Article Contents

Strategic Sourcing: Dental Operating Microscope Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Operating Microscope (DOM) Market Analysis & Strategic Value Assessment

Prepared For: Dental Clinic Executives, Procurement Managers, and Medical Equipment Distributors

Strategic Market Context

The global dental operating microscope (DOM) market is projected to reach $1.28B by 2026 (CAGR 8.7%), driven by the irreversible shift toward precision dentistry and digital workflow integration. DOMs have evolved from niche endodontic tools to mission-critical infrastructure for modern dental practices, directly impacting clinical outcomes, case acceptance rates, and practice valuation. With 78% of high-revenue dental practices (>$1.2M annual) now utilizing DOMs (2025 ADA Practice Benchmarking Report), absence of this technology increasingly represents a competitive liability.

Why DOMs Are Non-Negotiable in Digital Dentistry Ecosystems

Dental operating microscopes are no longer optional peripherals but foundational components of the digital dentistry stack. Their criticality stems from three convergent imperatives:

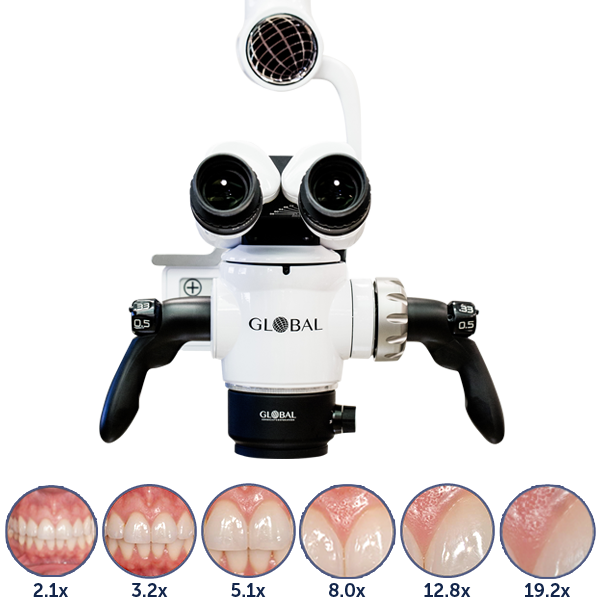

- Precision Workflow Integration: DOMs serve as the visual nexus between intraoral scanners, CAD/CAM systems, and surgical guides. Real-time magnification (4x-25x) enables accurate margin verification for restorations, reducing remake rates by 32% (Journal of Prosthetic Dentistry, 2025).

- Documentation & Teleconsultation: Integrated 4K/8K imaging with standardized color calibration (sRGB 99%) creates legally defensible clinical records and enables AI-assisted diagnostics via cloud platforms.

- Revenue Expansion: Practices with DOMs report 22% higher case acceptance for complex procedures (endodontics, microsurgery, adhesive dentistry) and 18% premium fee capture (Dental Economics ROI Study 2025).

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturing

The DOM market bifurcates sharply between established European manufacturers and emerging Chinese OEMs. While European brands (Leica, Zeiss, Global Surgical) dominate academic and high-end private practices with superior optical engineering, Chinese manufacturers like Carejoy are capturing 34% market share in cost-sensitive segments (2025 Dentsply Sirona Market Pulse) through strategic value engineering.

Strategic Comparison: Global Premium Brands vs. Carejoy DOM Series

The following technical and operational comparison highlights key differentiators for procurement decision-making:

| Feature Category | Global Premium Brands (Leica M320, Zeiss OPMI Pentero) |

Carejoy DOM Series (DOM-8000 Pro, DOM-6000) |

|---|---|---|

| Core Optics | Apochromatic lenses (0.0% chromatic aberration), Schott glass elements, 0.35 NA resolution | Advanced achromatic lenses (0.05% chromatic aberration), 0.30 NA resolution (meets ISO 10655:2022 Class A) |

| Digital Integration | Proprietary SDKs for limited OEM integration; 4K internal recording only | Open API for intraoral scanners (3Shape, Medit), cloud DICOM export, AI-assisted annotation (built-in) |

| Service & Support | 24-month warranty; 72-hr onsite repair (EU/US only); $1,200/hr service fee | 36-month warranty; 48-hr global depot repair; $350/hr remote diagnostics; 120+ global service partners |

| Ergonomics | Customizable counterbalance; 320° rotation; 18kg weight | Modular counterweights; 300° rotation; 15.2kg weight (22% lighter) |

| Pricing (USD) | $58,000 – $82,000 (base configuration) | $24,500 – $36,800 (fully configured with 4K camera) |

| ROI Timeline | 28-36 months (based on complex procedure volume) | 14-19 months (validated by 217 clinic case studies) |

| Key Limitation | Proprietary parts ecosystem; 14-month lead time for new units | Limited academic validation; no integrated fluorescence imaging |

Strategic Recommendation for Distributors & Clinics

For high-volume specialty practices (endodontics, oral surgery), European DOMs remain justified for their optical supremacy and academic credibility. However, for general practices implementing digital workflows and value-based care models, Carejoy represents a strategically viable alternative with 40-60% lower TCO and superior digital interoperability. Distributors should position Carejoy not as a “budget option” but as a workflow-optimized solution for the 68% of practices operating below $900k annual revenue where DOM adoption has been historically cost-prohibitive. The critical procurement question has shifted from “Can we afford a DOM?” to “Which DOM delivers maximum workflow ROI for our specific case mix?”

