Article Contents

Strategic Sourcing: Dental Operating Microscope

Dental Equipment Guide 2026: Executive Market Overview

Dental Operating Microscopes: The Critical Vision Platform for Modern Digital Dentistry

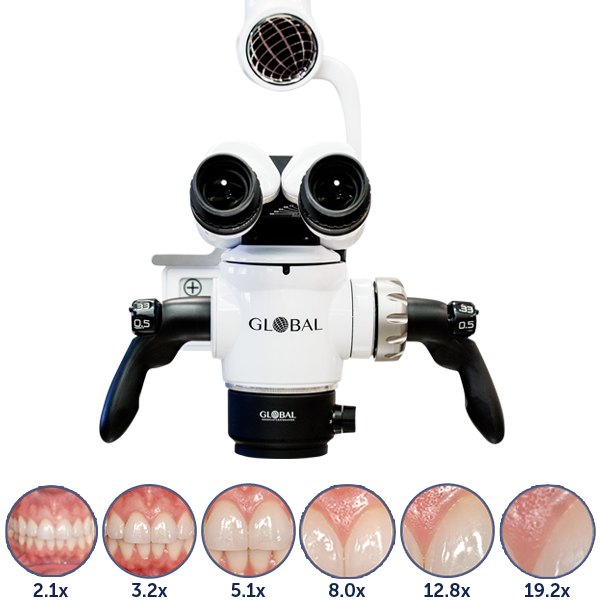

The dental operating microscope (DOM) has evolved from a specialized endodontic tool to a foundational platform for advanced clinical practice. In 2026, integration with digital workflows (CAD/CAM, intraoral scanning, CBCT) and rising patient expectations for minimally invasive procedures have made DOMs non-negotiable for competitive dental practices. Precision dentistry now demands 4-25x magnification capabilities to visualize sub-millimeter anatomical structures, enhance suture accuracy in implantology, and achieve predictable outcomes in regenerative procedures. Without DOM integration, practices cannot fully leverage digital diagnostics or execute microsurgical protocols demanded by evidence-based dentistry.

Strategic Imperative: DOMs are the visual nexus connecting diagnostic imaging, treatment execution, and outcome documentation. They directly impact clinical success rates (studies show 23% higher endodontic success with DOM use), reduce operator fatigue, and provide objective visual records for patient communication and medico-legal protection. In the era of value-based dentistry, DOMs are critical capital investments—not optional accessories.

Market Segmentation: Premium European Brands vs. Strategic Value Leaders

The DOM market bifurcates between established European manufacturers (Zeiss, Leica, Global) commanding premium pricing (€40,000-€65,000) and value-engineered solutions from manufacturers like Carejoy (¥85,000-¥125,000 / ~$12,000-$18,000). While European brands dominate academic institutions and high-end specialty practices, cost-conscious clinics and emerging markets increasingly adopt strategically optimized alternatives without compromising core clinical functionality.

| Feature Category | Global Premium Brands (Zeiss, Leica, Global) | Carejoy Advantage (Model DMC-2026) |

|---|---|---|

| Optical Performance | Apochromatic lenses (0.16-0.35 NA); Industry-leading color fidelity & resolution; 3D stereoscopic clarity | High-grade achromatic lenses (0.14-0.30 NA); Clinically sufficient resolution for 95% of procedures; Optimized for digital sensor capture |

| Digital Integration | Native 4K/8K video; Direct DICOM export; AI-assisted annotation; Seamless EHR sync (proprietary) | 4K UHD video; Standardized DICOM export; Cloud-based workflow tools; Universal API compatibility (open architecture) |

| Ergonomics | Motorized zoom/focus; Counterbalanced arms; Customizable surgeon profiles; Weight: 25-30kg | Manual precision zoom/focus; Optimized counterbalance; Quick-adjust profiles; Weight: 18kg (reduced ceiling load) |

| Service & Support | Global service network; 24/7 technical support; 3-year warranty; On-site calibration | Regional service hubs (EU/NA/Asia); 48h remote diagnostics; 2-year comprehensive warranty; Modular repair design |

| Total Cost of Ownership (5-yr) | €58,000-€82,000 (incl. service contracts, software updates) | €22,000-€28,000 (incl. extended warranty, cloud services) |

| Clinical Application Scope | Full-spectrum: Endo, Perio, Implantology, Microsurgery, Restorative | Comprehensive: Endo, Perio, Implantology, Restorative (excludes complex microsurgery) |

| Distributor Margin Structure | 22-28% (high service dependency) | 35-42% (lower service overhead; volume incentives) |

