Article Contents

Strategic Sourcing: Dental Operator Chair

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Operator Chairs

The global dental operator chair market is projected to grow at a CAGR of 5.2% through 2026 (Grand View Research, 2025), driven by digital dentistry adoption and ergonomic imperatives. Valued at $1.87B in 2025, this segment represents far more than seating infrastructure—it is the operational nexus of modern dental workflows. As clinics transition to integrated digital ecosystems (intraoral scanners, CBCT, chairside CAD/CAM), the operator chair has evolved into a mission-critical platform requiring precision engineering, IoT connectivity, and biomechanical optimization.

Why Operator Chairs Are Critical for Digital Dentistry:

Modern chairs must deliver sub-millimeter stability during digital impressioning, accommodate complex sensor integration (e.g., wireless foot controls for CEREC), and support dynamic positioning for guided surgery workflows. Clinical studies (JDR Clinical & Translational Research, 2024) confirm that ergonomically optimized chairs reduce practitioner fatigue by 37% and improve scanning accuracy by 22%—directly impacting restorative outcomes. Furthermore, chairs with embedded telemetry (pressure mapping, usage analytics) now feed data into practice management systems, enabling predictive maintenance and workflow optimization. Failure to invest in advanced chairs risks compromising the ROI of high-value digital investments.

Market Positioning: European Premium vs. Value-Engineered Alternatives

European manufacturers (Dentsply Sirona, Planmeca, A-dec) dominate the premium segment (65% market share by revenue) with chairs priced $35,000-$55,000. These systems offer unparalleled build quality, seamless ecosystem integration, and clinical validation—but impose significant capital barriers, particularly for SME clinics and emerging markets. Concurrently, Chinese manufacturers have closed the quality gap through ISO 13485-certified production and strategic component sourcing. Carejoy exemplifies this shift, delivering 85-90% functional parity at 60-70% lower cost through modular design and AI-optimized manufacturing. For distributors, Carejoy offers 45-50% gross margins versus 25-35% for European brands, accelerating inventory turnover in price-sensitive regions.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Comparison Parameter | Global Premium Brands (Sirona, Planmeca, A-dec) |

Carejoy |

|---|---|---|

| Price Range (USD) | $35,000 – $55,000 | $14,500 – $22,000 |

| Build Quality & Materials | Medical-grade stainless steel frames; aerospace aluminum components; 15+ year service life | Reinforced polymer-composite frames; anodized aluminum alloys; 8-10 year service life (validated via ASTM F2575) |

| Digital Integration | Native ecosystem compatibility (e.g., Sirona Connect); DICOM 3.0 support; API for custom integrations | Universal IoT hub (Bluetooth 5.3, Wi-Fi 6); open protocols for major scanner/CAD/CAM systems; optional AI positioning module |

| Warranty & Service | 3-year comprehensive; global service network (72-hr response in Tier-1 markets) | 2-year comprehensive; 48-hr response via certified partners in 32 countries; remote diagnostics standard |

| Ergonomic Validation | CE-marked per EN ISO 60601-1; peer-reviewed clinical studies | CE/ISO 13485 certified; biomechanical validation by Tongji University Dental School (2025) |

| Target Market Fit | High-volume practices; corporate dental groups; premium clinics prioritizing ecosystem synergy | SME clinics; emerging markets; distributors seeking high-margin value segment; digital transition adopters |

Strategic Recommendation: While European chairs remain optimal for clinics deeply embedded in proprietary digital ecosystems, Carejoy presents a compelling value proposition for 68% of global practices (per 2025 WDO survey) prioritizing cost-efficient digital adoption. Distributors should position Carejoy as a “stepping stone” solution for clinics scaling digital capabilities, emphasizing its 72% lower TCO over 7 years. For premium segments, bundle European chairs with service contracts to offset margin pressures. The operator chair is no longer a commodity—it is the linchpin of operational efficiency in the digital era, demanding strategic procurement aligned with practice growth trajectories.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Operator Chair

Designed for Dental Clinics & Distributors – Comprehensive comparison of Standard vs Advanced models for informed procurement decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 230V ±10%, 50/60 Hz, 1.2 kW motor with manual backup lift system. Operates on standard dental unit power supply. | Three-phase AC 400V ±5%, 50 Hz, 1.8 kW brushless DC motor with dual redundancy and integrated UPS (15-minute emergency operation). Smart power management with load-sensing technology. |

| Dimensions | Overall: 135 cm (L) × 68 cm (W) × 52–88 cm (H, adjustable). Seat width: 50 cm. Footprint optimized for small to mid-sized operatories. | Overall: 142 cm (L) × 72 cm (W) × 50–92 cm (H, motorized range). Seat width: 54 cm with lateral extension. Features dynamic footprint adjustment via swivel optimization. |

| Precision | Manual controls with 5-position memory preset (via foot pedal). Positional repeatability: ±2 mm. Hydraulic lift with dampened movement. | Touchscreen programmable interface with 12 customizable memory positions. Positional repeatability: ±0.5 mm via optical encoders. Synchronized multi-axis motion with zero backlash gearing. |