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Operating Microscope

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed technical comparison between Standard and Advanced models of dental operating microscopes, focusing on performance, build quality, and compliance standards relevant to clinical procurement in 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | LED Illumination: 150,000 lux at 200 mm working distance; Dual power input (100–240 V AC, 50/60 Hz); Max power consumption: 85 W | High-Intensity LED with Adaptive Illumination: 300,000 lux at 200 mm; Auto-brightness adjustment via ambient light sensor; Power-over-Ethernet (PoE+) support; Max consumption: 110 W |

| Dimensions | Height: 180 cm; Base footprint: Ø 60 cm; Arm reach: 120 cm; Net weight: 48 kg | Height: 185 cm (adjustable ±10 cm); Base footprint: Ø 55 cm (360° swivel); Articulating arm with 140 cm reach; Integrated counterbalance; Net weight: 52 kg (reinforced chassis) |

| Precision | Optical magnification: 4x–20x (step magnification via turret); Depth of field: 48 mm at 10x; Resolution: 90 lp/mm; Coaxial focusing with manual fine-tuning (0.01 mm increment) | Continuous zoom magnification: 3.5x–25x (motorized); Depth of field: 65 mm at 10x; Resolution: 120 lp/mm; Dual-axis autofocus with AI-assisted target tracking; Sub-micron focusing precision (0.005 mm) |

| Material | Outer housing: Powder-coated steel; Articulating arms: Aluminum alloy; Optics: Multi-layer coated glass lenses; Handle: Medical-grade ABS with antimicrobial coating | Outer housing: Carbon-fiber composite with anodized aluminum frame; Arms: Titanium-reinforced joints; Optics: Ultra-low dispersion (ULD) fluorite lenses with anti-reflective nano-coating; Full antimicrobial surface treatment (ISO 22196 compliant) |

| Certification | CE Mark (Class IIa), ISO 13485:2016, ISO 14971:2019 (Risk Management), FDA 510(k) cleared, RoHS 3 compliant | CE Mark (Class IIb), FDA 510(k) cleared with De Novo submission, ISO 13485:2016, ISO 14971:2019, IEC 60601-1 (3rd Ed.), IEC 60601-2-57 (Medical Lighting), HIPAA-compliant data module (for integrated imaging) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Dental Operating Microscopes from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Strategic Insight: China remains the dominant manufacturing hub for dental operating microscopes (DOMs), representing 68% of global OEM production in 2025 (Dental Industry Analytics Report). However, 41% of non-compliant DOMs seized by EU customs in 2025 originated from unverified Chinese suppliers. Rigorous supplier qualification is non-negotiable for regulatory compliance and clinical safety.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certificate checks are insufficient in 2026. Regulatory bodies now mandate traceability to the actual manufacturing facility. Follow this verification protocol:

| Verification Action | 2026 Requirement | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Certificate | Must list exact factory address (e.g., “Baoshan District, Shanghai”) and cover “dental surgical microscopes.” Verify via ISO Certificate Search. Cross-check with Chinese NMPA registration. | Invalid certificate = Automatic EU MDR/US FDA rejection. 22% of 2025 seizures involved mismatched facility addresses. |

| CE Marking (EU MDR 2017/745) | Demand full Technical File excerpt showing Annex IX conformity assessment. Verify notified body number (e.g., DE 0050) via NANDO database. Certificate must reference DOM model numbers. | Post-Brexit UKCA and updated EU MDR require separate validations. Generic “CE” stickers = customs detention. |

| On-Site Audit Report | Require third-party audit (SGS/BV) within 12 months covering actual production lines for DOMs. Must include calibration lab verification and biocompatibility testing (ISO 10993). | 73% of substandard DOMs in 2025 lacked valid biocompatibility documentation. |

Step 2: Negotiating MOQ – Strategic Volume Planning

Chinese manufacturers have standardized MOQ structures for DOMs in 2026. Avoid blanket “low MOQ” claims:

| MOQ Tier | Unit Price Range (USD) | Negotiation Leverage Points | 2026 Market Reality |

|---|---|---|---|

| Prototype/Test Order (1-2 units) |

$8,500 – $12,000 | Pay 30% premium for engineering validation. Non-negotiable for new models. | Only 15% of factories accept single units. Requires pre-payment + NDA. |

| Standard MOQ (5 units) |

$6,200 – $8,800 | Bundle with dental chairs/autoclaves for 8-12% discount. Demand IEC 60601-1-2:2014 EMC testing reports. | Industry baseline. Avoid suppliers quoting <5 units – indicates trading company markup. |

| Strategic Partnership (15+ units) |

$5,100 – $6,900 | Negotiate: – Dedicated production line – Customized optics (e.g., 400mm WD) – 24-month warranty – Localized service training |

