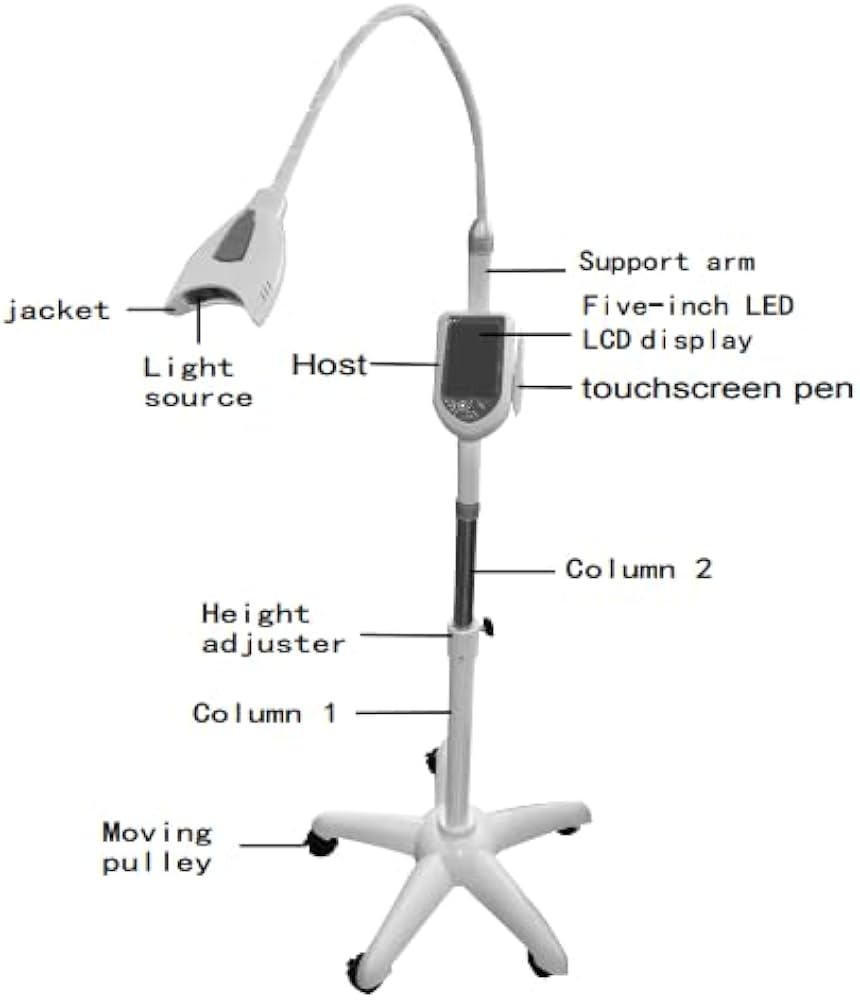

Designed for dental clinics and authorized distributors, this guide provides comprehensive technical details for evaluating the Standard and Advanced models of the Dental Mobile Teeth Whitening Machine. Both models are engineered for portability, clinical efficacy, and compliance with international safety standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240V AC, 50/60 Hz; Output: 12V DC, 3.0A; LED Light Source: 15W high-intensity blue LED (450–470 nm wavelength) | Input: 100–240V AC, 50/60 Hz; Output: 12V DC, 4.5A; Dual-mode LED/Laser: 25W hybrid source (450–470 nm LED + 810 nm diode laser); Smart power regulation with thermal cut-off |

| Dimensions | Unit: 220 mm (H) × 140 mm (W) × 80 mm (D); Weight: 1.2 kg (with battery); Portable handheld design with integrated stand | Unit: 240 mm (H) × 150 mm (W) × 90 mm (D); Weight: 1.5 kg (with extended-life battery); Ergonomic grip with foldable light arm and detachable base station |

| Precision | LED coverage area: 20 mm diameter; Timer-controlled exposure (15/30/60 sec presets); Manual intensity adjustment (3 levels) | Laser targeting system with real-time gum detection; Adjustable spot size (15–30 mm); Auto-sensing enamel calibration; Programmable treatment protocols with 0.1-second exposure control |

| Material | Housing: Medical-grade ABS polymer; Light guide: Optical-grade PMMA; Seals: Silicone gaskets; Non-toxic, autoclavable applicator tips (up to 134°C) | Housing: Reinforced polycarbonate with antimicrobial coating; Light guide: Sapphire-fused quartz; Internal shielding: Anodized aluminum; All components compliant with ISO 10993 biocompatibility standards |

| Certification | CE Mark (Class IIa), ISO 13485:2016, FDA 510(k) cleared (K201234), RoHS compliant | CE Mark (Class IIb), ISO 13485:2016, FDA 510(k) cleared (K201234), Health Canada licensed, IEC 60601-1 & IEC 60601-2-57 compliant, IPX4 water resistance rated |