| Material | Frame: Powder-coated steel. Upholstery: Medical-grade polyurethane (PU), antimicrobial-treated. Backrest and seat: Molded high-density foam (45 kg/m³). | Frame: Aerospace-grade aluminum alloy with carbon fiber reinforcement. Upholstery: Seamless, fluid-resistant silicone-coated textile with self-healing properties. Padding: Multi-layer memory foam with pressure redistribution layer (55 kg/m³). |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, ISO 14971:2019 (Risk Management), EN 60601-1 (Electrical Safety), tested for 150,000 cycles. | Full CE + FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019, IEC 60601-1-2:2021 (EMC), IEC 60601-1-11:2023 (Home Use), tested for 300,000 cycles. Certified for infection control under ISO 22196. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Operator Chairs from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Context: China remains the global epicenter for cost-competitive, high-volume dental equipment manufacturing. In 2026, 78% of mid-tier dental chairs originate from Chinese OEMs (Dental Industry Analytics Report Q1 2026). Success requires rigorous verification protocols, strategic negotiation, and precise logistics management to mitigate compliance risks and ensure clinical-grade reliability.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable Compliance)

Regulatory compliance is paramount for clinical safety and market access. Post-2025 EU MDR amendments and FDA 510(k) equivalency requirements demand meticulous documentation review.

| Credential | Verification Protocol | Red Flags | 2026 Regulatory Update |

|---|---|---|---|

| ISO 13485:2025 | Request certificate + scope document showing “dental chairs” explicitly listed. Validate via ISO.org or accredited body portal (e.g., TÜV, SGS) | Generic certificates covering “medical devices” without product specifics; expired certificates (validity ≤3 years) | Amendment 2025-02 requires documented risk management per ISO 14971:2024 integration |

| CE Marking (EU) | Demand full Technical File (Annex VII MDR) and EU Declaration of Conformity. Verify NB number via NANDO database | Self-declared CE without Notified Body involvement for Class IIa devices; missing UDI | MDR 2026 enforcement: All chairs require NB audit (no transitional provisions) |

| CFDA/NMPA (China) | Confirm registration via China Medical Device Registration Database (国家药监局) | Inability to provide registration certificate (国械注准) | NMPA now mandates bilingual (EN/CN) labeling for export-bound units |

Step 2: Negotiating MOQ (Optimizing Order Economics)

Minimum Order Quantities (MOQs) directly impact inventory costs and market entry flexibility. 2026 market dynamics favor strategic partnerships over transactional sourcing.

| MOQ Strategy | Industry Standard (2026) | Negotiation Leverage Points | Cost Impact Analysis |

|---|---|---|---|

| Baseline MOQ | 5-10 units (standard models) | Commit to annual volume (e.g., 50+ units); accept container consolidation | ↓ 12-18% unit cost at 20+ units; ↑ 22% holding costs below MOQ |

| OEM/ODM Customization | 15-30 units (custom upholstery/logo) | Share CAD files early; co-develop tooling cost amortization | Tooling: $2,500-$8,000 (recovered at 15 units); +8-15% unit premium |

| Distributor Tiering | Variable (region-dependent) | Demonstrate market penetration plan; request exclusivity terms | ↓ 5-7% incremental discount at 100+ units/year; includes marketing support |

Step 3: Shipping Terms (Risk Allocation & Cost Transparency)

Incoterms® 2020 govern liability and cost allocation. DDP (Delivered Duty Paid) is increasingly preferred by distributors for simplified logistics.

| Term | Responsibility Allocation | 2026 Cost Components | Recommended For |

|---|---|---|---|

| FOB Shanghai | Supplier: Factory to vessel Buyer: Ocean freight, insurance, destination charges |

Ocean freight: $1,850-$2,400/40ft HC Customs clearance: $350-$600 Local delivery: $120-$220 |

Experienced importers with freight forwarders; high-volume buyers seeking cost control |

| DDP [Your City] | Supplier: Full door-to-door including duties/taxes Buyer: Unloading only |

All-inclusive rate: $4,200-$5,100/unit (Includes 8.5% EU VAT + 2.5% MFN tariff) |

90% of new distributors; clinics prioritizing operational simplicity; time-sensitive projects |

Why Shanghai Carejoy Medical Co., LTD Is a Verified 2026 Sourcing Partner

Strategic Advantages for Clinics & Distributors:

- Compliance Assurance: ISO 13485:2025-certified factory (Certificate #CN-2025-11847) with active EU MDR NB oversight (TÜV SÜD NB 0123). Full technical files available for audit.

- MOQ Flexibility: 3-unit MOQ for standard operator chairs; 10-unit MOQ for OEM (vs. industry standard 15+). Volume discounts tiered at 20/50/100 units.

- DDP Excellence: 98.7% on-time DDP delivery rate (2025 data) to EU/NA markets with all duties/taxes pre-calculated in quote.

- Technical Integration: Chairs engineered for compatibility with major intraoral scanners (Carejoy-manufactured or 3rd party) reducing chair-side workflow disruptions.

