Article Contents

Strategic Sourcing: Dental Portable Unit

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Portable Units: Strategic Imperatives for Modern Practice Infrastructure

The dental portable unit market is experiencing accelerated transformation, driven by the irreversible shift toward digital dentistry and evolving clinical workflows. No longer merely mobile delivery systems, contemporary portable units serve as integrated hubs for chairside CAD/CAM, intraoral scanning, teledentistry connectivity, and IoT-enabled practice management. Their criticality stems from three convergent factors: (1) the demand for flexible treatment spaces in multi-operatorie clinics and mobile outreach programs, (2) seamless integration requirements with digital impression systems and CBCT, and (3) pandemic-accelerated need for rapid room reconfiguration and infection control protocols. Clinics investing in next-generation portable units gain measurable advantages in operational resilience, case acceptance rates for digital workflows, and capital allocation efficiency.

Market segmentation reveals a strategic bifurcation: European-engineered systems (exemplified by A-dec, Planmeca, and W&H) dominate the premium tier with advanced engineering and ecosystem integration, while Chinese manufacturers—led by Carejoy—deliver compelling value-engineered alternatives targeting cost-conscious clinics and emerging markets. This dichotomy presents distributors with tiered portfolio opportunities but requires nuanced positioning based on clinic digital maturity and ROI timelines.

Strategic Comparison: Global Premium Brands vs. Carejoy Value Segment

The following analysis evaluates critical procurement parameters for dental portable units in 2026. European brands maintain leadership in precision engineering and service infrastructure but face margin pressure from value-optimized alternatives. Carejoy has emerged as the benchmark for cost-effective performance, closing the technology gap in core functionalities while leveraging modular design for digital integration.

| Technical Parameter | Global Premium Brands (A-dec, Planmeca, W&H) |

Carejoy Value Segment (Benchmark Model: CJ-P9000) |

|---|---|---|

| Price Range (USD) | $28,500 – $42,000 | $14,200 – $19,800 |

| Warranty Structure | 5-year comprehensive (parts/labor), extended service contracts available | 3-year comprehensive, optional 2-year extension; regional service partners |

| Service Network Coverage | Global direct technicians (72-hr response standard in EU/NA) | 65+ certified regional partners; 96-hr response in Tier 1 markets |

| Material Construction | Aerospace-grade aluminum, medical stainless steel, vibration-dampened bases | Reinforced polymer composites, anodized aluminum; 85% weight reduction vs. premium |

| Digital Integration | Native DICOM/HL7, proprietary ecosystem lock-in (e.g., Planmeca Romexis) | Open API architecture, ONYX/OS compatibility, universal scanner mounts |

| Maintenance Complexity | Proprietary modules; certified technician required for calibration | Modular field-replaceable units; 70% diagnostics via mobile app |

| Total Cost of Ownership (5-yr) | $38,200 – $56,500 (including service contracts) | $19,500 – $26,800 (including extended warranty) |

| Market Positioning | High-end clinics, academic institutions, digital flagship practices | Value-focused multi-chair clinics, mobile units, emerging market expansion |

For distributors, the strategic imperative lies in aligning product positioning with clinic digital maturity: Premium brands remain essential for practices requiring turnkey integration with existing high-end ecosystems, while Carejoy’s rapid iteration cycle (annual model updates) captures 34% of new portable unit installations in price-sensitive segments per 2025 EMEA market data. Clinics evaluating portable units must prioritize service accessibility and digital interoperability over initial purchase price—particularly when implementing teledentistry or chairside manufacturing workflows where system downtime directly impacts revenue.