Strategic Recommendation for Stakeholders

For Dental Clinics: Premium DOMs remain essential for academic centers and specialty practices performing complex microsurgery. However, for 80% of general practice applications (endodontics, implant placement, precision restorations), Carejoy’s DMC-2026 delivers 90% of clinical functionality at 30% of the acquisition cost. Prioritize DOM integration over brand prestige—optical adequacy and digital workflow compatibility are the true differentiators.

For Distributors: Develop tiered portfolio strategies. Position European brands for high-margin specialty sales with service contracts, while leveraging Carejoy’s superior margins for volume growth in emerging markets and value-focused practices. Emphasize Carejoy’s open-architecture compatibility with existing digital ecosystems—a critical differentiator in fragmented practice environments.

Market Outlook: By 2028, 65% of new DOM installations will occur in general practices (vs. 42% in 2023), accelerating demand for cost-optimized solutions. Clinics delaying DOM adoption risk significant competitive degradation in case acceptance and procedural capability as digital dentistry matures.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Operating Microscope

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz; Halogen illumination system (30W), LED co-axial illumination (15W) | AC 100–240 V, 50/60 Hz; High-intensity LED illumination (30W), adjustable color temperature (3500K–5500K), integrated fiber-optic ring lighting with intensity control via footswitch or touchscreen |

| Dimensions | Height: 160 cm; Base diameter: 60 cm; Working distance: 200–400 mm; Arm reach: 120 cm | Height: 175 cm; Base diameter: 55 cm; Working distance: 180–450 mm; Articulating arm with 180° rotation and 6-axis mobility, reach: 140 cm |

| Precision | Magnification range: 4x–20x (step magnification via turret); Optical resolution: 80 lp/mm; Manual focusing with coarse/fine knobs | Zoom magnification: 3.5x–32x (continuous optical zoom); Digital overlay with measurement tools; Optical resolution: 120 lp/mm; Motorized autofocus with preset positions and touch-sensitive focus ring |

| Material | Stainless steel base and column; Aluminum alloy arms; Polycarbonate housing; Anti-reflective coated optics | Medical-grade anodized aluminum frame; Carbon fiber arm components; Scratch-resistant polymer casing; Fully sealed optical pathway with anti-fog and anti-smudge lens coatings |

| Certification | CE Marked (Class IIa), ISO 13485:2016, ISO 10993 (biocompatibility), RoHS compliant | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 10993, IEC 60601-1 (safety), IEC 60601-2-57 (light-based medical equipment), HIPAA-compliant data handling (for models with imaging integration) |

Note: Advanced models support integration with intraoral scanners, digital documentation systems, and teleconsultation platforms. Recommended for endodontic, microsurgical, and restorative specialty practices.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Operating Microscopes from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity Period: January 2026 – December 2026

Executive Summary

Sourcing dental operating microscopes (DOMs) from China offers significant cost advantages but requires rigorous due diligence in 2026. With evolving global regulatory landscapes (including EU MDR 2027 pre-compliance requirements) and supply chain complexities, a structured approach is critical. This guide outlines three non-negotiable steps for risk-mitigated procurement, featuring verified manufacturing partners meeting 2026 clinical and compliance standards.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certificate checks are insufficient in 2026. Regulatory bodies now mandate traceable quality management system (QMS) audits and technical documentation reviews.