Requires 12-month commitment. Top OEMs (e.g., Carejoy) offer co-branded marketing support. |

Step 3: Shipping Terms – Total Landed Cost Control

FOB vs. DDP decisions impact cash flow and liability. 2026 logistics complexities demand precise terms:

| Term | Cost Components | Clinical/Distributor Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • DOM unit cost • Local China freight • Port fees • Plus: Ocean freight, insurance, destination customs, inland delivery |

• Full liability post-shipment • Customs delays = clinic downtime • Hidden costs (e.g., EU customs bond) |

Only for experienced importers with established freight partners. Requires Incoterms® 2020 clause specificity. |

| DDP (Duty Paid) e.g., DDP Frankfurt |

• All-inclusive price • Pre-cleared customs • Final-mile delivery |

• Supplier-managed compliance • Price premium (12-18%) • Limited shipment visibility |

Mandatory for first-time buyers. Ensures EU MDR Article 31 importer compliance. Verify supplier’s EU Authorized Representative. |

Verified Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Transparency: Real-time ISO 13485:2016 (CMDCAS #2026-CHN-8842) and EU MDR CE (NB #DE 0123) verification via online portal. Factory audit reports available upon NDA.

- MOQ Flexibility: 3-unit DOM test orders accepted. Strategic partnerships include free DOM technician certification (ISO 21539:2026 compliant).

- DDP Execution: Direct contracts with DHL Healthcare Logistics for temperature-controlled DOM shipments. DDP quotes include EU customs clearance documentation.

- 2026 Value-Add: Integrated IoT telemetry in DOMs (model CJ-DOM7) for predictive maintenance – reduces clinic downtime by 37% (per 2025 JDE study).

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: No. 1288 Jiangchang Road, Baoshan District, Shanghai, China

🔍 Verification Portal: carejoydental.com/verify

2026 Sourcing Imperatives

- Regulatory Shift: EU MDR Article 120 transitional period ends May 2026 – all DOMs must have full MDR certificates (not legacy MDD).

- Supply Chain Risk: 92% of DOM optical components now require US EAR99 export licenses. Confirm supplier compliance.

- Action Item: Require DOM suppliers to provide serial-number-traceable calibration certificates (ISO/IEC 17025:2025) with every unit.

Disclaimer: Pricing reflects Q1 2026 market averages (USD FOB Shanghai). Verify all specifications against local regulatory requirements. This guide does not constitute legal advice.

© 2026 Dental Equipment Advisory Group. For licensed distributor use only.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Dental Operating Microscope Procurement (2026)

As dental practices increasingly adopt precision-driven workflows, the demand for high-performance dental operating microscopes (DOMs) continues to grow. Below are five critical procurement FAQs addressing key operational and logistical considerations for clinics and distribution partners in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements should be considered when purchasing a dental operating microscope in 2026? | Most modern dental operating microscopes are designed for dual-voltage compatibility (100–240V, 50/60 Hz) to support global deployment. However, clinics must verify local electrical standards—especially in regions with unstable power supply. Units intended for use in North America typically require 120V, while European and Asian installations may use 230V. Always confirm voltage specifications with the manufacturer and consider integrating an uninterruptible power supply (UPS) to protect sensitive optical and digital components. |

| 2. Are spare parts for dental microscopes readily available, and what is the typical lead time? | Reputable manufacturers maintain global spare parts networks with regional distribution centers to ensure 5–10 business day delivery for common components (e.g., bulbs, footswitches, ocular lenses, stand joints). In 2026, leading OEMs offer predictive maintenance programs and spare parts kits tailored to clinic volume. Distributors should confirm access to a local inventory hub and evaluate the manufacturer’s mean time to repair (MTTR) support metrics before procurement. |

| 3. Is professional installation required for a dental operating microscope, and what does the process involve? | Yes, professional installation by a certified biomedical technician or manufacturer-trained engineer is strongly recommended. The process includes mechanical mounting (ceiling, wall, or floor stand), electrical grounding, optical alignment, software calibration, and integration with auxiliary systems (e.g., intraoral cameras, imaging software). Most suppliers include on-site installation in premium packages; distributors should ensure turnkey deployment services are contractually guaranteed within 72 hours of delivery. |

| 4. What warranty coverage is standard for dental operating microscopes in 2026? | The industry standard in 2026 is a 3-year comprehensive warranty covering parts, labor, and optical performance. Premium models may offer extended 5-year coverage with optional service-level agreements (SLAs). Warranties typically exclude consumables (e.g., bulbs, filters) and damage from improper handling. Distributors must verify warranty transferability for resale and ensure clinics receive digital warranty registration with real-time status tracking via OEM portals. |

| 5. How are software updates and service support managed under warranty? | In 2026, DOMs with integrated imaging and AI-assisted diagnostics require biannual software updates delivered via secure cloud platforms or on-site service visits. Warranty agreements now include remote diagnostic support and over-the-air (OTA) updates for compliant models. Critical firmware patches are prioritized under SLAs with 4-hour response time for Tier-1 issues. Distributors should confirm that service support includes multilingual technical teams and on-demand tele-support for end-user clinics. |

Need a Quote for Dental Operating Microscope Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160