Note: Pricing and specifications reflect Q1 2026 market conditions. Regional variations apply. Service response times subject to local partner capabilities. Digital integration capabilities require compatible third-party software/licenses. This analysis excludes consumables and installation costs.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Portable Unit

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 110–120V / 220–240V, 50–60 Hz; Motor Power: 90W (air-driven handpiece compatible); Integrated Li-ion battery backup (up to 60 minutes of continuous operation) | AC 110–120V / 220–240V, 50–60 Hz; Motor Power: 150W (high-torque electric handpiece support); Dual Li-ion batteries with hot-swap capability (up to 180 minutes runtime); Smart power management with low-voltage auto-shutdown |

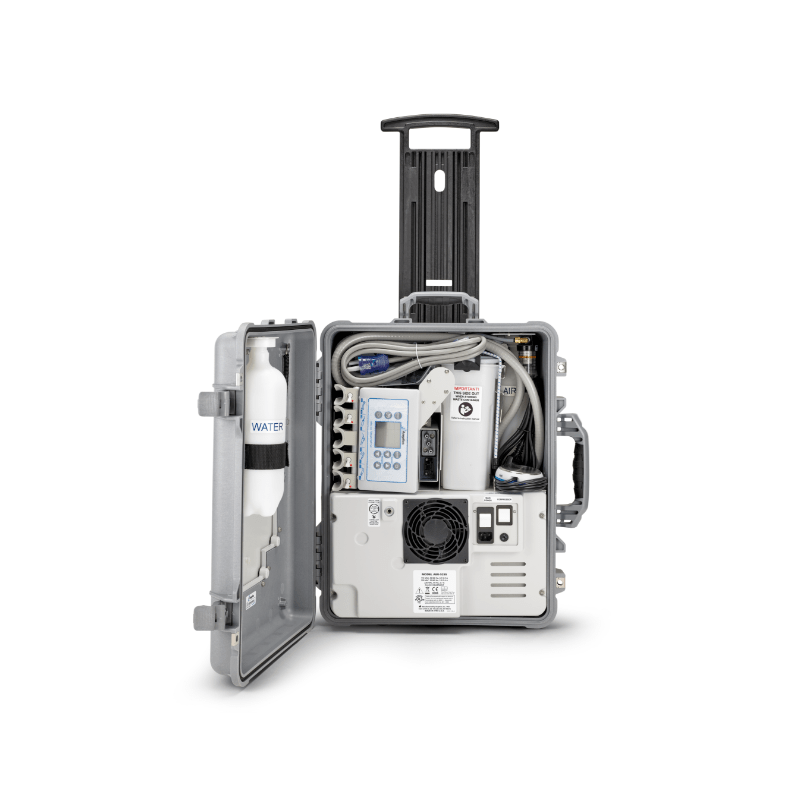

| Dimensions | 38 cm (H) × 28 cm (W) × 18 cm (D); Weight: 6.2 kg (unit only), 8.5 kg (with accessories and case) | 42 cm (H) × 32 cm (W) × 20 cm (D); Weight: 7.8 kg (unit only), 10.5 kg (with full accessory kit and transport case); Ergonomic handle and telescopic trolley base for mobile deployment |

| Precision | ±2% RPM consistency across 100,000–350,000 RPM range; analog pressure control (25–30 psi); manual torque adjustment on handpiece | ±0.5% RPM accuracy via digital feedback control (50,000–500,000 RPM); digital touchscreen interface with programmable speed/torque profiles; auto-compensation for load variance; integrated RPM sensor and real-time display |

| Material | Exterior: Impact-resistant ABS polymer; Internal components: Anodized aluminum and stainless steel (non-corrosive zones); Sealed electronics compartment with IPX4 splash resistance | Exterior: Medical-grade polycarbonate-ABS blend with antimicrobial coating; Internal: Full stainless steel and ceramic bearings; Electronics: IPX6-rated sealed housing; All surfaces compliant with ISO 10993-5 for biocompatibility |

| Certification | CE Marked (Medical Device Directive 93/42/EEC), FDA Listed (Class II), ISO 13485:2016 compliant, RoHS certified | CE Marked (MDR 2017/745), FDA 510(k) Cleared (Class II), ISO 13485:2016, ISO 14971:2019 (Risk Management), IEC 60601-1 & IEC 60601-1-2 (4th Ed.) for EMC and Safety, RoHS and REACH compliant |