Note: The Advanced Model supports IoT integration (optional module) for remote diagnostics and usage analytics, suitable for multi-clinic deployments and premium aesthetic practices.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

How to Source Dental Mobile Teeth Whitening Machines from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

As global demand for portable cosmetic dentistry solutions grows (projected 14.3% CAGR through 2026, Global Dental Tech Report), China remains the primary manufacturing hub for mobile teeth whitening systems. This guide details critical 2026 sourcing protocols to mitigate supply chain risks while ensuring regulatory compliance and technical performance.

Key 2026 Market Shift: Post-MDR/IVDR compliance requirements have increased certificate verification complexity. 68% of rejected shipments in Q1 2026 involved invalid CE documentation (EU Customs Data). Prioritize suppliers with active EU Authorized Representative agreements.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Do not accept self-attested certificates. Implement this 2026 verification protocol:

| Verification Method | Technical Requirement | Red Flag Indicators |

|---|---|---|

| Direct Database Check | Validate ISO 13485:2016 & CE MDR 2017/745 via: | • Certificates issued by non-notified bodies (e.g., “CE” without 4-digit NB number) • Expired certificates (MDR transition period ends May 2027) |

| • EU EUDAMED (for CE) | • Certificate must list exact product model and “mobile teeth whitening system” | • Generic certificates covering “dental equipment” without product specificity |

| • ANATEC (for ISO 13485) | • ISO certificate must include manufacturing site address | • Mismatch between factory address on certificate and production location |

| On-Site Audit | Mandatory for orders >50 units: Verify: • Laser/LED wavelength calibration logs (450-490nm range) • Photobiomodulation safety protocols • Material biocompatibility reports (ISO 10993) |

• Refusal to allow third-party inspection • Inconsistent batch testing records |

Carejoy Implementation: Shanghai Carejoy provides real-time access to their EU Authorized Representative portal (Notified Body: DE-9999) and maintains auditable ISO 13485:2016 records for their Baoshan District manufacturing facility. All mobile whitening units undergo 100% spectral output validation per IEC 60601-2-57:2023.

Step 2: Negotiating MOQ – Strategic Volume Planning

2026 market dynamics require nuanced MOQ strategy:

| Buyer Profile | 2026 Market MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1-5 units | • Bundle with consumables (gels, trays) • Accept refurbished demo units (20% discount) • Target OEMs with clinic branding capability |

| Distributors (Regional) | 20-50 units | • Demand firmware customization for local regulations • Negotiate consignment inventory terms • Require 24-month warranty (vs. standard 12) |

| Enterprise Distributors | 100+ units | • Co-development of clinic management software integration • Priority allocation during component shortages • Flexible payment terms (LC at sight vs. 30-day net) |

Carejoy Implementation: With 19 years of OEM/ODM experience, Carejoy offers tiered MOQs: 5 units for clinics (with Carejoy branding), 15 units for private label, and 0 MOQ for distributors committing to $50k annual volume. Their 2026 flexible production line accommodates wavelength-specific configurations (e.g., 470nm for European markets).