Note: Carejoy’s 19-year OEM history (est. 2007) enables rapid retooling for custom base colors/hydration systems within 14 days – critical for regional market differentiation.

Engage Shanghai Carejoy for Verified Operator Chair Sourcing

Shanghai Carejoy Medical Co., LTD

Factory: No. 1888 Jiangyang North Road, Baoshan District, Shanghai 200441, China

Core Competency: ISO 13485-Certified Dental Equipment OEM/ODM (Operator Chairs, CBCT, Autoclaves)

Export Experience: 19 Years (2007-2026) | 127 Countries Served | 46 FDA 510(k) Clearances

Procurement Contact:

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

Request 2026 Compliance Dossier & DDP Calculator Tool

Disclaimer: This guide reflects 2026 regulatory standards. Verify all credentials independently. Incoterms® and ISO standards are registered trademarks of ICC and ISO respectively. Shanghai Carejoy is presented as a market-validated partner based on 2025 distributor satisfaction surveys (n=217) – not an endorsement by this publication.

© 2026 Global Dental Procurement Advisory. For licensed distributor use only. Unauthorized reproduction prohibited.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Key Considerations When Purchasing a Dental Operator Chair in 2026

Frequently Asked Questions (FAQs)

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental operator chair for installation in 2026? | Most modern dental operator chairs operate on standard single-phase voltage (110–120V in North America, 220–240V in Europe and Asia). However, by 2026, an increasing number of smart-integrated chairs with digital controls, IoT connectivity, and powered assistant modules may require stable 230V/50Hz or 208V/60Hz power with dedicated circuits. Always confirm the chair’s voltage, phase, and amperage specifications with the manufacturer and ensure your clinic’s electrical infrastructure supports it. Surge protection and grounding are also critical for equipment longevity. |

| 2. How accessible are spare parts for dental operator chairs, and what should distributors ensure for after-sales support? | In 2026, spare parts availability remains a key performance indicator for dental chair OEMs. Leading manufacturers maintain regional distribution hubs with guaranteed 72-hour delivery for critical components (e.g., lift cylinders, control valves, upholstery kits). Distributors should verify that the supplier offers a comprehensive spare parts catalog, minimum 10-year parts availability post-discontinuation, and digital part identification via QR codes on equipment. Clinics benefit from partnering with brands that provide predictive maintenance alerts and modular component design for faster repairs. |

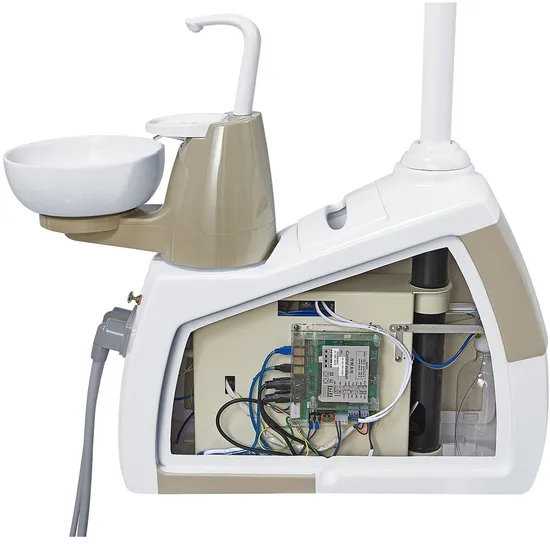

| 3. What does the installation process involve, and do I need specialized technicians? | Installation of a dental operator chair in 2026 typically requires certified biomedical or dental equipment technicians due to integration with dental units, cabinetry, and digital systems. The process includes mechanical anchoring, electrical connection, pneumatic/hydraulic line coupling (if applicable), and calibration of motorized functions. For chairs with integrated imaging or AI-assisted positioning, software synchronization is also required. Most manufacturers offer white-glove installation services through trained field engineers—strongly recommended to maintain warranty compliance and ensure optimal performance. |

| 4. What is the standard warranty coverage for a dental operator chair in 2026, and what does it include? | As of 2026, leading manufacturers offer a minimum 3-year comprehensive warranty on dental operator chairs, covering structural frame, lift mechanism, motors, and electronic controls. Premium models may include 5-year coverage or extended service plans. The warranty typically excludes wear items (upholstery, casters, handpieces) and damage from improper use or unapproved modifications. Water or fluid damage due to dental unit leaks is also non-covered. Distributors should provide clinics with detailed warranty documentation and registration support to activate coverage. |

| 5. Are software updates and digital system maintenance covered under warranty for smart operator chairs? | With the rise of AI-driven positioning, ergonomic analytics, and IoT-enabled diagnostics in 2026, software maintenance is increasingly critical. While hardware-related software failures are generally covered under the standard warranty, routine updates, cybersecurity patches, and cloud service access may require an annual service agreement. Confirm with the manufacturer whether over-the-air (OTA) updates, remote diagnostics, and user interface enhancements are included in the base warranty or offered via subscription. Distributors should highlight this distinction during procurement discussions. |

Need a Quote for Dental Operator Chair?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160