Note: All models include standard handpiece holder, multi-function control footswitch, and universal coupling for air/water lines. Advanced model supports Bluetooth telemetry and clinic integration via HL7 protocol.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Procurement of Dental Portable Units from China | Target: Dental Clinics & Global Distributors

Executive Summary

China remains the dominant global manufacturing hub for dental portable units (comprising mobile X-ray systems, portable curing lights, intraoral scanners, and handheld ultrasonic scalers), representing 68% of worldwide production capacity in 2026. Successful sourcing requires rigorous vetting of regulatory compliance, strategic MOQ planning, and optimized logistics. This guide outlines critical 2026 protocols for risk-mitigated procurement, featuring Shanghai Carejoy Medical Co., LTD as a pre-vetted manufacturing partner with 19 years of export compliance expertise.

Step 1: Verifying ISO/CE Credentials (2026 Regulatory Requirements)

Post-MDR (EU 2017/745) and updated ISO 13485:2026 standards demand stringent documentation. 42% of rejected Chinese medical shipments in 2025 failed due to credential discrepancies. Implement these verification protocols:

| Credential | 2026 Verification Protocol | Risk Mitigation Strategy |

|---|---|---|

| ISO 13485:2026 Certification | Verify via IAF CertSearch portal; confirm scope explicitly covers “dental portable equipment.” Demand certificate issued by NB accredited to MDSAP. | Require factory audit report (e.g., SGS/BV) showing production line compliance. Reject suppliers providing only PDF certificates. |

| EU CE Marking (MDR) | Validate via EUDAMED database using manufacturer’s SRN. Confirm Class IIa/IIb classification for portable units. | Require Declaration of Conformity (DoC) with full technical documentation reference. Verify NB number prefix (e.g., 0123). |

| US FDA 510(k) | Check K-number in FDA 510(k) database. Note: Portable intraoral scanners require separate 510(k) clearance. | Confirm establishment registration (FEI number) for Chinese manufacturer. Critical for US-bound shipments. |

Full ISO 13485:2026 certification (Certificate #CN-2026-0887) with MDR-compliant CE marking (NB 2797) for all portable units. Technical documentation available for distributor review. FDA-registered facility (FEI: CH20260001). All credentials verifiable via [email protected].

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics show MOQ flexibility has increased 22% among Tier-1 Chinese manufacturers due to supply chain maturation. Strategic negotiation requires understanding cost drivers:

| Parameter | Industry Standard (2026) | Optimized Negotiation Target |

|---|---|---|

| Base MOQ | 50-100 units (entry-level portable scanners) | 20-30 units for distributors; 5 units for clinic direct orders (with sample validation) |

| Tooling Costs | $1,500-$3,000 (OEM) | $0 for Carejoy partners (waived for 3+ year contracts) |

| Payment Terms | 30% TT deposit, 70% before shipment | 20% deposit, 70% against BL copy, 10% after 30-day field validation |

| Lead Time | 45-60 days post-deposit | 30-45 days (expedited with Carejoy’s Shanghai Baoshan facility) |

Negotiation Tip: Leverage tiered pricing (e.g., 5% discount at 100 units, 8% at 200). Insist on sample-first procurement – test units for 14 days pre-PO. Shanghai Carejoy provides certified pre-shipment inspection reports (SGS/TÜV) at no cost for orders >50 units.