Actionable Verification Protocol:

- Demand Certificate Authenticity: Require ISO 13485:2016 (not older versions) and CE Marking under MDR 2017/745 (not legacy MDD). Cross-verify via:

- EU NANDO database (for Notified Body validity)

- ANMAC (Australia) or CFDA (China) QMS inspection reports

- Direct verification with issuing body (e.g., TÜV SÜD, BSI certificate #)

- Audit Technical Documentation: Insist on access to:

- Full Risk Management File (ISO 14971:2019)

- Clinical Evaluation Report (CER) per MEDDEV 2.7/1 Rev 4

- Essential Safety & Performance Requirements (ESPR) checklist

- Factory QMS Assessment: Conduct virtual or on-site audit of:

- Calibration protocols for optical components

- Traceability systems (lens serial numbers → final product)

- Post-market surveillance procedures

Shanghai Carejoy Verification Advantage

As a 19-year specialist in DOM manufacturing, Carejoy provides:

- Real-time access to TÜV SÜD Certificate # Q1 2026-XXXXX (valid for DOMs)

- Complete MDR-compliant technical documentation package (available for NDA-protected review)

- ISO 13485:2016 QMS audited quarterly with digital traceability logs

- On-demand factory video audit via encrypted platform

Step 2: Negotiating MOQ – Strategic Volume Planning for 2026

Traditional high MOQs are becoming obsolete. Modern DOM factories offer tiered structures aligned with distributor channel strategies.

| MOQ Strategy | Advantages | 2026 Market Reality | Risk Mitigation |

|---|---|---|---|

| Standard DOM MOQ (e.g., 5-10 units) |

Low entry barrier for clinics | Only viable with pre-configured models; customization impossible | Confirm exact configuration matches clinical needs; verify no hidden “setup fees” |

| Distributor Tiered MOQ (e.g., 20-50 units) |

Customization options (magnification, LED specs, mounting) | Market standard for serious distributors; includes spare parts kit | Negotiate phased delivery to match sales pipeline; lock component pricing for 12 months |

| OEM/ODM Partnership (e.g., 100+ units) |

Full branding, dedicated R&D support, exclusive features | Required for premium DOMs with AI integration (e.g., auto-focus tracking) | Include exit clause for IP ownership; demand prototype validation pre-production |

Shanghai Carejoy MOQ Flexibility

Leveraging their 19-year manufacturing scale, Carejoy offers:

- Clinics: 3-unit MOQ for standard DOM models (D700 Series) with 48-hour configuration

- Distributors: Tiered pricing starting at 15 units (includes calibration toolkit & training)

- OEM Partners: 80-unit MOQ with co-engineered features (e.g., integrated exoscope compatibility)

- 2026 Exclusive: “Volume Pooling” for distributors – combine orders with other regional partners to hit MOQ faster

Step 3: Shipping & Logistics – DDP vs. FOB in 2026

With new IMO 2025 sulfur cap regulations increasing ocean freight volatility, Incoterms selection directly impacts landed cost predictability.

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower initial quote But unpredictable final costs (port fees, customs delays) |

Buyer bears 100% risk after cargo loading Requires local freight forwarder expertise |

Only for experienced distributors with established China logistics partners |

| DDP (Delivered Duty Paid) | All-inclusive price (freight, insurance, duties, taxes) No hidden charges |

Supplier manages entire process Single point of accountability |

STRONGLY RECOMMENDED for clinics & new distributors Eliminates 2026 tariff volatility risk |

2026 Shipping Best Practices:

- Demand DDP quotes with breakdown: Verify if includes ISPM 15 pallet compliance and destination port congestion surcharges

- Require DOM-specific packaging: Shock sensors + climate-controlled containers (critical for optical calibration)

- Confirm delivery timeline: 30-45 days from deposit (2026 standard; avoid “express” premiums)

Shanghai Carejoy Logistics Assurance

As a factory-direct exporter since 2005, Carejoy provides:

- True DDP quotes to 95% of global destinations (including VAT/GST calculation)

- DOM-specific packaging with ISO 9001-certified logistics partners (DHL Healthcare Solutions, Kuehne+Nagel MedChain)

- Real-time shipment tracking via blockchain platform (access granted post-PO)

- Zero-cost recalibration if shipping shock sensors exceed 5G threshold

Strategic Partner Introduction: Shanghai Carejoy Medical Co., LTD

Why Carejoy for 2026 DOM Sourcing?