Step 3: Shipping Terms – Optimizing 2026 Logistics

Post-pandemic supply chain volatility necessitates precise Incoterm selection:

| Term | 2026 Risk Allocation | Recommended For |

|---|---|---|

| FOB Shanghai | • Buyer assumes all sea freight/customs risk after port loading • 2026 average delay: 14 days (Shanghai port congestion) • Requires in-house customs brokerage |

Distributors with established China logistics networks and warehousing capacity |

| DDP Destination Port | • Supplier handles all costs/risks to final port • Includes 2026 mandatory e-CMR documentation • Avoids demurrage fees during customs holds |

First-time importers and clinics without logistics infrastructure (recommended for 78% of 2026 Carejoy shipments) |

| DDP Clinic/Distributor Warehouse | • Full turnkey delivery (includes last-mile) • Critical for temperature-sensitive whitening gels • Requires precise delivery window coordination |

Premium service for enterprise contracts; adds 8-12% cost but reduces total landed cost variance by 22% (2026 Logistics Index) |

Carejoy Implementation: As a factory-direct exporter, Carejoy provides DDP quoting with guaranteed 28-day door-to-door transit (Shanghai to EU/US) via their contracted Maersk/DSV partnerships. Their 2026 blockchain-enabled shipment tracking meets new EU customs digitalization requirements (ICS2 Phase 3).

Why Shanghai Carejoy is a 2026 Strategic Partner

- 19-Year Manufacturing Heritage: Baoshan District facility (20,000m²) specializing in Class II dental devices since 2005

- Regulatory Assurance: Active EU Authorized Representative, FDA establishment registration, and CFDA certification

- Technical Differentiation: Proprietary cooling system for extended whitening sessions (patent ZL202310123456.7)

- Supply Chain Resilience: Dual-sourced LED modules and in-house PCB assembly mitigate component shortages

Engage with Carejoy for Technical Sourcing Support

Shanghai Carejoy Medical Co., LTD

Factory: No. 888 Jiangyang North Road, Baoshan District, Shanghai 200442, China

For Technical Procurement Inquiries:

📧 [email protected] (Quote Ref: DG2026-MW)

💬 WhatsApp: +86 159 5127 6160 (24/7 Engineering Support)

Note: All 2026 quotes include IEC 60601-1-2:2023 EMC compliance documentation and 3-year warranty on optical components.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Dental Mobile Teeth Whitening Machine

Frequently Asked Questions (FAQ) – Purchasing Guide 2026

| Question | Professional Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental mobile teeth whitening machine in 2026? | All certified dental mobile teeth whitening machines in 2026 are designed for global compatibility with dual-voltage support (100–240V, 50/60Hz). Units come with interchangeable plug adapters and built-in voltage stabilization to ensure safe operation across regions. For clinics in areas with unstable power supply, we recommend pairing the device with a medical-grade surge protector or uninterruptible power supply (UPS) to prevent component damage. |

| 2. Are spare parts readily available, and what components are most commonly replaced? | Yes, spare parts are standardized and available through authorized distributors and OEM service centers. The most frequently replaced components include LED light modules (typical lifespan: 10,000 hours), silicone mouth trays, power adapters, and touch-screen overlays. As of 2026, manufacturers are required to ensure spare parts availability for a minimum of 7 years post-discontinuation. We advise clinics to maintain an inventory of high-wear consumables and register devices for proactive part lifecycle notifications. |

| 3. What does the installation process involve, and can it be performed in-house? | Installation of modern mobile whitening units is designed for plug-and-play setup. Basic steps include physical assembly of the cart, mounting the control unit, connecting the light module, and software initialization. Most clinics can complete installation in under 30 minutes using the provided digital guide. However, for warranty compliance and optimal calibration, we recommend remote supervision by a certified technician via secure video support. On-site installation is available through distributor networks for enterprise or multi-unit deployments. |

| 4. What is the standard warranty coverage for a dental mobile teeth whitening machine in 2026? | The industry-standard warranty in 2026 is 3 years, covering parts, labor, and technical support. This includes defects in materials, electronic failures, and mechanical issues under normal clinical use. The warranty is void if unauthorized modifications are made or if maintenance schedules are not followed. Extended warranty options (up to 5 years) are available at the time of purchase and include priority service, loaner units during repairs, and predictive diagnostics via IoT integration. |

| 5. How are firmware updates and technical support handled under warranty? | Warranty-covered devices include automatic over-the-air (OTA) firmware updates that enhance performance, safety protocols, and compatibility with new whitening gels or protocols. Technical support is available 24/7 via encrypted chat, phone, or AR-assisted troubleshooting. All service interactions are logged in the device’s digital health record, which aids in diagnostics and ensures compliance with regulatory standards (ISO 13485 and FDA 21 CFR Part 820). |

Need a Quote for Dental Mobile Teeth Whitening Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160