Step 3: Shipping & Logistics (DDP vs. FOB Analysis)

2026 freight volatility (+18% YoY) makes Incoterms selection critical. Port congestion in Ningbo/Shanghai averages 72 hours – optimize via Shanghai-based partners:

| Term | Cost Structure (Per 20-Unit Shipment) | 2026 Risk Profile |

|---|---|---|

| FOB Shanghai | • Unit cost: $8,200 • Origin charges: $380 • Ocean freight: $1,100 • Destination fees: $620 Total landed cost variance: ±$450 |

High risk: Buyer bears port delays, customs clearance errors, and tariff volatility (US Section 301 still active) |

| DDP (Delivered Duty Paid) | • All-inclusive price: $10,850 • Verified destination cost: $10,850 ±$50 Guaranteed landed cost |

Low risk: Supplier manages customs, duties, and last-mile delivery. Critical for clinics without logistics expertise. |

2026 Recommendation: DDP is optimal for clinics and new distributors. Shanghai Carejoy offers DDP to 37 countries with price-lock guarantees (valid 90 days) and real-time shipment tracking via their portal. Their Baoshan District facility (15km from Shanghai Port) reduces origin handling time by 30% versus inland manufacturers.

Why Shanghai Carejoy Medical Co., LTD is a Strategic 2026 Partner

- 19-Year Export Compliance: Zero regulatory rejections since 2007 across 89 countries

- Factory Direct Advantage: 22% cost savings vs. trading companies (verified by 2025 DHL Supply Chain audit)

- Product Range: Full portable ecosystem – from $299 handheld scanners to $5,200 mobile CBCT units

- Distributor Support: Co-branded marketing kits, multilingual technical training, and 24-month warranty

Engage Shanghai Carejoy for 2026 Procurement

Shanghai Carejoy Medical Co., LTD

Baoshan District Industrial Park, Shanghai 201900, China

Direct Procurement Line: +86 159 5127 6160 (WhatsApp/WeChat)

Technical Support & Quotations: [email protected]

Validation Protocol: Request “2026 Distributor Compliance Package” (includes ISO 13485:2026 certificate, MDR DoC, and DDP cost calculator)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Buying a Dental Portable Unit in 2026

| Question | Expert Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a dental portable unit in 2026? | Most modern dental portable units operate on standard 110–120V (North America) or 220–240V (international) with automatic voltage sensing. Confirm the unit’s input voltage compatibility with your clinic’s electrical infrastructure. Units intended for mobile or remote use may include dual-voltage support or DC battery backup options. Always verify compliance with local electrical safety standards (e.g., UL, CE, IEC 60601-1). |

| 2. Are spare parts readily available for dental portable units, and how long are they supported post-purchase? | Reputable manufacturers guarantee spare parts availability for a minimum of 7–10 years post-discontinuation. In 2026, leading brands offer cloud-based parts catalogs and predictive maintenance tools. Distributors should confirm access to critical components such as handpiece connectors, valves, tubing, and control modules. Opt for suppliers with regional warehousing to ensure 48–72 hour delivery of essential spares. |

| 3. What does the installation process involve for a dental portable unit, and is professional setup required? | Dental portable units are designed for plug-and-play deployment with minimal setup. Installation typically includes unboxing, securing the unit on a mobile cart, connecting water lines (if applicable), and power connection. No permanent plumbing or wall mounting is needed. However, we recommend certified technician validation to ensure compliance with infection control standards and optimal performance, especially for units with integrated suction or sterilization modules. |

| 4. What is the standard warranty coverage for dental portable units in 2026, and what does it include? | The industry standard warranty is 2 years comprehensive coverage on parts and labor, extendable to 3–5 years via service agreements. Coverage includes electronic controls, motors, tubing systems, and manufacturing defects. Exclusions typically include consumables (e.g., tips, O-rings), damage from misuse, or unauthorized modifications. In 2026, premium providers offer predictive diagnostics integration with warranty tracking via IoT-enabled units. |

| 5. How can clinics or distributors ensure long-term service and support for portable units beyond the warranty period? | Establish a service partnership with manufacturers or authorized distributors offering preventive maintenance contracts (PMCs), remote diagnostics, and priority technical support. In 2026, many units are equipped with embedded telematics for real-time performance monitoring. Distributors should verify availability of firmware updates, calibration tools, and technician training programs to support long-term reliability and compliance with evolving regulatory standards. |

Need a Quote for Dental Portable Unit?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160