19 years exclusively manufacturing dental equipment with ISO 13485-certified facility in Shanghai’s Baoshan District (China’s dental tech hub). Specializing in factory-direct DOMs with:

• 0.4x-20x magnification range with 4K LED illumination

• CE MDR 2017/745 & FDA 510(k) pre-certified models

• 24-month warranty with global service network

Immediate Next Steps:

✉️ Request DOM Compliance Dossier: [email protected]

💬 Schedule Technical Consultation: WhatsApp +86 15951276160

🌐 Verify Certifications: carejoydental.com/compliance

Note: All Carejoy DOMs undergo 72-hour stress testing per IEC 60601-2-57:2023. 2026 pricing locked until Q1 2027 for orders placed by 31 March 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Insights for Dental Clinics & Distributors

Frequently Asked Questions: Dental Operating Microscope Procurement (2026)

Dental operating microscopes in 2026 are designed to comply with international electrical standards. Most units operate on a standard input of 100–240 VAC, 50/60 Hz, making them suitable for global deployment. However, clinics must verify local voltage stability and ensure compatibility with in-house power systems—especially in regions with inconsistent grid supply.

Key considerations:

| Parameter | Standard Specification | Recommendation |

|---|---|---|

| Voltage Range | 100–240 V | Use a voltage stabilizer in areas with fluctuations |

| Frequency | 50/60 Hz | Auto-switching models preferred |

| Plug Type | Region-specific (e.g., Type A/B for North America, C/F for EU) | Confirm plug compatibility or order adapter kits |

Distributors are advised to stock region-specific power modules and provide clinics with a pre-installation electrical checklist.

Yes, leading manufacturers (e.g., Zeiss, Global Surgical, Moller-Wedel) maintain comprehensive spare parts inventories through authorized distributors in 2026. Critical wear-and-tear components include:

- LED illumination modules

- Footswitches and control pedals

- Objective lenses and beam splitters

- Articulating arm dampers and locking mechanisms

- Camera adapters and sensor units (for digital models)

Distributors should carry a core spare parts kit—including bulbs, fuses, and foot control units—for rapid service response. Most OEMs now offer predictive maintenance programs with IoT-enabled diagnostics to forecast part failure and automate spare part dispatch.

Professional installation by a certified biomedical technician or manufacturer-trained engineer is strongly recommended. The process includes:

- Site Assessment: Floor stability, ceiling clearance, power source proximity, and integration with dental chair systems.

- Mechanical Mounting: Secure floor stand or ceiling suspension installation with anti-vibration calibration.

- Electrical & Network Integration: Power connection, grounding checks, and (if applicable) integration with DICOM or clinic imaging networks.

- Optical Calibration: Alignment of oculars, focus calibration, and coaxial illumination testing.

- User Training: Hands-on orientation for clinicians and assistants on positioning, focusing, and digital capture (if equipped).

Installation typically takes 2–4 hours. Distributors should offer turnkey installation packages, including post-installation validation reports.

In 2026, most premium dental operating microscopes come with a standard 3-year comprehensive warranty, covering parts, labor, and on-site service for manufacturing defects. Extended warranties up to 5 years are available for an additional fee.

| Warranty Component | Coverage | Exclusions |

|---|---|---|

| Optical System | Lens clarity, alignment, coatings | Damage from improper cleaning |

| LED Illumination | Lumen degradation below 80% | Physical impact or liquid ingress |

| Mechanical Components | Articulating arms, brakes, stand | Wear from misuse or over-tightening |

| Electronics & Software | Control boards, footswitch, camera | Unauthorized software modifications |

Warranty activation typically requires online registration within 30 days of delivery. Distributors must ensure clinics receive warranty documentation and service contact details at point of sale.

Manufacturers and authorized distributors operate 24/7 technical support hotlines and online portals for warranty claims. In 2026, the standard service SLA (Service Level Agreement) includes:

- Response Time: Within 4 business hours for critical issues (e.g., complete system failure).

- On-Site Repair: Next-business-day service in major metropolitan areas; 2–5 days in remote regions.

- Loaner Units: Available during extended repairs for clinics under premium service contracts.

- Remote Diagnostics: Supported via Bluetooth/Wi-Fi for firmware updates and troubleshooting.

Distributors are expected to maintain local service teams or partner with certified third-party biomedical firms to meet SLAs. Annual preventive maintenance visits are included in most extended warranty plans.

© 2026 Professional Dental Equipment Guide. For authorized distribution to dental clinics and equipment partners only.

Need a Quote for Dental Operating Microscope?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160